Closing is the last step of buying investment property. This is when all the agreements between the seller and buyer are finalized, paperwork is signed, the seller gets paid, and the buyer receives the property’s title. This stage also involves paying closing costs such as appraisal fees, origination fees, credit report fees, title search fees, underwriting fees, attorney fees, escrow fees, and recording fees.

Related: What Happens at a Real Estate Closing?

You may be familiar with a typical closing in real estate, but have you heard of a double closing?

What Is Double Closing in Real Estate?

Also referred to as simultaneous closing or back-to-back closing, double closing is a term commonly used in real estate wholesaling. It is a coordinated real estate deal involving a seller, an investor (wholesaler), and an end-buyer. In back-to-back closing, two separate transactions are finalized on the same day.

Double Closing vs Contract Assignment

In a double closing, the wholesaler finds a motivated seller and agrees on a below-market buying price. The wholesaler then purchases the investment property and immediately sells it to an end buyer at a higher price. Both deals are closed on the same day, thus the name back-to-back closing. Buying and selling property at the same time is an ideal strategy for investors that want to sell a house quickly and make an immediate profit.

With a contract assignment, the wholesaler signs a sales contract after negotiating a buying price with the seller. The wholesaler then has 30-45 days to find a buyer. In case their search is unsuccessful, they will simply walk away from the deal. However, if a buyer is found, the wholesaler will sell the contract to them at a higher price. Unlike in double closing, the wholesaler doesn’t actually purchase the property in the contract assignment method.

The Real Estate Wholesaling Process Through Double Closing

As mentioned earlier, double closing involves a seller, a real estate investor (wholesaler), and an end buyer. Since the wholesaler doesn’t plan to own the income property, they need to work with an investor-friendly title company or real estate attorney.

Here are the steps for wholesaling real estate using the double closing wholesale strategy:

1. Find a seller

The wholesaler looks for a property owner that is willing to sell below market rates. This typically means searching for off market real estate deals. Off market properties can be found in different ways including driving for dollars, checking public records, networking with fellow investors, attending real estate auctions, direct mail marketing, talking to real estate agents, and searching online resources.

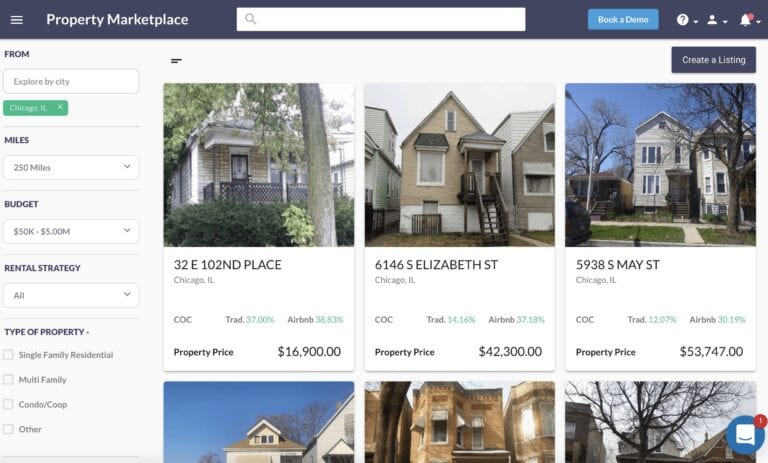

One of the best online resources out there is the Mashvisor Property Marketplace. With a click of a button, you can browse through hundreds of off market properties all over the US. You can narrow down your search using filters like miles, type of property, rental strategy, and budget. In addition, you can analyze the investment potential of off market properties for sale using metrics like cash flow, cap rate, cash on cash return, and occupancy rate.

In wholesaling lingo, this step is referred to as the ‘A to B transaction’. A refers to the seller, while B refers to the wholesaler.

2. Set a fee

Typically, wholesalers charge a fee for finding buyers. Some will charge by percentage of the real estate transaction. For instance, if the property is selling for $100,000, the wholesaler could charge 3% ($3,000) as fees. However, others charge a fixed dollar amount per transaction.

3. Find a buyer

The wholesaler is then expected to find a buyer that will eventually own the home. This transaction is referred to as the ‘B to C transaction’ (the wholesaler is B and the end buyer is C). Wholesalers can find buyers by getting listed on the MLS, advertising on Craigslist, placing bandit signs, newspaper advertising, direct mail, social media advertising, and in-person networking.

Another option is to list the property for free on the Mashvisor’s Property Marketplace. The home will be marketed to thousands of agents, real estate investors, and other serious potential buyers.

4. Secure funding

Once a buyer is found, the wholesaler is then required to purchase the home from the seller. If they are not paying in cash, the wholesaler can get funding through traditional mortgage lenders or transactional funding. Also referred to as flash cash, transactional funding is basically a very short-term loan. Typically, such loans are meant to be paid back very fast (within one to seven days). The cash is usually advanced by a private hard money lender, as opposed to a mortgage lender or bank.

Most wholesalers prefer transactional funding because the cash is released fast, doesn’t involve any kind of background checks (like creditworthiness), and is provided in full. This means that the wholesaler doesn’t have to spend their own money on the transaction. The cost of such loans could be anything between 1% to 2.5% of the amount borrowed. However, if the loan is not paid back on time, the wholesaler will have to pay additional fees.

5. Sell the property

Once the funding has been acquired and the property bought, the next step is to sell to the end buyer. The wholesaler will use the proceeds of the sale to pay off the loan, and then keep the difference as their profit. A real estate attorney or company will facilitate both transactions.

Pros of a Double Closing

- Leaves a clean paper trail – Back-to-back closing helps avoid legal and regulatory issues that would arise when a real estate wholesaler attempts to assign their sales agreement to the end buyer, as opposed to buying it and then selling it in a separate transaction. Though the wholesaler might just own the home for a short while at the closing table, the important thing is that they actually own it. When they sell the home, they are selling something that they actually owned.

- Gains can be kept secret – Most wholesalers would not want to disclose their profits to the end buyer. The best way of doing this is through double closing, where the end buyer doesn’t have any information about the A-to-B transaction.

Cons of a Double Closing

- It’s hectic – With all the documents to be signed and cash to be exchanged within a short time, double closing can be very stressful.

- There is some risk – The wholesaler might receive a flash cash loan, only for the end buyer to back out at the last minute. This could cause the wholesaler great financial distress and even ruin their reputation.

- Scheduling is not easy – Timing two separate closings to happen at the same time can be a hassle.

Bottom line

Wholesaling is a real estate exit strategy worth exploring. A back-to-back closing might cost more money and require more effort than a contract assignment. However, this alternative wholesale strategy does have some advantages for the investor closing real estate wholesale deals.

Related: How to Flip Real Estate Contracts: 7 Steps