With some disposable income, a portion of your inheritance, or a loan – you got the option to invest 200k. The real question is – where to invest 200k?

Many will turn to the good, old stock market. To that, we say – consider real estate investing!

With real estate, you’re looking at lower risks, better returns, and greater diversification. So, we suggest that you continue scrolling – and find out how!

Where To Invest 200k Now For Income?

We’ll start by stating the obvious – 200k is not a small amount of money. It’s definitely enough to get you into the world of real estate investments. And while investing that much is a bold step, it could be what you need to diversify your portfolio.

But what should I do with 200k?

There’s no right, one-size-fits-all answer to questions such as “where to invest 200k” – and that’s precisely the reason why we’ll discuss a few different scenarios.

Real Estate Syndications

The first opportunity we’d like to discuss is one that allows you to invest in real estate passively – a concept that’s otherwise known as real estate syndications.

How does it work?

A real estate syndication is, in short, when a group of individuals pools together their capital to invest in one large property – like an apartment building, land, or self-storage units, to name a few.

Syndications are an excellent way to access a much more significant investment when you lack the funds to do so single-handedly. The financial threshold for investment is somewhat high – up to 100k – but it still leaves enough room for you to invest in something else, as well, if you desire to.

Syndications are a relatively popular way to invest in real estate for two reasons.

One, you’ll receive passive income monthly or quarterly – and two, the real estate syndicators, or general partners, generally do most of the heavy lifting, from finding the deal, arranging the financing, structuring the syndication, to executing the plan.

So, you get the benefits of investing in real estate – minus the hassle.

The issue with syndications is that it’s completely passive and hands-off – investors have no say in how the real estate syndication will work. That’s why the investors are advised to pick out the syndication to invest their money in with utmost care.

Rentals

Investing in rentals like family or vacation homes is very lucrative because they come with great annual returns – usually more than 10% of your initial investment. Rentals are associated with a good cash flow, but what’s even better is that the value of your purchased property will increase over the years; you can make a profit selling it later on.

Investing in rental property is an active income since you can – and will have to – do everything yourself to protect your investment and organize your cash flow.

Some people are “against” investing in a rental property because it can be hard work – and they wish to avoid the hassle of being a landlord.

If that’s the case with you, consider hiring a manager that will deal with all the issues regarding the property and the tenants – but keep in mind that it will affect your cash flow.

Besides being financially rewarding, rental properties also offer numerous tax benefits. What’s more, if you decide to get a vacation home, you can use it up to 14 days a year – without losing the ability to deduct it from your taxes.

Still, it can be a hassle – even when you take being a landlord out of the equation. Change in the tax code, along with variations in the housing market and neighborhood decline, could result in your rental being worth less than it initially cost you.

Real Estate Investment Trusts

Real estate investment trust (REIT) is another excellent way to generate passive income as you would when investing in syndication.

Real estate investment trusts offer the benefits of stock and real estate investments – in essence, they’re the best of both worlds.

Investing in REITs is highly lucrative because they offer high annual returns – over 15% in 2020. Considering that REITs are a means of passive income, they will leave the investors with a great cash flow without breaking a sweat.

So, how do REITs work, exactly?

Generally speaking, REITs are very easy to comprehend:

By leasing the real estate and collecting rent, the company generates revenue, which is then paid out to the shareholders – people that invested in the REIT – in the form of dividends.

In most public companies, the level of dividends is decided on each year. However, real estate investment trusts have to pay out at least 90% of their revenue to the shareholders – with many REITs paying out their entire taxable income at the end of the year.

The issue with REITs is that they carry risks related to the changes in the housing market. Many people can experience short-term losses, especially during a housing market crisis.

House Flipping

House flipping is highly lucrative in the world of real estate investments. But the real underlying issue with house flipping is that it’s incredibly time-consuming. Because of that, flipping houses is the ideal way to be a real estate investor if you don’t have a full-time job.

House flipping consists of purchasing a damaged property at a low price and renovating it to sell it for a much higher price. The thing is, investing in real estate via house flipping isn’t risk-free.

You will have to find a property at a low price, take into account all the costs of repairs, and be able to sell it for a higher price later on.

Doing house flips can be a way to make a quick buck – but it comes with some downsides:

Many people aren’t aware of the hidden costs associated with house flipping, such as building permits you might require, delays regarding the renovations, issues with contractors, and the worst thing – the holding costs.

Holding costs can make house flipping non-profitable if the property you acquired doesn’t sell nearly as fast as you hoped it would.

Furthermore, to save money, you need to be able to do some of the renovations yourself. If not, the whole act of house flipping might not offer a desirable ROI if you need to hire a contractor for every single thing.

Mortgage

You could also use 200k as a down payment for a large-scale mortgage to acquire an apartment building. With a large down payment like that, you could obtain a property much larger than you would otherwise.

To top it off, you can rent out many of the apartments to finance the monthly payments.

Another benefit of getting out a mortgage is equity accrual:

Each mortgage payment consists of two major parts – one portion of it is the interest rate, while the other more significant part goes your mortgage balance. With each payment, you own more equity in your home, meaning you own more of the property.

As you cover the last payment on the income property, you own the full rights to your property.

So, with the cash flow generated from renting, not only could you get your monthly payments covered, but you can also turn a profit – while slowly owning more equity on the acquired real estate.

Of course, this method isn’t without its downsides – like vacancies, for example. Filling out each apartment unit could take time; you should do a property investment analysis and calculate the ROI to see whether it still pays off even if you have some vacancies.

Remember that you’re still obligated to pay taxes and the mortgage on the vacant apartments – along with utilities and other bills.

Furthermore, there’s the risk of the property losing value, despite the prices being on the rise at the moment. Certain neighborhoods might be worth way less by the time you pay off your mortgage – leaving you at a significant loss.

What To Consider Before Investing?

As previously mentioned, 200k is not a small amount of money – and shouldn’t be treated as such. Investing 200k for income should be carefully thought out, which brings us to our next point:

When considering where to invest 200k, remember that a well-chosen real estate asset could potentially be the highest-earning asset class in your portfolio.

There are several aspects you’ll need to consider before you can settle for your ideal property, though – and we’ve outlined them below.

Personal Objective

Before all else, think about your objective and what you are hoping to gain with your investment. Consider what you genuinely want – and if you wish to take the short or long position on the real estate market.

When you’ve decided on your desired position, it’s time to create a concrete plan for your future:

What do you hope to gain with this investment?

Whether it’s early retirement or leaving an inheritance to your children or spouse, you should set a goal for yourself and your investment. Only then can you start thinking about different ways to spend that 200k.

Passive vs. Active Income

When deciding what to do with 200 dollars, time is going to be a pretty significant factor.

If you have plenty of time, perhaps active income might be the right route for you since it could generate a good return on investment. On the other hand, if you have a demanding job but are looking to spend your disposable income on a lucrative investment, passive sources of income might be the way to go.

It’s worth noting that you can still generate an active source of income with real estate – even if you don’t have a lot of time – through rentals. However, you’ll need to hire a property manager, which will reduce your revenue from the investment.

Think About The Associated Risks

Investing in anything carries a certain risk – and the story’s the same with real estate. Although it’s generally considered one of the safest forms of investments, secured by the actual asset – the property – real estate investing carries some risks – and you must be aware of them before you take the plunge.

Think your steps through to ensure you are protected from the risks associated with properties, like changes in the real estate market.

To protect yourself and your investment, you will need to diversify your investment portfolio. Diversifying your portfolio essentially means all your eggs are not in the same basket – you will need to scatter them around.

That way, if you break a few in one place, the other place can still pick up the losses.

Diversifying your 200k investment could consist of you investing half of your money into low-risk property that comes with high prices to rent. However, you should use the other half for buying a risky property that comes with a high profit when sold.

Finding The Right Property

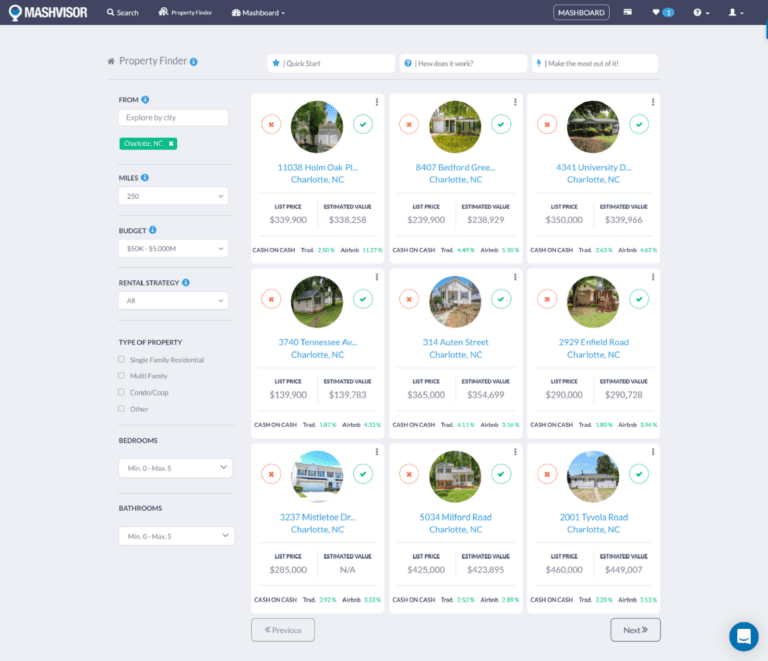

Finding the right investment property can take quite a bit of your valuable time – especially if you aren’t experienced in the field. That’s where Mashvisor’s investment property analysis tool – the Property Finder – comes in:

Property Finder is AI-driven and enables you to search through high-performing properties in up to five cities at once – all in a matter of minutes. More importantly, it does so by factoring in your search criteria and investment goals.

These filters include types of property, listing price, return on investment, market availability, and optimal rental strategy – all of which can help you identify properties that match your goals.

The Bottom Line

When it comes to where to invest 200k, there’s more than one route you can take. Each one comes with some pros and cons, so it’s entirely up to you to make that capital decision.

After all, it all comes down to what you want – to generate active or passive income. Or, to put it simply:

Do you want to be involved in the money-making process, or do you want it to be as hassle-free as possible?

Finding a new income property to invest in was once a relatively tricky thing to do – but with our Property Finder, it’s as easy as it was meant to be.

If you wish to learn more about real estate investments or need assistance finding the ideal type of property for you, sign up for a free 14-day trial with Mashvisor today!