If you’re an investor contemplating investing in Houston real estate in 2023, you should familiarize yourself with the market situation first.

Table of Contents

- Is Houston, Texas a Good Place to Invest in Real Estate in 2023?

- 5 Things to Consider When Finding Rental Properties for Sale in Houston, Texas

- 7 Best Neighborhoods in Houston, Texas for Traditional and Airbnb Rental Investment

The scope of the real US housing market provides many diverse and attractive opportunities for investing in real estate. Regardless of their experience, real estate investors can find lucrative locations for investment with good and thorough research.

As for Houston, Texas, investors do not need additional information to see how favorable this location can be for living and business opportunities alike. Texas, as a state, has a very good infrastructure and a steady economy. Houston has been a hotspot for real estate investors for some time now. So, the most fitting follow-up question seems:

Is investing in Houston real estate in 2023 a good idea?

Although the mention of 2023 may seem far away to some, it is a very short period when it comes to real estate investing ventures. Besides, with attractive locations, such as the city of Houston, investors have to plan their steps months in advance.

To learn more about the real estate investing opportunities in Houston and whether this idea is something worth pursuing in the upcoming months, continue reading.

Is Houston, Texas a Good Place to Invest in Real Estate in 2023?

It most certainly is.

Houston, Texas is a location real estate investors should strongly consider in 2023. It is mainly because the state of Texas is favorable both for real estate investment opportunities and for life itself.

In order to show you the state’s development, we will take this opportunity to list down several things that favor real estate investors considering investing in Houston real estate in 2023.

Population Growth

The steady population growth is the first reason Texas represents a potential attraction for real estate investors across the US housing market.

Houston is home to seven million people, which makes it the fourth-most-populated place in Texas. It is a popular location for both tourists and future residents. The fact that one-third of the population here are immigrants seems enough to encourage real estate investors.

Strong Economy

The economic situation can strongly influence your investment and its outcome. But luckily enough, Houston, Texas can brag—and rightfully so—about steady economic growth and job opportunities.

Investing 101: A weak economy means a weak housing market—and vice versa.

In Houston, the situation seems to be improving each year, and the state is known for its industrial power. It is, in fact, the second-strongest industrial base in the US.

Furthermore, in Houston, there are more than 1,700 biotechnical companies, health facilities, and several research institutions—so the economic condition of the state is undoubtedly at a desirable level. Additionally, Houston produces $80 million in goods on an annual basis.

Employment is not a problem, as well. Once the critical part of the COVID-19 pandemic has passed, Houston is set to hire another 174,000 to return to pre-pandemic levels.

Quality of Life

Another factor that makes investing in Houston real estate a great move is the quality of life one can expect there. It is of great importance to tourists who will spend their vacation there. It can also be a decisive factor for someone who wants to move to Houston.

According to recent statistics, the brightest aspects of life here include leisure, schools, job opportunities, and healthcare.

The one potential obstacle for someone planning to relocate here would be safety. Vehicle theft is one of the problems with which Houston, Texas is often identified.

Since up-to-date information is the best evidence, here are a couple more that put Houston on the list of desirable places for investing in real estate:

- The median property price in Texas is $574,905.

- The monthly traditional rental income in Texas is $2,000.

- The monthly Airbnb rental income in Texas is $2,953.

Related: The Best Rental Markets in Texas: The 2022 Guide

5 Things to Consider When Finding Rental Properties for Sale in Houston, Texas

Before you agree that buying a real estate property in Houston, Texas is the right investment move for you, know the following:

There are some “background checks” that real estate investors should pay attention to here. In other words, before any major investment moves, certain factors should be considered so that your investment wouldn’t take the wrong turn—and potentially leave you in debt.

Here are the five things any real estate investor must consider when finding rental properties for sale in Houston, Texas.

1. Demand for Real Estate

We may currently be talking about Houston, Texas, but prevailing real estate demand can also be applied to the US housing market as a whole. When it comes to investing, it is of great importance for real estate investors to know whether there is currently a seller’s or buyer’s market.

Although it’s possible to get a good deal in both, for real estate investors, a buyer’s market is an ideal time for investments. It is when there are fewer competitors—and the prices tend to be lower.

What side is Houston, Texas on right now?

As of August, Houston is still a seller’s market—meaning that there are more people looking to buy a home. According to statistics, there’s no indication that it will convert to a “buyer’s market” until the end of 2022.

Even though the situation will remain unchanged for Houston, it shouldn’t be viewed as a discouragement for investors—the catch is focusing on the right location.

2. Neighborhood

Location is key when searching for real estate properties in Houston, Texas. When it comes to this particular factor, the crucial step is to deeply analyze and research the neighborhood that seems attractive to you.

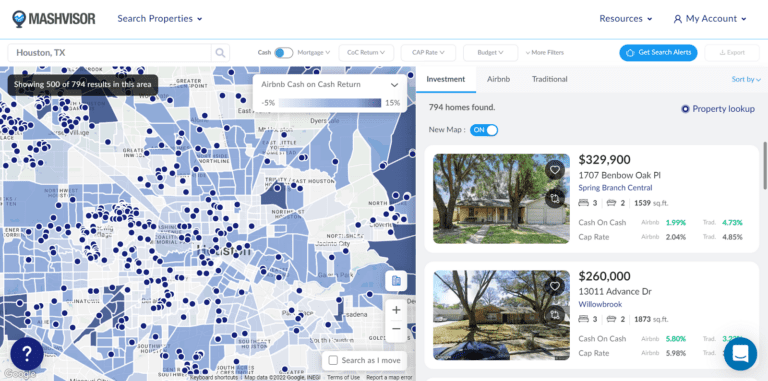

After you decide which kind of investment is for you—traditional or Airbnb—focus on finding a neighborhood that is suitable for your specific type of investment property. Performing a neighborhood analysis is often tedious and time-consuming. In this regard, Mashvisor provides an analysis tool that you can use to obtain accurate results in the least amount of time.

On that note, here are some of the most famous neighborhoods in Houston, Texas:

- South Main

- Downtown

- Fourth Ward

Related: How to Evaluate a Neighborhood Before Investing

3. Financial Metrics

After finding your ideal real estate property in Houston, the next factor you should pay attention to before investing would be the key financial metrics.

Regardless of how tempting the real estate property seemed to you at first glance, the data and numbers provided by Mashvisor are there to help you determine the success of your investment. They can give you a deeper insight into each neighborhood or property based on the different metrics calculated by the platform.

A few examples of key financial metrics that should influence your decision include:

- Cash flow

- Cash on cash return

- Cap rate

- Vacancy rate

- Loan-to-value ratio (LTV)

4. Property Condition

Before signing the deal and becoming the rightful owner of the property, real estate investors should conduct a thorough inspection to get a better insight into the property’s condition.

Why is this important?

The price at which you buy your real estate investment property in Houston can turn out to be too much for your budget if you find that the property is actually in bad condition.

Do note that, by “bad condition,” we are not talking about small repairs and “touch-ups” that you need to do, though. We are referring to the major issues that affect the overall value of your real estate.

5. Property Management

The next factor real estate investors must consider before investing is their preferred method of property management. While some real estate investors might decide to self-manage their property, others prefer to hire an agent or a property management company.

Both cases are more or less common in the real estate business and come with certain obligations and costs.

On that note, what we want to draw your attention to when it comes to property management is the following:

- Determining the rent (relying on real estate comps)

- Addressing issues and taking care of repairs

- Respecting community and landlord-tenant laws

- Providing regular financial reports

- Collecting deposits

Related: Top 8 Property Management Companies in 2022

7 Best Neighborhoods in Houston, Texas for Traditional and Airbnb Rental Investment

Investing in real estate in Houston, Texas requires serious research skills. Considering that it is one of the largest real estate markets in the US, we took the time to compile the following list of the five best neighborhoods for traditional—and a couple for Airbnb—investments.

The neighborhoods below are ranked from the highest to the lowest cash on cash return, according to Mashvisor’s August location report.

5 Best Neighborhoods in Houston, Texas for Traditional Rental Investment

Here are the top five Houston neighborhoods for traditional rental investments:

1. South Main, Houston

- Median Property Price: $279,917

- Average Price per Square Foot: $158

- Days on Market: 13

- Monthly Traditional Rental Income: $2,042

- Traditional Cash on Cash Return: 4.93%

- Traditional Cap Rate: 5.29%

- Price to Rent Ratio: 11

- Walk Score: 30

South Main in Houston is known for its high living standards, low unemployment rate, and some of the top-ranked schools in the area. The neighborhood is home to about 8,000 residents and is considered one of the best places to live in Houston.

2. Washington Avenue Coalition – Memorial Park, Houston

- Median Property Price: $531,077

- Average Price per Square Foot: $242

- Days on Market: 9

- Monthly Traditional Rental Income: $2,639

- Traditional Cash on Cash Return: 2.67%

- Traditional Cap Rate: 2.72%

- Price to Rent Ratio: 17

- Walk Score: 83

Investing in Washington Avenue Coalition – Memorial Park can be a profitable opportunity. It provides its residents with everything they need—schools, gyms, churches, restaurants, and more. It is a popular choice for real estate investors because it’s “in the center of it all.”

3. Fourth Ward, Houston

- Median Property Price: $462,446

- Average Price per Square Foot: $293

- Days on Market: 12

- Monthly Traditional Rental Income: $2,329

- Traditional Cash on Cash Return: 2.51%

- Traditional Cap Rate: 2.57%

- Price to Rent Ratio: 17

- Walk Score: 78

Investing in Fourth Ward in Houston means investing in one of the six historic wards. You’ll be glad to know that 63% of the neighborhood is renter-occupied. Plus, Fourth Ward is known for its exceptional daycare centers, which is why many families decide to raise their children here.

4. Midtown, Houston

- Median Property Price: $502,211

- Average Price per Square Foot: $223

- Days on Market: 22

- Monthly Traditional Rental Income: $2,236

- Traditional Cash on Cash Return: 2.39%

- Traditional Cap Rate: 2.44%

- Price to Rent Ratio: 19

- Walk Score: 81

Midtown, Houston can be a good location if you want to invest in an urban living area. The neighborhood is lively, with many coffee shops, restaurants, and bars scattered around the area. It is a popular location for many young professionals looking to kick off their careers, as well.

5. Downtown, Houston

- Median Property Price: $440,244

- Average Price per Square Foot: $238

- Days on Market: 9

- Monthly Traditional Rental Income: $2,458

- Traditional Cash on Cash Return: 2.22%

- Traditional Cap Rate: 2.27%

- Price to Rent Ratio: 15

- Walk Score: 95

Investors looking for a “busy” area with many job opportunities should consider investing in Downtown, Houston. It is one of the largest business districts in the city. Even more so, it’s a safe, progressive, and innovative area for future residents.

For more reliable and up-to-date information on traditional investment properties for sale in Houston, Texas, click here.

Use Mashvisor to find reliable and updated information on traditional and Airbnb investment properties for sale in Houston and other cities in the US.

2 Best Neighborhoods in Houston, Texas for Airbnb Investment

Check out the folowing Houston neighborhoods for investing in Airbnb:

1. Midtown, Houston

- Median Property Price: $502,211

- Average Price per Square Foot: $223

- Days on Market: 22

- Monthly Airbnb Rental Income: $2,618

- Airbnb Cash on Cash Return: 1.37%

- Airbnb Cap Rate: 1.40%

- Airbnb Daily Rate: $162

- Airbnb Occupancy Rate: 40

- Walk Score: 81

2. Washington Avenue Coalition – Memorial Park, Houston

- Median Property Price: $531,077

- Average Price per Square Foot: $242

- Days on Market: 9

- Monthly Airbnb Rental Income: $2,535

- Airbnb Cash on Cash Return: 1.04%

- Airbnb Cap Rate: 1.06%

- Airbnb Daily Rate: $144

- Airbnb Occupancy Rate: 44%

- Walk Score: 83

The fact that there are only two potential Houston neighborhoods for Airbnb investment suggests that the city’s short-term rental market might be slowing down. By the looks of the statistics, it’s true. The question is, “What is the reason for the apparent slowdown?”

For the most part, it’s the competition. The rapid growth in the Texas real estate market means it’s become flooded with investment opportunities, with Airbnb getting the short end of the stick. Websites are crowded with hundreds of Airbnb listings, making it hard for investors to set a price that will allow them to make a profit.

So, if you’re looking to invest in Airbnb in Houston neighborhoods, the two neighborhoods with the most potential in Houston are Midtown and Washington Avenue Coalition.

Start your search for profitable Airbnb investment properties for sale in Houston, Texas by clicking here.

Summing Up: Investing in Houston Real Estate

We’ve now successfully reached the end of the topic of investing in Houston real estate in 2023. But in order to successfully conclude it, we should go over the main points once again.

As a state, Texas is known for its steady economy and favorable life standards. Houston, as one of its most famous cities, is considered a hotspot for investors contemplating new investment opportunities.

It’s safe to say that Houston will remain a lucrative location for real estate investments. Here, there are both traditional and Airbnb investment properties available that can help you, as an investor, generate a steady income and realize high returns.

When choosing the ideal real estate property that will fit your plans and budget, you will need to consider factors like the neighborhood, the property’s condition, financial metrics, property management, and current demand for real estate.

Houston is, indeed, an advantageous location for real estate investors—and Mashvisor can help you pin down the property that matches your business and personal preferences. Our Property Finder tool is designed to assist you and other real estate investors in locating your ideal investment property across the entire US housing market.

To get access to our real estate investment tools, sign up for a 7-day free trial of Mashvisor today, followed by 15% off for life.