Over time, real estate investors have created a great income stream with Airbnb properties. Find out how an Airbnb cash flow will work for you.

A lot of folks get into real estate investing, especially rental properties, to generate extra income and help build equity. As far as positive cash flow is concerned, vacation rental properties tend to give an investor a better revenue stream compared to long term rentals. But what is a good Airbnb cash flow?

Table of Contents

- What Is a Good Cash Flow for Airbnb Rentals?

- 3 Cities Where Your Airbnb Rentals Can Generate Positive Cash Flow

- 3 Tips for Boosting Your Airbnb Cash Flow

As a real estate investor, what are the things you should consider to generate a positive cash flow when investing in an Airbnb property? Why are Airbnb properties generally the better option for a positive cash flow for most investors?

Other investment strategies, like house flipping and the BRRRR strategy, provide a pretty good return on investment. However, most investors tend to gravitate towards rental properties, especially vacation rentals.

For one, investing in rental properties gives investors a reliable income source that helps them take care of the property’s upkeep and gives them a little something to take to the bank. It is especially helpful for those who took out a loan to purchase an investment property.

Two, owning a rental property allows you to be flexible to sell at the right time. If you plan to sell the property later on, renting it for several years will give you consistent income while its value appreciates over time.

So let’s talk about how to generate a positive cash flow for your Airbnb property.

What Is a Good Cash Flow for Airbnb Rentals?

A decent positive cash flow for Airbnb rentals is pegged at a minimum range of $100 to $200 monthly profit. However, your income will vary depending on several factors, such as location, property price, local economy, tourism, and operating expenses, among others.

The first thing you must consider is the property price. Logically, the higher the price, the longer it will take you to get a return on your investment. It is why most rental property investors prefer to buy undervalued properties that can be improved with a few repairs and upgrades compared to turnkey properties.

If you’d like to give it a try with your calculator, the cash flow formula for a rental property is:

Cash Flow = Total Rental Income – Total Rental Property Expenses

If you paid for your property with a loan, a huge chunk of your rental income will go to paying off your mortgage. For this reason, you will need to consider the property’s price and overall condition before making a purchase.

And then, you also need to look at a few metrics to determine if a certain location can give you both a good ROI and continuous income. The metrics are the cap rate, cash on cash return, and occupancy rate.

Capitalization Rate

The cap rate is a metric used by real estate investors and professionals to determine a property’s profitability as a rental property. The cap rate formula involves taking a property’s net operating income (NOI) and dividing it by the property’s market value.

To use the cap rate formula on your calculator, refer to the following:

Cap Rate = Net Operating Income (NOI) / Property Market Value

Industry professionals and experts all agree that a good cap rate hovers between 8% and 12%. However, properties that give you such numbers are few and far between. That said, many investors and industry insiders also agree that an Airbnb cap rate that does not go below 2% is a good place to start to get a positive cash flow.

Cash on Cash Return

The cash on cash return is quite similar to the cap rate, which explains why many people use them interchangeably. The ideal rate for good cash on cash return is also between 8% and 12%, just like the cap rate. And again, properties that give you numbers that good are harder to find, so a cash on cash return rate of at least 2% puts you in a good place for positive cash flow.

However, despite their similarities, they are not exactly the same. While cap rate bases its value on a property’s actual current market value or selling price, cash on cash return takes into account financing methods in its computation.

The formula for cash on cash return is:

Cash on Cash Return = Net Operating Income (NOI) / Total Amount of Cash Invested

What it simply means is that you only compute the dollar-for-dollar return on the total amount of cash you invested. If you took out a loan to buy an investment property, you only need to factor in how much cash you used to buy the property and have it fixed.

It is why a lot of investors who take out loans use the cash on cash metric instead of the cap rate, as it applies to their situation best.

Occupancy Rate

One more very important metric used to see if a property is worth investing in is the occupancy rate. Generally, you will refer to rental comps to see how busy things can get in a vacation rental market.

The occupancy rate is the core key performance indicator of an Airbnb property. It gives you an idea of how many bookings you will get against the number of days your property is listed. An ideal number would be between 70% and 95%, but, once again, that’s not always the case. Getting an occupancy rate of at least 50% should give you a good positive cash flow.

Computing Airbnb Cash Flow Made Easy

We’ve already given you the cash flow formula earlier if you want to take a crack at it using your calculator. However, there’s a more efficient and easier way to compute Airbnb cash flow, and it is by using an Airbnb calculator from a reputable platform.

Mashvisor is one such platform that offers users access to its investment property calculator. The site uses actual real estate market data gathered from trusted sources like Zillow, Realtor.com, the MLS, and Airbnb itself. The provided Airbnb data is regularly updated, so you’re assured of highly accurate and realistic ROI projections and revenue computations.

All you need to do is sign up for Mashvisor’s services to get access to its massive database and investment tools, like the Property Finder, Dynamic Pricing, and Airbnb profit calculator. In addition, it offers you a free trial period to see if it works for you or not.

MAhvisor’s different features and tools makes real estate investing a lot easier and far more cost-effective than the conventional way of going out and using spreadsheets.

3 Cities Where Your Airbnb Rentals Can Generate Positive Cash Flow

Now that we know the importance of Airbnb cash flow and what to look for in a potential investment property, the next step is to find a good location for investing.

There are literally thousands of rental property markets spread across the US. But not all of them offer numbers that are off the charts where Airbnb rentals are concerned. You need to find a market that will suit your investment goals and financial situation.

For this reason, you need to find a neighborhood that will offer you the best numbers to get a very positive return on your investment.

We went through Mashvisor’s March 2023 data to give you a list of three rental markets that will give you a good positive Airbnb cash flow free of charge. The following list’s been filtered based on the following criteria:

- Each location should have a median property price of no more than $1,000,000;

- Each location should have at least 100 active listings on the short term rental market;

- Each location should give you a minimum monthly rental income of $2,000;

- Each location should have no less than 2% cash on cash return; and

- Each location should have an occupancy rate of 50% and above.

That said, here’s our list of the three best markets for Airbnb rentals, ranked according to cash on cash return (highest to lowest):

1. Northlake, IL

- Median Property Price: $323,180

- Average Price per Square Foot: $217

- Days on Market: 139

- Number of Airbnb Listings: 120

- Monthly Airbnb Rental Income: $4,269

- Airbnb Cash on Cash Return: 8.29%

- Airbnb Cap Rate: 8.44%

- Airbnb Daily Rate: $171

- Airbnb Occupancy Rate: 53%

- Walk Score: 33

We looked for a property in Northlake and found a four-bedroom, two-bathroom property using the following filters:

- The property is within 100 miles;

- $1,000,000 budget ceiling;

- Four bedrooms; and

- Two bathrooms

The property is listed at $231,999 and provides an Airbnb cash on cash return of 16.25%. Using Mashvisor’s calculator, we found the property’s estimated values to be the following:

- $5,443 per month in short term rental income;

- 46% occupancy rate; and

- $2,233 monthly rental expenses

If you whip out your calculator, you will find the above numbers give you a very positive Airbnb cash flow of $3,210 per month. Of course, not all properties in Northlake, IL will give you the same numbers, which is why we recommend using Mashvisor to search for the best deals in the most profitable rental markets across the US.

2. Columbia Heights, MN

- Median Property Price: $294,482

- Average Price per Square Foot: $142

- Days on Market: 22

- Number of Airbnb Listings: 314

- Monthly Airbnb Rental Income: $3,724

- Airbnb Cash on Cash Return: 8.06%

- Airbnb Cap Rate: 8.21%

- Airbnb Daily Rate: $158

- Airbnb Occupancy Rate: 58%

- Walk Score: 82

Using the same filters, we were able to spot a listed property in Columbia Heights with a price tag of $319,900 and cash on cash return of 9.96%. With a high occupancy rate of 61%, the property offers an estimated monthly Airbnb rental income of $4,463. Minus its estimated monthly rental expenses, amounting to $1,836, you still get a positive cash flow of $2,627 in a month.

3. Bridgeton, MO

- Median Property Price: $264,711

- Average Price per Square Foot: $136

- Days on Market: 23

- Number of Airbnb Listings: 120

- Monthly Airbnb Rental Income: $3,291

- Airbnb Cash on Cash Return: 7.69%

- Airbnb Cap Rate: 7.83%

- Airbnb Daily Rate: $154

- Airbnb Occupancy Rate: 58%

- Walk Score: 3

Last on our list is Bridgeton in beautiful Missouri. With the same filters, we found a listed property that would set you back by only $91,000, since it’s a condo unit. It offers a cash on cash return rate of 11.66% on Airbnb rentals, with an estimated 60% occupancy rate.

With a projected monthly rental income of $1,770 and monthly expenses amounting to $837, you get a positive cash flow of $933 a month. Not bad for an Airbnb condo.

To start looking for and analyzing the most affordable rental properties with good Airbnb cash flow potential in your city and neighborhood of choice, check out Mashvisor.

3 Tips for Boosting Your Airbnb Cash Flow

If you want to improve your revenue, here are three tips to boost your Airbnb cash flow:

Tip #1: Hire a Property Manager

We understand that not many of you can take on the responsibilities of an Airbnb host full-time. It can be quite challenging to juggle your other priorities and try to make money off your rental property. If you’re having trouble managing your Airbnb rental, we suggest hiring a property manager to help you build your business.

A property manager can take a huge load off your shoulders, allowing you to focus on other equally important pursuits. The manager can focus on running the day-to-day operation of your business. It includes communicating with guests, maintaining the property, and getting more bookings. They can also take care of marketing your property, among other things.

Tip #2: Offer Additional Amenities and Services

You may also add a few add-on services and amenities to give your guests a better overall experience. You may include breakfast offerings or free parking. Or, perhaps you can give your guests a free tour of the city to show them how to get around. All you need to do is be creative.

Tip #3: Customize Your Pricing

Lastly, if you want to improve your Airbnb cash flow, consider customizing your pricing. A customized pricing model will give you better flexibility and control of your listing.

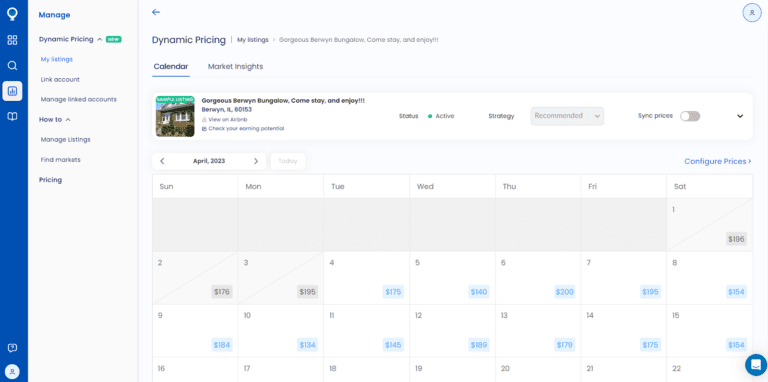

One simple way to do it is by using Mashvisor’s Dynamic Pricing tool. The Dynamic Pricing feature lets you manage your Airbnb account and listings in one platform. Among the tool’s positives for investors include the following:

- It allows you to set the right rental rates in your market and increase your occupancy rate to give you a positive Airbnb cash flow;

- It allows you to assess the competition by giving you a greater market insight and letting you keep track of your performance against other similar properties;

- It gives you free access to AI-powered dynamic pricing with its calendar feature; and

- It gives you full control over your booking prices, availability, and settings.

Mashvisor’s Dynamic Pricing tool offers real estate investors several benefits, including access to a calendar to manage all your listings and nightly pricing.

Learn more about Mashvisor’s Dynamic Pricing tool and how it can give you a good Airbnb cash flow on your vacation rentals by scheduling a demo now.

Wrapping It Up

The bottom line is that when starting a rental property business, you should always take into account how much positive cash flow you will get. No investor goes into a venture without the idea of making a profit. You’re not in it to simply break even.

As an investor, you should keep an eye out for the different indicators that will get you a positive Airbnb cash flow. It will ensure that you get a good return on your investment and give you a steady monthly income.

To help you find the best deals on investment properties that will give you a positive cash flow, use a platform like Mashvisor. Mashvisor provides essential investment tools like Dynamic Pricing and Airbnb calculator to ensure you find properties that match your investment needs.

Get access to Mashvisor’s Dynamic Pricing and other tools to boost your Airbnb cash flow and be you on your way to a thriving real estate investing career. Get started on your 7-day free trial today.