Computing Airbnb fees is a part of being an Airbnb owner and host. To get the most accurate calculations, you need a good Airbnb fee calculator.

There are plenty of sites and platforms online that offer their own version of an Airbnb calculator. As a real estate investor, you need to find the one that will allow you to make the most accurate and realistic computations. They include the estimated fees, expenses, and profits on your Airbnb property.

Table of Contents

- What Is an Airbnb Fee Calculator?

- What Does an Airbnb Fee Calculator Do?

- 3 Airbnb Fees That Could Impact Your Payout

What are you planning for this year? Are you looking at becoming one of many real estate investors this year? Perhaps you’re considering a short term rental property because you heard such good things about Airbnb.

Undoubtedly, becoming an Airbnb host offers an excellent return on investment. Investment property analysis shows that short term rentals generate much more annual revenue than more traditional rentals.

One question you’re bound to ask yourself is whether Airbnb is as profitable as people say it is. Unfortunately, not all Airbnb properties are equal, so it stands to reason that while some will generate good returns, others might not be as profitable.

There is something you can do before you buy an Airbnb investment property, and that’s to look at potential returns. Don’t worry if you don’t have a head for figures or you don’t know where to start with your real estate analysis. Technology comes to the rescue with Mashvisor’s Airbnb fee calculator.

This post will look at how Mashvisor’s tool can help real estate investors make intelligent investment decisions and increase their earning potential going into this year and beyond.

What Is an Airbnb Fee Calculator?

Mashvisor’s Airbnb Fee Calculator

Real estate investing is a lot easier to do in a digital age compared to decades past. Thanks to the boons of modern technology, investors now enjoy more open doors for real estate investing. Investing out-of-state is easier. Acquiring pertinent real estate market data and information is made faster. Doing the math is easier.

You’ll find investment property calculators all over the internet. It’s a digital tool investors use when they want to analyze the potential of an investment property.

Mashvisor’s Airbnb calculator is similar in many ways but also vastly different. It focuses on the potential of Airbnb investment properties.

Mashvisor’s Airbnb profit calculator can help because it can access reliable and relevant Airbnb data and analytics. Using the said information, the tool analyzes the profitability of a potential Airbnb investment in any housing market in the United States.

The data the Airbnb income calculator uses comes directly from Airbnb.com. So, rather than spending weeks gathering data yourself and working out projections, all the work is done for you.

Using the most critical data and real-time analysis, you’ll be able to make smarter decisions about your potential Airbnb investment property. Rather than taking weeks, you’ll be able to do it all in a matter of minutes.

All these, and more, makes Mashvisor’s investment property calculator the best Airbnb calculator out there today.

To get access to Mashvisor’s Airbnb calculator and other real estate investment tools, sign up for a 7-day free trial of Mashvisor today, followed by a 15% discount for life.

What Does an Airbnb Fee Calculator Do?

Mashvisor’s Airbnb fee calculator provides a wide range of information you can use to help you find the best Airbnb rental property for sale.

Let’s look at the Airbnb data and analytics that you access with Mashvisor’s Airbnb fee calculator.

Airbnb Occupancy Rates

According to almost every vacation rental data available online, the vacation rental marketplace is very seasonal. The influx of guests is directly affected by the calendar. Sometimes, geography and location play a significant role. Other times, it is related to the local tourism industry calendar in your area.

The volume of guest inquiries and bookings will depend on your location and the locale’s tourist-friendly activities. Fluctuations in bookings are commonplace, but the patterns tend to be unique to each short term rental market.

If you want to calculate the rental income of an Airbnb property based on guest bookings, you need to know its occupancy rate. The more guests you receive in a year, the higher the occupancy rate. The higher the occupancy rate, the bigger the rental income you’ll generate every month.

As an investor, when you make your calculations on your rental rates, make sure you can generate a high Airbnb income during the peak seasons. Ideally, what you make during the high seasons should be enough to cover you during the off-peak months.

Mashvisor’s fee calculator uses data relating to the performance of comparable rental properties in the same area to estimate Airbnb occupancy rates.

Airbnb Rental Income

To determine your potential cash flow and return on investment, you need to know about Airbnb rental income.

After deciding on a location, the next step is to begin your investment property search. There are many places you can look at, including newspapers and your network. You can also seek the assistance of real estate agents. However, a more efficient way to look for properties is to use Mashvisor’s Property Finder.

Mashvisor’s Property Finder

The Property Finder is an online property search tool that helps you find top-performing Airbnb properties for sale in any location of your choice. You can streamline your search by entering various criteria and preferences to ensure you get the best match for your goals.

Using the Airbnb fee calculator, enter an address, and the revenue estimator will deliver accurate rental estimates of potential Airbnb rental incomes.

The Airbnb investment calculator bases the estimate on Airbnb daily rates and Airbnb occupancy rates of rental comps or similar rental listings in the area.

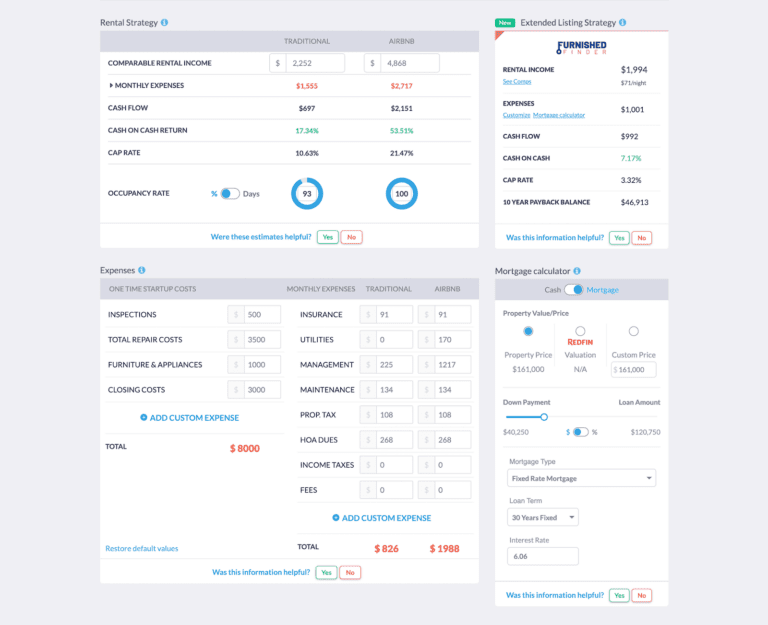

In addition to using the data for determining cash flow, you can also use it to help you decide how much rent to charge guests. The Airbnb fee calculator also provides data for traditional properties. It means you can compare the profitability of two rental strategies and decide which works best for you and will give the best rental income.

Airbnb Rental Expenses

Anyone new to rental property investment might not appreciate that you need to cover lots of expenses. As the adage goes, “You’ve got to spend money to make money.”

Being able to estimate all those Airbnb rental expenses will be very helpful when you’re deciding whether to buy an Airbnb property or not. The estimates also prove helpful in calculating expected cash flow and return on investment.

The Mashvisor Airbnb fee calculator provides a list of possible expenses, including one-time startup costs and recurring monthly expenditures. For each category, you’ll also get a total cost.

Some of the Airbnb rental expenses you’ll find included in Mashvisor’s Fee Calculator include:

One-time startup costs such as:

- Closing costs

- Total repair costs

- Furniture and appliances

- Inspection fees

In terms of monthly expenses, you’ll find the following:

- Rental income tax

- Property tax

- Property management costs

- Insurance

- Property maintenance

- Cleaning fees

- Utilities

- HOA dues

Compared with a traditional landlord, an Airbnb owner/host faces more recurring costs in terms of fees and services. While some of the recurring costs might not be included in the Airbnb fee calculator, you can modify the expenses and add custom ones as you see fit.

The more detailed you are in listing down your fees and expenses based on the goods and services you acquire as a host, the tighter and more realistic your cash flow projections will be.

Airbnb Cash Flow

The cash flow for any business is the difference between income and expenses. For an Airbnb business, it’s no different. The cash flow is your monthly Airbnb rental income minus your monthly expenses. If the cash flow for your Airbnb rental is positive, your property pays for itself and provides you with a dependable monthly income stream.

If you want to make sure the property you’re investing in generates a positive cash flow, you must conduct a cash flow analysis before buying.

Use the Mashvisor calculator tool, and you’ll get carefully calculated Airbnb cash flow estimates for any property you might want to consider.

Airbnb Capitalization Rate

When a real estate investor wants to compare the profitability of several investment opportunities quickly, they use a return on investment metric known as the capitalization rate.

The cap rate doesn’t consider the financing method of the investment and can be very time-consuming, particularly when you want to compare multiple Airbnb properties for sale.

Luckily, our Airbnb fee calculator can do the hard work for you and deliver readily-calculated cap rate estimates.

Airbnb Cash on Cash Return

Another very important metric for anyone looking at purchasing an Airbnb property is cash on cash return. The Airbnb cash on cash return metric is slightly different from the cap rate because it takes into account the financing method.

If you’ve chosen to finance your Airbnb purchase with a real estate investment loan, calculating Airbnb cash on cash return is critical to your Airbnb investment analysis.

It doesn’t matter if you don’t know how to make the calculation because the Airbnb income calculator pre-calculates it for you.

Airbnb Rental Comparisons

Knowing what level to set your Airbnb rental is essential after you’ve decided to invest in an Airbnb property. To help you choose the best investment property, you can conduct a detailed rental market analysis. It involves comparing rental prices of similar Airbnb properties in the area.

There are many ways you can find comparable properties, but one of the most effective, fastest, and easiest ways is to use Mashvisor’s Airbnb price estimator tool. Using Mashvisor’s tool, you’ll get a list of active Airbnb rental comps for every property on the platform.

Looking at the data allows you to see how each of the rental comps is performing relating to the nightly rate, occupancy rate, rating, and rental income.

Using the said information, you’ll be able to decide on an Airbnb rental that will maximize your occupancy rate and rental income. Running Airbnb rental comps is critical if you want to be competitive now and into the coming year.

3 Airbnb Fees That Could Impact Your Payout

Airbnb is a business model that has allowed regular people to earn by subletting their properties as vacation rentals. It has provided countless people with an added income stream. However, you need to remember that what you make on your short term rental property isn’t yours to take at a hundred percent.

As an Airbnb host, you are charged by the company certain fees that they take from each confirmed booking. Airbnb automatically charges you such fees to cover its operating costs and handle the host’s administration costs. The Airbnb fees charged to your account typically go to the following:

- 24/7 customer assistance and support

- Online marketing and promotion

- Protection for the Airbnb host and property

- Host education and development

Let’s take a look at Airbnb’s service fees so you get a better idea of what you can expect as a potential Airbnb host.

1. Airbnb Service Fees

There are two types of Airbnb service fees: host fees and guest fees. For the sake of simplicity, we will focus on the host fees in this discussion.

As an Airbnb host, you have two options to choose from where service fees are involved:

- Host-Only Fees – Airbnb charges the hosts the entirety of the service fees, which usually fall between 14% and 16% of the reservation’s subtotal. It may seem unfavorable for hosts, but it does give you better control over your nightly rates. You can adjust your nightly rates accordingly to transfer some or all of the service fees to the guest.

- Split Fee – The service fee is split between the host and the guest. Under this model, the guest takes the bulk of the charges as the host is charged only 3% while the guest picks up the slack and takes on around 14.2% of the reservation’s subtotal.

2. Airbnb Experience Fees

If you plan to add Airbnb Experience to the services you offer, be warned that Airbnb will deduct 20% of your Airbnb Experience rates.

3. Financing Options

Although financing is technically not an Airbnb fee, it is still an expense you must factor in when using an Airbnb fee calculator. The financing method you use to purchase your Airbnb property will significantly affect your return on investment and cash flow.

So, what are your financing options if you want to purchase an Airbnb rental property? Unfortunately, financing Airbnb properties is not as easy as you might expect. Their short term nature means you’ll face higher levels of scrutiny from lenders compared to standard investment loans for traditional properties.

It depends on your situation, but one of the following might suit you:

Conventional Loans

You can get a conventional mortgage from many established lending institutions, such as a national bank or a smaller mortgage lender, like a credit union or local bank.

Conventional mortgages tend to come with strict requirements that often include a higher credit score, higher cash reserves, a larger down payment, and a lower debt-to-income ratio.

However, when it comes to mortgage rates, they are usually more competitive compared to other Airbnb loans.

Home Equity Loans

If you already own a property, you could use the equity to take out a fixed-rate home equity loan or a home equity line of credit (HELOC).

You could probably borrow enough funds to cover your down payment, but it would depend on your debt-to-equity ratio, the cost of your investment, and other factors. You would also need to use another financing option for the balance. Alternatively, you could borrow the total amount required to purchase the property.

One of the advantages of home equity loans is that the rates are low. Terms also tend to be very favorable. However, you’re putting your primary residence at risk if you fail to pay down the loan.

Small Business Loans

Small business loans are another way to finance the purchase of an Airbnb rental. We saw increased demand for Airbnb financing in recent years, leading to an increase in the number of companies offering small business loans.

A small business loan for an Airbnb property tends to be more challenging to secure. The reason is that most lenders would prefer to finance a business with an established track record. To get a small business loan, you also must be registered as a business entity.

Hard Money Loans

A hard money loan is a short term loan given by an institution or private individual. Hard money loans tend to be a last resort for most borrowers. It is because they typically require a high down payment and charge higher interest rates than other financing options.

On the plus side, they usually have come with requirements and will be approved much more quickly. For such reasons, they make a viable alternative if you’re not eligible for other loans.

However, before you choose the hard money loan option, remember you’ll need a sizable down payment and must repay the loan in a shorter period.

If you want to know how much a financing option will impact your Airbnb investment, the Airbnb fee calculator includes an inbuilt mortgage calculator. Simply enter the details of your mortgage, and you’ll see how the cash flow and cash on cash return is affected by the size of your down payment, the type of loan, and the interest rate.

Final Thoughts

Looking forward, Airbnb hosting can be a lucrative business opportunity. It starts with finding the right investment opportunities that offer very promising returns on investment. But it doesn’t end there.

First, however, you need to do your research to ensure you’re purchasing the right property and renting it out at the correct rate. It can only be done when you perform due diligence so you can come up with a highly accurate rental property analysis.

If you want to make an intelligent investment decision, you can’t go wrong if you run the numbers first. Use Mashvisor’s Airbnb fee calculator because it will make your analysis easier. The tool provides accurate analytics and Airbnb data in just a few minutes. It will also point you to the right properties that line up with your goals as an investor.

Learn more about how Mashvisor can help you find the best deals in the most profitable markets by scheduling a demo now.