Buying a vacation rental investment property is one of the best ways of making a great return on investment in real estate. Many travelers all over the world are opting to stay in a vacation home rather than a hotel. Vacation rental sites such as Airbnb, VRBO, HomeAway, TripAdvisor, Booking.com, Atraveo, Interhome, and Homestay.com have made it easy for anyone to book a room almost anywhere and for anyone to list a property for rent and make money in the homesharing industry. According to statista.com, the revenue generated from vacation rentals is expected to hit $97,010m by 2023. Anyone buying a vacation rental property in 2020 can have a piece of this pie.

Related: Vacation Home Rentals: All You Need to Know as a Real Estate Investor

However, before buying a vacation rental property, there are some things you need to know.

Finding the Right Location Is Crucial for Success

When it comes to investing in vacation rental properties, location is everything. This is why it is important to conduct extensive market research before purchasing a vacation home investment. Look for towns or cities that have great weather and are located near lakes, national parks, mountains, beaches, and other attractions. For example, Florida is sunny all year and boasts some of the best beaches in America. Therefore, buying a vacation rental property in Florida would be a worthwhile investment. Besides the Florida real estate market, Mashvisor lists these locations as some of the best places for buying a vacation home:

- Huntington, Vermont

- Tuscaloosa, Alabama

- Sevierville, Tennessee

- Buffalo, New York

- Gatlinburg, Tennessee

- Memphis, Tennessee

- Marana, Arizona

- Hutchinson, Kansas

- Springfield, Missouri

- Jonesboro, Arkansas

Related: 10 Best Places for Buying a Vacation Home in 2020

When choosing a location for buying a vacation rental property, you should also consider other factors that will influence your profitability. You can use Mashvisor’s heat map to compare different neighborhoods based on Airbnb data such as Airbnb occupancy rate, cash on cash return, Airbnb rental income, and listing price.

Start your neighborhood analysis now using Mashvisor’s real estate heat map to find a profitable vacation rental.

Investment Property Analysis Is Equally Important

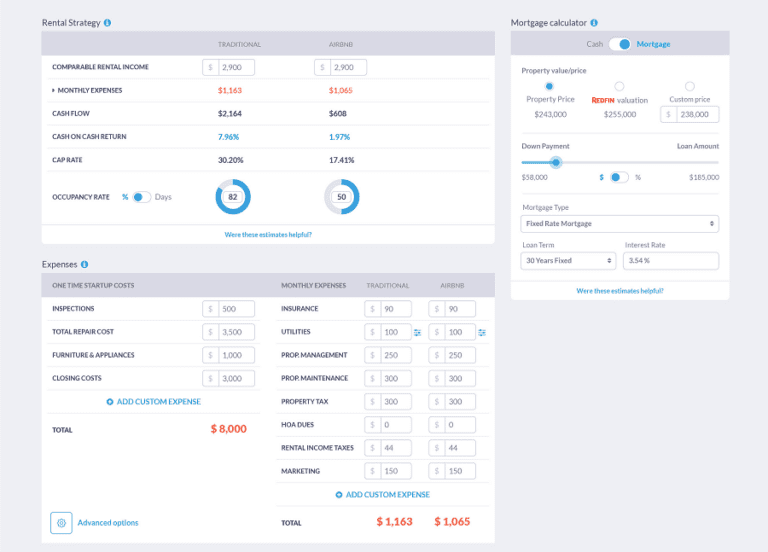

After identifying a location that fits your criteria, you’ll have a list of vacation rentals for sale. Next, you will need to conduct an investment property analysis. This is crucial to ensure you end up with a good return on investment from the property you purchase. You can further analyze vacation rentals using Mashvisor’s rental property calculator. This tool helps you conduct Airbnb analytics using metrics such as rental income, rental expenses, cash flow, cash on cash return, cap rate, and occupancy rate. It functions as an Airbnb estimator and lets you figure out how much money you’ll make.

To start your 7-day free trial with Mashvisor and subscribe to our services with a 20% discount after, click here.

There Are Numerous Financing Options for Vacation Rentals

When it comes to buying a vacation rental property, one of the main challenges real estate investors grapple with is getting financing. These are some of the options available for financing a vacation rental:

- Cash-out refinance

- Home Equity Lines of Credit

- Reverse mortgage

- Conventional financing

- 401(k) loan

However, to get approved for a mortgage as a real estate investor looking to buy a vacation home, you will need to have a low debt to income ratio, strong credit score, and some reserve funds.

Owning a Vacation Rental Property Comes with Costs

Besides the cost of purchase, renovation and furnishing, buying a vacation rental property comes with other expenses that many new real estate investors forget about. Here are some of the costs you need to know about:

- Insurance – The cost of insuring your vacation rental against natural disasters like mudslides and tornadoes can be very high. Besides property insurance, you will also need liability insurance in case your visitors injure themselves while at your vacation home or destroy your belongings.

- Utilities – Utilities in a short-term rental include TV streaming services, internet, trash collection, electricity, gas, water, and sewer. The cost of utilities could add up to several hundred dollars per month.

- Repairs and maintenance – Whether it’s a broken window, a faulty HVAC system, a leaky roof or a worn-out carpet, your vacation home will need occasional repairs and maintenance.

- Real estate marketing – To stay ahead of the competition and boost your rental income, you will have to invest in different forms of marketing. This could be a newspaper ad, paid social media posts, and listing on different real estate sites.

- Homeowners’ association (HOA) fees – If you buy a short-term rental property that is located within a community, you might have to pay HOA fees. These funds go towards maintaining shared amenities such as a clubhouse, swimming pool, security, and lawns.

- Vacation rental property management – Hiring a property management company will save you the trouble of handling the day-to-day running of your rental. However, this will eat into your profits.

Adherence to Short-Term Rental Laws and Regulations Is a Must

Most states and local governments have imposed restrictions on vacation rentals. Before you decide to start investing in vacation rental property, you need to be aware of the laws and regulations in your target area. You could simply do a Google search by typing the name of the municipality or town with the phrase ‘vacation rental laws’. However, the best way to be sure is to visit the city hall to seek clarity about all the Airbnb regulations.

Legal restrictions on short-term rentals cover things such as:

- Owner Occupancy – Some areas regulate whether or not you have to live on-site in order to rent out your vacation home to short-term guests.

- Rental license – As a short-term rental owner, you might need to get a general business license, as well as a short-term rental license.

- Type of structure – The definition of a vacation rental varies from one county or city to another. In some places, a home must have a minimum number of bedrooms to qualify as a short-term rental.

- Length of stay – County or city laws will determine how long guests can stay at your vacation home. Quite often, the maximum length of stay is 30 days.

- Limit on the number of short-term rentals in an area – Major tourist destinations and large cities usually have very strict rules concerning the number of short-term rentals that are allowed to operate.

- Taxes – After buying a vacation rental property, you will be required to pay tax to the local or state government.

Related: 15 Best Vacation Rental Tips for Owners

Conclusion

When it comes to buying a vacation rental property, there is clearly a lot to learn. This is why you need to do your due diligence before taking the leap. Buying a vacation rental property is a good investment only if you do your homework well.

To learn more about how Mashvisor can help you find profitable investment properties, schedule a demo.