Buying an income property can be a smart financial decision. If done right, one can get a good return through rental income, equity gains, and tax benefits. However, profitability is not guaranteed. There are many things to consider prior to signing on the dotted line, and a lot of risks, too. If you are planning to make your first income property investment, it might be quite intimidating. Nevertheless, this shouldn’t stop you from making a move.

To ensure success, you need to know what to look for when buying an income property and be strategic when selecting and buying one. If you don’t do your due diligence well, it can turn out to be a costly mistake. To help you make a good purchase, we’ve put together a list of the major things to ask before buying an investment property. These must-ask questions will help you make a well-informed investment decision.

Top 9 Questions to Ask Before Buying an Income Property

1. What are your financial goals?

An investor can earn money from an income property through rental income, the future resale of the investment property after value appreciation, or both. Before buying an income property, you should know what your main financial goal is. Are you buying property for rental income or capital gains? Your answer to this question will help you find the best investment property for your financial goals and expectations. If you lack clarity of purpose, you may end up in financial distress, particularly if you finance income property with a mortgage.

2. Is the income property located in a good neighborhood?

Location is a key consideration when buying an income property. Where the property is located has a huge impact on its profitability. Therefore, take your time and analyze the local housing market to understand economic and social trends. The area should have what your potential tenants are looking for. You want to buy an investment property in a neighborhood with features such as:

- Low crime rate

- Growing local economy

- Future development

- Access to public transportation

- Proximity to amenities like hospitals, schools, shopping centers, and restaurants

- Employment opportunities

- Rising population

- Tourist attractions

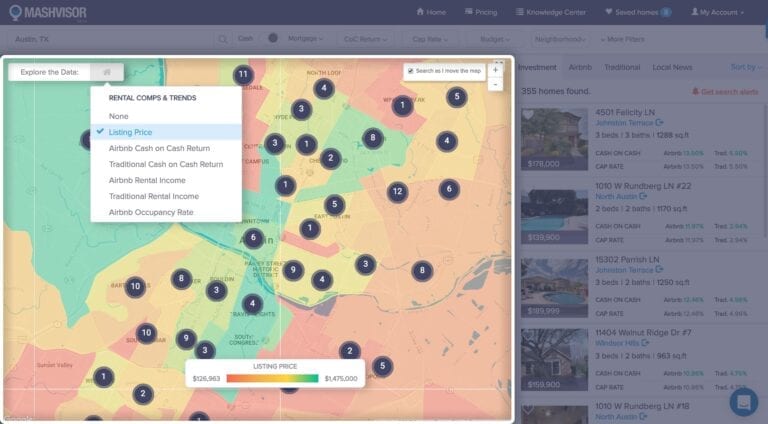

Mashvisor makes things easier for you. You don’t have to walk the neighborhood and research for days to know if the area is profitable for an income property investment. You can conduct a quick neighborhood analysis using Mashvisor’s real estate heatmap. This tool uses visual cues to give you an idea of how the neighborhood is performing relative to other neighborhoods in your city of choice based on metrics like median listing price, rental income, cash on cash return, and Airbnb occupancy rate.

Related: 6 Reasons Why Income Property Location Is So Important in Real Estate Investing

3. What is the income property really worth?

The listing price of an investment property is not always what it is actually worth. To get a true understanding of its fair market value, you need to conduct a comparative market analysis. This is a property valuation method that involves comparing the property you are researching with similar properties in the area that have been recently sold (real estate comps). Knowing the fair market value of an income property will help you to negotiate the best price and prevent you from overpaying for it.

4. What is the rental potential?

One of the most crucial factors to consider when buying an income property for sale is its rental potential. Will potential tenants want to live there and what rent could you reasonably charge? To know what the investment property would earn in rent, check what rental comps in the area are renting for.

5. Will it generate positive cash flow?

Before buying an income property, you need to run the numbers to know whether it makes financial sense. One of the key numbers that will determine the profitability of the investment property is cash flow. Positive cash flow means that there is a surplus after rental expenses are deducted from the rental income. Mashvisor’s cash flow calculator helps real estate investors to easily determine the cash flow of any investment property in the US housing market.

6. Will it generate a good return on investment?

Your income property analysis should include estimating the income property’s return on investment (ROI). ROI is how much profit an investment property makes as a percentage of its cost. It is one of the most important metrics for an investor when buying an investment property.

The two key ROI metrics you need to calculate are cap rate and cash on cash return. Mashvisor’s income property calculator allows you to estimate these ROI metrics in a matter of minutes. Keep in mind that the cap rate does not take into consideration the financing method. This makes it more suitable for comparing multiple income properties.

Related: Real Estate Return on Investment: 2 Formulas

7. What’s the optimal rental strategy for the income property?

Income properties usually perform differently depending on the rental strategy used. Therefore, knowing the optimal rental strategy would help you generate the most ROI. Mashvisor’s income property calculator provides you with numbers for both the Airbnb and traditional rental strategy. This makes it easier for you to do a comparison and determine the best rental strategy for an investment property.

8. What is the current condition of the property?

When buying income property for rental income, you should bear in mind that it should be ready to rent as soon as possible. If the property needs significant repairs and renovations, it might take you a while before you can rent it out.

Moreover, buying an income property with major deferred maintenance may impact your ability to borrow. This is because lenders usually require the property to meet certain minimum standards. They may also request proof of funds for repairs before approving the loan. Therefore, be sure to conduct a home inspection to know the cost of repairs needed before signing the contract.

9. How am I going to finance the income property?

Buying an income property is a costly endeavor. If you are like most real estate investors who can’t afford to buy with cash, you may need to take out a mortgage loan. However, not everyone can qualify for a mortgage loan. You need to raise a minimum down payment (at least 20%), have good credit, and meet other requirements.

Even if you can’t raise the minimum down payment, you shouldn’t be discouraged. Buying income property with no money down is also possible. You can explore other financing options like seller financing, house hacking, rent to own, home equity loans, hard money loans, private money loans, and real estate partnerships. Compare different investment property financing options and pick one that best suits your situation.

Related: Buying Rental Property with No Money Down: 10 Ways It’s Possible

The Bottom Line

Buying an income property can be a lucrative way to make money in real estate and diversify your investment portfolio. But the rewards don’t come without some level of risk. Before taking the plunge, it’s important that you understand how to prepare for your purchase and how to analyze income property. If you are looking to buy an income property soon, be sure to ask yourself the above questions to ensure that you maximize your profits and minimize your risks. Don’t forget to use Mashvisor for your property search and analysis. Mashvisor tools make finding income properties with a good return potential more efficient.

To start searching for and analyzing the best investment properties in any city and neighborhood of your choice, click here.