As a property investor, it’s crucial that you run an investment property analysis and assess the profitability of any property before investing your time and money in it. Doing so will help you determine what return on investment you can expect to earn and, hence, determine whether or not the property is worthwhile. For this reason, every real estate investor needs to have a sufficient understanding of the numbers and metrics used to calculate the rate of return on a rental property. The two most common metrics you need to know are the cap rate and the cash on cash return (CoC return for short).

We’ve already talked about and explained what cap rate in real estate is and how to calculate it (you can learn all about it here). But what is cash on cash return? In short, this is the ROI an investor will earn based on the profit that the property makes and the amount of cash invested in the rental property. What makes this metric different from the cap rate is that it takes into consideration the investment property financing method while the cap rate does not. Therefore, you can use the COC return formula to analyze how an income property will perform if you financed it with a loan vs. its performance if you bought it fully with cash. As you can tell, this is beneficial for investors as they can decide which financing method (cash vs. mortgage) brings the highest rate of return.

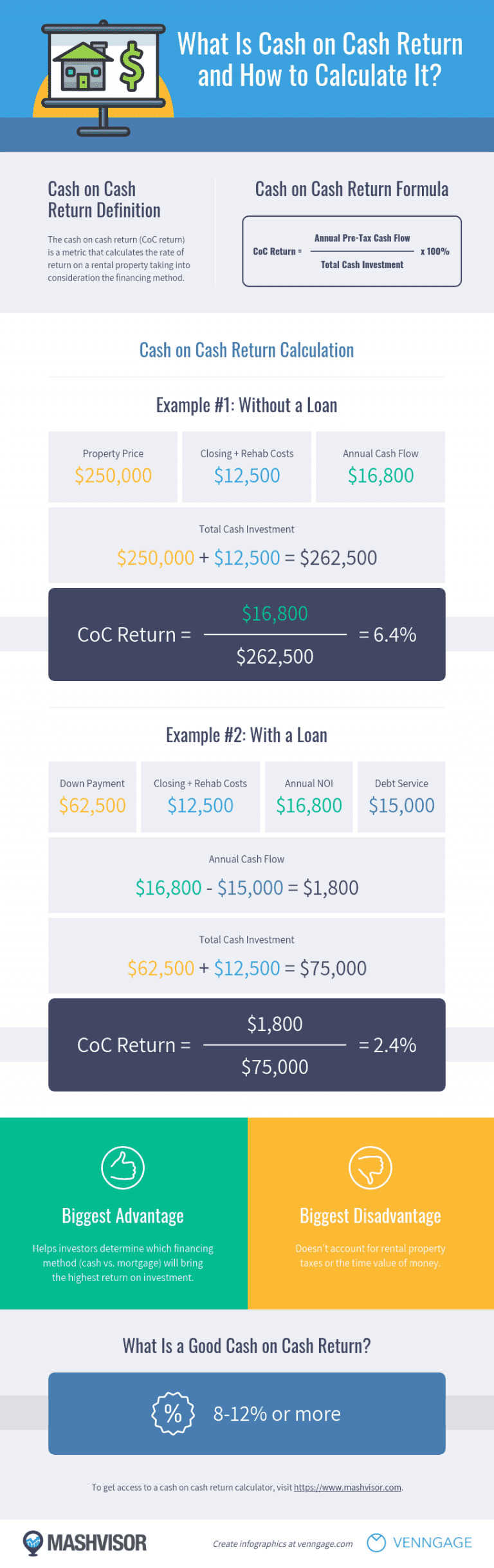

For a comprehensive explanation of the cash on cash return in real estate, have a look at the real estate infographic below. Our “What Is Cash on Cash Return and How to Calculate It?” infographic shows the following:

- The cash on cash return definition

- The CoC return formula

- CoC return calculation example: without a loan

- CoC return calculation example: with a loan

- The biggest advantage of using CoC return

- The biggest disadvantage of using CoC return

- What is a good cash on cash return for rental properties?

This real estate infographic was created by Venngage Infographic and Timeline Maker.

If you’re a beginner real estate investor and you’re looking for more details on this topic, you should check out our full article: What Is a Good Cash on Cash Return? There, you’ll find more details on each aspect of the CoC return highlighted in the above real estate infographic. Furthermore, if you’re interested in finding the best locations in the US housing market for buying rental properties (both traditional and Airbnb) with high CoC returns, read this!

Now, if doing the math and running real estate numbers is not your strongest point, don’t worry! Today’s real estate investors don’t need to manually calculate cash on cash return (or other ROI analysis metrics) when using Mashvisor’s Investment Property Calculator. This real estate investment tool provides you with pre-calculated CoC return data for thousands of properties across the US housing market. Our calculations are based on both traditional and predictive analytics, so you can ensure getting accurate real estate data for your investment property analysis. Learn more about our product here.

To start looking for the best rental properties for sale with high CoC return in your city and neighborhood of choice, sign up for Mashvisor.