Is the Population Growing in Colorado Springs?

Colorado Springs is not a very large city – it has the 39th largest population in the United States. However, the Colorado Springs real estate market benefits from the fact that the population continues to grow in the area. For many years now, the population has continued to grow at a steady rate and the UN population projections see continued growth through 2037. And Colorado Springs is the 2nd largest city in the state of Colorado, after Denver.

Is the Renter Population High?

General population statistics are important to research when trying to decide whether or not to invest in the Colorado Springs real estate market. But what matters more is the renter population. NeighborhoodScout reports that renters make up about 41% of the population. While there is a large number of homeowners (59%), there are still enough renters in the city to drive demand for long-term rental properties.

It’s also important to note the price to rent ratio of the Colorado Springs real estate market. This metric helps investors determine what is more affordable for the average resident of a city – buying a home or living in a rental property. Mashvisor’s data reveals that the price to rent ratio is 24. This indicates that most residents find it more affordable to live in a Colorado Springs rental property than to buy their own home.

Related: How to Use Price to Rent Ratio as a Real Estate Investor

Both Colorado Springs real estate market statistics point to high rental demand.

How’s the Economy Doing in Colorado Springs?

Before COVID-19 hit, the economy in Colorado Springs was standing strong and growing. In the past, the city has been ranked highly in terms of job opportunities and the economy has managed to sustain job growth throughout the years. These positive economic indicators led to a hot Colorado Springs housing market.

Of course, the coronavirus has taken a toll on economies all around the world and the US. And Colorado Springs has suffered from businesses being forced to close to curb the spread of COVID-19.

However, thanks to the strong foundations that the economy sat on before the rise in coronavirus cases as well as some help from local non-profit organizations like the Downtown Partnership of Colorado Springs, experts are confident that it will recover quickly.

Are Colorado Springs Home Prices Expensive?

Investing in Colorado Springs real estate is more expensive when compared to national property prices ($342k for June 2020 according to Realtor.com). Take a look at Mashvisor’s data:

- Median Property Price: $459,246

- Price per Square Foot: $182

At the same time, some of the best neighborhoods in Colorado Springs for real estate investing are actually more affordable (see list below).

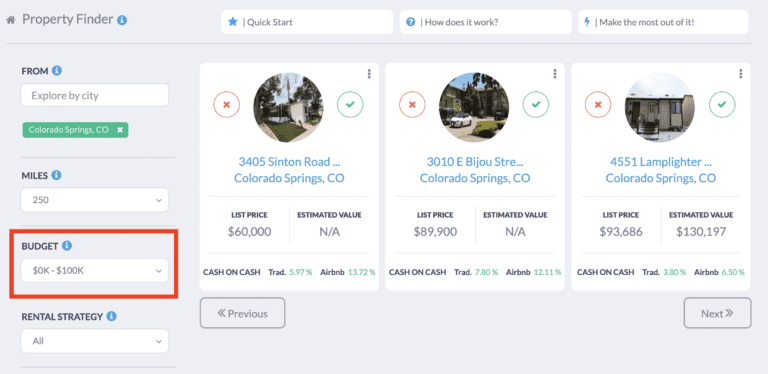

If you’re looking for affordable Colorado Springs investment properties for sale, turn to Mashvisor’s rental property finder. Take a look at some of the high return properties available for under $100k:

Related: 2 New Ways to Find Cheap Investment Properties for Sale

Will Local Real Estate Appreciate or Lose Value?

Historically, Colorado Springs real estate investors and homeowners have enjoyed property appreciation. Last year, Zillow reports that Colorado Springs real estate appreciated by 7.6%. Since Q1 2000, real estate has appreciated by 92%, at an annual average rate of 3.28%. Although it seems COVID-19 will keep property values stagnant from now until 2021, you can expect a Colorado Springs real estate investment to appreciate down the line based on historical data.

Is the Colorado Springs Real Estate Market a Buyer’s or Seller’s Market?

Currently, Zillow labels the Colorado Springs real estate market as a super hot seller’s market. Redfin gives the market a Compete Score of 90 (most competitive). Most Colorado Springs homes for sale receive multiple offers and sell for 1% above their listing price, according to Redfin. For June 2020, Mashvisor’s data shows that the days on market is 33.

Related: The Market Is Hot for a Colorado Springs Investment Property

How Does Rental Property Perform in the City?

To answer this question, we turn to Mashvisor’s rental data on the Colorado Springs real estate market:

- Traditional Rental Income: $1,566

- Traditional Cash on Cash Return: 1.4%

- Average Airbnb Daily Rate: $137

- Airbnb Rental Income: $2,417

- Airbnb Cash on Cash Return: 2.8%

- Airbnb Occupancy Rate: 53%

- Best Type of Rental Property: Condos

- Median Property Price: $220,566

- Price per Square Foot: $196

- Traditional Rental Income: $1,007

- Traditional Cash on Cash Return: 1.8%

- Airbnb Rental Income: $1,889

- Airbnb Cash on Cash Return: 4.0%

According to the data, a Colorado Springs investment property can generate a good rate of return as a rental property. This is whether it’s rented out as a long-term or Airbnb rental property. The best type of rental property that will generate the highest return on investment is a condo. Find condos for sale in Colorado Springs here.

Airbnb Colorado Springs Properties Perform Well, But Are They Legal?

Based on Mashvisor’s Airbnb data, Colorado Springs short-term rental properties are quite profitable. But is Airbnb legal in Colorado Springs? At the end of 2019, non-owner occupied Airbnbs were banned from all residential neighborhoods. While they are allowed to operate in nonresidential zones, they must be 500 feet apart from another non-owner occupied Airbnb rental.

Essentially, buying a Colorado Springs income property with the intention of renting it out completely to guests while you live somewhere else is very difficult thanks to the new Airbnb Colorado Springs laws.

Click here to learn more about the Airbnb regulations in the Colorado Springs real estate market.

So, Is Colorado Springs a Good Place to Invest in Real Estate in 2020?

Yes, Colorado Springs is a good place to invest in real estate. As long as you plan on renting out the property to long-term tenants while implementing the buy and hold real estate investment strategy, the city is a great place to invest.

There is one more question you need to ask before investing in the Colorado Springs real estate market:

Where Will Rental Property Generate the Highest ROI in Colorado Springs?

The following are the best neighborhoods in Colorado Springs for investing in traditional rental properties based on Mashvisor’s data:

10 Best Neighborhoods in Colorado Springs

#1. Peterson Air Force Base

- Median Property Price: $337,066

- Price per Square Foot: $152

- Price to Rent Ratio: 15

- Traditional Rental Income: $1,832

- Traditional Cash on Cash Return: 2.5%

#2. Falcon

- Median Property Price: $334,432

- Price per Square Foot: $172

- Price to Rent Ratio: 17

- Traditional Rental Income: $1,638

- Traditional Cash on Cash Return: 2.3%

#3. Southeast Colorado Springs

- Median Property Price: $254,454

- Price per Square Foot: $168

- Price to Rent Ratio: 18

- Traditional Rental Income: $1,179

- Traditional Cash on Cash Return: 1.7%

#4. Powers

- Median Property Price: $358,687

- Price per Square Foot: $160

- Price to Rent Ratio: 19

- Traditional Rental Income: $1,560

- Traditional Cash on Cash Return: 1.7%

#5. Central Colorado Springs

- Median Property Price: $387,281

- Price per Square Foot: $229

- Price to Rent Ratio: 24

- Traditional Rental Income: $1,365

- Traditional Cash on Cash Return: 1.3%

#6. Briargate

- Median Property Price: $475,262

- Price per Square Foot: $168

- Price to Rent Ratio: 23

- Traditional Rental Income: $1,707

- Traditional Cash on Cash Return: 1.3%

#7. Southwest Colorado Springs

- Median Property Price: $707,144

- Price per Square Foot: $207

- Price to Rent Ratio: 31

- Traditional Rental Income: $1,902

- Traditional Cash on Cash Return: 1.2%

#8. Northeast Colorado Springs

- Median Property Price: $402,130

- Price per Square Foot: $162

- Price to Rent Ratio: 24

- Traditional Rental Income: $1,403

- Traditional Cash on Cash Return: 1.2%

#9. East Colorado Springs

- Median Property Price: $318,085

- Price per Square Foot: $171

- Price to Rent Ratio: 22

- Traditional Rental Income: $1,219

- Traditional Cash on Cash Return: 1.2%

#10. Northgate

- Median Property Price: $551,729

- Price per Square Foot: $174

- Price to Rent Ratio: 26

- Traditional Rental Income: $1,764

- Traditional Cash on Cash Return: 1.1%

To start your Colorado Springs real estate investing journey, use Mashvisor to find and analyze top-performing properties in the neighborhood of your choice. Click here to start your search today.

To learn more about choosing a place to buy rental property, read: How to Choose a Real Estate Market to Invest In.