Investing in multifamily real estate, also known as multi-dwelling units (MDUs), can be a good option for generating rental income, building long-term wealth, and establishing financial security. These investment properties are usually attractive to beginner real estate investors because they can simultaneously live in one unit and rent out the rest. You can also qualify for FHA financing, which typically offers lower interest rates and lower down payments than other investment loans. Generally, multifamily real estate tends to have more income potential than single family real estate.

Related: Understanding Multifamily Investment Property Returns and Benefits

However, not all multifamily real estate for sale is made equal. If you don’t know what you are doing, it can be a risky endeavor. Coupled with the stiff competition for lucrative deals, finding profitable multifamily real estate for sale can be a struggle for new investors.

So, how do you identify high return multifamily real estate for sale? Here are 6 tips that will ensure you don’t learn the hard way:

1. Work with a Qualified Professional

While the process of acquiring a multifamily home and a single family home are quite similar, there are usually a few differences that need to be addressed. Therefore, a beginner real estate investor should consider working with a qualified real estate agent who focuses on multifamily homes.

A professional that is familiar with multifamily real estate for sale will ensure that you smoothly navigate the buying process and make wise investment decisions. A realtor can be a key source of information regarding multifamily real estate trends in the area. They will help you avoid the common pitfalls of getting into multifamily investing.

2. Find a High Return Real Estate Market

Savvy real estate investors know that location is key to finding multifamily homes for sale with the highest return potential. Being able to identify the best locations to buy high cap rate properties is half the battle.

So should I look for multifamily homes for sale near me? Or in another city?

To find profitable locations for multifamily real estate, you need to conduct thorough market research. Generically, you should look for multifamily real estate for sale in areas near hospitals, schools, shopping centers, restaurants, good infrastructure, and other amenities. You should also consider job growth and crime rate in the area.

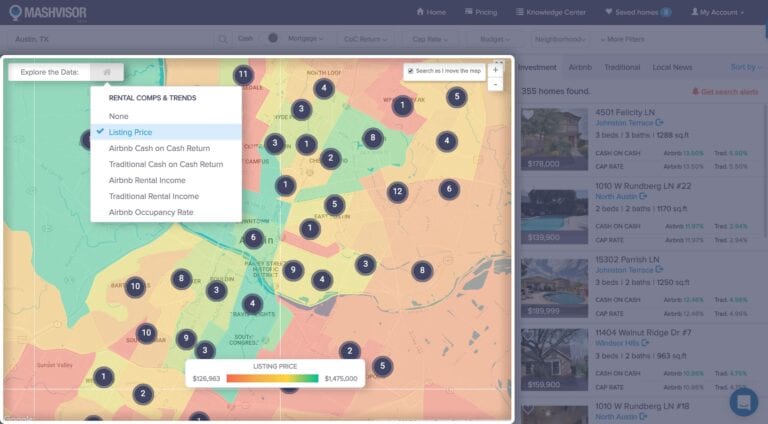

Savvy property investors will also take into account key property data to identify up and coming neighborhoods. The best way to find areas with high cap rate properties in the US housing market is to use Mashvisor’s real estate heatmap. This tool uses different colors to compare the performance of different neighborhoods in the real estate market.

By using this tool for your neighborhood analysis, you will be able to identify high return neighborhoods in your city of choice in a matter of seconds. Top-performing neighborhoods will be displayed in green when you select either the traditional or Airbnb cash on cash return filter.

3. Use the Rental Property Finder for Your Property Search

After finding a high return neighborhood, you should now begin your property search. You will need to look at multiple properties in the neighborhood and find those that best suit your investment goals.

While there are many ways to find multifamily real estate for sale, most of them can be time-consuming and inefficient. So, what is the best way to find high return multifamily homes? Use Mashvisor’s rental property finder!

This tool uses predictive analytics and machine-learning algorithms to help investors find the best-performing rental properties for sale that match their search criteria and goals. You can customize your investment property search using the following filters:

- Location (Cities and miles)

- Budget

- Type of property type (Select “Multifamily”)

- Rental strategy (Airbnb or traditional)

- Number of bedrooms

- Number of bathrooms

By using Mashvisor’s property finder, you will be able to narrow down your search to only the best performing multifamily real estate for sale in your area of choice. With fewer properties on your list, it will be easier to do in-depth multifamily real estate investment analysis.

Related: How to Find Investment Properties Using a Property Finder Tool

4. Use the Rental Investment Calculator for Property Analysis

When looking for multifamily real estate for sale, you should never let your emotions drive your decisions. Buying your first investment property can be exciting, but be sure to only make a decision based on objective analysis. Provided the numbers work, you are likely to get a high return.

Before buying a multifamily home, make sure that you understand the numbers. You want to focus on high cap rate multifamily real estate for sale that is within your budget. Note that it should also produce good cash flow as sometimes low cap rate properties can also make for good investments if they produce good cash flow and are likely to appreciate.

The best tool for multifamily real estate investment analysis is Mashvisor’s multifamily investment calculator. This tool allows you to easily calculate key real estate metrics such as cash flow, cap rate, cash on cash return, and Airbnb occupancy rate. It eliminates the need for boring research and tiresome spreadsheets.

Our calculator provides metrics for both Airbnb and traditional rental strategies. This makes it easy for the user to determine the optimal strategy for a particular rental property investment.

The calculator also helps users to quickly perform comparative market analysis. You can access a list of the rental comps with a click of the button. They will help you determine the fair market value of the multifamily real estate you are analyzing so that you know what to offer for it and avoid overpaying.

Related: Mashvisor’s Rental Property Calculator: A Guide for Beginner Real Estate Investors

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here

5. Start with Small Multifamily Real Estate

For beginner investors, it’s advisable that you start small with multifamily real estate by buying units such as duplexes, triplexes, or quadruplexes. Smaller multifamily real estate is easier to manage and has fewer costs. By buying a smaller multifamily house, you will be able to learn the ropes without much risk. While bigger multifamily real estate might generate more returns, they come with bigger risks.

6. Inspect the Multifamily Property

Before buying multifamily real estate for sale, be sure to inspect it for any deferred maintenance. Deferred maintenance means that you will incur extra repair costs after purchasing the property which can affect your multifamily return on investment. Do you have the finances to make these repairs?

You should also take into account that, if you are buying a fixer-upper, you may have to leave it vacant for some time. If this happens, will you be able to make mortgage payments?

The Bottom Line

While buying multifamily property can be a lucrative investment for new real estate investors, your business can easily go south if you don’t find high return multifamily real estate for sale. By following the six tips outlined in this guide, you’ll eventually find high return multifamily real estate for sale. If you are looking to buy a multifamily property soon, be sure to use Mashvisor’s real estate investment software platform for your property search and analysis. With this software, you will be able to make better and faster investment decisions. Start out your 7-day free trial with Mashvisor now.