Investing in rental properties is a three-step process. In order to make a profit in real estate, you need to find, analyze, and maintain income properties. How you maintain your rental property will determine whether it’s a successful real estate investment or not. However, to even get to that point, you first have to succeed in finding rental properties and analyzing them. These two stages of the real estate investing process are vital steppingstones to generating positive cash flow. So in today’s blog, we’ll tell you how to find rental properties and analyze them.

Related: How to Maintain a Real Estate Investment Property

How to Find Rental Properties

To find good rental properties, you need to use top-notch real estate investment tools. With Mashvisor’s real estate investment software, you will gain access to a state-of-the-art real estate heatmap and rental property finder. Powered by data from reliable rental comps and predictive analytics, these tools offer the best way to find rental properties online.

-

Finding an Investment Location

Before learning how to find rental properties to buy, you need to know where to find rental properties. As the common saying goes, location is the most important thing in all of real estate. An investment location influences everything from rental property expenses to expected return on investment. Investors, therefore, need to conduct a neighborhood analysis as the first step when searching for properties.

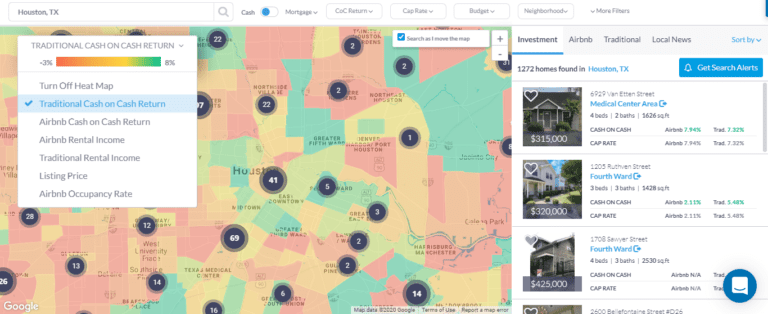

So, how can you perform a neighborhood analysis? Mashvisor’s real estate heatmap is all you need for this step! Mashvisor’s heatmap analysis tool will help you find a suitable investment location in a matter of minutes. Like heatmaps used by weathermen, Mashvisor’s heatmap color-codes various areas based on different metrics. The heatmap makes finding a location to invest in very simple and intuitive. All a user needs to do is enter a city to analyze. Then, you can filter the analysis based on the following real estate metrics:

- Listing price

- Traditional rental income

- Airbnb rental income

- Traditional cash on cash return

- Airbnb cash on cash return

- Airbnb occupancy rate

As a result, the heatmap will color the market, using various reds and greens, based on your selected filters. For example, a neighborhood where rental properties generate a high Airbnb rental income will be colored in green when that filter is selected. An affordable neighborhood will show up in red and an expensive one, in green when the listing price filter is selected. A user can then click on specific neighborhoods, with their number of rental properties for sale displayed, and continue to study the location.

-

Finding Rental Properties for Sale

Once you’ve settled on a location, you can begin to find rental properties for sale. As you would expect, Mashvisor has the perfect tool for this crucial step. The rental property finder gives buyers a competitive edge during their investment property search. Similar to the heatmap, the property finder utilizes predictive analytics and AI to search for property listings that promise a high return on investment. In addition, the only thing investors need to do is provide personal inputs, which include:

- The rental markets you wish to invest in (an unlimited number of locations if you sign up for an Expert Plan)

- Your budget

- Preferred property type (single-family, multi-family, townhouse, condo, etc.)

- Optimal rental strategy (traditional or Airbnb)

- Number of bedrooms and bathrooms

The property finder will then generate the results, based on your inputs, for any US housing market you’ve chosen. Every property listing presented will show the following data:

- Address

- Property price

- Estimated value

- Airbnb cash on cash return

- Traditional cash on cash return

How to Analyze Rental Properties for Sale

Now that you’ve found potential rental properties for purchase, you can begin to analyze them. Once again, Mashvisor is here to help. Not only is Mashvisor the best website to find rental properties, but it’s also the best website for analyzing them. The only tool you’ll need for analysis is the rental property calculator.

Related: Mashvisor’s Rental Property Calculator: A Guide for Beginner Real Estate Investors

-

Performing a Rental Property Analysis

The first thing Mashvisor’s calculator does is perform a rental property analysis. Through this analysis, the calculator will compute the property’s expected profitability. This includes metrics such as rental income, cash flow, and rate of return on a rental property. In addition, the calculator provides many other forms of property data like days on market.

To compute these numbers, the calculator uses predictive analytics and rental comps. The calculator also requires user input, mainly for financing and start-up expenses. The expenses are actually estimated using rental comps. Still, investors are free to adjust the figures with their own information. Users can enter the data of the following:

- Financing method

- Down payment

- Mortgage interest rates

- One-time startup fees (ex: furnishing, inspection dues, closing costs)

- Recurring costs (ex: HOA dues, insurance, income tax)

After receiving investor inputs, the calculator will compute the following:

- Airbnb rental income

- Traditional rental income

- Airbnb and traditional cash flow

- Monthly rental property expense estimates

- Airbnb and traditional cash on cash return

- Airbnb and traditional cap rate

- Optimal rental strategy comparison (Airbnb or traditional)

- Airbnb occupancy rate

- Investment payback balance

-

Performing a Comparative Market Analysis

Finally, after completing a rental property analysis, you need to make sure the property is reasonably priced. Typically, many properties for sale are overpriced. This can be deliberate or unintentional by the seller. Nonetheless, to learn if a property is overpriced, a comparative market analysis (CMA) is what you’ll need to conduct.

To begin a CMA, you need to find properties that are similar to yours. In other words, you need to search for real estate comps, short for comparables. Real estate comps share many features with your property, such as location, size, type, condition, amenities, and more. Luckily for you, Mashvisor’s rental property calculator automatically finds real estate comps during its investment property analysis. Just like Mashvisor’s tools that find rental properties, the calculator automatically finds comps. You can then quickly and accurately conduct a CMA. If the CMA shows that the property is reasonably priced, and the property is expected to be profitable, then you’ve just found a great property worthy of investment!

The Bottom Line

Mashvisor’s real estate investment tools are all you need to find rental properties and analyze them. To find positive cash flow properties with Mashvisor, CLICK HERE to start a FREE trial!

Related: 5 Best Real Estate Investment Tools for 2020