You’ve probably come across a heatmap before. In fact, you most likely recently saw several heatmaps during the 2016 U.S.Presidential election, displaying the different votes across the country. A heatmap shows data in a visual form rather through a numerical form, using different colors to represent different ranges or percentages. A heatmap can show anything from the most popular restaurants to displaying the most clicked areas on a screen. Heatmaps can now be used to find the best places to invest in real estate and for finding income properties.

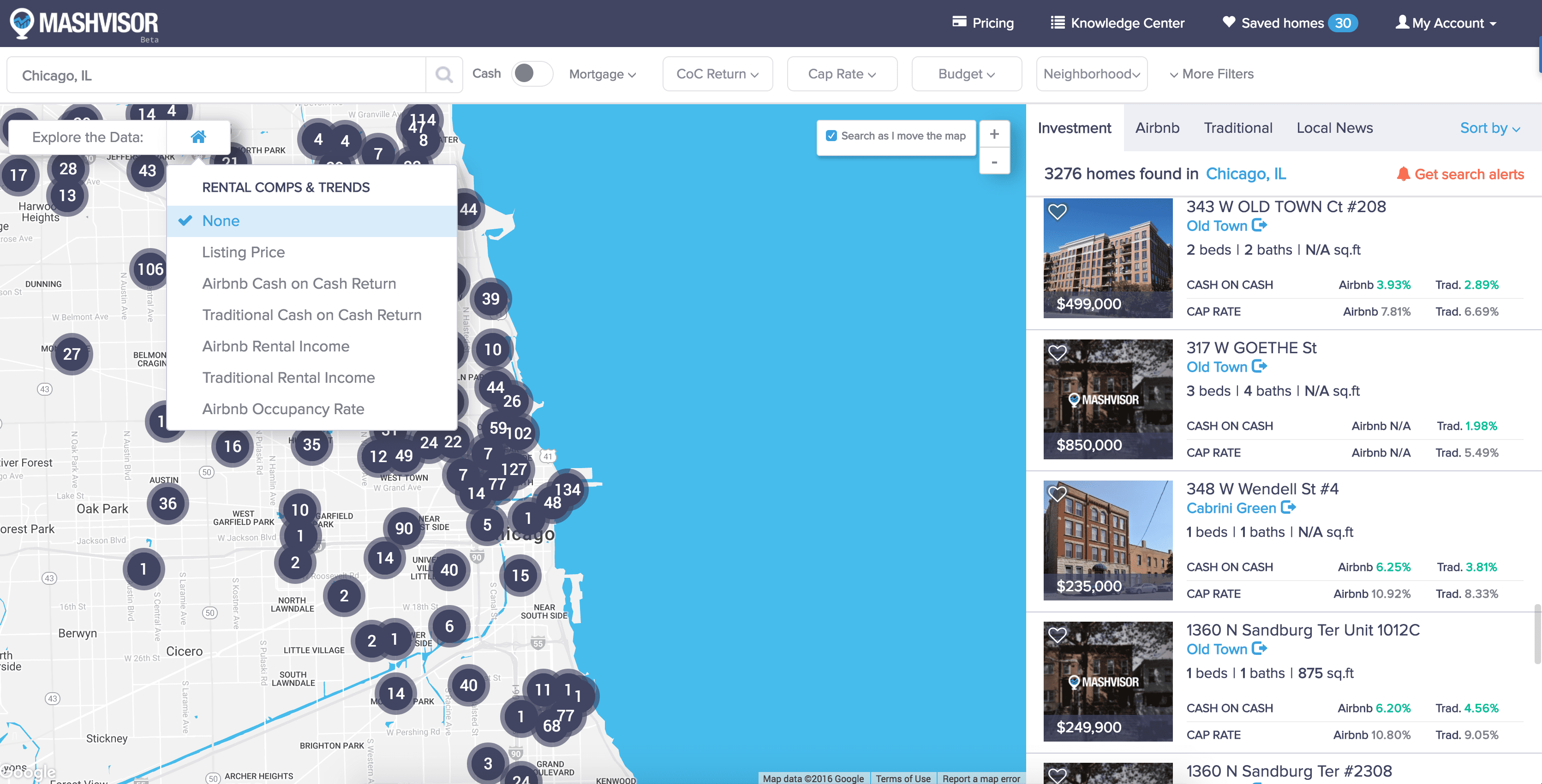

When real estate investors are trying to determine where to buy an investment property, they look for areas with the best investment performance and the best returns. What better way to find these areas than by using a heatmap? Mashvisor’s heatmap allows investors to find income properties by identifying the areas that have the highest listing prices, cash on cash returns, rental income, and Airbnb occupancy rate. It’s a fast way to locate money-making areas in a city.

Related: How to Make Money in Real Estate Passively

How do most investors find this data on their own? Unfortunately, most investors analyze real estate investments by following a dreary, ineffective cycle using different sites to find income properties, learn more about the area, and what they’re supposed to look for in an investment property. The heatmap gets straight to the point and tells an investor which area has, for example, the highest rental income based on the rental comps and past performance.

So why are the values important? Let’s break down the different criteria the heatmap includes, what they mean, why they’re important when finding income properties.

Listing Price

Usually, the first question an investor asks is, “how much will a property cost me?” While it’s recommended to consider investing outside of your local area, sticking to the budget is important. The heatmap immediately tells you which part of town has properties in your price range. For example, if you’re interested in investing in cheap rental properties, stick to the red areas.

Related: Top 7 Cheapest Cities for Buy-and-Hold Investment Properties

Cash on Cash Return

Cash on cash return is a new metric to some investors, while cap rate is usually what investors inquire about. While cap rate tell the returns of a property, it doesn’t not factor in how the property is financed. Cash on cash return, on the other hand, tells the returns of an investment property based on how much money is put into the investment. A return of 10% is favorable. To calculate this, you divide how much money is leftover every year, or the net operating income (NOI), by the investment costs.

If a mortgage is being used to finance the property, the cash on cash return could be higher because the investment costs are lower than if the property is purchased using all cash.

Cash on cash return = NOI [(Monthly Income-Monthly Expenses) X 12]/ Investment Costs

Mashvisor’s heatmap includes Airbnb and traditional cash on cash return so that investors can find income properties in the optimal locations.

Rental Income

Rental income is of course the core of real estate investing and is essentially the investor’s salary. This particular criterion is a huge asset to the heatmap because most investors spend their time searching real estate comps, just to find the average rental rates. Now an investor can quickly find the areas with the highest rent, whether listing their property on Airbnb or traditionally.

Airbnb Occupancy Rate

Just as an investor would inquire about vacancy rates for their rental property, an investor should inquire about an area’s Airbnb occupancy rate when looking for an Airbnb income property. Since rental income from Airbnb is received per stay and not per month, the Airbnb occupancy rate directly affects the monthly rental income. The right Airbnb calculator will make computing your rental income based on occupancy rate a lot easier.

Related: Airbnb Reviews: Top Influencers Affecting Your Occupancy Rate

Overall, finding income properties in the optimal locations can be challenging. The typical search process of a real estate investor is 1) find a city that is well-known to be fruitful for real estate investing 2) find out the best neighborhood to invest in based on the budget 3) find out how much other rental properties are making 4) find out how much my returns will be.

The heatmap eliminates this messy breakdown of analyzing real estate investments and gives the data first-hand, eliminating the use of various sources.

One major benefit of using the heatmap is being able to quickly pick a focus-area in a city that the investor may not be familiar with. It essentially helps them to skip the extra step of understanding the city as a whole and then finding an area to consider for their real estate investment.

See Mashvisor’s heatmap in action here. What better way to find hot markets than using a heatmap?