With price wars on residential homes and a nationwide housing crisis, 2022 is a fantastic year to get into the fix and flip business. Due to the pandemic, several people have started migrating from cities to the suburbs and buying up any residences they can find along the road, especially in the South.

With all this in mind, Texas is one area where a fix and flip is more than likely to yield a large profit. You’ll discover plenty of fix and flip chances whether you want to start flipping properties in Houston, Dallas, San Antonio, or any other region of the country’s second-most populous state.

There are many fantastic prospects for savvy house flippers in Texas, but nothing is certain. Fortunately for you, our guide breaks down all of the fundamentals of flipping houses in Texas to put you on the fast track to becoming a successful house flipper.

Why Flipping Houses in Texas?

Texas, the world’s live music center, has some of the top real estate markets in the country. That isn’t the only motive to fix and flip in Texas, though. Here are some more compelling reasons to take that step:

- House prices – Houses in Texas are less expensive than the national average. According to the National Association of Realtors (NAR), the average home price in May 2020 for all house types (single-family, townhouses, condos, and co-ops) was $284,600. On the other hand, properties in Texas are less expensive than the national average, with an average property value of $213,036.

- Life quality – Texas is just a fantastic place to live for your fix and flip project purchasers. For example, the city of Austin was named the finest place to live in the United States in 2019.

- Everybody is moving there – According to Move.org, Texas was the second-most-moved-to state in 2020, with millennials accounting for the majority of individuals moving there. This is mainly owing to the pandemic, which prompted a massive migration from America’s major cities.

- Rapid population growth – About the last nine years, the population of Texas has increased from over 25.2 million to nearly 29 million. The city of Frisco, which is part of the Dallas-Fort Worth metro area, is an excellent illustration of rapid population increase.

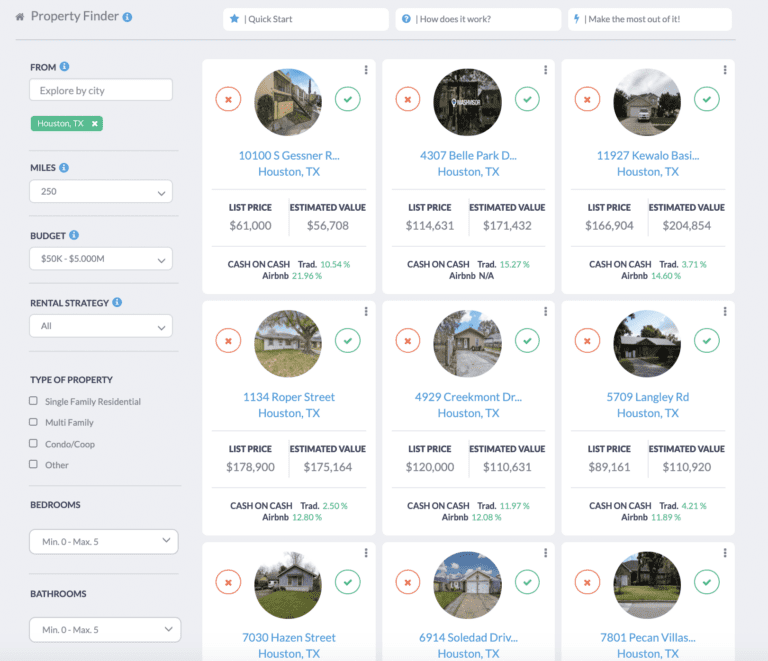

But how can you identify houses that would make you the most money? The answer is Mashvisor’s Property Finder.

With Property Finder you can Locate the best-performing investment properties in your chosen market(s). These properties will be filtered automatically to provide you with the top rental properties depending on their performance in terms of return on investment.

- Listing Price

- Rental Income

- Occupancy Rate

- Cap Rate

- Cash on Cash Return

The properties that appear on the Property Finder page fit your search parameters and investment objectives. This means that you may relax knowing that these houses will live up to your expectations in terms of:

- Property Type

- Optimal Rental Strategy

- Return on Investment

- Listing Price

- Market Availability

The Property Finder AI uses the most up-to-date machine-learning algorithms to locate the best investment properties for you based on your search history and other customized criteria and trends. In addition to that, you can use the Property Finder to select up to 5 cities that you’re interested in, and the AI will locate you the top-performing homes in each of them.

How to Start Flipping Houses in Texas

Let’s not lose sight of the goal: flipping properties is all about profit. But how do you go about finding residences that would make you the most money?

When it comes to flipping houses in Texas, location is a real estate mantra. A place has a more significant impact on its worth than any other single element. So looking for inexpensive properties in popular neighborhoods is a simple method to uncover a potentially profitable flip. It may be an elderly resident’s longtime house or vacant property in disarray. Still, if it’s in a high-value area, it could be just a renovation away from a highly profitable sale.

Do your investigation if you haven’t decided on a neighborhood yet. To capture the early, steepest phase of the rise, look for up-and-coming neighborhoods. Look for areas with excellent schools, rising property values, and improving job statistics.

Are you wondering how to find the best neighborhood for your Texas house flipping? Then check Mashvisor’s Real Estate Heatmap!

This tool can do neighborhood research and zero in on profitable investment markets. In addition, Mashvisor’s heatmap tool allows real estate investors to conduct a real estate analysis of a location to identify regions with the best rental income, cash on cash return, and Airbnb occupancy rate.

The state of the house is a crucial factor to consider. Look for homes with “excellent bones” because flipping houses in Texas is supposed to be fast. However, water leaks, mold in the rooms, and foundation faults make it impossible to restore and resell a home swiftly. You’re seeking short-term tasks that require primarily cosmetic work, not long-term ones.

Architecture is a key element of home value in Texas. Ranch-style houses are the most popular in the suburbs because the solitary design helps to lessen the dreaded Texas heat. However, various aesthetics take prominence in urban settings. If you’re flipping in Dallas, search for townhomes or mid-century moderns to attract the most incredible attention.

The value of the nearby properties is also a significant factor to consider. You may believe you’ve found a fantastic deal, but if local statistics don’t support up your intuition, you could wind up losing money.

Remember to do your homework; a comparison market study is one of the greatest tools at your disposal for flipping houses in Texas and determining what kind of property prices the market allows in the location you’ve chosen. However, when it comes to deciding whether to trust your instincts or the numbers, the numbers always win.

Try Mashvisor’s Investment Property Calculator to determine the cash flow and profits that income properties can generate. Its analysis is based on the most recent data and trends, and it allows investors to input data to create incredibly precise estimates!

How to Flip Houses in Texas: How to Turn a Profit

The 70% Rule is the first calculation you should apply when forecasting your house flipping profitability. Simply said, the 70% rule implies that you should never spend more than 70% of a home’s after-repair worth, minus repair and remodeling costs.

Let’s take a look at a particular market in Texas. If you’re trying to flip a house in the famous Austin market, where the median home value is $368,800, and you’ve discovered one that needs $25,000 in repairs, the equation will look something like this:

($368,800 x 0.70) – $25,000 = $233,160

Therefore, assuming $25,000 in renovations, the maximum you should pay on prospective flipping houses in Texas, Austin is $228,160.

The 70% Rule is an excellent method to start planning your budget, but don’t forget to factor in all of your costs. You’ll have to pay for the initial cost, as well as all fixes and repairs, as well as transporting and selling charges. So when estimating your profits, be sure you account for all of these variables.

Flipping Homes in Texas: Cash vs Loan

Paying in cash should always be your primary option if you have the money reserves to cover down payment and improvements. While you’re retaining and renovating the property, you won’t make payments, and paying cash enables you to wait until market circumstances are favorable rather than working against the schedule.

However, not everyone has a large sum of money on hand, so they will need to seek funding for flipping homes in Texas. You’ll have a few choices if you take this path.

One possibility is a recovery or hard money loan, which is a short-term loan with a reasonably high-interest rate. A home equity line of credit, or HELOC, is another possibility. A HELOC is a line of credit obtained from your personal residence equity, as the name suggests.

A decent credit score and a certain amount of home equity are typically required to qualify for a HELOC. This credit line allows you to convert your equity into cash at any time and spend it for whatever purpose you like.

When you opt for flipping houses in Texas, you have the option of getting your funding by the home equity loan, or HEL is strongly connected to the HELOC. However, in contrast to the credit line method of a HELOC, a home equity loan is just a lump sum payment obtained from your home equity. Some consumers prefer the lump amount technique over the bit-by-bit method of withdrawing money from a HELOC.

Best Cities for Flipping Houses in Texas

Austin

Although it can be challenging to find a cheap house to renovate and flip in Austin, the town is one of the top five most popular U.S. real estate regions to invest in for 2022. Furthermore, if you plan your investment carefully, the rising prices will have no impact on your profits, so don’t be discouraged.

Houston

Houston is among the most popular destinations for flipping houses in Texas. That said, you can still discover some excellent properties to fix and flip. Looking into local foreclosure auctions is a beautiful place to start.

The disadvantage is that Houston has some of the biggest real estate taxes in Texas, so the longer your property is on the marketplace, the more those taxes will go into your profits.

Dallas Fort-Worth

Profits for flippers have dropped in recent years in what was once one of the trendiest regions in the country to fix and flip. Nevertheless, if you buy in the appropriate zip code, you can find some strategically located properties with great fix and flip potential in this metro region.

San Antonio

San Antonio, which has long been regarded as one of the top locations in the country for house flipping, provides excellent value and a thriving market. It is a fantastic place to look for a fix and flip because of the perfect blend of gross profit growth and inexpensive renovating costs.

Corpus Christi

There are plenty of run-down properties in this coastal city that are waiting to be fixed up and sold. This opens up a lot of opportunities for significant returns on flip investments.

El Paso

Minimal existing home values and low repair and renovation expenses combine to enable investors to make significant profits. As a result, this city offers substantial market potential, with a population of over 600,000 people and predicted expansion.

Seguin

Seguin may appear to be a peaceful small town at first glance, yet its location is ideal. Seguin, 30 minutes from San Antonio and 45 minutes from Austin, is home to many significant industrial companies.

To continue to attract new people, the city has been investing in housing and local facilities. As a result, home values continuously increase while rental prices maintain pace with national averages.

Do You Need a License to Flip Houses?

It’s better to be the readiest than the least prepared when starting a flipping career. Although a real estate license is not required to become a house flipper, it is a good idea to have one because it will provide you with additional options along the journey.

Conclusion

Given the recent excitement surrounding Texas, its low-cost properties, and high quality of life, it’s an excellent area to start your next fix-and-flip project.

In addition, there’s a terrific group of flippers in Texas who can help you out when you need it. And if you contact a competent private lender for finance, you can be flipping houses in Texas in less than a week.

Ultimately, whether you’re a first-time investor or an experienced short-term investor, Mashvisor is here to help you find the best property for investment and strategy. Start your 7-day free trial with Mashvisor now!