The growth of Airbnb has offered travelers an abundance of choice when looking for temporary accommodation anywhere in the world. And with the increased demand for Airbnb rentals, buying Airbnb rental properties has become a worthy real estate investment opportunity. Indeed, there’s a lot of money to be made through Airbnb. The hard part is usually finding an investment property that will generate high Airbnb profit.

A good number of those who invest in Airbnb never achieve the returns they desire. This is because most beginner investors think that buying Airbnb property is a guessing game. They simply buy any investment property they find without bothering to estimate Airbnb income.

However, savvy real estate investors understand the power of Airbnb investment analysis in finding profitable deals. Knowing how much you can make before you invest in Airbnb can prevent you from ending up with a money pit and help you identify the best Airbnb properties to buy. But how can this profit be calculated?

If you are looking for the most efficient way to calculate Airbnb profit, look no further. Mashvisor is the best real estate investment software for Airbnb investors and has revolutionized Airbnb profit analysis with one tool – the Airbnb profit calculator.

Keep reading to learn why and how to use Mashvisor’s Airbnb calculator to calculate potential profit and determine whether an Airbnb for sale is worth buying.

Why Use Mashvisor’s Airbnb Profit Calculator?

For years, real estate investors have been using Airbnb analysis spreadsheets to calculate Airbnb profit. While this method has served investors for a long time, with the advancement of technology, spreadsheets are technically obsolete in this day and age.

Time is of the essence in real estate investing. The most successful real estate investors are often those who are able to identify the most lucrative deals in the housing market and make a move before everyone else. However, collecting Airbnb data and analyzing it using spreadsheets can be time-consuming and sometimes is prone to error.

However, Mashvisor’s Airbnb profit calculator eliminates these problems. You don’t have to spend days or weeks collecting Airbnb data and analyzing it manually to find the potential profit of Airbnb properties. With our calculator, anyone can accurately calculate Airbnb profit in just a matter of minutes. Any investor who still uses spreadsheets for Airbnb analysis is actually putting himself or herself at a disadvantage.

Mashvisor’s calculator is the ultimate tool for Airbnb analytics. Research that could have taken several weeks or months can now be done within minutes.

What Airbnb Data Can You Get Using the Airbnb Profit Calculator?

You can get key Airbnb data from Mashvisor for calculating profit no matter which stage in your property search you’ve reached:

If you have already done an Airbnb market research and have found a number of Airbnb properties for sale that meet your criteria in your real estate market of choice, you can use the calculator to do an in-depth Airbnb investment analysis to determine which of those properties has the highest potential for profit.

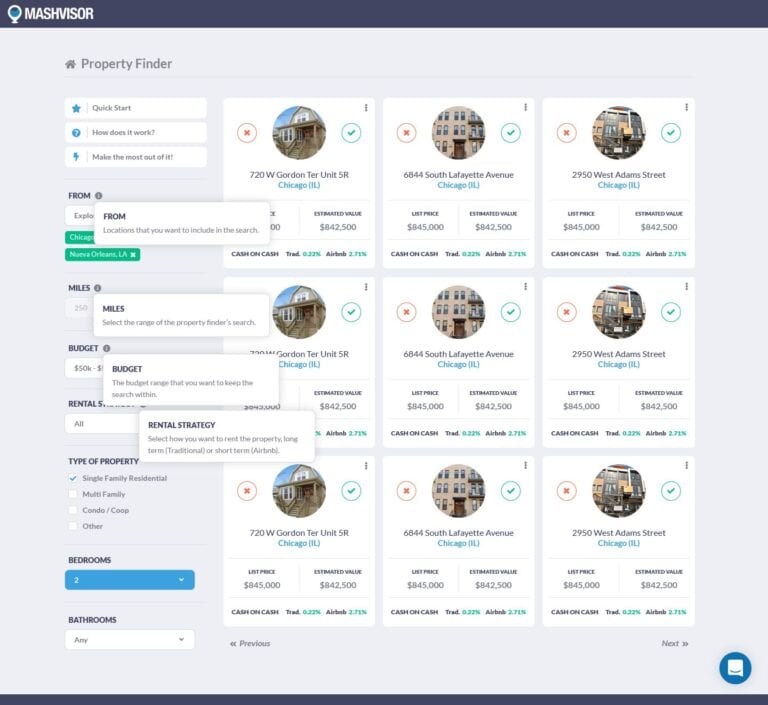

If you’re not sure where to get started, you can check for lists of the best markets for Airbnb investment on Mashvisor’s real estate blog. You can then use our Property Finder to search for Airbnb properties for sale that match your criteria. After this, use the calculator for analysis.

If you already own a rental property or have identified an off-market property for sale, you can add the address to Mashvisor and use the calculator to analyze Airbnb data.

Here are the metrics that the Airbnb profit calculator provides for any Airbnb investment property for sale in the US housing market:

1. Airbnb Occupancy Rate

Airbnb occupancy rate has a big impact on how much profit an Airbnb property will earn. It refers to the ratio of days an Airbnb property is occupied to the number of nights it was available for booking. A high Airbnb occupancy rate means that there is a high demand for short-term rentals in the area, which usually translates into high rental income.

The Airbnb profit calculator provides the Airbnb occupancy rate for investment properties for sale on the platform. This is calculated based on data that comes from Airbnb. Mashvisor’s Airbnb analytics and calculations are also verified by real hosts.

2. Airbnb Rental Income

The Airbnb profit calculator also provides investors with estimates of Airbnb rental income. This is the amount of money that an Airbnb investment property is able to generate every month. Generally, an investment property with high Airbnb rental income will have more potential for Airbnb profit.

Mashvisor is able to estimate Airbnb income based on nightly rates and Airbnb occupancy rates of Airbnb rental comps.

3. Airbnb Costs

It’s also important for investors to consider Airbnb costs when buying Airbnb property since they affect your Airbnb profit. However, estimating Airbnb expenses can be challenging since they vary widely depending on a number of factors including location and property type.

Fortunately, with our Airbnb calculator, real estate investors can easily access estimates for both one-time costs and recurring expenses for Airbnb properties on the platform.

4. Airbnb Cash Flow

Airbnb cash flow provides a more accurate estimate of Airbnb profit. To generate a good Airbnb profit, positive cash flow is a must. Positive cash flow means that every month you’ll be left with some rental income after accounting for the Airbnb costs. This means that you won’t need to use any money from your pocket to pay off your mortgage. You can use the extra cash flow to renovate your property to increase its value, buy another Airbnb property, keep as cash reserves, or spend on personal expenses.

If you don’t want cash flow problems with your Airbnb investment, you should use our calculator to estimate Airbnb cash flow before buying.

5. Airbnb Return on Investment (Cap Rate and Cash on Cash Return)

Before you invest in Airbnb, you should also use Mashvisor’s rental property calculator to estimate Airbnb return on investment (ROI). This is the measure of Airbnb profit as a percentage of the cost of the investment property. A higher Airbnb ROI means that the property generates more Airbnb profit relative to the cost of investment. However, high ROI can also mean higher risk.

Taking your method of financing (mortgage or cash) into consideration, you can use Mashvisor’s Airbnb profit calculator to estimate the two main ROI metrics (Airbnb cash on cash return and Airbnb cap rate). They are already pre-calculated for you and can be used to quickly compare the profitability potential of Airbnb properties for sale.

6. Airbnb Rental Comps

The Airbnb profit calculator also provides Airbnb rental comps for Airbnb properties on the platform. This allows you to estimate Airbnb profit based on similar properties already operating in the area.

The Bottom Line

For more than a decade now, owning an Airbnb has been a lucrative investment for many. However, even if you are equipped with the best techniques and tools for managing Airbnb rental properties, it will be hard for you to generate desirable Airbnb profit if you don’t buy the right investment property. Success in the Airbnb business boils down to analyzing potential Airbnb properties the right way and using the right tools. Be sure to use Mashvisor’s Airbnb profit calculator to determine Airbnb profit and make smarter investment decisions.

Are you looking to invest in Airbnb in 2020? Sign up for Mashvisor today to find Airbnb data for housing markets, neighborhoods, and Airbnb properties in the US.