By now, most everyone in the real estate industry knows that off market properties make for the best deals. That’s why one of the most common questions among real estate investors is how to find off market properties for sale in the US housing market. Go ahead and Google that question and you’ll find tons of articles that lay it out for you. You can even find some of the best resources about finding off market properties here on Mashvisor’s real estate investment blog as we also think this is crucial information that you need to have.

But one question that a lot of people fail to ask is how to analyze off market properties. And this question is even more important. Why? Because there is a common misconception regarding off market properties and that’s that every off market deal is a great real estate deal– just because it is off market. That couldn’t be further from the truth. Even if the price tag makes it feel like an off market deal is a bargain, you have to analyze its true investment potential. Will it produce positive cash flow? The only way to find out is to conduct a thorough investment property analysis. That’s why we’ve put together this guide for you on how to analyze off market properties.

How to Analyze Off Market Properties in 4 Steps

To complete the off market property analysis, you are going to need a tool designed specifically for this task. You can try to use investment property analysis spreadsheets and your own equations. You can even try to come up with your own rental income and cost estimates by spending time looking for and analyzing real estate comps. But remember, you’re not the only one in the market for off market properties. Although you may have found one, someone else could find it soon and snatch it up before you. That’s why you need to use Mashvisor’s Investment Property Calculator. This real estate investment tool allows you to get the available data for any property in the US housing market. Here’s how to use it:

If you haven’t found an off market property yet, read: How to Find Off Market Properties in 2020.

Step #1: Add Your Off Market Property to Mashvisor’s Real Estate Database

The first step is to add your investment property to Mashvisor’s real estate database. It’s possible that we already have the off market real estate property stored with all of its data. But if not, you can easily add it.

Visit Mashvisor’s homepage and type in the address of your off market property:

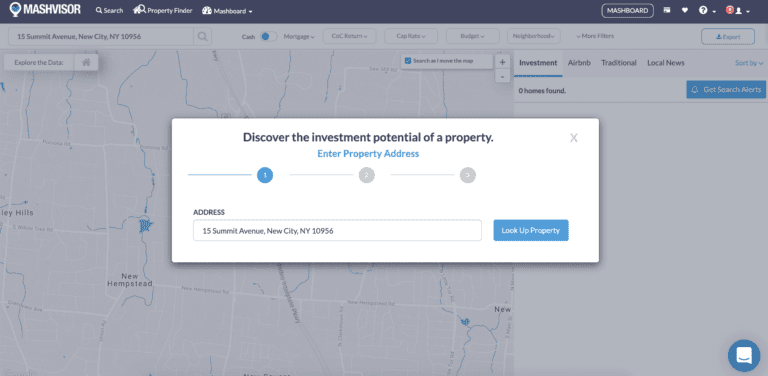

If it’s not in Mashvisor’s real estate database, you will see this message:

Click on “Look Up Property” and you’ll be asked to enter some basic property information such as:

- Number of Bedrooms

- Number of Bathrooms

- Property Type (Single family home, multi family home, townhouse, condo/coop, other)

- Square Feet

- HOA Dues

- Year Built

- Taxing

- Lot Size

As you can see from the image above, some of these filters are mandatory and others are optional. So don’t worry if you don’t have all of this information on your off market property.

Finally, click “Verify” and this message will appear to let you know you’ve successfully added the off market property:

You can check out the complete investment property analysis by clicking “Go to Property Page”. And you can view any off market properties you add to Mashvisor by visiting your “Saved Homes”- the heart symbol at the top left corner of the screen (pictured above).

Sign up now to Mashvisor and complete this first step so you can follow along with the rest of the steps of how to analyze off market properties.

Step #2: Use the Mortgage Calculator

If you’re able to finance off market properties for sale with cash, then you can skip this step. But if you’ll be using a mortgage, then you need to take advantage of Mashvisor’s Mortgage Calculator. This tool is integrated with the Investment Property Calculator to ensure that your analysis is a true reflection of your financing method. Simply enter the following investment property mortgage info:

- Property Price

- Down Payment

- Mortgage Type

- Loan Term

- Interest Rate

With this information, you’ll be one step closer to figuring out if certain off market homes are a good deal or not. That’s because this information will affect a lot of the following return on investment analysis.

Step #3: Check Out the Numbers Provided by the Investment Property Calculator

At this stage of analyzing off market properties, your work is almost done. All you have to do now is check out the numbers. Here’s what the analysis looks like for an NYC investment property that was added to Mashvisor:

Let’s take a closer look at some of these real estate metrics and how you can analyze off market properties using them:

Rental Income

Rather than trying to look at rental comps to figure out the rental income that your off market property will generate, simply check out the property data that Mashvisor’s calculator displays for you. It retrieves this data using reliable rental comps so you don’t have to.

So how do you determine if off market deals are good deals based on an analysis of the rental income? Generally speaking, the higher the rental income, the better. However, you’ll only know if you’re looking at a good rental income when you look at two other property metrics: rental property expenses and the cash flow.

One-Time and Monthly Rental Property Expenses

Mashvisor also provides estimates of rental property expenses based on comps. So rather than spending time talking to local landlords in the real estate market to try and get estimates, Mashvisor can provide estimates for off market properties added to the database. You also have the option to add or adjust any of the rental property expenses yourself.

At this point in your analysis, if you see that the rental income is greater than the total monthly rental property expenses, it’s likely that this is a good real estate deal. By comparing rental income vs rental property expenses, what you’re trying to analyze is the rental property cash flow.

Rental Property Cash Flow

But you don’t have to spend any time manually analyzing the rental property cash flow. Mashvisor’s Investment Property Calculator will prominently display the expected cash flow of an off market property for sale. Any adjustments made to the expenses will be immediately reflected in the cash flow calculation as well.

To ensure you only go after the best off market deals, you want to find an investment property with positive cash flow. As mentioned, this means that the rental income will be higher than the rental property expenses. If the rental income is lower, this means the off market home is a negative cash flow rental property. A more experienced real estate investor may be able to take this kind of property on, but if you’re a beginner, try to find positive cash flow properties.

Cash on Cash Return

The cash on cash return is a crucial property metric if you’re buying off market properties with a mortgage or another type of investment loan. This ratio represents the return on investment compared to how much cash you invest from your own pocket into the rental property. Here’s what the cash on cash return formula looks like:

Cash on Cash Return = Pre-Tax Cash Flow / Total Cash Investment

You can read up on what’s included in the cash on cash return formula by checking out: Cash on Cash Return Calculation in Real Estate: What to Include. But because Mashvisor’s goal is to make your life as a real estate investor much easier, we provide pre-calculated cash on cash return figures for off market properties.

But what’s a good cash on cash return? Generally, a good cash on cash return is one with double digits. However, there are a lot of variables that come into play when analyzing the cash on cash return like the investment property type and the real estate market. Still, it’s best to try to aim for off market properties with a higher cash on cash return.

Cap Rate

Buying an off market property using cash would make the cap rate equal to the cash on cash return. If you’re using a mortgage, however, then you should take a quick look at the cap rate metric when analyzing an off market investment property. Here’s the cap rate formula:

Cap Rate = Net Operating Income / Current Market Value (or Property Price)

Looking at the cap rate provided by Mashvisor, you want to find off market properties with a cap rate between 8% to 12%. This is what most real estate experts agree is a good cap rate. However, as with the cash on cash return, there is a lot that goes into determining what a good cap rate is. For example, a good cap rate for an off market property in the Los Angeles housing market will be lower than one in the Indianapolis housing market due to the major difference in property prices and rental income potential. And off market multi family properties will have different cap rates than single family off market properties. To make things easier, understand that a higher cap rate is typically better but that you may not find 20% cap rates in your housing market of choice.

Discover the cap rate of your off market property now.

Occupancy Rate

The rental occupancy rate will give you an idea of whether or not the off market home will be able to attract and keep tenants. Mashvisor’s occupancy rate calculation is based on a few different factors including the location of the investment property.

A good occupancy rate for a traditional rental property is closer to 100%- typically above 90%. A good Airbnb occupancy rate, on the other hand, will be much lower. In some of the best cities for Airbnb investment, you may find Airbnb occupancy rates over 70%. In other locations, it may be much lower. You will have to take a look at the Airbnb daily rate, rental income, and cash on cash return- all of which Mashvisor provides- to determine if the occupancy rate is high enough to produce a profit or not.

Learn More: What Is a Good Airbnb Occupancy Rate?

Optimal Rental Strategy

Speaking of traditional vs Airbnb investments, part of your analysis of off market properties is to decide which rental strategy would be more profitable. Because Mashvisor’s Investment Property Calculator grants you access to both traditional and Airbnb analytics, you can easily make this decision. For the NYC property above, the Airbnb data shows that this rental strategy is more profitable.

Investment Payback Period

Finally, you want to be sure that an off market real estate property will continue to make money. Based on the current stats, Mashvisor can show you the investment payback period. This is how much money a rental property will generate as a traditional or Airbnb rental property over a span of 10 years. This part of the off market property analysis lets you know if you’ll be making money or losing money while holding onto the property for years in the future.

Step #4: Get a Home Inspection

This step is especially important if you’re in the market for off market distressed properties and that’s why we have included it here. All of the property data provided by Mashvisor may look promising, but you still need to be sure of the condition the off market investment property is in. Hire a professional home inspector to walk you through the property and point out any issues. You may find that there are a few needed repairs that you have to factor into your budget. Or you may find some serious issues like structural problems that would make the off market deal a bad one. So be sure not to skip this step.

Start Your Analysis of Off Market Real Estate Deals Now

If you have an off market property and want to start analyzing its investment potential, Mashvisor has all the data and tools you need. Start out your 7-day free trial with Mashvisor now. And be sure to follow up with a thorough inspection before making an offer.