Mistakes! We make them, see them and know them.

In property investment there probably isn’t a mistake that hasn’t been made. The majority of mistakes in property investment are made by real estate investors just beginning in real estate who don’t have enough experience in the field to avoid them. It’s mistakes that stop real estate investors from continuing in real estate investing after their first investment.

Let’s begin by talking about the most common property investment mistakes and give some advice about how you can avoid them. Feel free to share any comments below or any personal experiences that you feel would be beneficial.

Related: Real Estate for Beginners: Watch Out for These Pitfalls

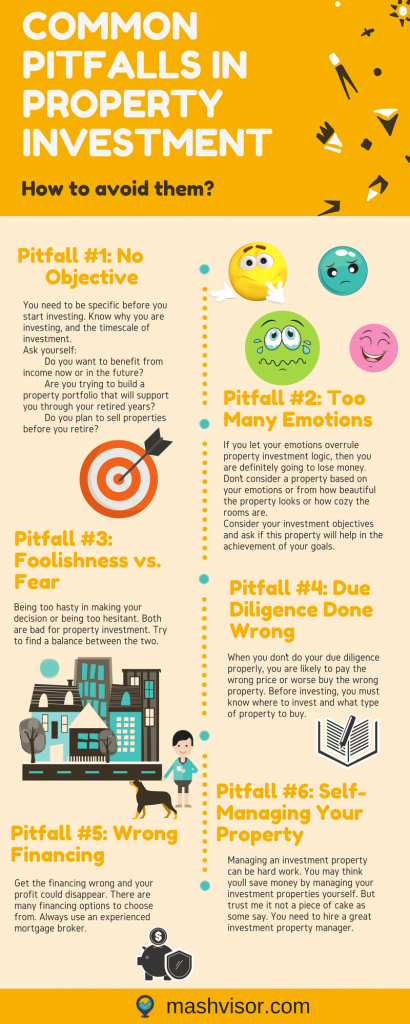

Pitfall #1: Not knowing what your objectives are

If you don’t know your destination, how can you plan to get there? You need to be specific before you start investing in real estate. Know why you are investing and the timescale of investment. Do you want to benefit from income now or in the future? Are you trying to build a property investment portfolio that will support you through your retired years? Do you plan to sell properties before you retire, perhaps to make more money to meet other financial responsibilities? Answering questions like these are crucial to creating a property investment plan to get you to where you want to be in life and successfully become a real estate investor.

Pitfall #2: Letting your emotions get the worst of you

When you buy a home, your emotions begin to kick in. You just “know” and “feel” when it is the right property for you to live in. Investing in a property is a completely different story. If you let your emotions overrule property investment logic, then you are definitely going to lose money. Don’t consider an investment property based on your emotions or from how beautiful the property looks or how cozy the rooms are. Consider your investment objectives and ask if this property will help in the achievement of your goals. Will it attract tenants? Will it give you a good return? Be very specific in what your goals are and don’t rush into making a decision unless you’re sure that this property will generate positive cash flow for you in the future.

Related: Do Not Fall for These Pitfalls When Buying an Investment Property

Pitfall #3: Foolishness vs. Fear

Too much haste or too much hesitancy. There are two types of real estate investors out there: the foolish and the fearful. The foolish property investor acts in haste. They don’t sleep on a deal or even second guess it. They believe everything the seller’s agent tells them, and then rush to sign. Their hasty attitude will probably cost them money and blind them from seeing what a mistake they are making. On the other hand, there are investors who overly cautious. These types of real estate investors hesitate too much before closing a deal or making one. They hesitate and think and hesitate some more and with a blink of an eye comes someone else and takes from them what could have been a good property investment opportunity. The fearful type of investors doesn’t know how to overcome their fear. They know the real estate investing game but don’t have the courage to actually play it. You must be in between these two opposites to succeed in real estate.

Pitfall #4: Not doing your due diligence properly

There are first-time investors who attend property auctions and buy a property at a bargain price. Months later that same property has come back to auction. It has failed to give the investor return, and he/she is now desperate to sell and cut the losses. The problem is that this real estate investor didn’t do proper due diligence before buying the property. When you don’t do your due diligence properly, you are likely to pay the wrong price or even worse, buy the wrong property. You need to know what type of property you want to invest in and where before making any decisions. You need to estimate and calculate the expected cash flow for the property and make sure that the property will produce as you expect. Do your due diligence correctly to avoid this pitfall and speak to local agents for help.

Pitfall #5: Getting the wrong financing

One of the exciting benefits of property investment is that you get to invest with borrowed money. Using a mortgage to fund your property investment allows you to profit from other people’s money. It could massively increase your returns and yield on your capital investment. Get the financing wrong, though, and your profit could disappear. Your biggest monthly expenses are going to be the interest payments when you invest in property using a mortgage. Always use an experienced mortgage broker. They will know the real estate market like the back of their hand and help you avoid costly financing pitfalls.

Related: Financing a Rental Property: What’s the Best Way?

Pitfall #6: Thinking you’ll save money by self-managing your property

Only after investing does the game actually start and the hard work begins! You’ve got to find and examine tenants, make sure they pay their rent on time and keep up with maintenance issues. You’ll need to organize tradespeople to attend to repair work and keep all your paperwork in order. You’ll also have to make regular property inspections and maintain an updated inventory list. Managing an investment property can be hard work. Many investors fall into this misconception and think that they will save money by undergoing property management by themselves. But trust me, it’s not a piece of cake as some might say. You need to hire a great investment property manager and let them have the daily trouble, while you concentrate on enjoying the benefits of investing in property.

Final thoughts

As many would say, we all learn from mistakes, but it’s much less costly to learn from other people’s mistakes than repeat them. By avoiding these common pitfalls made in property investment, and ensuring you continue to invest without making them, you should achieve your investment and lifestyle goals easily.