Buying a vacation home to rent out is one of the best ways of making money in real estate. According to statista.com, vacation rentals generated revenues of about $57 billion in 2019 globally. If that doesn’t get you on board with this real estate investment strategy, there are several reasons why investing in vacation rental properties is a good idea:

- Generate high (and possibly passive) rental income – Buying short-term rental properties offers you an opportunity to make passive income. Since rent is charged on a per night basis, you could earn more than a traditional rental, allowing you to hire a professional property manager.

- Build value via appreciation – In the long term, your property will probably be more valuable than it is now. This means that you can sell it at a higher price and make a good ROI for vacation homes.

- Enjoy tax deductions – If you want to reduce your taxes, vacation rentals are a good investment. Rental property owners are usually allowed to deduct expenses such as utilities, insurance premiums, property tax, and mortgage payments.

- Use it as a second home – That home in the mountains or near the beach could come in handy whenever you want to go on a vacation. You will save what you would have spent for accommodation elsewhere.

Wondering how to buy a vacation home to take advantage of all of that and more? Here are the steps:

1. Identify a Suitable Location

The state, city, or neighborhood where you choose to invest will have a major impact on your return on investment. When looking for vacation rental properties for sale, you will want to find a location that would be appealing to your visitors.

The best spots would be those near attractions such as a national park, lakes, mountains, and beaches. For example, the Florida housing market would be an ideal location due to its great beaches and perfect weather.

According to Mashvisor, the best locations to buy a vacation home in Florida include Key West, Daytona Beach, Pensacola, Lakeland, Tampa, and Jacksonville. Another great option according to Mashvisor’s data is Phoenix vacation rentals.

Don’t forget to check the local short-term rental laws when deciding where to buy a vacation home. For example, you might be required to get a permit before hosting guests. Violating such laws could result in a fine or even imprisonment.

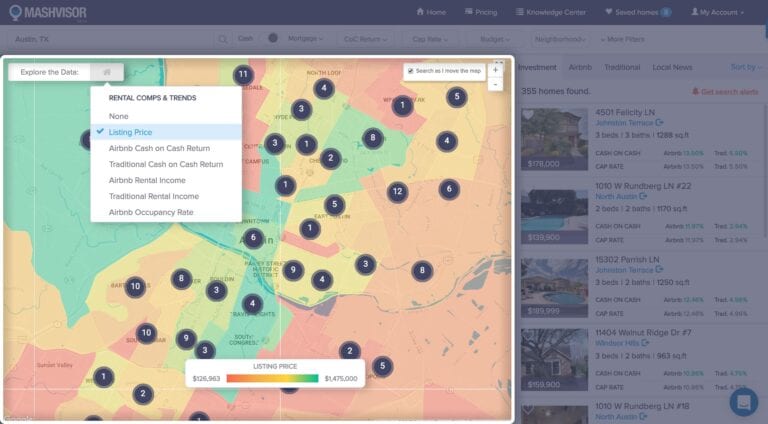

After choosing a city, Mashvisor’s real estate heatmap tool will help you determine the potential profitability of neighborhoods with vacation homes for sale. Our vacation rental market analysis tool looks at metrics such as Airbnb cash on cash return, Airbnb rental income, listing price, and Airbnb occupancy rate.

To learn more about how we will help you make faster and smarter real estate investment decisions, click here.

This tool will also display all the available investment properties for sale in the neighborhood of your choice. That way, you can choose one that fits your criteria and move onto the next step of buying a vacation rental home.

2. Calculate the Vacation Rental Expenses

Along with the cost of a mortgage (if this is your method of financing), there are other expenses that come with owning a vacation rental property. This includes:

- Closing costs – This is an expense that many real estate investors overlook when making a budget. Closing costs include fees such as appraisal fee, home inspection fee, attorney’s fee, loan origination fee, and title search fee. In total, these fees could range between 3-6% of the purchase price.

- Property taxes – These are taxes paid annually to the local or federal government.

- Occupancy tax – Also referred to as lodging or hotel tax, these are taxes that you pay anytime you rent out a bed, room, or any other space.

- Property insurance – This is insurance that protects your vacation rental property from risks such as theft, fire, floods, and earthquakes.

- HOA fees – If you buy a vacation home rental in a planned community with common spaces, you will be required to pay HOA fees. The amount will vary depending on the location, amenities, and property type.

- Utilities – This includes expenses for cooking gas, electricity, cooling, and heating. You can get an estimate of such costs from local utility companies and the seller.

- Professional property management fees – You might need to hire a professional property manager to handle the day-to-day running of your vacation home. Property management fees are usually charged as a percentage of the rent collected.

- Marketing costs – These are expenses related to advertising your rental property on online and offline platforms.

Knowing these costs will not only help you create a budget, but it will make your investment property analysis (the next step) easier and more accurate, helping you to buy the most profitable vacation home for sale.

3. Conduct an Investment Property Analysis

Once you’ve identified some of the best places to buy a vacation home, you should now conduct a vacation rental investment analysis on a property for sale there. Mashvisor’s vacation rental income calculator will do the analysis for you! Our vacation rental data includes key metrics and info such as:

- Median property price

- Airbnb rental income

- Rental property expenses (our calculator provides estimates, but you can adjust them based on what you found in step #2)

- Airbnb cash on cash return

- Airbnb cap rate

- Optimal rental strategy

- Airbnb occupancy rate

- Airbnb rental comps

4. Get Pre-approved for a Mortgage

The next step in how to buy a vacation home is to select a financing method. You can choose between a conforming loan, multi family loan, portfolio loan, or short-term loan. Most sellers will want to see a mortgage pre-approval letter to be sure that a buyer is serious. Here are some of the requirements for pre-approval:

- Good credit – Most lenders require a credit score of 620 or higher. If you have a lower score, you must make a higher down payment.

- Proof of income – You must produce recent pay stubs or records of recent tax returns.

- Employment verification – The lender will want the name and contact details of your previous and current employers.

- Proof of assets – Submit paperwork showing your investments in bonds, stocks, retirement savings, mutual funds, and life insurance.

5. Conduct a Home Inspection

A home inspection is crucial when it comes to how to buy a vacation home. You must get the investment property inspected before closing the deal. Some of the things you need to pay attention to include the HVAC system, roof, electrical system, water drainage, foundation, noxious gases, asbestos, waste systems, and lead paint.

If the inspection reveals significant mechanical or structural defects, you could negotiate for a lower selling price or ask the seller to fix them. Be ready to walk away if the seller is not willing to cooperate.

Conclusion

Anyone can learn how to buy a vacation home. If you prepare well and mind your due diligence, you will be the proud owner of a rental property that could benefit you for years to come.

Start your 7-day free trial with Mashvisor now and make the process of buying a vacation home much easier for yourself.