For most beginner real estate investors, real estate investing sounds like a complex venture that requires a lot of money, knowledge, and experience for one to be successful. Actually, many aspiring investors refrain from investing in real estate altogether because they have limited budgets and no experience. While having money and experience will give you an upper hand as a real estate investor, lacking any of them shouldn’t stop you from getting started. There are strategies that you can use to quickly obtain or make up for what you lack. If you are a novice, read on to learn how to invest in property with limited budget and no experience.

How to Invest in Property With Limited Budget and No Experience: 4 Tips

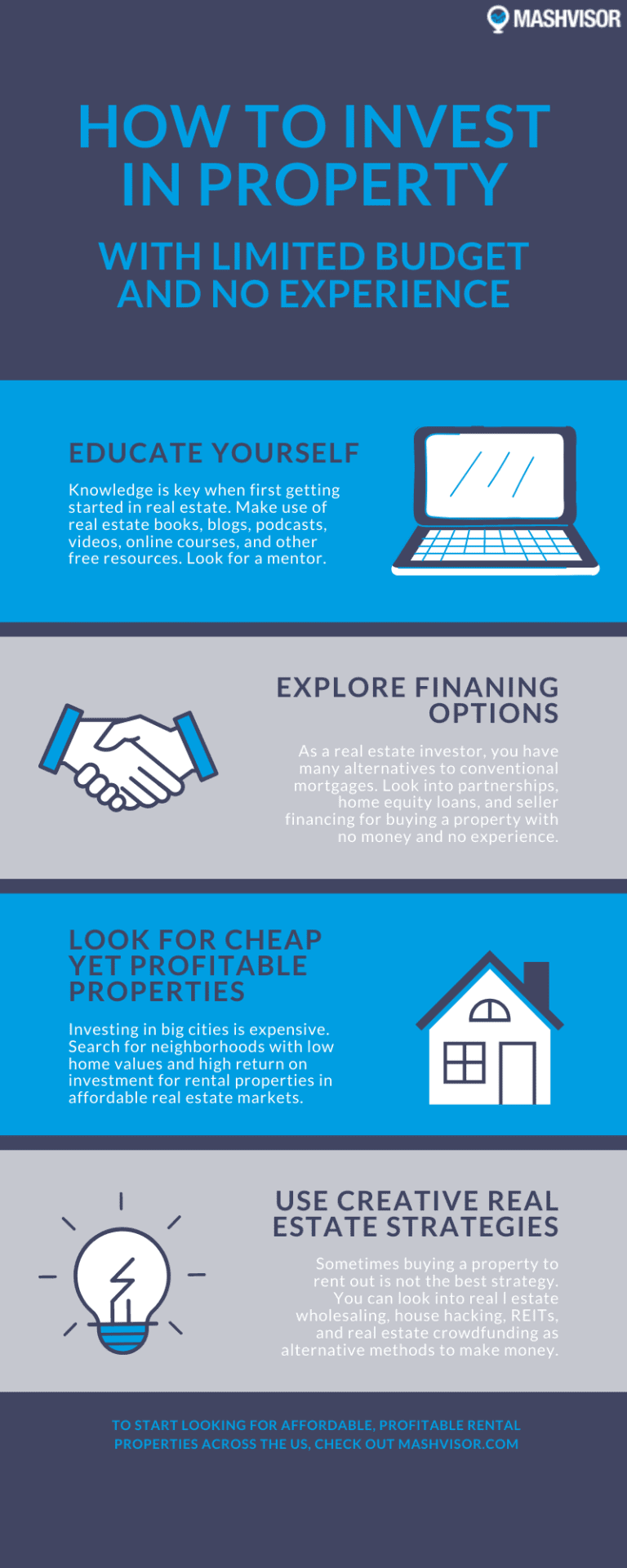

Mashvisor Infographic: How to Invest in Property With Limited Budget and No Experience

1. Educate Yourself

Real estate investing for beginners usually seems intimidating because they lack adequate knowledge on how to invest in estate. Remember, confidence comes with knowledge. If you have no experience, the first thing you should do before getting into real estate is to learn the key fundamentals of the business.

You don’t need to acquire a Master’s degree to learn how to invest in rental property as a beginner. You can acquire real estate education from a number of resources including real estate books, blogs, real estate podcasts, videos, online courses, and others. Also consider finding a real estate mentor to teach you about real estate investing first-hand. Find someone who has been there, done that.

Start educating yourself about investing in real estate as soon as possible. While it won’t completely make up for your lack of experience, it will help you avoid common mistakes made by beginners.

2. Explore Financing Options Available to You

The main obstacle that beginner real estate investors usually face is finding money to buy property. While real estate investing is generally capital intensive, the beauty about it is that you don’t have to use your own money. Savvy real estate investors have mastered the art of how to invest in property with no money of their own.

However, not all may be able to buy investment property using a conventional mortgage because they can’t raise the required down payment (usually at least 20%) or have poor credit score. For beginners looking for how to invest in property with limited budget, here are some attractive financing options to consider.

-

Real Estate Partnerships

One of the best strategies for how to invest in real estate with no money is to look for partnerships. If you want to get into the real estate investing game and don’t have the financial muscle, consider forming a partnership with someone who does. There are many people out there with access to funds but who lack the time or willingness to actively invest in real estate.

Forming a real estate partnership also offers investors with no experience the opportunity to learn from more seasoned investors. Basically, you should find a partner who makes up for what you lack. However, keep in mind that for you to attract partners, you have to bring something to the table too. Since you lack money or experience, be ready to bear most of the responsibility for finding, buying, and managing investment property.

-

Home Equity Loans

If you are already a property owner and have built substantial equity in it, you can borrow against this equity to purchase an investment property. You can do so by obtaining a home equity loan or a home equity line of credit (HELOC). You can use the funds as a down payment or for the entire purchase if it’s enough.

-

Seller Financing

If you are wondering how to invest in property with little or no money, seller financing is another great financing option. It is when the seller provides you the loan themselves rather than making you acquire one from a bank. You will be required to make regular payments depending on the terms you agree on. One major advantage of using this strategy is that the loan terms are flexible. Therefore, you can negotiate terms that suit your current financial situation.

Related: The 6 Best Real Estate Investment Loans in 2021

3. Look for Cheaper but Profitable Properties

Getting into real estate can be very expensive if you invest in primary markets like the New York real estate market and the Los Angeles real estate market. If you have a limited budget, you want to limit your search for rental property for sale to smaller cities and inner city suburbs. In this way you will be able to find cheap houses for rent that fit your budget.

Related: 15 Most Affordable Real Estate Markets in 2021

However, you shouldn’t focus on average property prices only. You should also consider the potential return on investment. To find the best places to invest in real estate in terms of affordability and profitability, you need to do a thorough real estate market analysis.

The easiest way to find affordable cities in the US that are performing well is to check for city data on Mashvisor’s real estate blog. After you have identified an affordable and profitable city to invest in, you can use Mashvisor’s real estate heatmap to do a comprehensive neighborhood analysis based on real estate data such as average property price, cash on cash return, and rental income. With this real estate software tool, you’ll be able to easily locate the best-performing and most affordable neighborhoods in your city of choice.

Last but not least, you need to analyze multiple real estate deals in the neighborhood that fit your criteria to identify the most profitable one. A quick search using our Property Finder will help you find the best performing rentals that match your search criteria and investment goals. Using the Investment Property Calculator, you’ll be able to do an in-depth investment property analysis and identify the most profitable income property for sale.

Remember, finding great property investment deals is also key to finding financing deals. If you know how to do the math and find profitable investment properties for sale, getting financing will be much easier for you.

4. Use Creative Real Estate Investing Strategies

Buying rental property is one of the best ways to invest money in real estate. However, if you have a limited budget and zero experience, you need to diversify your options. Depending on your financial standing and personal preference, buying rental property may not be right for you.

-

Real Estate Wholesaling

If you are thinking about how to invest in property with no money, real estate wholesaling can be a great way to start. You don’t need to own or repair a property. You just need to find a property that is selling at a discounted price, put it under contract, and find a buyer to whom to assign the contract. This requires very little or no money to start.

-

House Hacking

House hacking is when you buy a multi unit property like a duplex or a triplex, live in one unit, and rent out the other units. With this strategy, you can qualify for an FHA loan which has a down payment requirement of only 3.5%. If you buy the right property, the rental income can cover your expenses and allow you to live for free. By living with your tenants under the same roof, you’ll also get a hands-on experience on what it takes to be a landlord.

-

REITs and Real Estate Crowdfunding

If you want to get into real estate investing with little money but don’t want the work that comes with managing a property or finding properties to wholesale, you can consider investing in a REIT or in a real estate crowdfunding company. Real estate investment trusts (REITs) are companies that invest in and operate income-generating real estate properties. They pool funds from multiple investors who earn dividends on their investments. Real estate crowdfunding is when an online platform is used to pool funds from many investors and finance real estate projects managed by experienced developers.

For both of these strategies, you can invest with small amounts of money and you aren’t involved in managing the investments. So long as you choose them well, you don’t need experience as your income will be passive.

Related: How to Flip Houses With No Money in 2021: 5 Steps

The Bottom Line

If you didn’t know how to invest in property with limited budget and no experience, you now have several options in mind. You have no excuses. It’s now up to you to take action and find the best real estate investments in 2021!

To get started on the right foot, sign up for Mashvisor.