It is no secret that a well located, reasonably priced rental property can effectively generate a good return on investment. We keep hearing stories about successful real estate investors who’ve rented out properties in good areas for over 10 years and how this has helped them create wealth. This proves that real estate investing – when done right – offers one of the most lucrative opportunities on the market. Wondering how to make money with rental properties in 2019? There are mainly 3 ways that a real estate rental property can make you money:

Let’s take a look at each of these ways in a little more detail.

#1 Cash Flow

The ultimate way for an income property to make money is the good old-fashioned way: cash flow. Simply put, this is the difference between the rent you collect and all your operating expenses. For example, if you rent out a real estate property for $1,500 per month and your mortgage payments are $900 a month, this leaves you with $600 dollars of income that you’ll put back into your pocket. This is a positive cash flow because you’re making more money in rent than you spend on expenses.

However, calculating cash flow to understand how to make money with rental properties is not really that simple. To figure out how much money you’re actually making, you need to take the Net Operating Income into account. The NOI is basically your annual rental income minus operating rental expenses (excluding mortgage payment!). The most common operating expenses are:

- Vacancy (when the property sits empty)

- Repairs (when the property needs fixing)

- Management fees (finding/evicting tenants)

- Delinquency (when tenants are late to pay or stop paying altogether)

How to Calculate NOI

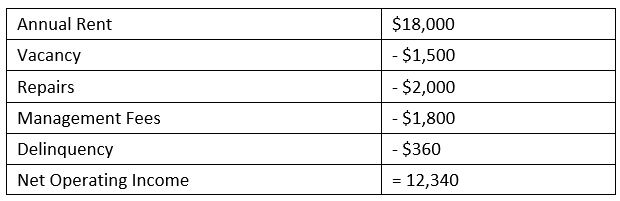

To calculate the NOI, first multiply the monthly rent by 12 ($1,500 x 12 = $18,000). This is your gross rental income from which you’ll subtract these expenses. For example, if the income property was vacant for one month out of the year, deduct a month’s worth of rent ($1,500). Say that you needed to do some repairs on the property to keep it in a good condition which cost $2,000. Furthermore, many property management companies charge about 10% of the gross rental income ($18,000 x 10% = $1,800). Finally, take 2% off gross rental income for delinquency ($18,000 x 2% = $360).

Now, deduct your annual mortgage payments from your NOI ($12,340 – $10,800 = $1,540). This is your annual cash flow, which isn’t bad since it’s a passive income that required no time or work from you. Keep in mind that if you’re managing the rental property yourself, your cash flow will be higher as you won’t have management fees as an expense. Also, this is a basic description of how to make money with rental properties from positive cash flow. For more details, read: How to Calculate Cash Flow for an Investment Property.

Note: Using Mashvisor’s Investment Property Calculator helps you calculate cash flow more efficiently and guarantees accurate results. To learn more about our product, click here.

#2 Appreciation

Another way of making money in real estate from rental properties is through appreciation. When you buy an investment property, you pay (either in cash or with a mortgage) the current asking price. As time passes and the real estate market changes, the value of your property will (hopefully) increase. Therefore, when you put your investment property up for sale years later, however much it has appreciated, it is money that goes right back into your pocket. So, in a nutshell, real estate appreciation is the increase of an asset’s value over time and is another way of how to make money with rental properties.

Related: How to Calculate Real Estate Appreciation

It’s important to keep in mind that appreciation takes years to take effect and isn’t always a guaranteed thing. In addition, the average appreciation rate for real estate properties is heavily dependent on local factors as well as booms in the US economy. Therefore, if you want to focus only on appreciation as a way to make money in real estate investing, think about it before buying a rental property. Most importantly, you need to look for properties for sale in up-and-coming locations that are projected for major growth in the upcoming years.

You can find more tips on how to make money with rental properties in our real estate investment blog!

#3 Tax Benefits

Real estate investing offers some of the most generous tax deductions. As an owner of rental properties, you qualify for a number of tax write-offs that reduce your taxable income and can make you some serious cash at the same time. Some write-offs that a real estate investor can qualify for when investing in rental properties include:

- Interest on your mortgage

- Depreciation on your investment properties

- Repairs on your properties (including costs of renting or buying any tools needed for the repairs, labor costs, etc.)

- Maintenance on your properties (including landscaping, labor costs, pest control, etc.)

- HOA fees

- Insurance premiums (including homeowner’s insurance, mortgage insurance, liability insurance, etc.)

- Utilities for your rental properties (including electricity, gas, water, etc.)

- Travel expenses related to visiting your investment properties

- Start-up costs associated with a new real estate investment property

- Property management fees

- Marketing and advertising expenses

- Legal fees

As you can see, there are plenty of tax benefits that you can take advantage of when owning real estate rental properties. The more you take advantage of them, the less you’ll pay on taxes – and the more money you’ll get to make as a result! To better understand how to make the most out of the tax benefits that apply to you as a beginner investor, the best thing you can do is hire a tax professional. They know the ins and outs of tax law and can help you find tax breaks and write-offs you didn’t know existed.

How to Make Money with Rental Properties: Important Things to Remember

Buy Rentals in the Best Locations

The first thing beginner investors are told when they enter the real estate investing business is “location, location, location.” You should invest in the best locations where there’s a demand for rental properties. Typically, the best rental properties are located in solid working-class and middle-income neighborhoods. So, look for areas with good schools, available shopping centers, transportation, and communities where people care about where they live. In these locations, you’ll find strong demand for rentals.

Choose the Right Rental Strategy

When thinking of how to make money with rental properties, a real estate investor has two options. They can rent their properties out either traditionally (long-term rental) or on Airbnb (short-term rental). Both rental strategies have good potentials for making money in real estate. However, the best that you should go for depends on a number of factors. Savvy real estate investors look at what rental income, cash on cash return, cap rate, and occupancy rate a certain property will have as a traditional rental vs as an Airbnb. Analyzing and comparing such data will show you which is the better strategy and which yields a better return on investment.

You can get this type of data using Mashvisor’s Investment Property Calculator. Our tool allows real estate investors to find and analyze investment opportunities in any city/neighborhood in the US housing market using analytics. Simply, after finding an investment property for sale on our platform, Mashvisor gives you a comparison and an analytical breakdown of both strategies. This tells you if the property would be more lucrative if listed on Airbnb or through traditional renting.

To start looking for and analyzing rental properties in your city and neighborhood of choice, click here!

Know Your Market’s Rental Rate

Another tip to keep in mind to make money from a rental property is knowing the rental rate in your housing market. Property investors need to set a rent price that allows for positive cash flow and is fair at the same time. The best way to do that is by doing a rental market analysis and looking at comparable rentals (rental comps) in the neighborhood. This allows you to find the best rent price that is not above the market rate which can push tenants away and not too low that you could potentially lose money.

The Bottom Line

How to make money with rental properties is a frequently asked question among beginner investors. As you can see, there’s a number of ways to generate income from renting out real estate properties – and a number of considerations to keep in mind to succeed. Remember, not all investment properties are cash flow positive, appreciation is not always guaranteed, and some tax benefits may not apply to you! Therefore, you should always do your due diligence before buying a rental property to make sure that it will indeed make money.

Mashvisor can help you find the best rental properties for sale in the best locations. Start out your 14-day free trial with Mashvisor now to kick start your real estate investing career on the right foot!