Indicators of a healthier Los Angeles housing market were clear two years back, but what can real estate investors expect from LA in 2020?

Los Angeles Real Estate Market Predictions: Future Trends

Real estate investors interested in the Los Angeles rental market should know what they’re getting into before making any serious investments. By looking at the stats of the housing market, evaluating the performance of existing rental properties, and studying real estate trends, Los Angeles real estate investors can form a good picture of what’s to come in 2020.

Expect Steady Rental Return Rates

Mashvisor’s rental property calculator analyzes investment property performance in housing markets across the US. Today, we’ve used it to analyze the estimated return a Los Angeles real estate investment will make next year. Take a look at the data below as this is a good starting point before we continue discussing Los Angeles real estate market predictions.

- Median Property Price: $999,186

- Price per Square Foot: $561

- Price to Rent Ratio: 24

- Average Days on Market: 75

- Monthly Traditional Rental Income: $3,413

- Traditional Cash on Cash Return: 1.2%

Traditional in this sense is referring to long term rentals where tenants occupy the unit for a long period of time (from a couple of months to years). The above data in combination with a few other positive trends mentioned below points to the fact that LA real estate investors can expect steady returns on rental investment properties next year.

Keep in mind that non-owner occupied Airbnb Los Angeles rental properties are illegal. If you wish to rent out your primary residence and would like Airbnb data for the Los Angeles real estate market, sign up for Mashvisor to get access.

Get a more comprehensive analysis by checking out the Los Angeles Real Estate Market Report 2019.

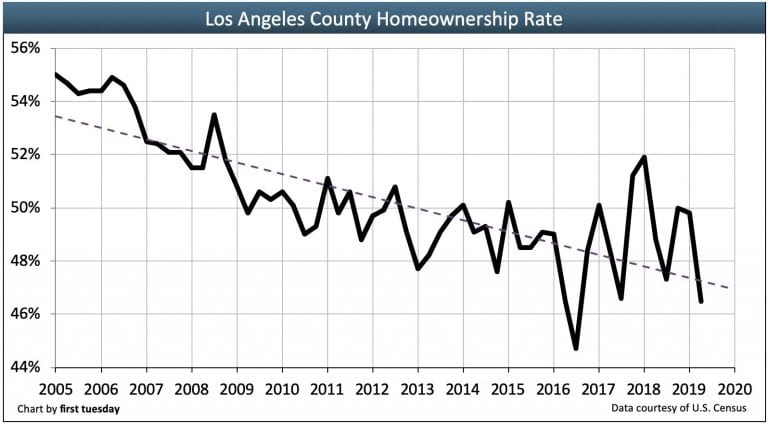

Homeownership Will Remain Low

The most recent homeownership rate is 46.5%, only slightly above the lowest point witnessed in the Los Angeles real estate market which was 45% in 2016. It’s also currently much lower than the statewide average for the California real estate market which is 53%. As Los Angeles house prices have continued to rise, homeownership just isn’t an option for a lot of people.

Low affordability is a big driver for the strong rental market in the Los Angeles housing market 2020. Los Angeles real estate market predictions include a downward trend for homeownership until 2021. The resulting demand for rental units will continue to push rental prices up.

Source: Ft Journal Los Angeles Housing Indicators

There Will Be Moderate Home Prices Following the Economic Recession

Los Angeles real estate trends are a bit tricky when it comes to home prices. Prices have been steadily rising since the housing market crash in 2008. But we have witnessed price fluctuations which make it difficult for confident Los Angeles real estate market predictions 2020.

Experts predict that the US as a whole may go through a mild recession in 2020 which will likely lead to a drop in housing prices. Zillow’s Los Angeles real estate market forecast is that house prices will remain moderate for the next twelve months. In Los Angeles County, prices are most likely expected to drop by 1 percent.

It seems that although Los Angeles house prices will remain high, they won’t be as high as we have seen in the past.

A Buyer’s Market Will Keep Home Sales Low

Los Angeles real estate market predictions for sales volume is that it will remain low. A buyer’s market reflects low competition and low demand meeting Los Angeles homes for sale. Typically, homes will receive 2 offers and go pending in around 48 days. Although home sales did slightly increase in 2017, there has been an apparent downward trend for sales volume in the Los Angeles real estate market. The volume of LA home sales in 2018 was a whopping 7,500 fewer sales than in 2017. And so far in 2019, the slowdown in sales continues and is 8 percent less than in 2018.

The good news is that a recovery in home sales is expected in the years following 2021. It needs time to correct itself, but once the seller’s market picks up again, experts are predicting an annual sales volume of 110,000 homes.

Related: How to Differentiate Between a Buyer’s Market and a Seller’s Market in Real Estate

A Lot of New Housing Starts

An increase in both multifamily and single-family construction starts has been apparent for years now. While single-family construction starts have held a more steady rise over the last three years, multifamily construction witnessed a much more significant boost. In 2018, there were 16,500 multifamily starts, while single-family starts held their modest pace with only 6,100 starts. However, Los Angeles real estate market predictions are that there will be a rise in construction, with a total of 9,400 new units of housing on the way.

Learn more about real estate investment in Los Angeles.

Los Angeles Real Estate Market Predictions: The Best Neighborhoods for 2020

All of these Los Angeles real estate market predictions are good to know, but when it comes down to it, real estate investors want accurate and reliable data for their investments. Los Angeles is a big city and it has a lot of neighborhoods that all perform differently in regards to rental property investments depending on what side of town you’re in. So using our investment property calculator to find the best neighborhoods in Los Angeles, we will tell you where real estate investors can find the highest potential return rate with Los Angeles investment property in 2020.

West Hills

- Median Property Price: $768,037

- Price per Square Foot: $368

- Price to Rent Ratio: 21

- Average Days on Market: 60

- Monthly Traditional Rental Income: $3,106

- Traditional Cash on Cash Return: 2.3%

Lake Balboa

- Median Property Price: $642,332

- Price per Square Foot: $436

- Price to Rent Ratio: 20

- Average Days on Market: 44

- Monthly Traditional Rental Income: $2,729

- Traditional Cash on Cash Return: 2.1%

Canoga Park

- Median Property Price: $616,750

- Price per Square Foot: $376

- Price to Rent Ratio: 20

- Average Days on Market: 61

- Monthly Traditional Rental Income: $2,635

- Traditional Cash on Cash Return: 1.9%

Granada Hills

- Median Property Price: $786,826

- Price per Square Foot: $351

- Price to Rent Ratio: 22

- Average Days on Market: 72

- Monthly Traditional Rental Income: $3,007

- Traditional Cash on Cash Return: 1.9%

How to Find Profitable LA Real Estate Investments

Don’t let these Los Angeles real estate market predictions of low average return rates discourage you. If you’re using the right resources, you can have a successful real estate investment in any market, and the search doesn’t need to take you forever. Do you have a free Mashvisor account? Because if you do, you can use our Property Finder to locate lucrative investments in the Los Angeles real estate market that match your criteria in just a matter of minutes.

To show you exactly how easy it is to find attractive investment properties using our tool, we’ve pulled up a couple of listings. Check out their stats:

Investment Property #1:

- List Price: $1,999,000

- Traditional Cash on Cash Return: 18.3%

Investment Property #2:

- List Price: $2,790,000

- Traditional Cash on Cash Return: 18.1%

Investment Property #3:

- List Price: $79,900

- Traditional Cash on Cash Return: 15.1%

There are so many other real estate listings on our platform with returns just like these. To search for other Los Angeles investment properties, click here. To learn more about how we will help you make faster and smarter real estate investment decisions based on these Los Angeles real estate market predictions, click here.