If you’ve been in the residential real estate investing business in the past few years, you might have heard about Mashvisor. But what is Mashvisor? What does it do for real estate investors? Does it work for anyone else in the real estate industry?

This Mashvisor review will answer these and many other questions to show you how Mashvisor helps even beginner real estate investors make smart, educated, data-based real estate investment decisions.

What Is Mashvisor?

In brief, Mashvisor is a real estate investment software platform which helps investors find lucrative traditional and Airbnb rental properties. However, in reality, it is much more than that.

Mashvisor is a website which hosts numerous real estate investment tools which aim at making the work of rental property investors less demanding and more profitable. Mashvisor uses the power of predictive analytics combined with real estate data and rental data to predict with a high degree of accuracy the future performance of long term and short term rental properties in any US housing market.

What Does Mashvisor Do for Real Estate Investors?

The short answer to this important real estate investment question is: Mashvisor turns 3 months of research into 15 minutes.

What does this mean? How is this possible?

Here are the detailed, in-depth answers to the questions “What is Mashvisor?” and “What does Mashvisor do for real estate investors?”

This real estate investment app allows rental property investors to do the following 7 things more easily and more efficiently than ever before:

1. Learn about Real Estate Investing

Residential real estate investing for beginners can be tough if you don’t know where to start. That’s why the first thing you need as a new real estate investor is a reliable knowledge center. That’s exactly what Mashvisor’s real estate blog provides.

The real estate blogs on Mashvisor’s real estate app are organized in a few categories so that investors can quickly find the most appropriate articles for their needs, interests, and real estate investment strategies. For example, there is a special section with real estate blog posts which teach new comers how to begin investing in real estate properties to rent out. There is another category which focuses on how to buy an investment property with a high return on investment. Another category concentrates on real estate market analysis and investment property analysis. Yet another real estate blog section highlights the best places to invest in real estate for each rental strategy: traditional rentals and Airbnb rentals.

In brief, Mashvisor’s blog constitutes a comprehensive knowledge center for every beginner real estate investor. Meanwhile, even experienced rental property investors have lots to learn from the available articles.

2. Analyze the Investment Potential of Neighborhoods

Location location location – these are the 3 most important factors in real estate investing, right?

We at Mashvisor know that, and that’s why the next thing which Mashvisor does for residential real estate investors is to help them conduct neighborhood analysis. As you might already know, areas within the same housing market vary drastically in terms of home values, rental rates, occupancy rates, and other important residential real estate investment metrics. Mashvisor’s real estate investment tools facilitate real estate market analysis at the neighborhood level in two major ways.

First of all, Mashvisor’s heatmap provides a color-coded overview of the areas in any US city or town to display a few different measures. These include:

- Listing price

- Traditional rental income

- Traditional cash on cash return

- Airbnb rental income

- Airbnb occupancy rate

- Airbnb cash on cash return

Our real estate heatmap tool shows low values in red and high values in green. This quick neighborhood analysis allows even new and out of state real estate investors to find the best places to invest within their budget which offer the rate of rate which they expect.

Second, Mashvisor’s neighborhood pages provide an even more detailed rental market analysis at the neighborhood level. Importantly, this real estate analysis is available for all areas in absolutely any US housing market, no matter how big or small it is.

In specific, Mashvisor’s real estate software algorithms use real estate data from the MLS, Auction.com, Zillow, Airbnb, and a number of other reliable publicly available sources to evaluate the rental property investment potential of an area.

If you want to know if a neighborhood is worth investing in real estate, you should look at the Mashmeter. This is a score, on a scale between 0 and 100, which has been specifically developed by Mashvisor’s team. It summarizes whether an area has a strong or a weak residential real estate investing potential in a single number. Obviously, the higher the score, the better the average performance of traditional and Airbnb rental properties in this neighborhood.

However, you should not blindly trust a number between 0 and 100 to tell you where to invest your money. You should look at the real estate data analytics behind this Mashmeter score.

Mashvisor’s neighborhood analysis provides all the following numbers and indicators:

- Median property price

- Average price per square foot

- Traditional cash on cash return

- Airbnb cash on cash return

- Traditional rental income

- Airbnb rental income

- Number of real estate listings for sale

- Number of traditional rentals

- Number of Airbnb rentals

- Airbnb occupancy rate

- Optimal rental strategy: traditional vs. Airbnb

- Walk Score

- Historical rental income for traditional and Airbnb rental properties

- Real estate comps

- Optimal type of property: single family home, condo, townhouse, multi family home, etc.

- Optimal number of bedrooms

This detailed neighborhood analysis helps even beginner investors find the best places to invest in traditional rental properties as well as the most profitable Airbnb locations quickly and efficiently.

Wondering where all these figures are coming from?

As we’ve already mentioned above in this Mashvisor review, all real estate data comes from various reliable sources. The average performance of listings and income properties in a neighborhood is based on actual real estate comps and rental comps. Mashvisor’s machine learning and AI software tools apply predictive analytics to big data to show real estate investors how entire neighborhoods as well as individual traditional and Airbnb rentals are expected to perform based on their recent performance.

3. Search for Profitable Investment Properties

The next thing which Mashvisor does for real estate investors is to facilitate the property search process. Even if you’ve selected one of the top locations for residential real estate investments, you still need to find positive cash flow properties with a high return.

There are two ways in which you can search for such real estate properties for sale on the Mashvisor platform.

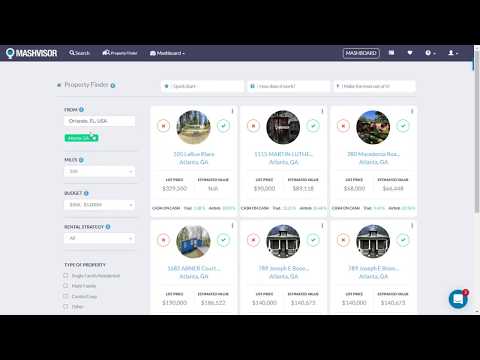

First, you can use the Property Finder. This is one of Mashvisor’s real estate analysis tools which save investors months of work. The Property Finder tool allows investors to search for available listings in a single housing market or multiple markets at the same time. They can use the following filters:

- Budget

- Rental strategy: traditional or Airbnb

- Property type: single family home, multi family home, condo, or other

- Number of bedrooms

- Number of bathrooms

Mashvisor’s Property Finder will not just show all rental properties for sale which match an investor’s criteria. It will also sort them in a decreasing order of cash on cash return for the preferred rental strategy (traditional or Airbnb). This means that the best-performing income properties will be displayed on top, so that real estate investors can focus on them right away.

Second, investors can use the search app to perform a more detailed rental property search. That’s yet another of Mashvisor’s real estate investment tools aimed at accelerating and optimizing the investing in real estate business.

Real estate investors can base their property search on the following indicators:

- Financing method: cash vs. mortgage

- Cash on cash return

- Cap rate

- Budget

- Neighborhood

- Number of bedrooms

- Number of bathrooms

- Year built

- Size in square feet

- Traditional rental income

- Airbnb income

- Property type: single family home, condo, townhouse, multi family home, and others

- Property status: for sale, pending, or foreclosure

Mashvisor’s search app would apply these criteria to the housing market on which you want to focus to pull all properties for sale which match them. Investors can then arrange the property search results by price, rental income, return on investment, and others.

4. Analyze the Return on Investment of Rental Properties

The next step in the process of how to get into real estate investing with which Mashvisor helps is conducting rental property analysis. This is done by Mashvisor’s investment property calculator, yet another must-have real estate software tool for buying a profitable investing property.

As soon as you’ve pulled a few real estate investment properties for sale which match all your criteria through our income property search app, you can perform detailed investment property analysis on them. The purpose of this analysis is to make sure that you invest in positive cash flow properties with a high rate of return. Remember that the best real estate investments bring:

- Positive cash flow: the monthly rental income exceeds the monthly rental expenses

- Good cap rate: 8-12%

- Good cash on cash return: 8% or more

First of all, on the investment property analysis page of our real estate investment software app, you will be provided with some basic information about the property which is an integral part of the decision whether it makes for a good rental property investment or not. These include:

- Property address

- Property type

- Description from the MLS

- Listing agent’s name and contact information

- Photos

- Days on market

- Year built

- Owner occupied status

- MLS ID number

- Number of bedrooms

- Number of bathrooms

- Type of heating

- Type of cooling

- Virtual tour

This information comes directly from the MLS for MLS listings and from Auction.com for foreclosed homes, short sales, and bank-owned homes. For off market properties added by other users of Mashvisor’s real estate investment app, they are provided by the owner.

Next, Mashvisor’s rental property calculator provides a real estate investor with readily available analysis of the investment potential of any property listed on the platform as well as any real estate property in the US housing market added by the investor. The figures include:

- Traditional rental income

- Airbnb rental income

- Traditional cash flow

- Airbnb cash flow

- Traditional cash on cash return

- Airbnb cash on cash return

- Traditional cap rate

- Airbnb cap rate

- Traditional occupancy rate

- Airbnb occupancy rate

- One-time startup costs for renting out traditionally and on Airbnb

- Inspections

- Repair costs

- Furniture and appliances

- Closing costs

- Other custom costs

- Monthly expenses for traditional and Airbnb renting

- Insurance

- Utilities

- Property management

- Property maintenance

- Property tax

- HOA dues (if buying a condo)

- Rental income tax

- Cleaning fees (if buying an Airbnb property)

- Other custom costs

Mashvisor also has an integrated Mortgage Calculator which helps even beginner real estate investors choose the best financing method for their residential real estate investments. On this tool, you can choose the following:

- Method of financing: cash or mortgage

- Property price

- Down payment as a percentage of the property price or as a dollar amount

- Mortgage type: fixed rate mortgage, interest only mortgage, or adjustable mortgage

- Loan term: 30 years fixed or 15 years fixed

- Loan ARM type: 3/1, 5/1, 7/1, or 10/1

- Loan ARM ratio

Once you’ve selected all these options, the corresponding down payment and monthly mortgage payments will be incorporated into the rental property analysis and your return on investment figures will be recalculated.

Furthermore, users of Mashvisor’s real estate software platform are not left in the dark, wondering where all these real estate data and traditional and Airbnb analytics are coming from. The “Rental Comps & Insights” tab on the investment property analysis page provides investors with both traditional and Airbnb rental comps from the area. The traditional rental comps data comes from the MLS and Zillow, while the Airbnb data comes directly from Airbnb.

5. Select the Optimal Rental Strategy

Additionally, Mashvisor’s real estate investment software platform helps new investors decide on the best rental strategy for the income property they are planning to buy. Based on the figures provided by the investment property calculator, you can decide right away whether a long term rental or a vacation home rental will make more money. Successful real estate investments depend not only on the location and the investment property but also on the rental strategy. Some markets and some properties are better suited to make money as traditional rentals, while others are more appropriate for short term rental properties.

Nevertheless, aspiring Airbnb investors should check out the local short term rental rules and regulations as many major US markets have prohibited non-owner occupied vacation rentals. You can get this information from Mashvisor’s real estate blog.

6. Find a Real Estate Agent

The next step in real estate investing for beginners is finding an agent to help with the process of buying an investment property. Working with a real estate agent is highly recommended for new investors who don’t have the necessary negotiations skills yet. The top-performing agents in their real estate market will help rental property investors get the best price and close the deal in the best possible way.

There are two different ways in which the Mashvisor real estate investment app helps investors find the best agents in the local market. First of all, each property listing on Mashvisor has the name and contact information of an agent in this area. Second, through the agent directory, investment property buyers can search for real estate agents in any US location. The agent profiles will show buyers all the information which they need to choose a top-performing agent such as experience, expertise, listings, and off market properties. Moreover, you can read the Mashvisor reviews left by the past clients of each agent.

7. Access Homeowners Data

Investing in off market properties – rather than MLS listings – can be one of the most profitable real estate investment strategies. Buying an off market property comes with many advantages such as more choices, less competition, less pressure, and better prices.

But how can you find off market properties?

The Mashvisor real estate investment software app has a special tool – the Mashboard – which helps investors find out who owns a house in any US market. This is in case they have seen a home which they believe would make the ideal rental property to add to their real estate investment portfolio. Moreover, with the Mashboard, you can also search for general homeowners data by choosing a location, property type, contact data you’d like to find out (name, phone number, and/or email address), and a few other filters. Our CRM platform allows you to contact property owners directly to enquire about their interest in selling a home.

How Can Real Estate Agents Use Mashvisor?

Now that we’ve covered all the different ways in which Mashvisor helps investors optimize their residential real estate investing decisions, it’s time to see what Mashvisor can do for real estate agents and brokers.

Here are the main things which Mashvisor’s real estate software platform does for agents:

1. Help with Digital Real Estate Marketing

As digital marketing is getting more and more importance in the real estate industry, Mashvisor is realizing this reality and acting on it. Our real estate agent directory allows agents and brokers in any US housing market to claim their agent profile and fill it in with all the information which rental property investors need to choose the top-performing agent in their area. Importantly, all this is for free.

Here is the information which your Mashvisor’s real estate agent profile will provide:

- Name

- Phone number

- Real estate website

- Overview

- Real estate license

- Real estate experience

- Areas served

- Agent specialties

- Agent experience

- Office agents

- Real estate blog posts: You have the option to upload and publish your own real estate blogs. First of all, this will demonstrate your expertise and knowledge to real estate leads and help you build a reputation. Second, it will improve the online search engine ranking of your profile, and SEO is an important part of any real estate digital marketing efforts.

- Active listings

- Off market properties

- Reviews: You can proactively ask your real estate clients to share their experience of working with you. Online reviews are becoming very important in digital marketing for real estate agents.

Having filled in a profile on a third-party real estate website as Mashvisor, with numerous real estate blog posts and positive reviews from past clients, will give a real boost to your real estate digital marketing strategy.

2. Generate Buyer and Seller Leads

The goal of marketing your real estate business is to get leads, and that’s another thing with which Mashvisor’s real estate software platform helps agents directly. The Mashboard is a real estate CRM tool which our team developed with real estate agents in mind.

The “Owners” section of your Mashboard allows you to find homeowners data in any US real estate market, no matter how big or small it is. You just need to enter the following to be provided with a list of property owners in your selected area:

- Property address

- State

- City

- Zip code

- Property type

- Year built

- Contact data type: name, phone number, and/or email address

- Sale date

The homeowners list that will be generated for you by our real estate software tools includes some important details for real estate lead generation. These include but are not limited to income, homeowner status, year of property purchase, real estate investor status, net worth, and many others. All these factors help real estate agents decide which owners will make good buyer leads and which good seller leads.

3. Qualify Leads

With Mashvisor, qualifying real estate leads doesn’t have to be done manually. Our tools have automated the lead qualification process for maximum efficiency and accuracy. We use predictive analytics and mathematical algorithms to qualify real estate leads based on all the data available for them. The “Leads” tab on your Mashboard will give you access to all homeowners which match your search criteria with a readily available status as a real estate lead. This shows whether there is a low, medium, or high probability for them to be buying and selling real estate properties in the near future.

4. Match Leads with Properties

Last but not least, Mashvisor makes lead-property matching easy, quick, and efficient even for new real estate agents. The “Properties” section of the profile page of any of your leads will show you properties available on Mashvisor which are ideal for this specific lead. Once again, this matching is done by the predictive analytics algorithms of our real estate software tools.

Moreover, the Mashboard allows real estate agents to send emails to the generated leads including the investment properties for sale selected for them. All activities are logged and saved.

What Can Mashvisor Do for Property Managers?

Real estate investors and agents are not the only people who find value in Mashvisor. Professional property managers are also able to make use of the real estate software tools available on the platform.

Here are the two main ways in which property managers can use Mashvisor:

1. Find New Clients

Similar to real estate agents, professional rental property managers can also generate leads through the homeowners data available on the Mashboard. As mentioned above, the property owners data shows whether a person is a real estate investor or not. Property managers can contact real estate investors to ask about the current property management status of their traditional and Airbnb rentals and offer their services.

Many real estate investors have not thought about hiring a professional property manager or have refrained from doing it because of the assumed high cost. They will be surprised to hear about the many benefits which this offers along with the reasonable and affordable pricing. When contacting rental property owners, don’t forget to talk about the passive income that they can make if they hire a property management company.

2. Help Customers Expand Their Portfolio

The second thing which Mashvisor does for professional property managers is to help them help their current clients find new investment properties. Many rental property investors are interested in buying a new income property but don’t have the time to conduct the necessary real estate market analysis and investment property analysis. As many of them have the available cash for a down payment, they will be happy to move forward with buying rental properties if they are presented with the right opportunity.

As a property manager, you can use Mashvisor’s real estate investment tools to find rental properties for sale which match the needs and requirements of your clients. If you help them buy a rental property, they will definitely assign the property management to you. That’s an easy and straightforward way to grow your rental property management portfolio without the need for marketing and lead generation.

Are you a real estate investor, a real estate agent, or a professional property manager looking for the best real estate software platform to expand your business? You’ve come to the right place. Mashvisor’s tools will help you do exactly this.

To start using the Mashvisor real estate website today, sign up with Mashvisor promo code BLOG15 for a 15% discount on your subscription.