Interested in buying multifamily homes for investment? Good thinking – this is one of the best ways of making money in real estate. However, if you’re an absolute beginner in the industry, one thing you should always know is that analyzing real estate deals is a must before investing your time and money in them. This is because not just any property can bring a good rate of return on investment. So to assure that you’ve landed on a good multifamily deal, you need to analyze the numbers before making an offer. But how do you analyze a multifamily deal? Well, there’s only one way to do it – by using a multifamily deal analyzer. What is this tool? Where can you find one? And how exactly does it work? Keep reading as we answer all these questions.

What is Mashvisor’s Multifamily Deal Analyzer?

The multifamily deal analyzer is part of the bigger multifamily investment calculator (or the rental property calculator). This is an online tool that was designed to help real estate investors analyze multifamily investment property returns. To do this, it utilizes real estate data and predictive analytics to run all ROI metrics as well as key insights on the performance of housing markets. This allows real estate investors to evaluate the expected performance of multifamily homes for sale in any given market across the US.

So where can you find this must-have tool? Right here on Mashvisor! Mashvisor is a real estate investment software that provides investors with numerous tools to help them in their real estate investing career. Among the tools we have to offer are the Real Estate Heatmap, Property Finder, Property Marketplace, and of course, the Rental Property Calculator. The multifamily deal analyzer falls under the last tool as it allows you to analyze any type of rental property, including multifamily homes. Our calculator is user-friendly and offers unique features that others don’t. Here’s how to use Mashvisor to analyze multifamily real estate deals.

How to Use The Multifamily Deal Analyzer

Besides the fact that it provides data that you need for running a multifamily investment analysis, Mashvisor’s investment property calculator is easy to use. Here’s what this real estate investment tool does to let you know if a multifamily home is a good deal:

#1 Calculates Expected Rental Expenses

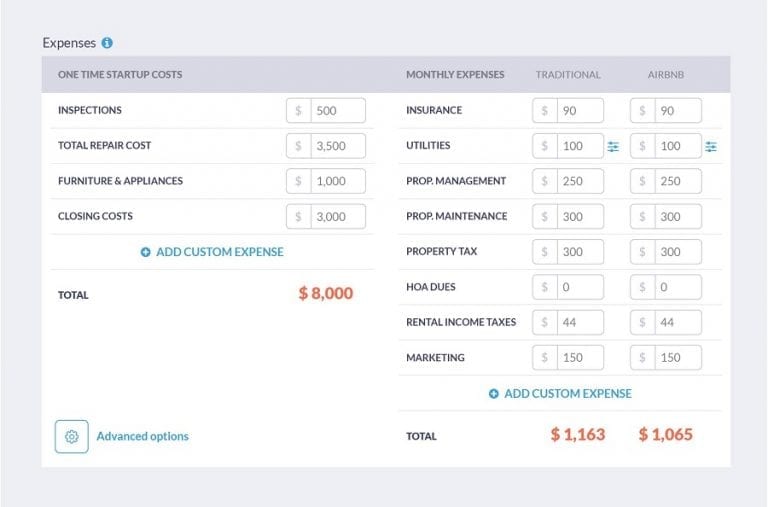

As anyone can expect, owning a multifamily real estate investment is not cheap. These properties come with rental expenses and costs that you need to estimate before making a purchase. Doing so will help you make sure that you can afford this real estate investment and not end up in foreclosure. So, the first thing that Mashvisor’s multifamily deal analyzer provides is readily-calculated data for the expenses that come with a multifamily home. In this section, you’ll get to see both the property’s one-time startup costs and its recurring expenses based on data on actual properties in the neighborhood as well as publicly available data. These expenses include home inspection, appraisal, property taxes, insurance, rental income tax, maintenance, and more.

How much you need to spend on your rental property is an essential part of the multifamily deal analysis. This is because rental expenses are one of the determining factors of cash flow and rate of return. In other words, the lower the rental expenses compared to the rental income, the more profitable the real estate deal is. A multifamily investment calculator like Mashvisor’s makes this data readily-available for multi-family homes for sale in the US housing market. If you have your own estimates, you can also adjust the numbers as you see fit and our software will automatically re-recalculate the return on investment metrics.

#2 Estimates Monthly Rental Income

The next step in analyzing multifamily investment property returns is to calculate the expected rental income. In other words, you need to ask yourself: “how much can I rent my investment property for?” The traditional way to answer this is by fining rental comps (these are similar rental properties in your area) and figuring out how much they rent for. The better way for real estate investors to do that, however, is with the help of the multifamily deal analyzer.

Mashvisor’s multifamily investment calculator will show you the comparable rental income for any property for sale in the US. The estimates are based on a detailed neighborhood analysis of comparable income properties. Hence, our comparable rental income estimates are very accurate and reliable. A unique feature for Mashvisor is that it’ll show you these estimates for the same property whether rented out traditionally or on Airbnb. This helps you decide which rental strategy is optimal and can generate higher rental income.

#3 Calculates Rental Property Cash Flow

After getting the rental expenses and rental income estimates, it becomes easy to do the next step of the multifamily deal analysis: calculating the cash flow. Cash flow is simply the difference between rental income and rental expenses. However, Mashvisor wouldn’t be the best multifamily deal analyzer if it didn’t show how much cash flow a certain property can generate without the need for the previous calculations.

For each rental property investment that you want to analyze before buying, you’ll get a readily available estimate of the cash flow it will bring under each rental strategy. A real estate investor must always keep in mind to go for positive cash flow properties. A negative cash flow property will only cost you more than it earns. Again, you don’t want your costs to be too high as you could lose your investment. Positive cash flow properties, on the other hand, bring passive income that goes straight into your pocket and increases your return on investment.

Related: How to Find Positive Cash Flow Properties in 2020

#4 Estimates Vacancy and Occupancy Rates

No real estate investor wants to buy a multifamily rental property only for it to remain vacant. As a property owner, you want your property to always be occupied and generating rental income to keep your cash flow positive. In fact, vacancy is a cost in the eyes of real estate investors because they’ll need to keep paying most of the rental expenses but without receiving any rent. So the next step in how to analyze a multifamily deal is to estimate the occupancy rate that you can expect.

However, this is not easy as it depends on numerous factors like current rental market conditions, the specific characteristics of your income property, and your marketing skills as a landlord. The best you can do when analyzing real estate deals is to look at the average occupancy rate in your neighborhood, taking into consideration the property type and the number of bedrooms. But why do that yourself when you have a tool like the multifamily deal analyzer that does the work for you! Mashvisor looks at the performance of actual comparable rental properties in the area and gives you readily-calculated data of the expected occupancy rate of the property you want to buy.

#5 Analyzes Investment Property Cap Rate

Finding multi family cap rates is one way of analyzing multifamily investment property returns. A real estate investor will calculate the cap rate of a rental property if he/she is planning to buy it fully in cash. To calculate the cap rate, you first need to estimate the net operating income (this is your annual cash flow) and then divide that number by the property’s purchase price.

This may sound easy enough if you’re calculating the cap rate for a single investment property. But what if you’re comparing between different multifamily real estate deals to choose from? It’ll take a lot of time to gather the necessary data to calculate cap rates and run a comparison. Mashvisor’s multifamily deal analyzer will make things a lot easier for real estate investors. With our real estate investment tools, you can access readily available estimates of the cap rate of any income property in the US. This saves time when trying to figure out if a multifamily home is a good deal and help you find the best property investment quicker.

Related: What Is a Good Cap Rate When Investing in Multi Family Homes for Sale?

#6 Estimates Property Cash on Cash Return

Cash on cash return is another way to calculate the rate of return on a multifamily home for sale. However, unlike the cap rate, this metric is used to analyze real estate deals that you’re planning to finance with a mortgage loan. To calculate the cash on cash return, investors divide the pre-tax cash flow by the total cash invested in the property (down payment, closing costs, renovation costs, etc.). As you can see, the cash on cash return is not as easy to calculate as multifamily cap rates. But it can be made easy with our multifamily deal analyzer, of course.

Mashvisor designed the multifamily investment calculator to come with a mortgage/financing calculator. Meaning, if you’ve decided to buy the investment property with a mortgage, simply turn on the mortgage calculator and enter the necessary information (loan amount, mortgage type, loan term, and interest rate). Our real estate investment tool will then accurately calculate the cash on cash return you can expect in a matter of minutes. Just like all the previous estimates, Mashvisor will provide the cash on cash return on a rental property for both the traditional and Airbnb strategy.

The Bottom Line

And there you have it – this is all you need to know about how to analyze a multifamily deal and how our real estate investment software makes it an easy process. Our tool is a must-have for both experienced real estate investors and beginners. Not only does it save you time, but it also provides accurate multifamily property data and eliminates the risk of making work decisions.

To get access to our multifamily deal analyzer and other real estate investment tools, sign up for a 7-day free trial of Mashvisor now, followed by 15% off for life.