Investing in rental properties is one of the best ways to make money in real estate and build wealth. However, not every investment property for sale will turn a profit. There’s one key method that successful investors use to measure profitability potential: calculating the rate of return on investment property. It’s crucial that you calculate the rate of return on a rental property before you purchase it to determine if it would be worth spending your time and money on it.

While there are many aspects of a real estate deal that investors need to consider before making a purchase decision, the return on investment is the most common real estate metric for evaluating and comparing the performance of multiple comparable investments. With this metric, investors can balance risk against potential reward.

Read on to learn how to calculate expected rate of return in 2021.

Related: The Ultimate Guide to Rate of Return on Investment Properties

What Is Rate of Return?

Rate of return on a rental property, sometimes called return on investment (ROI), is a measure of the amount of profit a house would generate as a percentage of the amount invested in it. If this measure is high, it means that the returns generated by the rental property compare favorably with its cost and, thus, this is a potentially profitable investment.

As a real estate investor, knowing how to calculate the rate of return on rental properties is important as it will help you determine the best income property for sale to buy. Generally speaking, the higher the rate of return on an investment property, the more desirable it is to purchase.

Here’s the general return on investment formula:

Related: What Is a Good Return on Real Estate Investment?

Rate of Return Metrics

The problem with the basic rate of return formula is that it is too broad and makes many assumptions. The fact of the matter is that there are many variables that can affect the profitability metric such as the method of financing, rental expenses, etc. As such, this metric has a number of variations depending on the situation and what you are trying to figure out.

There are three common ways in which real estate investors calculate return on investment: cap rate, cash on cash return, and internal rate of return. Understanding these three real estate metrics and how to calculate each one of them properly is a crucial part of being a successful real estate investor.

Let’s dive into each of these metrics:

1. Cash on Cash Return

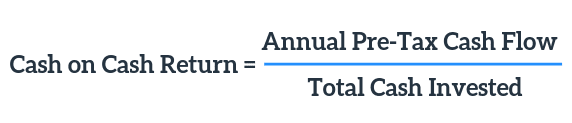

Cash on cash return is the most popular profitability metric in real estate. It is usually used to estimate the profitability of a rental property when using mortgage financing. This means that the mortgage costs are accounted for. The metric measures the annual pre-tax cash flow relative to the total cash invested in the property. It’s usually shown as a percentage.

Here’s how to calculate annual rate of return using the cash on cash formula:

Where:

- Annual Pre-Tax Cash Flow = Net Operating Income (NOI) + Mortgage Expenses

- Total Amount Invested = Down Payment + Closing Costs + Remodelling Costs

2. Capitalization Rate (Cap Rate)

Cap rate is similar to cash on cash return except that it doesn’t factor in the mortgage loan costs and considers the purchase price rather than the total amount invested. It is used to determine the profitability of a rental property when bought all-cash. It measures the annual net operating income relative to the fair market value.

The cap rate formula is as follows:

Where:

- NOI= Annual Rental Income – Annual Rental Expenses

Related: Cap Rate vs. Cash On Cash Return: How to Calculate Rate of Return in Real Estate Investing

3. Internal Rate of Return

Calculating cap rate and cash on cash return will show you the annual rate of return. However, there is another way to calculate rate of return on rental properties that gives a long-term view of the potential yield – the internal rate of return.

What Is IRR?

In real estate investing, IRR is an estimate of the rate at which an investment property grows in value throughout the period the investor holds it. It is essentially the total interest a real estate investor earns from the money he/she invests in the property over the whole holding period. Unlike cash on cash return and cap rate, this metric takes into account the time value of money.

IRR is more precise than the other two ROI metrics as it helps investors monitor the growth of their capital investment in the long-term. This is very useful if you are looking to buy and hold rentals for a long period of time.

However, IRR is not always the best way to analyze real estate investment opportunities because it requires you to make many assumptions about the investment property that may or may not be true over the holding period. Your calculations can be useless if the market changes in an unpredictable way in the future or if unexpected expenses arise.

How to Calculate IRR

The internal rate of return formula is more complicated than that of CoC return and cap rate and is not easy to estimate analytically. It’s often calculated using a financial calculator or Excel spreadsheets. To calculate IRR, you set the net present value for all the property’s expected cash flows equal to zero and solve for the discounted rate (IRR).

Here is the IRR formula:

Where:

- N: The number of years you hold the property

- n: Current period

- Cn: Cash flow in the current period

- r: Internal rate of return

Related: How to Calculate IRR for Real Estate Investment

Mashvisor’s Investment Property Calculator: The Best Tool for Calculating Return in Real Estate

As you can see, calculating the profitability of an investment property manually is not easy, especially when comparing multiple real estate investments. Calculating the metrics by hand is time-intensive and also leaves room for errors.

Fortunately, in 2021 Mashvisor’s real estate rate of return calculator can help you calculate ROI metrics accurately in a matter of minutes. Mashvisor is a real estate investment software offering a range of tools that investors can use to find and analyze real estate deals in the US housing market. With our calculator, you will be able to accurately calculate the expected cap rate and cash on cash for both traditional and Airbnb rental strategies. In this way, you will be able to find the most profitable property for sale and determine the optimal rental strategy for it.

Related: Using Mashvisor’s Investment Property Calculator to Estimate Rate of Return

The Bottom Line

When it comes to purchasing an investment property, calculating the return gives you insight into how profitable an investment property for sale is. However, to quickly and accurately determine if a real estate investment has the required rate of return, you need more than just the ROI formulas. The best way to ensure that you make the right investment decisions in 2021 is to use Mashvisor’s rental property calculator for your rate of return analysis.

To get access to our real estate investment tools, click here to sign up for a 7-day free trial of Mashvisor today and enjoy 15% off afterwards.