The world of real estate investing has been shattered by the recent COVID-19 outbreak, no doubt. The unprecedented extent of spread and effect has been such that not even experts dared to predict the precise impact of the Coronavirus on the US real estate market. Nevertheless, despite the uncertainty, savvy investors are still able to find real estate opportunities amid the pandemic. In this article we help beginner investors identify hidden opportunities for real estate investing in the spring of 2020.

Why Invest in Real Estate in the Time of a Pandemic

Real estate opportunities and stocks have been long-term rivals for the title “Best Investment Strategy.” However, after the Coronavirus outbreak, the stock market was quick to take a downward turn, while property prices have remained almost unchanged in the US housing market in the spring of 2020. Although real estate activities have declined as buying and selling real estate in the time of COVID-19 is challenging, to say the least, real estate investors are not losing from the value of their income properties.

As many experts have highlighted, the experience from the 2008 recession is showing us that while US home prices will drop to a degree, the real estate market will be quick to come back and recover once things start going back to normal. Long term real estate appreciation will not be impacted in any major way. Despite the temporary economic crisis, real estate investments will continue generating excellent long term return on investment.

Meanwhile, once the pandemic reaches its peak and starts subsiding, it will be the best time to buy a house for investment due to the forecast short term decline in median property prices across the US house market. This will be particularly true for the locations which are most significantly affected by the Coronavirus such as the NYC housing market, the Seattle real estate market, and the Bay Area housing market. In other words, good real estate investment opportunities should be abundant as soon as normalization starts happening.

Related: Why Spring Is the Best Time to Buy Real Estate

To know when and where to start looking for real estate opportunities, keep up to date with Coronavirus real estate trends in our blog.

What Real Estate Investment Strategy Is Best during the Coronavirus

The COVID-19 pandemic’s impact on the economy is about to establish once and for all that real estate investment is the ultimate investing strategy.

But what are the best real estate investment strategies for beginners amid the pandemic?

Rental properties emerge as the top strategy for real estate investing for beginners in times of crisis and recession such as the current one.

Investing in Traditional Rental Properties

During the Coronavirus pandemic, long term rental properties constitute some of the best real estate opportunities for both new and experienced investors. Regardless of the situation, people still need places to live. Very few tenants have been forced or have chosen to leave the traditional rental properties where they reside. Renters have received legal protection in the vast majority of US housing markets as evictions have been prevented in case of tenants not being able to afford to pay rent for a few months.

This is not bad news for landlords as it means that they will be able to keep their renters and will avoid having to search for and screen tenants amid the current uncertainty. At the same time, real estate investors in long term rentals should not worry about paying mortgage as the CARES Act offers some provisions for homeowners who are unable to make their regular mortgage payments in the coming months. This means that investors will not suffer from a foreclosure.

Related: How the CARES Act 2020 Will Impact Real Estate

Actually, as many people are postponing buying a home at the moment, rental demand can be expected to go up in the future. Landlords will face lower vacancy rates. Meanwhile, rental rates are not likely to undergo a sharp downturn in the upcoming months. All in all, this means that traditional rental income is expected to remain strong despite the COVID-19 outbreak. That’s why long term rental properties will continue being one of the best real estate investments in 2020 and beyond.

Investing in Airbnb Properties

There are plenty of real estate opportunities for investing in Airbnb income properties amid the pandemic as well. Airbnb data gathered and analyzed by Mashvisor’s real estate investment software shows that the Coronavirus outbreak has had a major negative impact on short term rental properties in many US cities. The most sizeable effect has been on the Airbnb occupancy rate as guests have been canceling their reservations.

Related: Airbnb Data Reveals the Impact of Coronavirus

However, some hidden business opportunities for making money as an Airbnb host have risen as a result of the pandemic. In specific, COVID-19 created new segments of Airbnb guests. These include first and foremost medical personnel who have been temporarily stationed in the locations with the highest number of infected people. Many of these health workers choose to stay at Airbnb rentals as they are more private and safer than hotels and as hosts are offering them at discounted rates. In addition, some elderly and other vulnerable groups choose to relocate away from busy cities to more secluded areas until the pandemic subsides. An increasing number of remote workers are also moving to vacation home rentals in more isolated places to work to benefit from the quietness and safety of such locations.

Thus, investing in real estate to rent out on Airbnb and similar homesharing platforms could be turned into a source of profitable real estate opportunities during the pandemic.

Additionally, for existing Airbnb hosts, the homesharing platform issued a $260 million Airbnb relief package. As much as $250 million will go towards compensating Airbnb hosts for canceled reservations with a check-in date between 14 March and 31 May, while the remaining $10 million will go to Airbnb Superhosts in specific. This protection assures that Airbnb investment properties remain among the best investment opportunities even in times of crisis.

Where to Find Real Estate Opportunities for Investing amid the COVID-19 Outbreak

As demonstrated above, buying traditional and Airbnb rental properties remains the best answer to the question of how to invest in real estate, even amid a pandemic. That’s because real estate investors have ways to make money in both the short term (through rental income) and the long term (through real estate appreciation). So the question becomes: “How do you find good real estate investment opportunities during a pandemic?”

Here are 4 top ways of how to start investing in real estate in the US housing market at the moment:

1. Contact Your Real Estate Network

Under the shelter in place and stay at home policies, driving for dollars is not a viable strategy in the spring of 2020. To comply with federal and state policies as well as to protect their own health and safety, real estate investors have to look for other ways to find real estate opportunities.

One feasible strategy is to turn to their own real estate network. This doesn’t have to be limited to real estate professionals only. Without realizing it, you might know someone who wants to sell his/her home at the moment but doesn’t know what to do under these peculiar conditions. Just ask around. Talk to your friends, colleagues, neighborhoods, and other acquaintances to see if anyone is selling a home. With the limited number of property buyers, you might be able to buy an investment property below market value. This is the ultimate way to push up your rate of return on a rental property from the beginning.

Of course, if you are already a real estate investor, you should contact your real estate network too. Real estate agents and brokers, property managers, and other professionals might be aware of off market properties in your selected housing market and within your budget.

2. Hire a Real Estate Agent

Another strategy to find good real estate opportunities for rental property investment during the COVID-19 pandemic is to work with an agent. Many real estate agents have lost a significant part of their business due to the slowdown in real estate activities in the majority of US markets. Thus, they will be happy to go the extra mile to find you a good investment property without exposing you to unnecessary risk.

Agents have started quickly adopting virtual reality such as virtual tours and virtual open houses to continue buying and selling properties despite the pandemic. Just choose a top-performing real estate agent in your market and ask him/her for the investment opportunities he/she currently has.

3. Contact Homeowners

Even if your acquaintances are not interested in selling their homes at the moment, chances are many property owners in your chosen real estate market are doing that. So, another way to find real estate opportunities in the US housing market during the Coronavirus pandemic is to contact property owners directly.

“Easier said than done,” you are probably thinking. Actually, Mashvisor’s real estate investment app allows investors to access homeowners data in any US city or town. All you have to do is to go to your Mashboard and select the criteria for the properties in which you are interested including:

- Market: state, city, zip code, or even street address

- Property type: single family home, multi family home, condo, townhouse, etc.

- House age

Related: How to Find Out Who Owns a House in 6 Steps

With an expert level subscription to Mashvisor, you even get access to a collaborative CRM platform. From there, you can send email campaigns to property owners in whose homes you are interested. Those you are thinking of selling a home would be very pleasantly surprised to find a property buyer without any efforts amid the COVID-19 pandemic.

4. Use Real Estate Investment Tools

Another appropriate way to find real estate investment opportunities during the Coronavirus outbreak is with the help of online software tools. Good real estate opportunities are those which bring a high return on investment. The best metrics of rate of return on rental properties are cash on cash return and cap rate. Online real estate investment tools which use AI, big data, and predictive analytics can be used to identify real estate markets in general and rental properties for sale in specific with a good cash on cash return and a good cap rate.

Here are the tools available on Mashvisor’s real estate investment software platform that real estate investors can use to find property investment opportunities:

- Heatmap

The first step to finding profitable investment properties to rent out traditionally or on Airbnb is to conduct real estate market analysis. Mashvisor’s real estate heatmap helps investors perform neighborhood analysis to locate the best areas for investing in real estate properties in any US city or town. Positive cash flow income properties are generally placed in markets with low real estate values and high rental income. The heatmap on Mashvisor’s real estate investment app provides investors with a color-coded analysis of areas based on:

- Listing price

- Traditional and Airbnb income

- Traditional and Airbnb cash on cash return

- Airbnb occupancy rate

Related: Real Estate Heat Map: A Revolutionary Tool for Neighborhood Analysis

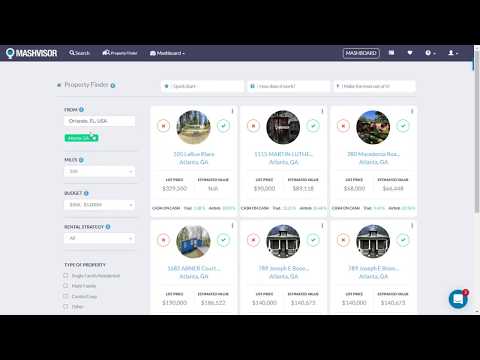

- Property Finder

Another must-have real estate investing tool during the COVID-19 pandemic is a smart Property Finder. This tools helps investors find good real estate deals in multiple markets simultaneously. You can do investment property search based on a number of different criteria such as:

- City or cities

- Property price

- Preferred rental strategy: traditional or Airbnb

- Property type: single family home, condo, townhouse, multi family home, or other

- Number of bedrooms

- Number of bathrooms

The Property Finder tool will display all investment properties for sale available in these markets in a decreasing order of cash on cash return for your selected rental strategy. This means that the best real estate investment opportunities will be shown first. This constitutes a quick and efficient way to find rental properties within a real estate investor’s budget with a high return on in investment.

Related: Property Finder Tool – Finding Real Estate Investment Properties

- Investment Property Calculator

The final step of the real estate analysis needed for buying rental properties with a good rate of return is performing rental property analysis. This process comprises of calculating different metrics to estimate the return on investment expected from an income property.

Mashvisor’s rental property calculator eliminates the need to conduct manual investment property analysis. This real estate investing tool provides investors will all necessary calculations right away. Some of the numbers supplied by Mashvisor’s investment property calculator include:

- Property price

- Financing strategy: cash or mortgage including down payment, mortgage type, and interest rate

- One-time startup costs: closing fees, inspection fees, repair costs, furniture, etc.

- Traditional and Airbnb rental income

- Traditional and Airbnb occupancy rate

- Recurring monthly expenses: property tax, property insurance, HOA fees, property management, property maintenance, utilities, cleaning fees, etc.

- Cash flow

- Traditional and Airbnb cash on cash return

- Traditional and Airbnb cap rate

Learning how to invest in real estate even during a crisis comprises of learning how to find real estate investment opportunities for sale with a good return on investment. In terms of cap rate, profitable rental properties are those with a cap rate between 8% and 12%. With regards to cash on cash return, a good profitability is considered a CoC return of 8% and more, depending on the financing method.

Related: How to Use Mashvisor’s Real Estate Investment Software Platform during the Coronavirus Pandemic

Finding real estate opportunities for investing during the COVID-19 pandemic is challenging but not impossible. With the expected decline in real estate values, new business opportunities will arise for rental property investors. Sign up for Mashvisor today with a 15% discount with promo code BLOG15 to start searching for investment properties with a high return in any US market.