Real estate is one of the best ways to make money nowadays, and rental properties are a top real estate investment strategy. Unlike other strategies, income properties allow investors to make money from real estate both in the short run (through rent) and in the long term (through appreciation). The rental income which an investment property generates is a major determinant of its cash flow and return on investment. If you are planning to buy an investment property in the coming months, here are our 12 expert tips on how to optimize your rental property income from scratch.

1. Find Out the Best Places to Invest in Real Estate

Location location location… Cliché or not, location remains one of the most important factors for how much profit you make on a rental property. The real estate market in which your property for rent is located will determine the demand (and thus the occupancy rate and the vacancy rate) and the monthly rental rate. Together, these two numbers define the rental income you will get as a landlord.

Generally speaking, the best places to invest in real estate to rent out are characterized by a strong diversified economy growing at an above-average rate, abundant opportunities in the labor market, a fast-growing population, and numerous tourist attractions. Nevertheless, conducting real estate market analysis is crucially important to determine if a location which fits within this description will bring high rental income.

If you are new to real estate investing and don’t have experience in rental market analysis, you should not worry. You can use Mashvisor’s investment property calculator to analyze real estate markets quickly and efficiently.

Related: 5 Steps to Conducting an Accurate Rental Market Analysis

2. Choose the Best Neighborhood for Rental Income

Investing in the right neighborhood is just as important as investing in the right city. Thus, the next step in the process of creating rental property income is neighborhood analysis to find the areas with the highest rental income. One way to perform neighborhood analysis in real estate is to spend a few days looking for rental comps within the area to estimate how much income you can expect on a monthly basis for an income property within your budget range.

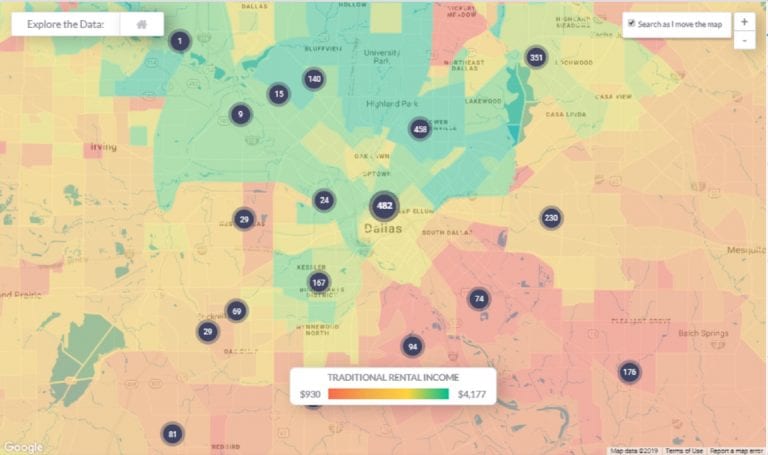

Another way to conduct this analysis is to make use of our heatmap analysis tool which will show you the range of income which you can expect to generate in each neighborhood within your US housing market of choice. As you can see in the image of the Dallas real estate market below, the neighborhoods with low rental income are marked in red, while those with high income are colored in green, with the mid-range areas being orange and yellow. One of the best features of this real estate investing tool is that it provides a quick but reliable overview of both traditional rental income and Airbnb rental income.

Heatmap: Traditional Rental Income in Dallas Neighborhoods

3. Analyze the Neighborhood in Detail

Once you have identified a top neighborhood for buying rental property, you need to do detailed real estate analysis to study its profitability potential including its ability to generate good rental property income. With the help of Mashvisor’s rental property calculator, you will be able to get insights on:

- The median property price in each neighborhood in any US real estate market

- The average price per square foot

- The average traditional cash on cash return and Airbnb cash on cash return

- The average traditional rental income and Airbnb rental income

- The number of homes for sale as well as the number of long term rental properties listings and Airbnb investment properties

- The average Airbnb occupancy rate

- The optimal rental strategy: traditional or Airbnb

- The optimal property type for real estate rentals: single family homes for rent, multi family homes for rent, townhouses for rent, condos for rent, apartments for rent, or others

- The optimal number of bedrooms

- Real estate comps from around the neighborhood

Having all this data and information at his/her hands, even a beginner real estate investor is equipped to make profitable investment decisions in the US rental market.

4. Select the Best Property Type for Rental Property Income

As you gain more experience in the rental business, you will realize that different types of properties create widely different amounts of investment income, even within the same location and with the same rental strategy. That’s why it is important to choose the best property type – in line with your budget and your preferred rental strategy – for the real estate market where you plan to buy an investment property. This is a requirement for optimizing your rental income.

An extra hint we’d like to give you here is that, in the US housing market, single family homes tend to provide higher income than other houses for rent. However, this does not hold true for every single market, so you still need to conduct a thorough analysis.

5. Engage in Thorough Investment Property Search

In 2019, there are so many different ways to look for a rental property for sale including:

- Driving for dollars and looking for “For Sale” signs

- Local newspaper real estate ads

- Real estate websites with property listings including MLS listings, foreclosures, bank owned homes, short sales, and off market properties

- The MLS (if you have access to it)

- Real estate agents

- Your network

While it is a good idea to have a look at at least a few different sources, you should focus your efforts on the one that makes the most sense for you. If you are a part-time investor looking for a way to make money in real estate, you should concentrate your rental property search on the best real estate investor websites.

Mashvisor is one of them. On our platform, you will find hundreds of homes for sale within your selected market which match your budget and other criteria. Moreover, all these properties come with a readily available analysis of the monthly income which they will generate – whether as a traditional or an Airbnb investment property. Have a look at this property for sale in the Atlanta real estate market.

Investment Property Calculator: Traditional and Airbnb Comparable Rental Income for Atlanta Investment Property

6. Analyze the Investment Property for Sale

Once you have narrowed down your property search to a few top choices, you should conduct detailed investment property analysis on each one of them to choose the one which will create the most rental property income. To do that, you have to find rental comps in the same area and of the same property type, number of bedrooms and bathrooms, and other key features.

You can also find real estate comps online on Mashvisor. Or even better – you can take a look at the readily available rental property analysis based on these comps to figure out exactly how much money you will be able to make from each property in the form of monthly rental income. This information is available for both renting out traditionally and on Airbnb.

Related: How to Conduct a Thorough Airbnb Investment Analysis

7. Go for the Optimal Rental Strategy

Even if you buy the best investment property in the entire US housing market, you will not make good rental property income if you choose the wrong strategy. Traditional rentals and Airbnb rentals vary significantly in the income which they generate in the same market. So, as soon as you know which income property you want to buy, you have to do some additional research to choose the best rental strategy.

Related: Real Estate Investing: Traditional vs. Airbnb Investments

Mashvisor’s rental property income calculator will give you the correct answer right away. The analysis of each rental property investment comes with the optimal rental strategy.

8. Base All Your Investment Decisions on Data

Experienced real estate investors know that all decisions should be data- and evidence-based. This is the only way to maximize not only your rental property income but also your cash flow and return on investment (whether looking at cap rate or cash on cash return). Before you decide to buy an income property, you have to know exactly how much profit to expect from it. That’s why rental comps are so important.

9. Use the Best Real Estate Investment Tools

In the 21st century, investing in rental property for beginners is all about having access to technology. Researching markets and finding a top-performing investment property should no longer take 3 months. Using the right software tools turns this process into simply 15 minutes, giving even new real estate investors the competitive edge they need to reach properties with the best rental income before anyone else. As you’ve seen from our tips above, any aspect of the real estate market research and investment property analysis can be done quickly and efficiently with one of the best real estate investment tools.

10. Do the Necessary Fixes and Repairs

Owning rental property is not enough to make good investment income. Another tip for optimizing your rental property income is getting your house for rent in the best possible shape, without overspending. In the investment property analysis stage, after the home inspection, you should estimate how much money you will need to spend on fixing and repairing your rental real estate property to make it competitive in the local rental market. Focus on repairs with the highest return on investment such as kitchen and bathroom improvements. Make sure that each dollar you spend on fixes will lead to a significant increase in the rental income.

11. Market Your Rental Property

Investing in rental properties is not only about buying the best property in a top location but also about marketing it to attract good tenants or Airbnb guests. To start creating rental property income right away, you should up your marketing efforts. List your income property on as many online platforms as you can. Tell your friends and colleagues about it.

Once you have some applicants, screen tenants carefully, without violating their rights to housing and discriminating against them of course. Finding good tenants is very important for making income in the long term without risking too much damage to your property.

12. Hire a Professional Property Manager

Renting out a house in the US real estate market can be a source of passive income. All you have to do is to get a rental property manager to take care of all aspects of becoming a landlord, from marketing through collecting rent to eviction. Many part-time investors are hesitant to hire a property manager as they think that the fees will bite into their income. The truth of the matter is that professional property management will help you boost your rental property income as it will optimize all processes.

If you are thinking of joining the millions of successful real estate investors in the US housing market, follow our top 12 tips to generate good rental property income. To find the best rental properties in any US city or town quickly and efficiently, sign up for Mashvisor now. Let the property search begin!