Rental property investing has become a popular investment strategy for real estate investors. This is because of a number of reasons, including the ability to generate consistent cash flow, leverage, tax benefits, and appreciation potential. However, simply buying a rental property is not a guarantee that you will reap the benefits of rental property investing.

You have to invest in the right property to take advantage of them. If you are thinking of buying an investment property, you will need to perform a thorough rental property analysis in order to find a good real estate deal. This involves assessing the different factors and metrics that affect the performance of an investment property or those that can be used to measure performance. In this guide, we will look into these factors and how you can use Mashvisor to analyze them.

1. Rental Property Location

In real estate investing, location is the most important factor to take into consideration. This is because rental property location has a direct effect on rental price, rental income, rental expenses, occupancy rate, and ultimately the return on investment. Property location will also determine your optimal rental strategy, marketing strategy, and the tenants to target. For instance, if you buy a rental property in a college town, your main target should be students and faculty members if you want to have a high occupancy rate.

For these reasons, the first step in your rental property investment analysis should be finding a good investment location. With Mashvisor’s tools, you can use neighborhood analytics and insights to search for the best performing locations for investment. You can access information such as the number of listings in the area, median price, average cap rate, average cash on cash return, average occupancy rate, and optimal rental strategy in a matter of minutes.

2. Rental Strategy

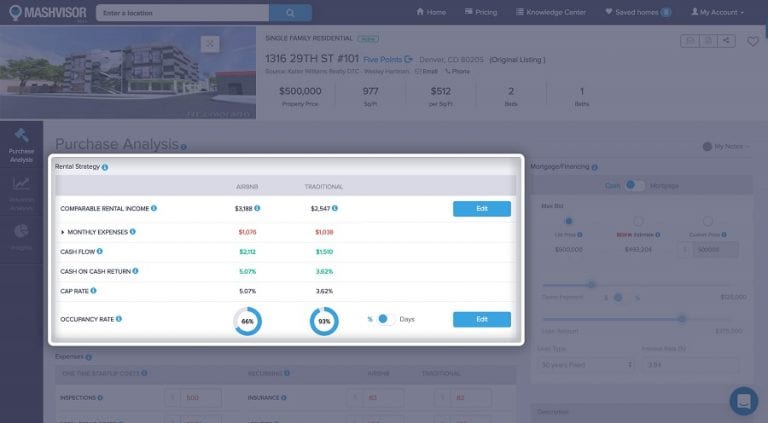

The rental strategy is another key factor in rental property analysis. The rental strategy you choose will have a big influence on your return on investment. The two rental strategies (Airbnb and traditional) work differently with different investment properties and in different locations.

With Mashvisor, you will be able to determine the optimal rental strategy to use to achieve the highest possible ROI. Mashvisor’s rental property analysis calculator will provide you with an accurate analysis of the cap rate, cash on cash return, and rental income for both Airbnb and traditional rental properties at the neighborhood or property level. It will also provide you with the average occupancy rate of Airbnb rental properties in the area as well as the Airbnb occupancy rate you can expect from a property for sale.

3. Rental Property Type

There is a wide variety of rental properties for investors to choose from, each with its own pros and cons. This includes single-family homes, multi-family homes, condos, townhouses, luxury homes, and vacation homes.

It’s important to know the property type you are investing in especially when doing comparative market analysis. This is the process of finding the market value of an investment property by looking at prices of comparable properties in the area (real estate comps). This will prevent you from overpaying for an investment property. Mashvisor’s tools also allow you to search for rental properties in the U.S. housing market based on their type and other filters like size, age, and the number of bathrooms/bedrooms. And each listing comes with a set of ready-to-use real estate comps for analysis.

Related: How to Find Real Estate Comps in 2020

4. Rental Income and Cash Flow

The main purpose of investing in rental property is to generate profit. Through rental property analysis, real estate investors can know the potential rental income and cash flow that a rental property can generate.

Cash flow is calculated by subtracting all rental expenses from the total rental income. Therefore, positive cash flow is an indicator of profitability while negative cash flow shows that you are losing money. Mashvisor provides real estate investors with both rental income and cash flow estimates for all listed investment properties.

Related: How to Find Positive Cash Flow Properties in 2020

5. Vacancy Rate/Occupancy Rate

One of the factors that determine your rate of return is rental demand, which can be measured in terms of vacancy rate and occupancy rate. A high vacancy rate means that the rental property has not had tenants most of the time that year. On the other hand, a high occupancy rate means that the rental property was occupied a huge percentage of time in that year.

Rental investors should look for properties with a high occupancy rate since it allows them to generate rental income throughout the year. The optimal occupancy rate for a long term rental is 100%. On the other hand, vacancy is usually treated as an expense when calculating cash flow and return on investment because you continue to pay monthly expenses without receiving rental income. Mashvisor can also provide you with the occupancy rate for listed rental properties- both long term rental and Airbnb occupancy rate.

6. Cap Rate and Cash on Cash Return

Cap rate and cash on cash return are the most common metrics used by real estate investors in rental property analysis. They are usually used to assess the return on investment of a rental property. The main difference is that cash on cash return takes into account the method of financing used while the cap rate does not. Again, you can use Mashvisor to access readily available estimates of cash on cash and cap rate values of listed rental properties. You don’t have to do tedious calculations.

Related: Cap Rate vs. Cash on Cash Return

The Bottom Line

Rental property analysis is an important step for every real estate investor looking for an investment property. When you learn how to analyze a rental property before making an offer, you can significantly alleviate or eliminate the risks associated with rental property investing.

However, using a rental property analysis spreadsheet can be time-consuming and cumbersome especially when analyzing multiple properties. Mashvisor is the most accurate and most effective rental property analysis software to use in your property search. Using our analysis tools will help you make informed investment decisions and save yourself countless hours of investment property analysis. You will be able to find the best performing rental properties that meet your criteria in just a matter of minutes.

Start out your 7-day free trial with Mashvisor now.