The sharing economy continues to boom as it provides travelers with unique and relatively inexpensive lodging options. In the past decade, Airbnb has become incredibly popular and continues to present lucrative opportunities for real estate investors looking to diversify their income.

In fact, buying Airbnb property is arguably one of the best ways to invest in real estate. Many Airbnb hosts have been able to generate enough Airbnb rental income to afford to quit their jobs. Therefore, if you are thinking of investing in Airbnb, it’s definitely a wise decision.

However, acquiring an Airbnb investment property and preparing it for guests is going to cost you money. The problem is that most of the people who are looking to tap into this rental market usually don’t have enough capital to buy a rental property with cash. As a result, the question in most aspiring Airbnb investors’ minds is usually “Can you finance an Airbnb?”

The short answer is yes. However, financing Airbnb properties is not as easy as most people would expect. Due to their short-term nature, you will typically face a higher level of scrutiny from lenders when trying to secure Airbnb property financing than with standard investment loans for traditional properties.

Therefore, if you are thinking of buying Airbnb property, it’s important that you learn how to obtain financing for Airbnb properties. In this article, I’m going to go over some of the main short-term rental financing options available to investors and some key financing tips.

Options for Airbnb Financing

Depending on your situation, you could use any of these options to finance an investment property that you intend to rent out on Airbnb:

1. Conventional Loans

One of the best Airbnb investment property financing options to consider is a conventional mortgage. You can get them from established lending institutions like national banks or from smaller mortgage lenders like local banks and credit unions.

These investment loans usually have strict requirements including a higher credit score, higher cash reserves, a lower debt to income ratio, and a larger down payment. However, rental property mortgage rates are usually more competitive compared to the rates of some other Airbnb loans.

2. Home Equity Loans

A second option for financing Airbnb properties is home equity loans. If you already own property, you can use the equity in your home to take out a fixed-rate home equity loan or a home equity line of credit (HELOC).

Depending on your debt-to-equity ratio, the cost of your Airbnb investment, and other factors, you can borrow funds to cover your down payment and use other Airbnb loans to finance the balance or you can borrow the entire amount required to buy the rental property.

The advantage of using these Airbnb loans is their lower rates and more favorable terms. However, you risk losing your primary residence if you fail to pay down the loan.

3. Small Business Loans

Financing Airbnb properties is also possible through small business loans. Due to the rising demand for Airbnb financing, there are many companies that have emerged to offer small business loans to Airbnb hosts.

However, these Airbnb loans are usually harder to secure. This is because most lenders prefer funding businesses with established track records. You also have to be registered as a business entity.

4. Hard Money Loans

Hard money loans are short-term loans from private individuals or institutions. These Airbnb loans are usually a last resort because they require a higher down payment and charge higher interest rates compared to other Airbnb loans.

However, they usually have fewer requirements and have quicker approval. This makes them a great alternative for financing Airbnb properties if you’re not eligible for other Airbnb loans.

Before you go for this financing option, keep in mind that you will need to have a good chunk of money for a down payment, and repay the loan within a short period.

Tips for Airbnb Loans

Eligibility for loans for Airbnb properties will vary depending on the type of loan and from lender to lender. However, if you have decided to invest in Airbnb, you can increase your chances of qualifying for Airbnb loans and getting the best rates by factoring in some key things. They include:

-

Look for Properties with a High Income Potential

The income potential of the Airbnb property you intend to buy is crucial. If you can prove that the expected Airbnb rental income will be able to cover your monthly repayments, you are more likely to qualify for the loan. You will also be able to secure the most competitive rates.

The best way to find Airbnb properties for sale with a high potential for profits in the US housing market is to use Mashvisor’s tools. With our tools, you can conduct a market analysis, property search, and investment property analysis in a matter of minutes.

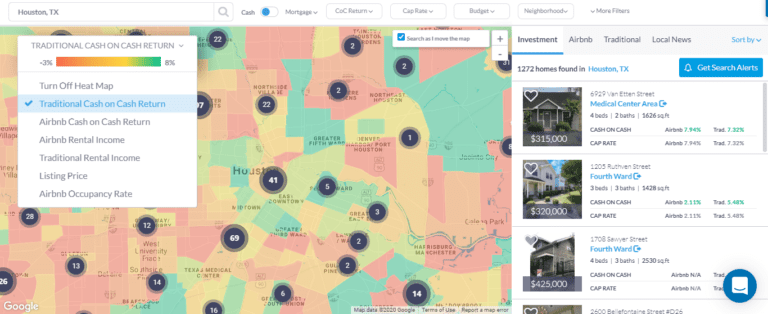

Mashvisor’s real estate heatmap is a great tool for performing neighborhood analysis. You can find top neighborhoods based on real estate metrics like median listing price, Airbnb rental income, Airbnb cash on cash return, and Airbnb occupancy rate.

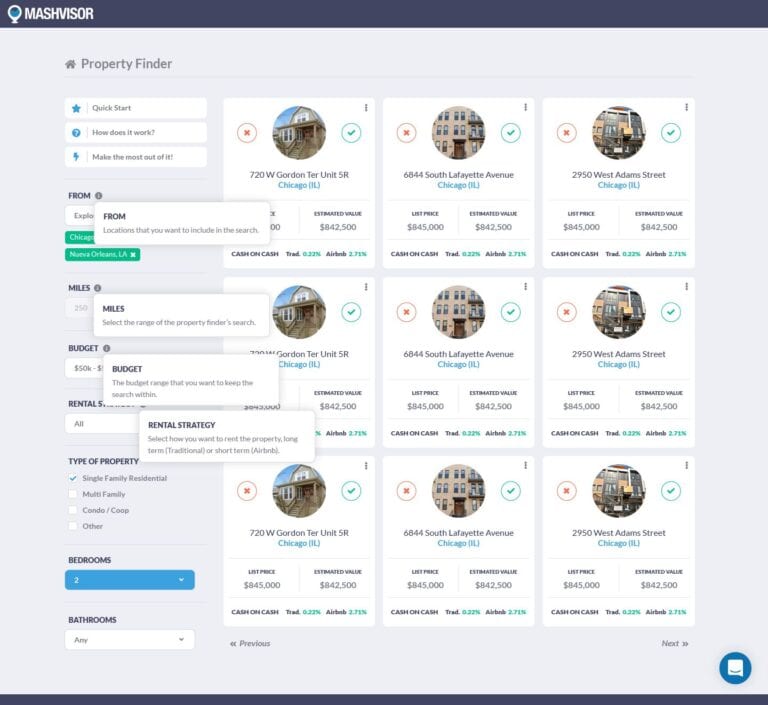

Once you have a promising neighborhood in mind, you can then use Mashvisor’s Property Finder to search for potentially profitable Airbnb for sale that matches your criteria in the area.

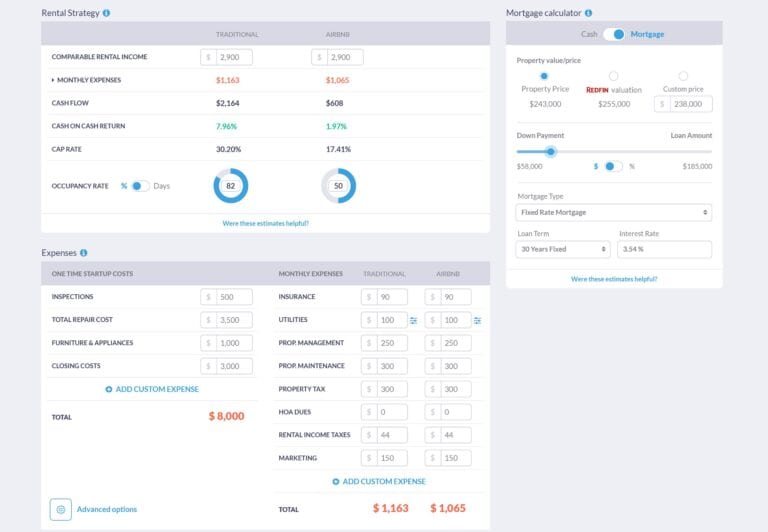

Finally, you can use Mashvisor’s Airbnb rental calculator to do an in-depth investment property analysis to find the best one. The tool quickly and accurately calculates key real estate metrics such as Airbnb rental income, Airbnb cash on cash return, Airbnb cap rate, and Airbnb occupancy rate.

-

Check Your Credit History (and Work On It If Needed)

Your credit record will also impact your chances of securing Airbnb investment property financing. If you have a poor credit record, there’s a limited chance that your loan application will be accepted. So be sure to check your credit report as soon as you decide to invest in Airbnb. If your credit needs improving, start working on it today.

-

Put Down a Larger Deposit

The minimum deposit amount will vary depending on the type of loan and the lender. However, if you can afford it, it’s always better to place a larger down payment.

The larger your deposit size, the better the interest rate you’ll get. Lenders prefer a larger deposit because it provides them with more security. It also shows them that you are more financially stable.

Paying down more upfront also means you’ll have a shorter repayment period or smaller monthly payments.

-

Work to Have a Low Debt-to-Income Ratio

Lenders will also take into account your DTI when assessing your ability to repay the loan. Before you begin shopping for Airbnb loans, you want to make sure that your DTI is as low as possible.

The Bottom Line

Financing Airbnb properties can be challenging. However, there are a number of great options available that you can use to get started in the Airbnb business. Be sure to do your due diligence to figure out the best Airbnb investment financing option for you.

To learn more about how Mashvisor can support your real estate investing journey, sign up for a 7-day free trial now, followed by 15% off for life.