Are you using an Airbnb calculator spreadsheet to determine the profitability of an Airbnb rental? Read to learn why you don’t need it anymore.

Airbnb rental properties have become a popular choice for travelers looking for temporary accommodation. Since Airbnb became popular in the market, it has become an attractive investment option. Indeed, buying Airbnb property can offer robust returns. However, investing in short-term rentals is not about purchasing any property around you and listing it on Airbnb.

Table of Contents

- What Is Airbnb Investment Analysis?

- 4 Reasons You Don’t Need an Airbnb Calculator Spreadsheet

- What to Use Instead of an Airbnb Calculator Spreadsheet

Savvy real estate investors know that it’s essential to analyze Airbnb data before making an offer for any income property. This helps ensure that buying said Airbnb property makes financial sense. For decades, an Airbnb spreadsheet has been the go-to tool for Airbnb investment analysis, but not anymore. In fact, the Airbnb calculator spreadsheet is a thing of the past.

Times have changed, and successful investors are using the latest technology for analysis. Technological advancement is making the once very useful resource obsolete. Nowadays, many successful investors use an Airbnb calculator instead. An Airbnb calculator is the best alternative to Airbnb spreadsheets because it offers automatic Airbnb computation and analysis.

You can find an Airbnb calculator online. However, you have to be selective when choosing a platform to work with. To be a successful real estate investor, it’s crucial to choose a real estate platform that provides accurate figures and real estate data. Fortunately, you can access a reliable and accurate Airbnb calculator using Mashvisor.

In this blog, we’re going to show you why you no longer need an Airbnb spreadsheet for analysis.

What Is Airbnb Investment Analysis?

Airbnb investment analysis involves computing a variety of real estate metrics to determine the performance of an Airbnb rental property. The metrics are then used to compare multiple Airbnb properties for sale to determine which one is the most profitable. Real estate investors use this analysis to help them make the right decision when buying a short term rental property.

Here are the key Airbnb metrics that a real estate investor needs to compute before making a decision:

1. Airbnb Occupancy Rate

Airbnb occupancy rate refers to the number of nights an Airbnb investment property is booked compared to the total number of nights it was available for booking throughout the year. This is an important metric because it’s a key indicator of profitability potential. Knowing the occupancy rate can help you determine if the property will be profitable.

Simply put, when an Airbnb property has a high occupancy rate, it generates more cash flow, increasing the investor’s potential to gain bigger profits. On the other hand, a short term rental property that has a low occupancy rate means there are more days that it is vacant. A vacant rental property is not generating income, and the owner will likely see a negative cash flow.

2. Airbnb Rental Income

Airbnb income refers to the amount of money the Airbnb rental property will generate on a monthly basis. It is influenced by a number of factors, including the nightly rate, Airbnb occupancy rate, and seasonality. Airbnb income is an important metric because it’s used in computing other key real estate metrics like cash flow, Airbnb cash on cash return, and cap rate.

As an investor, knowing the Airbnb rental income of a certain investment property is important because it tells you whether or not you will earn enough to cover the expenses of the property. Of course, no investor would want to cover the cost of owning a short term rental out of pocket. Knowing the Airbnb income can help you decide if the property will make a good investment.

3. Airbnb Cash Flow

Airbnb cash flow is the rental income that is left after deducting the total rental expenses. Since Airbnb is a seasonal business, the cash flow you can generate from a short term rental property will vary month-to-month. As a real estate investor, you should always look to buy positive cash flow Airbnb properties. They will ensure that you have money in your pocket every month.

When analyzing the cash flow of a particular Airbnb property, it’s important to take into consideration the seasonality of the location. During peak season, you should generate more cash flow to help you cover the expenses during the low season. If not, the property will have low to negative cash flow, which is not good for the business.

4. Airbnb Cap Rate

Airbnb cap rate is the ratio of the net operating income (NOI) to the property price or the current market value of the property. This return on investment (ROI) metric does not take into account the investment property financing method. The cap rate of an Airbnb property helps you determine if you can generate sufficient income to recover the cost of the property.

In general, the higher the cap rate, the more profits you can generate from a short term rental property. Many real estate experts believe that the best cap rate is 8% or higher. However, this figure can vary depending on the location of your investment property. In some big cities with high appreciation rates, anything above a 2% cap rate is considered good.

5. Airbnb Cash on Cash Return

The Airbnb cash on cash return is an ROI metric that refers to the ratio of the annual pre-tax cash flow to the total cash invested. Unlike the cap rate, Airbnb cash on cash return factors in the financing method used to acquire the property. This means that the cash on cash return is different if you purchased the property entirely in cash than if you take a loan to finance it.

Keep in mind that to calculate the cash on cash return, we only take into account the actual amount of cash you invested, not the value or cost of the property. For instance, if you purchase the property through a mortgage, you will only factor in the amount of the down payment. You will also consider the closing costs and other costs paid in cash.

You now understand the key metrics real estate investors need to estimate. For years, the investment analysis spreadsheet, also known as the Airbnb calculator spreadsheet, has been the main tool used by investors to analyze these real estate metrics. But is it still the best option when it comes to Airbnb investment analysis?

The answer is a resounding NO. In the next section, we will discuss why you no longer need an Airbnb spreadsheet to make projections on the profitability of an Airbnb investment.

4 Reasons You Don’t Need an Airbnb Spreadsheet

With the emergence of the Airbnb investment calculator, the investment analysis spreadsheet has been rendered obsolete. If you are still using an Airbnb spreadsheet for analysis, you are actually putting yourself at a disadvantage in the Airbnb business world.

Here are the reasons why you need to retire the Airbnb income spreadsheet:

1. The Airbnb Spreadsheet Is Prone to Error

Using an Airbnb spreadsheet requires you to input the figures manually. Since you need to enter data into the Airbnb spreadsheet manually, there’s always a chance that you’ll make a mistake. Moreover, a small data error will likely have a ripple effect, especially when analyzing large quantities of data.

As an investor, making an erroneous calculation is a no-no when it comes to analyzing real estate data. A small error can lead to a wrong judgment, which may result in making the wrong investment decision. You don’t want to risk your profitability by making a wrong decision just because of an inaccurate computation.

2. Manual Airbnb Spreadsheet Can Be Time-Consuming

Setting up Airbnb spreadsheet formulas and keying in data manually can take up a lot of your time. If you are a beginner, you will also have to spend time learning how to program spreadsheets to compute Airbnb metrics. As you know, time is of the essence in real estate investing.

Not only will you spend time keying in the figures manually, but you’ll also have to do your own research to find these figures. Finding real estate data on your own requires a lot of time and effort. It is not only time-consuming; it can also be exhausting. Savvy investors know that they should not waste their time doing these things manually when they have better alternatives.

3. It Doesn’t Allow for Real-Time Data Change

With the dynamic nature of the housing market, being able to identify and respond to changes promptly is crucial. However, an Airbnb spreadsheet can’t handle real-time data change. You have to continually update the numbers yourself. What’s more, you have to do this manually.

Not only that—you also need to constantly research the ever-changing real estate data from time to time to ensure that your figures remain accurate. As mentioned, this will not only eat up a large portion of your time, but it can also get too overwhelming that you might end up getting frustrated.

4. It Doesn’t Allow for Efficient Collaboration

As a real estate investor, you may have multiple stakeholders like mentors or partners who need to access your Airbnb data and analysis. They typically will want to see everything laid out for them directly as opposed to formulas and tons of data. So, if you’re using an Airbnb spreadsheet for analysis, you will most likely have to produce a separate report to share.

While it’s true that you can opt for a shareable Google Spreadsheets link, this is not the best Airbnb calculator option. Google documents may allow collaboration, but it doesn’t provide the efficiency that automatic Airbnb calculators offer.

In the following section, we will show you the best alternative to an Airbnb calculator spreadsheet and where you can find one.

What to Use Instead of an Airbnb Spreadsheet

As discussed above, an Airbnb calculator spreadsheet has several limitations. However, there’s a way to overcome these limitations—by using an online Airbnb calculator. Before we learn where to find the best Airbnb calculator online, let us first discuss what an Airbnb calculator is and how it works.

What Is an Airbnb Calculator?

An Airbnb calculator typically refers to an online calculator that computes the profitability of a short term rental property. In general, an Airbnb calculator uses several real estate metrics to determine the profit potential of an Airbnb property. Among these metrics are the monthly rental income, cash on cash return, Airbnb cap rate, occupancy rate, and cash flow.

How Does an Airbnb Calculator Work?

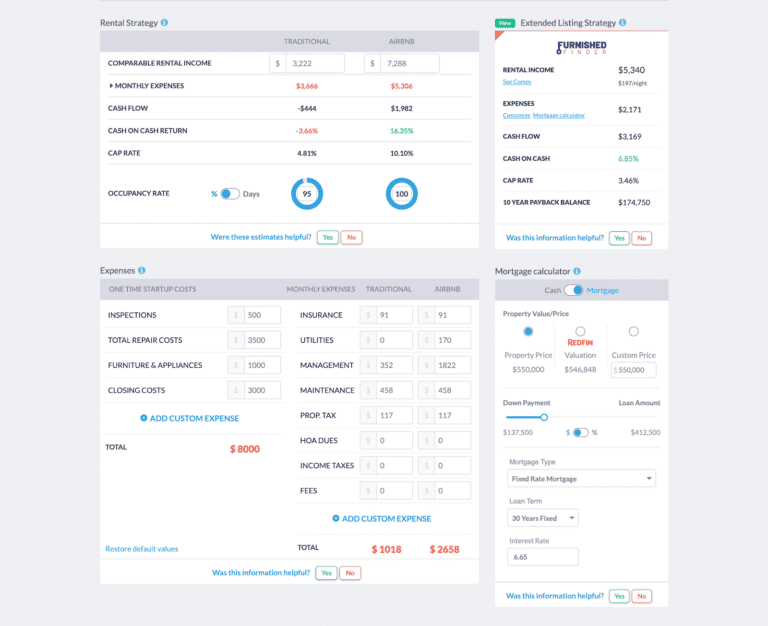

To determine the profitability of a particular short term rental property, the Airbnb calculator provides you with accurate Airbnb rental data. The calculator automatically computes the rental income of a property based on the estimated expenses provided. Moreover, you will also see other essential figures like the cash on cash return, cap rate, cash flow, and occupancy rate.

All of this information should be readily available. Some really good Airbnb calculators also allow you to include your financing method. In general, the way you acquire the property will have a great effect on your profitability. That is why being able to see how your financing preference would affect the computation is crucial in making an informed decision.

What’s the Best Airbnb Calculator Available?

The best Airbnb calculator available today is Mashvisor’s Airbnb income calculator. While it does the same job as the Airbnb spreadsheet, it’s more efficient, more accurate, more flexible, and offers several other benefits. What’s best about Mashvisor’s calculator is that it offers accurate figures, so you don’t have to do your own research.

This revolutionary and user-friendly tool allows you to conduct an Airbnb investment analysis on multiple properties in the US housing market in a matter of minutes. Since you don’t have to gather or enter data manually, using this calculator takes away the heavy burden of research from you. Plus, Mashvisor gets all of its data directly from Airbnb, so you know it’s reliable.

You simply enter a few filters, and you’ll receive a comprehensive analysis of the property’s investment potential. Our Airbnb income calculator uses big data, predictive analytics, and machine-learning algorithms to accurately estimate key Airbnb metrics. Moreover, the calculations are verified by real Airbnb hosts in the US to ensure accuracy.

Why Mashvisor Is the Best Airbnb Calculator

There are several reasons why Mashvisor is considered the best Airbnb calculator in the market today. Many seasoned and new investors rely on Mashvisor because it not only provides ease and convenience but also ensures that the data you receive is accurate and verified.

Here are a few reasons why you should also consider using Mashvisor’s best Airbnb calculator:

1. It Provides Accurate Real Estate Data and Cost Estimates

Thanks to Airbnb analytics, the calculator will provide you with real estate data and cost estimates based on averages of the area. Apart from Airbnb expenses, the calculator will provide you with estimates for Airbnb occupancy rate, Airbnb rental income, Airbnb cap rate, and Airbnb cash on cash return.

This eliminates the need to conduct manual research. You also don’t need to make an Airbnb expenses spreadsheet to list down all the costs associated with owning and operating a short term rental.

Mashvisor’s Airbnb Calculator pulls data from reliable sources like Airbnb.com, the MLS, and Redfin.

Start analyzing Airbnb Investment Properties today. Sign-up for a 7-day free trial with Mashvisor now to see how its tools work.

2. It Is Interactive

Another great thing about Mashvisor’s Airbnb calculator is that it allows you to personalize your Airbnb investment analysis report by entering your own costs. For example, if you think you will spend more on renovation and improvement, you can adjust the cost by entering the figure on the calculator. You can also add more expenses depending on your preference.

This calculator’s interactive feature allows you to generate more accurate and personalized figures based on your personal preferences.

3. You Can Factor in Your Financing Method

With Mashvisor, you can also use the mortgage calculator to factor in your preferred financing method. If you plan to take out a mortgage loan to finance your purchase, you can input your down payment, mortgage type, loan term, and interest rate to get a more accurate cash on cash return figure. This portion is also interactive, which means you can edit the data as needed.

4. It Helps You Determine the Best Rental Strategy for the Property

What makes Mashvisor’s calculator even more special is that it gives you more than just numbers for an Airbnb property. You’ll also be able to determine whether Airbnb is the optimal rental strategy for a particular property. This is because it displays numbers for both short term and long term rental strategies.

The purpose of this is to show prospective investors a comparison table of what they can potentially earn from either investment strategy. This way, you can easily compare the rental income and returns on investment you can earn from different rental strategies. You’ll see which strategy is more profitable so you can make the right decision based on the figures provided.

Other Mashvisor Real Estate Tools You Can Use

Aside from Airbnb calculator, Mashvisor also provides a number of different real estate tools that you can use, such as the following:

- Investment Property Search: One great thing about Mashvisor is that it makes searching for the right investment property so much easier with its investment property search tool. All you need to do is input the city or neighborhood of your choice, set some custom filters like budget, property type, and size, and it will generate results for you.

- Rental Comps: Analyzing real estate data from rental comps allow you to determine how similar properties perform in the same area. This will give you an idea of how to make your property stand out among the competition.

- Neighborhood Analytics: You can also access neighborhood analytics, which provides analysis of the rental properties within the neighborhood. Through this tool, you will see the market opportunities in the area of your choice, as well as the occupancy rate and rental income historical data and statistics.

- Insights: Mashvisor will also provide you with different scores based on the analyses the system has made. You will see the investment opportunity score in the area, as well as the short term occupancy insights and the overall neighborhood investment score.

Overall, these tools can help you make the right investment decision.

To start finding and analyzing the best Airbnb investment properties in your city and neighborhood of choice, sign up for a 7-day free trial with Mashvisor.

The Bottom Line

Using an Airbnb calculator spreadsheet for analysis can limit your potential as an Airbnb investor. While it serves the same purpose as the Airbnb income calculator, it is less accurate, less efficient, and less flexible. If you are looking to invest in Airbnb, instead of using an Airbnb spreadsheet, be sure to try out Mashvisor’s Airbnb calculator.

If you’re ready to invest in short term rentals in the area of your choice, make sure to use the best real estate platform available. Sign up for a 7-day free trial of Mashvisor now, followed by 15% off for life.