What is turnkey real estate investing?

Turnkey real estate investing is an investment strategy that consists of buying an investment property that is rent-ready, typically from a company that has already taken care of the renovations and upgrades. Essentially, this strategy allows real estate investors to buy a rental property and rent it out immediately for cash flow. Sometimes, tenants are already in place and there is a property management company already in charge of taking care of things for the investor. This means real estate investors can earn passive income from turnkey real estate.

Sounds like the perfect real estate investment strategy, right? So why have you come across articles that say you should never buy a turnkey rental property? The reason is simple: Not all turnkey properties for sale are going to be great real estate investments that generate high returns. That’s why it’s an absolute must to conduct a thorough turnkey real estate analysis. This will help you avoid real estate deals that are too good to be true.

Here are the 7 steps you need to take to complete your turnkey real estate analysis:

#1. Research the Turnkey Real Estate Company

First and foremost, know the seller.

In 2020, there are so many turnkey real estate websites and companies operating across the US housing market. If you have a specific location in mind where you want to buy a rental property, you may be limited to a few turnkey real estate companies.

Still, research the different companies. Check out lists of the best turnkey real estate companies online that are being recommended by other investors. Read online reviews from people who now own turnkey real estate from the company. On a lot of turnkey real estate websites, you will see an option to schedule a call. Take advantage of this (typically free) session to talk to an expert at the company about investing in turnkey real estate with them. This should help you choose the right company for you – one you can trust.

#2. Conduct a Neighborhood Analysis

Once you decide which turnkey real estate company to go with, you will have a lot of options to choose from. Find the investment properties that fit your budget and other criteria (like property type, size, etc.). However, before moving any further, it’s crucial that you analyze the neighborhood where the turnkey real estate property of your choice is located. This will help you ensure that you’re buying turnkey real estate in a location that will continue to thrive and support the success of your investment.

If you can, drive around the neighborhood to get a closer look. Did the turnkey real estate company buy a distressed property in a run-down neighborhood and fix it up? If so, this may not be a great turnkey real estate investment opportunity after all. If you can’t physically drive around the neighborhood, do some research online. Check out the Google Street View images of the area to get a better feel of the location.

Next, you’ll want to check out how rental properties perform on average in the area. While turnkey real estate listings are typically accompanied by return metrics like monthly rental income and cap rate, you want to be sure these are actually accurate estimations for the neighborhood.

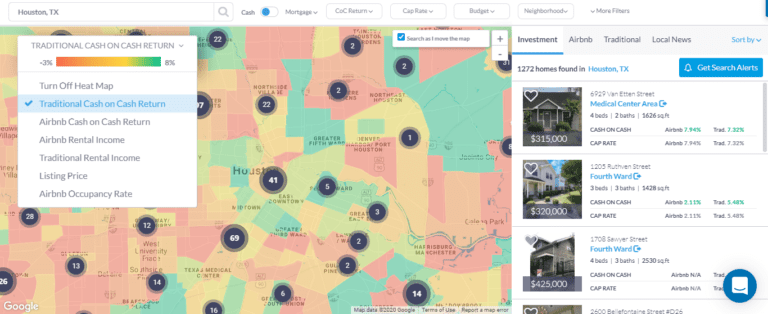

The easiest way to do this is to analyze the neighborhood on Mashvisor using our Real Estate Heatmap. This tool will allow you to see how the neighborhood measures up to others in the area. That way, you not only gain an understanding of the area you’re interested in, but you may immediately spot better places to buy rental property in the city. The neighborhood analysis can be conducted using the following metrics:

- Listing Price

- Traditional Rental Income

- Airbnb Rental Income

- Traditional Cash on Cash Return

- Airbnb Cash on Cash Return

- Airbnb Occupancy Rate

Analyze the neighborhood where the turnkey real estate property is located with Mashvisor’s Real Estate Heatmap.

You can continue your analysis of the neighborhood by checking out its Neighborhood Analytics page on Mashvisor. There, you’ll find data on the Walk Score, the number of properties (for sale, traditional, and Airbnb rentals), rental income of other local properties, real estate comps, and more.

All of this neighborhood data from Mashvisor will help you make a confident choice when it comes to turnkey real estate investing.

#3. Perform a Rental Property Analysis

As mentioned, a turnkey real estate listing will usually tell you how much rental income you can expect to earn and perhaps even the cap rate. But that is usually all you get. So it’s important to dig deeper as a rental property analysis requires that you look at a lot of other numbers before making a purchase. And you also want to look at data from other resources, besides the company selling the turnkey real estate, just to be sure.

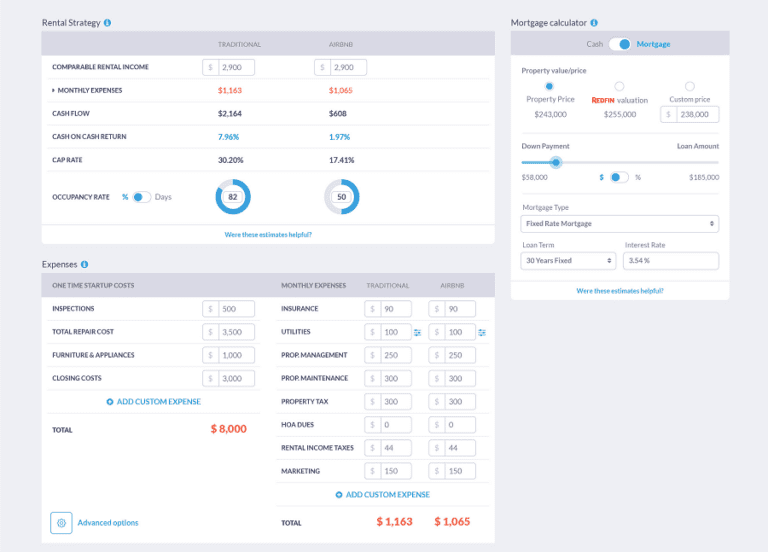

Turn to Mashvisor’s real estate investment software. You can enter the address of the turnkey property in our database. From there, you will be given a full analysis of the property including numbers like the rental income, expected expenses, cash flow, cap rate, cash on cash return, traditional and Airbnb occupancy rate, tax history, and the investment payback balance. All of the data is compiled from rental comps and calculated using our industry-leading algorithms. With our rental property calculator, you will be sure to find cash flow properties with a high rate of return on rental property.

#4. Carry Out a Home Inspection

You may get a home inspection report when you show interest in the turnkey real estate property. However, you should still conduct your own home inspection. You want to be sure that the turnkey real estate company knew what they were doing when they were making repairs and carrying out renovations. Was anything overlooked? Were any unnecessary repairs made, that you will now pay for?

While investing in turnkey real estate is appealing because you are guaranteed to not have to do any renovations yourself, you still want to check on the renovations that were made. A home inspector will guide you through the investment property and tell you everything you need to know.

Use The Ultimate Property Inspection Checklist for Real Estate Investors as a guide for this step of the turnkey real estate analysis.

#5. Find Out the Value of the Property

One reason some investors warn against investing in turnkey real estate is that you may overpay. If you researched your turnkey real estate company well, you may be able to avoid this. However, there’s always the possibility that the company is trying to earn a very large profit, all the while not offering you a great turnkey investment property.

The best way to avoid this issue is to conduct a comparative market analysis (CMA). Find real estate comps and make sure that the price is close to the actual value of the turnkey real estate. You can get comps for the property of interest through Mashvisor’s rental property calculator.

#6. Interview the Property Management Company

Interview the property management company and the manager of your turnkey rental property, just like you would if you were to hire them directly yourself. If the turnkey real estate deal is a great one but the rental property management in place is less-than-great, you will quickly regret the purchase.

Meet with the manager face to face or interview them through Skype or Zoom. Here is a list of questions you should ask when hiring a property management company. Be sure to cover all of them and that the interviewee provides sufficient answers. You should also check out online reviews for the management company itself. Find out what other rental property investors have to say about them. Don’t move on the turnkey property until you’re confident it will be in good hands.

#7. Get to Know the Tenants

While not all turnkey real estate properties are tenant-occupied, many are. This can make them all the more appealing as you can earn rental income from month #1. But remember, you didn’t put the tenants there. You don’t know them. So you have to get to know them.

Ask the property management company to provide the background info on the tenant that they gathered during the screening process. Make sure it all checks out (credit info, employment info, previous landlord references, etc.). If any key info is missing, don’t let it go. Ask the property manager to get a hold of it – but this would also be a warning sign against the manager.

Turn to this guide on How to Screen Tenants for a Rental Property in 7 Steps to make sure you get all the info you need.

Start Analyzing Turnkey Real Estate Now and Find a Great Opportunity

Follow the above 7 steps and you’re sure to find a great turnkey real estate deal. Don’t forget to take advantage of Mashvisor’s real estate investment tools. You’ll find them to be a vital part of your turnkey real estate analysis. Get access to our tools now with a 7-day free trial.