An Airbnb investment is one of the most profitable and rewarding ways to make money in real estate. That is if you have access to Airbnb data.

So, you want to become an Airbnb investor? Good for you! Short term or vacation rentals listed on Airbnb tend to get higher occupancy rates compared to properties on other platforms.

Table of Contents

- The Best Source for Airbnb Data

- Top 20 Locations for Airbnb Investment

- Airbnb Analytics: How to Analyze Airbnb Data

However, some real estate investors make the mistake of assuming they can rent out any home near a tourist attraction or scenic location and make lots of money. It can’t be further from the truth.

The only way to guarantee a profitable investment is to go into it with Airbnb data and Airbnb data analysis. You must run the numbers to know if you will come out with a positive cash flow or a money pit.

But where can you find such data? Obtaining reliable Airbnb data and a few other important things about Airbnb rentals will be discussed in this blog. We will also show you how to use Mashvisor as a tool for your Airbnb investment.

Serious rental property investors know the importance of Airbnb data and Airbnb data analytics in the success of an investment property. Without them, it’s like you’re going to war with no guns and blindfolded. Both Airbnb data and Airbnb data analytics are a must if you plan to start an Airbnb business.

Related: Real Estate Data Analytics Is What You Need to Get Rich

The Best Source for Airbnb Data

For starters, let’s point out that not all data is created equal, which means you can’t trust every source of information.

You can spend hours digging through the internet looking for rental comps and Airbnb data. Then, you will need to compile it all into an Airbnb spreadsheet. But wait: you must also update the spreadsheet for any changes.

And while there are plenty of websites you can access online and apps you can download for free, not all provide a high-quality set of data to conduct a proper Airbnb data analysis. To ensure you get the most out of your Airbnb data analytics, we recommend looking for an API that is best suited for rental property investment, specifically for Airbnb properties.

Regarding real estate investment APIs and apps available for download, Mashvisor is the simplest solution. The platform will help you gain instant access to a reliable set of Airbnb data from all across the US housing market going into the new year. It will allow you to perform the most historically accurate investment property analysis using Airbnb data analytics.

You can use a website like Mashvisor to obtain get high-quality, automatically-updated data at your fingertips. Also, you’ll get Airbnb investment analysis software to help you put it to use. It will give you a greater insight into the local market conditions, which will help you determine how in-demand Airbnb properties are in the area.

Our Airbnb data analytics help you quickly determine which properties and neighborhoods will be the most profitable and in demand.

See also: Airbnb Data: What Real Estate Investors Need and Where to Get It

What Airbnb Data Can You Access With Mashvisor?

If you are looking for short term rental data, Mashvisor is the right place online for you. However, before you get started, there are a few things you should be aware of.

Awareness of Airbnb Regulations

First of all, you must check each location on your list for current Airbnb regulations and laws, as well as those which might be in the works. It would be devastating and a waste of money to buy an Airbnb in a location that doesn’t permit or heavily restrict short term rental properties. If you get caught breaking laws, the consequences and fines can be very serious.

A quick internet search can give you a basic idea of Airbnb regulations for different locations. For more detailed information, check with the applicable city or state offices.

We are also constantly writing articles that include information on Airbnb laws and regulations here at Mashvisor, so check out our blog frequently for updates.

Neighborhood Profitability Potential

Secondly, you must determine the most profitable locations to invest in Airbnb. For this, you will want to check Mashvisor’s blog as well in order to stay up to date on the best places to invest. It is the first kind of Airbnb data you can get with Mashvisor – statistics by city and state.

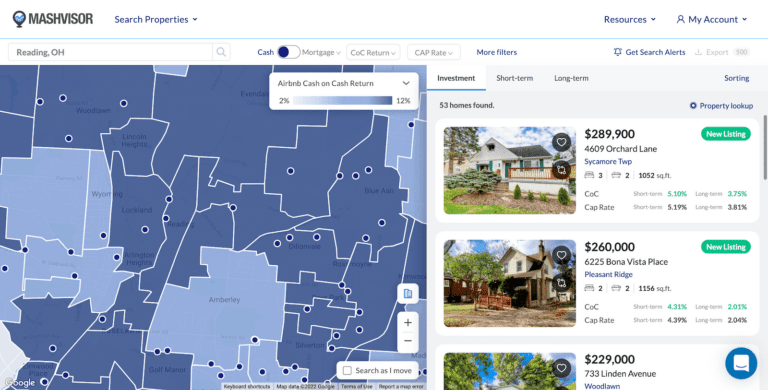

You can enter any location in Mashvisor’s search bar found on the homepage. Also, you can provide a specific address, neighborhood, city, or zip code.

After entering the location of your choice, you will be taken to a map of the area that shows actively listed rental and investment properties. You may hover your pointer over the pins to get a summary of the property. Also, you may click on the pin itself to view the full details of the property.

You may even customize your search and use Mashvisor’s real estate heatmap to filter your search results according to the following:

- Long Term Rental Income

- Airbnb Rental Income

- Long Term Rental Cash on Cash Return

- Airbnb Cash on Cash Return

- Listing Price

- Airbnb Occupancy Rate

Once you select a filter, the page will show a color-coded map with areas that are performing well (greens), poorly (reds), and everything in between. It will make finding the best location and investment property a lot easier.

Airbnb Occupancy Rate Data

One of the most important pieces of data in your search for the perfect Airbnb investment is the occupancy rate. The metric will let you know how often you can expect a property to be filled with tenants and guests. Remember, you can charge high rates for a property, but if you almost never have tenants (low occupancy rate), you likely won’t make a profit.

Airbnb occupancy rate data is included with every property in our database here at Mashvisor. It is frequently updated and can help you determine the profitability of a particular Airbnb investment property for sale.

Did you find a property with a low Airbnb occupancy rate but think you can change it? Our software uses predictive analytics to present the number of Airbnb reviews needed to boost your Airbnb occupancy rate.

To get access to our real estate investment tools, click here to sign up for a 7-day free trial of Mashvisor today, followed by 15% off for life.

Top 20 Locations for Airbnb Investment

Below, we’ve included current data for the highest-performing states and cities on average for Airbnb investments based on cash on cash return. It is just an example of the data you can typically find on Mashvisor’s blog.

It is important for investors to note, though, that before making an actual Airbnb investment, you need to find out the Airbnb regulations for each state and the cities you are considering. That being said, here are the top ten states with the highest Airbnb cash on cash returns according to Mashvisor’s data from October 30, 2022.

10 States With the Highest Airbnb Cash on Cash Returns

The following states offer the highest Airbnb cash on cash returns in the US. We used the following criteria to filter the results:

- Each state must have at least a median property price of no more than $1,000,000

- Each state must have a minimum monthly Airbnb rental income of $2,000

- Each state must have an Airbnb cash on cash return of 2.00% and above

- Each state must have an Airbnb occupancy rate of 50% and up

As investors, your goal should be to make the most out of your investment. You can do it by ensuring that you only get the properties with the highest potential for getting more bookings and optimizing your monthly rental income. That said, here are the top ten states with the highest Airbnb cash on cash return, ranked from highest to lowest:

1. Alaska

- Median Property Price: $370,408

- Average Price per Square Foot: $4,843

- Days on Market: 120

- Number of Airbnb Listings: 4,844

- Monthly Airbnb Rental Income: $3,524

- Airbnb Cash on Cash Return: 6.19%

- Airbnb Cap Rate: 6.31%

- Airbnb Daily Rate: $178

- Airbnb Occupancy Rate: 62%

- Walk Score: 33

To start looking for and analyzing the best investment properties in Alaska, click here.

2. Indiana

- Median Property Price: $315,045

- Average Price per Square Foot: $160

- Days on Market: 72

- Number of Airbnb Listings: 5,793

- Monthly Airbnb Rental Income: $2,550

- Airbnb Cash on Cash Return: 5.08%

- Airbnb Cap Rate: 5.19%

- Airbnb Daily Rate: $158

- Airbnb Occupancy Rate: 51%

- Walk Score: 43

To start looking for and analyzing the best investment properties in Indiana, click here.

3. Nebraska

- Median Property Price: $370,427

- Average Price per Square Foot: $182

- Days on Market: 67

- Number of Airbnb Listings: 1,951

- Monthly Airbnb Rental Income: $2,920

- Airbnb Cash on Cash Return: 4.85%

- Airbnb Cap Rate: 4.94%

- Airbnb Daily Rate: $154

- Airbnb Occupancy Rate: 53%

- Walk Score: 42

To start looking for and analyzing the best investment properties in Nebraska, click here.

4. Virginia

- Median Property Price: $491,148

- Average Price per Square Foot: $442

- Days on Market: 73

- Number of Airbnb Listings: 13,492

- Monthly Airbnb Rental Income: $3,447

- Airbnb Cash on Cash Return: 4.64%

- Airbnb Cap Rate: 4.71%

- Airbnb Daily Rate: $194

- Airbnb Occupancy Rate: 56%

- Walk Score: 48

Learn More: 11 Best Places for Buying a Vacation Home in Virginia

5. Minnesota

- Median Property Price: $402,483

- Average Price per Square Foot: $191

- Days on Market: 67

- Number of Airbnb Listings: 6,506

- Monthly Airbnb Rental Income: $3,250

- Airbnb Cash on Cash Return: 4.63%

- Airbnb Cap Rate: 4.71%

- Airbnb Daily Rate: $181

- Airbnb Occupancy Rate: 58%

- Walk Score: 46

To start looking for and analyzing the best investment properties in Minnesota, click here.

6. Alabama

- Median Property Price: $406,994

- Average Price per Square Foot: $285

- Days on Market: 83

- Number of Airbnb Listings: 15,048

- Monthly Airbnb Rental Income: $2,773

- Airbnb Cash on Cash Return: 4.50%

- Airbnb Cap Rate: 4.58%

- Airbnb Daily Rate: $186

- Airbnb Occupancy Rate: 52%

- Walk Score: 41

To start looking for and analyzing the best investment properties in Alabama, click here.

7. New Mexico

- Median Property Price: $485,894

- Average Price per Square Foot: $236

- Days on Market: 99

- Number of Airbnb Listings: 5,753

- Monthly Airbnb Rental Income: $3,010

- Airbnb Cash on Cash Return: 4.30%

- Airbnb Cap Rate: 4.37%

- Airbnb Daily Rate: $152

- Airbnb Occupancy Rate: 58%

- Walk Score: 42

To start looking for and analyzing the best investment properties in New Mexico, click here.

8. Wisconsin

- Median Property Price: $394,602

- Average Price per Square Foot: $231

- Days on Market: 71

- Number of Airbnb Listings: 9,238

- Monthly Airbnb Rental Income: $2,836

- Airbnb Cash on Cash Return: 4.29%

- Airbnb Cap Rate: 4.37%

- Airbnb Daily Rate: $199

- Airbnb Occupancy Rate: 52%

- Walk Score: 47

To start looking for and analyzing the best investment properties in Wisconsin, click here.

9. Kansas

- Median Property Price: $381,432

- Average Price per Square Foot: $173

- Days on Market: 106

- Number of Airbnb Listings: 2,300

- Monthly Airbnb Rental Income: $2,763

- Airbnb Cash on Cash Return: 4.24%

- Airbnb Cap Rate: 4.33%

- Airbnb Daily Rate: $127

- Airbnb Occupancy Rate: 51%

- Walk Score: 39

To start looking for and analyzing the best investment properties in Kansas, click here.

10. Iowa

- Median Property Price: $286,432

- Average Price per Square Foot: $176

- Days on Market: 84

- Number of Airbnb Listings: 2,499

- Monthly Airbnb Rental Income: $2,516

- Airbnb Cash on Cash Return: 4.14%

- Airbnb Cap Rate: 4.24%

- Airbnb Daily Rate: $174

- Airbnb Occupancy Rate: 51%

- Walk Score: 42

To start looking for and analyzing the best investment properties in Iowa, click here.

10 Cities With the Highest Airbnb Cash on Cash Returns

Just like in the previous list, the following cities offer real estate investors the best cash on cash returns for Airbnb properties. We combed through Mashvisor’s latest data and used the following criteria to filter this list:

- Each location must have at least a median property price of no more than $1,000,000

- Each location must have no less than 100 active Airbnb rental listings

- Each location must have a minimum monthly Airbnb rental income of $2,000

- Each location must have an Airbnb cash on cash return of 2.00% and above

- Each location must have an Airbnb occupancy rate of 50% and up

Here are the top ten cities with the highest Airbnb cash on cash returns, according to Mashvisor’s latest data. The following list is ranked from highest to lowest cash on cash return.

1. Reading, OH

- Median Property Price: $225,180

- Average Price per Square Foot: $139

- Days on Market: 40

- Number of Airbnb Listings: 171

- Monthly Airbnb Rental Income: $2,874

- Airbnb Cash on Cash Return: 7.85%

- Airbnb Cap Rate: 8.14%

- Airbnb Daily Rate: $117

- Airbnb Occupancy Rate: 53%

- Walk Score: 80

To start looking for and analyzing data for the best investment properties in Reading, OH, click here.

2. West Saint Paul, MN

- Median Property Price: $268,376

- Average Price per Square Foot: $169

- Days on Market: 35

- Number of Airbnb Listings: 320

- Monthly Airbnb Rental Income: $3,367

- Airbnb Cash on Cash Return: 7.70%

- Airbnb Cap Rate: 7.86%

- Airbnb Daily Rate: $151

- Airbnb Occupancy Rate: 62%

- Walk Score: 75

To start looking for and analyzing data for the best investment properties in West Saint Paul, MN, click here.

3. Bellwood, IL

- Median Property Price: $257,900

- Average Price per Square Foot: $198

- Days on Market: 54

- Number of Airbnb Listings: 152

- Monthly Airbnb Rental Income: $3,677

- Airbnb Cash on Cash Return: 7.45%

- Airbnb Cap Rate: 7.69%

- Airbnb Daily Rate: $161

- Airbnb Occupancy Rate: 64%

- Walk Score: 82

To start looking for and analyzing data for the best investment properties in Bellwood IL, click here.

4. Richmond Heights, OH

- Median Property Price: $229,130

- Average Price per Square Foot: $131

- Days on Market: 108

- Number of Airbnb Listings: 234

- Monthly Airbnb Rental Income: $2,958

- Airbnb Cash on Cash Return: 7.45%

- Airbnb Cap Rate: 7.63%

- Airbnb Daily Rate: $136

- Airbnb Occupancy Rate: 51%

- Walk Score: 23

To start looking for and analyzing data for the best investment properties in Richmond Heights, OH, click here.

5. Northlake, IL

- Median Property Price: $304,667

- Average Price per Square Foot: $205

- Days on Market: 66

- Number of Airbnb Listings: 100

- Monthly Airbnb Rental Income: $3,834

- Airbnb Cash on Cash Return: 7.35%

- Airbnb Cap Rate: 7.56%

- Airbnb Daily Rate: $168

- Airbnb Occupancy Rate: 57%

- Walk Score: 33

To start looking for and analyzing data for the best investment properties in Northlake, IL, click here.

6. Clawson, MI

- Median Property Price: $256,732

- Average Price per Square Foot: $219

- Days on Market: 30

- Number of Airbnb Listings: 298

- Monthly Airbnb Rental Income: $3,185

- Airbnb Cash on Cash Return: 7.18%

- Airbnb Cap Rate: 7.42%

- Airbnb Daily Rate: $167

- Airbnb Occupancy Rate: 52%

- Walk Score: 69

To start looking for and analyzing data for the best investment properties in Clawson MI, click here.

7. Luray, VA

- Median Property Price: $416,415

- Average Price per Square Foot: $222

- Days on Market: 67

- Number of Airbnb Listings: 192

- Monthly Airbnb Rental Income: $4,183

- Airbnb Cash on Cash Return: 7.00%

- Airbnb Cap Rate: 7.10%

- Airbnb Daily Rate: $239

- Airbnb Occupancy Rate: 54%

- Walk Score: 52

To start looking for and analyzing data for the best investment properties in Luray, VA, click here.

8. Robbinsdale, MN

- Median Property Price: $303,400

- Average Price per Square Foot: $159

- Days on Market: 36

- Number of Airbnb Listings: 335

- Monthly Airbnb Rental Income: $3,387

- Airbnb Cash on Cash Return: 6.94%

- Airbnb Cap Rate: 7.13%

- Airbnb Daily Rate: $166

- Airbnb Occupancy Rate: 56%

- Walk Score: 73

To start looking for and analyzing data for the best investment properties in Robbinsdale, MN, click here.

9. Melvindale, MI

- Median Property Price: $152,633

- Average Price per Square Foot: $132

- Days on Market: 75

- Number of Airbnb Listings: 110

- Monthly Airbnb Rental Income: $1,979

- Airbnb Cash on Cash Return: 6.86%

- Airbnb Cap Rate: 7.27%

- Airbnb Daily Rate: $126

- Airbnb Occupancy Rate: 50%

- Walk Score: 62

To start looking for and analyzing data for the best investment properties in Melvindale, MI, click here.

10. West Allis, WI

- Median Property Price: $238,308

- Average Price per Square Foot: $156

- Days on Market: 23

- Number of Airbnb Listings: 112

- Monthly Airbnb Rental Income: $2,437

- Airbnb Cash on Cash Return: 6.86%

- Airbnb Cap Rate: 7.05%

- Airbnb Daily Rate: $119

- Airbnb Occupancy Rate: 70%

- Walk Score: 54

To start looking for and analyzing data for the best investment properties in West Allis, WI, click here.

Keep in mind that historically, Airbnb cash on cash return and the booking percentage via the Airbnb occupancy rate are the best ways to measure the success of an Airbnb investment. Check out the 75 Top Locations for Airbnb Income in 2022 for a more detailed list.

Once you determine a list of profitable locations where Airbnbs are permitted, use our real estate heatmap. The tool will allow you to locate the most profitable neighborhoods in areas with high booking rates and cash on cash returns.

The heatmap will show you the Airbnb rental income in an area, along with the occupancy rate, cash on cash return, and more. It allows you to determine which areas will give you the highest positive cash flow. The tool is perfect for further narrowing down your search for the best property.

Related: The Ultimate Beginner’s Guide to Airbnb Analytics for Hosts

Get Airbnb data for neighborhoods using Mashvisor’s heatmap.

Airbnb Analytics: How to Analyze Airbnb Data

What good is Airbnb data without Airbnb analytics?

Airbnb analytics is a must-have for real estate investors who are keen on owning vacation rental properties and getting them listed on Airbnb. However, obtaining the necessary data for a proper investment property analysis can be done in two ways: the conventional way and the digital way.

The conventional way requires you to go out and hit the streets to look for similar Airbnb properties. You then talk to Airbnb hosts, vacation rental owners, and real estate professionals for leads. However, It can be a very lengthy and tedious process, not to mention costly.

On the other hand, you can just simply go online to find the Airbnb data you need. Many free sites offer downloadable apps that are compatible with any mobile device. It gives investors greater convenience and control over their data acquisition. As we already mentioned a while ago, Mashvisor is one of the best sites – if not the best – for high-quality Airbnb data.

Once you’ve collected Airbnb data, it’s time to analyze your findings. If you don’t have the time for lengthy calculations, don’t worry. Mashvisor will take care of this step for you!

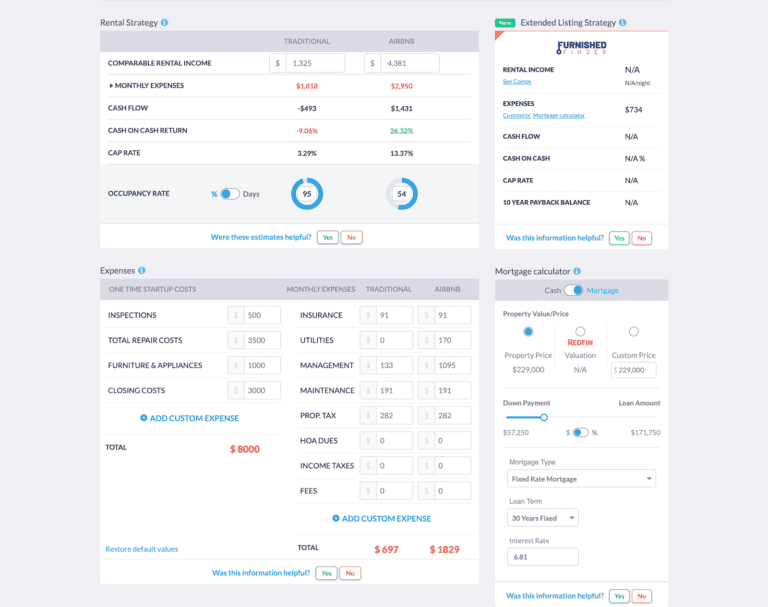

The Airbnb Profitability Calculator

The Airbnb profitability calculator is an excellent tool that provides real estate investors with a much-needed analysis of an Airbnb dataset. Using a particular Airbnb for sale that you’d like to analyze, the calculator will determine the following metrics:

- Cash flow

- Cap rate

- Cash on cash return

Get all kinds of Airbnb data analytics with Mashvisor’s calculator.

Mashvisor’s Airbnb profitability calculator allows you to quickly rule out properties that don’t provide a strong return on investment, saving you time in your Airbnb investment search. Using the calculator also allows you to locate the best neighborhoods that offer the most promising returns.

Related: How to Use Airbnb Predictive Analytics to Earn a High ROI

The Takeaway

As a serious real estate investor, you need to understand the importance of Airbnb data and how it can help you optimize your property’s monthly rental income.

Data acquisition can be done the conventional way but if you want to save time and money, we strongly recommend going the digital route with a website like Mashvisor. Once you give it a try, you won’t ever need any other tool besides Mashvisor to get reliable Airbnb data.

We offer up-to-date data on all of the properties listed in our database (and any you choose to add!) and provide additional Airbnb data on specific housing markets via blog posts.

Most importantly, we deliver fast data analysis through our top-notch real estate investment software, allowing you to determine the best possible Airbnb property for your investment goals.

To learn more about how we will help you make faster and smarter real estate investment decisions, click here.