Airbnb is a lucrative rental strategy. To be successful in Airbnb investing, you need to buy properties with a positive Airbnb cash flow.

Investing in rental properties provides two options: you invest in either long term rentals or short term rentals. In most cases, new investors test the waters in real estate by buying short term rentals first to see whether it’s a lucrative investment strategy.

Table of Contents

- What Is Considered Good Cash Flow in Airbnb Investing?

- Find a Profitable Location for Airbnb Investment

- Analyze Potential Cash Flow Before Buying

- Create an Eye-Catching Airbnb Listing

- Embrace Dynamic Pricing

- Cut Down on Expenses

- Offer Additional Amenities and Services

If the Airbnb strategy is also your preferred approach to real estate investing, you’ve probably wondered what you need to do to earn positive Airbnb cash flow. After all, this is the key to making money with Airbnb. Since vacation rentals are a seasonal business, you need to ensure that your cash flow remains positive even during the off-peak season.

According to a popular expression, “Cash is king”. The more cash flow you generate from your Airbnb property, the better the returns you’ll gain and the bigger the safety net you’ll have for unexpected expenses and vacancies. That’s why you should aim for positive cash flow properties when looking for an Airbnb investment opportunity.

Positive cash flow means your monthly income exceeds your monthly expenses. In the opposite situation, if your expenses and financing costs exceed your rental income, you will be losing money each month. This is something that no investor ever wants to experience, regardless of whether they invest in a long term or short term rental.

What Is Considered Good Cash Flow in Airbnb Investing?

Cash flow refers to the inflows and outflows of cash in a business or investment. In the case of Airbnb investing, cash flow is the difference between monthly income and monthly expenses. To be a successful and profitable short term rental owner, you need to ensure that your Airbnb property earns a positive cash flow, meaning your income is bigger than your expenses.

You can calculate a property’s cash flow using a cash flow calculator, or you can use the simplest cash flow formula as follows:

Cash Flow = Cash Inflows or Income – Cash Outflows or Expenses

But what really is considered a good cash flow when it comes to Airbnb investing, you ask?

Well, in reality, there is no standard rule of thumb as to how much cash flow is considered “good” cash flow. Ideally, any amount of positive cash flow should be considered good cash flow. The bigger the amount, the better. In fact, what makes a cash flow amount good is totally subjective, and it will also depend on your location.

Typically, the best short term rental markets have positive Airbnb cash flow properties. Prime locations that have high market demands get a high occupancy rate—which means that the Airbnb properties in such locations are continuously earning. Plus, the higher the demand, the higher the nightly rate you can charge.

When gauging a property’s income potential, most investors look at either the return on investment (ROI) or the cash on cash (CoC) return.

Using Return On Investment to Determine Good Cash Flow

Some rental property owners calculate the property’s ROI to determine whether or not it generates a good Airbnb cash flow.

You can compute the ROI using a rental calculator or by doing it manually. The formula for calculating ROI is as follows:

ROI = Annual Net Cash Flow / Property Cost

For example, if the short term rental property costs $250,000 and generates an annual net cash flow of $20,500, the ROI is computed as:

ROI = $20,500 / $250,000

ROI = 8.2%

Based on the above example, the return on investment for the property is expected at 8.2%. Now the question is, what is considered a good ROI? Most rental property investors strive for at least 10% ROI—however, a return on investment rate of 8% is not bad. Remember that there are several other factors that determine the profitability of a property, not just ROI.

Using Cash on Cash Return to Determine Good Cash Flow

Another popular way to determine if a property’s cash flow is good or not is by calculating the cash on cash return. With cash on cash return, we take into account the method of financing used. This is because it only calculates the cash you spent to invest instead of the total selling price of the property. It’s why this metric is useful if you plan to acquire the property through a mortgage.

There’s an option to calculate the CoC using cash on cash return calculator, or you can use the following cash on cash return formula:

CoC = Annual Net Cash Flow / Total Cash Investment

Let’s say you bought the property through a mortgage and paid a down payment of 30%, which is equivalent to $75,000. Plus, you invested an additional $10,000 in cash for the closing costs and renovation—this makes your total cash investment equal to $85,000. After paying the bills, including your mortgage, your annual net cash flow is now $4,500.

Given the above figures, your cash on cash return is as follows:

CoC = $4,500 / $85,000

CoC = 5.29%

Similar to other metrics of returns, there is no hard-and-fast rule when it comes to deciding what figure counts as a “good” cash on cash return. Although many real estate investors would agree that a CoC return of anywhere between 8% to 12% is ideal, this does not really apply to all markets.

What Is the 2% Rule in Real Estate?

The 2% rule states that the monthly short term rental income you should receive from an investment property should be at least 2% of the purchase price. This will give you sufficient positive Airbnb cash flow that can help cover unexpected expenses and vacancies during off-peak seasons.

Here’s an example computation of the 2% rule in short term rental investing:

Let’s say the property’s purchase price is $250,000. In order to get enough positive monthly cash flow, you should aim to generate at least 2% of $250,000, which is $5,000 per month. This amount should be enough to cover all your expenses, including your mortgage, as well as other unexpected costs.

It’s important to note that this rule is not set in stone. In fact, finding an investment property that can generate at least 2% of its purchase price is an extreme challenge. When it comes to identifying whether or not an Airbnb property will make a good investment, you should consider several factors like cap rate, occupancy rate, and CoC return.

After all, Airbnb cash flow is influenced by several factors, and therefore, one needs to employ a set of different strategies to achieve positive cash flow. Here are the top six ways that can help you achieve positive cash flow when investing using the short term rental strategy.

1. Find a Profitable Location for Airbnb Investment

Before you buy vacation rental property, you should first search for the perfect location for your short term rental investment. The first thing you should do to ensure that you earn positive Airbnb cash flow is to invest in the right location. After all, your location can either make or break your rental investment, so it’s crucial to study the market well and be selective.

The location of your Airbnb rental property will hugely impact the Airbnb occupancy rate, rental income, and rental property expenses, which will, in turn, affect your Airbnb cash flow. When choosing a location, you need to determine the market demand for Airbnb rentals. Study the short term rental data and trends in the area first to ensure that it is a profitable Airbnb market.

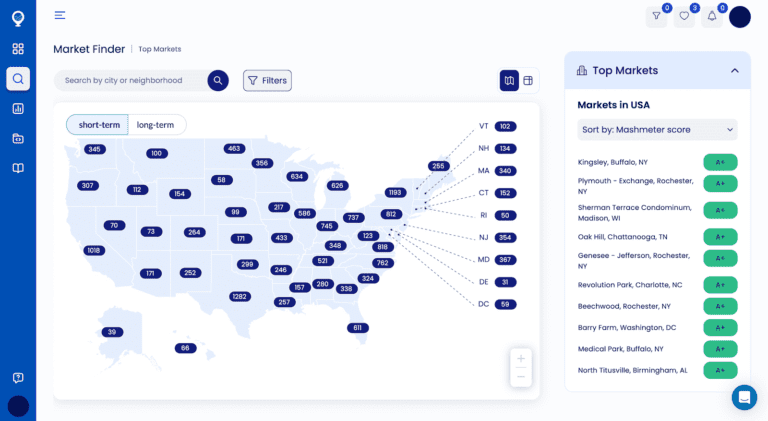

The easiest way that can help you find a good location for your short term rental investment is by using Mashvisor’s Market Finder tool.

What Is Mashvisor’s Market Finder Tool?

Market Finder is a feature in the Mashvisor real estate platform that helps investors determine the potential of an area. To find the best deals in the right short term rental market, you first need to identify the best places for Airbnb investment. The Market Finder tool can help you with this as it allows you to identify high-income markets easily, quickly, and efficiently.

Market Finder provides an overview of the Airbnb market that you are evaluating. You can also access other markets across the United States, allowing you to determine which markets are optimal for short term rental investing. With this tool, you’ll see the hottest investment opportunities in your chosen cities, as well as other locations, even outside of your home state.

Mashvisor’s Market Finder helps you search for a potential city to invest in based on your preferred investment strategy.

Conduct Neighborhood Analysis With Mashmeter Score

Market Finder has a Mashmeter score, which will let you know whether a specific neighborhood is worth investing in or not. This allows you to see the income potential of a particular short term rental market, which is necessary before you decide to buy vacation homes for sale.

With the Market Finder’s Mashmeter feature, you can easily conduct a neighborhood analysis to identify the most profitable area for your chosen rental strategy.

Are you ready to try Mashvisor’s Market Finder to find a positive Airbnb cash flow property? Start your 7-day free trial now.

2. Analyze Potential Cash Flow Before Buying

Positive cash flow is one of the main indicators of a rental property’s profitability. Unless this value is above zero, you will not be making money from your investment property. The best way to ensure that you earn positive cash flow with a short term rental strategy is to run the numbers even before you purchase the property.

You should have an idea of the potential Airbnb cash flow you’ll be able to generate from the property you’re eyeing before deciding whether or not to pursue the deal. Indeed, whether the property will be able to generate positive cash flow should be one of the main drivers in your investment decision. This should be established before you buy any vacation rentals for sale.

As an investor, you should perform a thorough rental analysis before making any decision. When analyzing the profitability of the property, you need to ensure that you get the correct figures that will greatly affect your results. This includes the estimated monthly income and expenses. This lets you calculate the cash flow from an income property accurately.

Remember, the key to finding the best Airbnb for sale is knowing how to accurately calculate the Airbnb cash flow. However, calculations can get complicated when you consider multiple rental properties for sale. This is the reason why most investors prefer to use a real estate calculator.

How to Evaluate Multiple Airbnb Properties For Sale

When you’re evaluating multiple Airbnb properties for sale, a cash flow analysis can help you eliminate any properties that do not meet your cash flow standards for investing. While there’s no magic number that represents an optimal amount of cash flow to earn, you can establish a minimum cash flow based on your financial goals.

The easiest and fastest way to calculate potential Airbnb cash flow—as well as other metrics for the rate of return—for multiple properties is to use Mashvisor’s Airbnb investment calculator. This tool allows you to analyze cash flow and other short term rental investment metrics such as Airbnb occupancy rate, cap rate, cash on cash return, and more.

What makes Mashvisor’s rental investment calculator the best option in the market is that it already provides all the necessary real estate information that you need. Plus, you can trust that the data that the calculator provides is accurate and up-to-date.

The calculator uses Airbnb data from actual Airbnb rental comps as well as Mashvisor’s Airbnb predictive analytics to give you an idea about how much you can potentially make. This tool eliminates the need for Airbnb spreadsheets, which can be time-consuming, overwhelming, and generally prone to error.

3. Create an Eye-Catching Airbnb Listing

The work of a savvy real estate investor who wants to ensure good profitability does not end with buying a property. While the neighborhood and the property analytics may promise you good returns for the Airbnb strategy, another important part of the equation is your ability to acquire bookings.

If you want to earn good Airbnb cash flow from your short term rental investment property, you need to draw in potential guests from the get-go to ensure a high occupancy rate. As you know, your short term rental occupancy rate will greatly influence your Airbnb rental income and, in turn, your Airbnb cash flow.

If you want to maximize your bookings when you are first starting out with Airbnb, you need to create an eye-catching listing that stands out from the rest. Remember that Airbnb is such a popular platform, and many investors are now listing their short term rental properties on this home-sharing technology. This means that the competition gets tougher each day.

The quality of your Airbnb listing will determine whether or not potential guests will book your Airbnb rental over the competition. As a short term rental owner, you need to ensure that your property can catch the attention of interested guests. However, with the pool of listings on the market today, how can you make sure that guests will book your property specifically?

How to Create a Quality Airbnb Listing

It all starts with a creative and high-quality Airbnb listing. Follow these tips to help make your property stand out from the competition:

- Take high-quality photos: There’s a saying that goes, “A picture paints a thousand words”—this remains true when it comes to marketing. When listing your property, make sure to post high-quality photos. Hire a professional photographer to ensure that your rental’s best features are highlighted with good lighting and the best angles.

- Create a captivating headline: Headlines should also be used to lure potential guests into clicking on your listing. Be creative when writing a headline, but keep it precise and accurate. Mention important features like the number of bedrooms and bathrooms, maximum capacity, and special amenities.

- Create a detailed property description: When writing a description for your Airbnb property, make sure to keep it comprehensive and enticing—yet stay truthful and accurate. Don’t forget to include the key amenities in detail, other desirable features, nightly rates, and any other important information that guests may need to know.

- Be straightforward and have good formatting: Always keep the readers in mind when writing your listing copies. Most readers don’t have time to read through long paragraphs. To make your listing description easier to read, and use bullet points and brief statements.

- Aim for good rankings and positive Airbnb reviews: If you want to be a sought-after host, you need to go the extra mile to ensure customer satisfaction. In addition to making sure that your Airbnb guests enjoy their stay, proactively ask them to write you a review afterward.

You may also check out listings of other successful Airbnb hosts in the area and see what they are doing and get inspiration from them. Stay creative and unique with your own marketing strategy.

4. Embrace Dynamic Pricing

A common mistake that novice investors make with the Airbnb strategy is charging the same rate all year round. Unlike long term rental properties, you have to be flexible with short term rentals. Keep in mind that short term rentals are highly seasonal, which means that some months are better than others.

To ensure that your Airbnb business is successful and yields positive Airbnb cash flow, you should embrace dynamic pricing. This means that you should price your vacation rental property based on market demand and seasonality. To do this, you’ll need to update your prices frequently depending on whether it is a high peak or a low peak season.

To remain competitive and maintain a high occupancy rate (which is one of the main factors for cash flow), be sure to look at what other Airbnb hosts in the area are charging. If you are just starting out, charging a slightly lower price than that of your competitors can increase your bookings. After building your reputation, you can gradually raise your nightly rates.

How Mashvisor’s Dynamic Pricing Can Help

Dynamic Pricing is another useful tool offered by Mashvisor that’s designed to help short term rental owners set the correct rates for their Airbnb properties. With Dynamic Pricing, it would be easier for you to determine the best Airbnb nightly rate depending on several factors, such as market demand, holidays, seasonality, and booking history.

The best thing about using the Dynamic Pricing tool from Mashvisor is that you don’t have to manually calculate the best rental rate for your property. What’s more, you can take full control over how much to charge by setting your base price, minimum price, and maximum price. You can also configure your booking settings and availability.

You can trust that Mashvisor’s data sources when calculating the best Airbnb rates are highly reliable and accurate. Mashvisor uses AI-powered technology and machine-learning algorithms to determine the best rate for your short term rental.

What’s more, you will have access to Market Insights so you can assess your competition and see how similar rentals in your area are performing. On top of that, you can keep track of your property’s performance and how it fares against the competition. You can use all these analyses to your advantage.

With Mashvisor’s Dynamic Pricing, you can maximize your returns and never miss any booking opportunity, even during off-peak seasons.

Want to learn more about Mashvisor’s Dynamic Pricing? Book a free demo with our product specialist.

5. Cut Down on Expenses

One of the most important factors that can greatly affect your Airbnb cash flow is the cost of operating a short term rental business. There are Airbnb fees and other rental property expenses that you need to be aware of. These expenses will typically have a huge impact on the amount of cash flow you can earn from your vacation rental investment.

Once you start running your Airbnb business, you need to keep track of all expenses and eliminate any unnecessary spending that cuts into your cash flow. That is why it’s crucial to review your financial reports regularly so you can stay on top of your finances.

Here are a few tips on how to lower your expenses:

- Regular maintenance: Schedule regular maintenance checks to help spot any repair and wear and tear issues before they get too costly to fix.

- Consider refinancing: To lower your monthly mortgage payments, you may consider a cash-in refinance.

- Manage the short term rental yourself: If possible, consider managing the Airbnb rental yourself instead of hiring a professional Airbnb management service.

- Clean the property yourself after bookings: While you can charge a cleaning fee from your guests, you have the option to do the cleaning yourself if it’s feasible for you. This way, you don’t need to pay for a professional cleaning service.

6. Offer Additional Amenities and Services

Offering amenities can help increase your short term rental’s value. If you want to make more money with your Airbnb investment and boost your Airbnb cash flow, consider offering your guests some additional services and amenities at an extra fee.

Apart from directly increasing your Airbnb cash flow, offering additional services will leave a good impression on your guests, which will lead to better reviews.

Here are some extra services you can offer for a fee to earn positive cash flow with the Airbnb strategy:

- Laundry services

- Car rental

- Guided tours

- Bike renting

- Cooked meals

- Airport pickup and drop-off

- Tickets to local events

- Pet accommodation

Bottom Line: Earn Positive Airbnb Cash Flow

Although Airbnb investing could make you more money than investing in long term rentals, it still requires a lot of work and effort for one to earn a positive Airbnb cash flow. To set yourself up for success when it comes to investing in short term rentals, be sure to choose your location carefully.

When evaluating a short term rental market, you can use several real estate investment tools to help you determine whether a particular income property will generate positive cash flow or not. You can use a spreadsheet or rental property cash flow calculator to determine the cash flow of a certain short term rental investment.

However, it’s worth noting that you should not only use cash flow as a basis of profitability. To be sure, use Mashvisor’s investment property calculator to get accurate figures for all metrics, including cap rate, cash on cash return, ROI, occupancy rate, and more. Moreover, follow the above tips to ensure that your short term rental stands out among the competition.

Start searching for a positive Airbnb cash flow property in your preferred location using Mashvisor. Schedule a demo to see how it works.