Buying foreclosed homes in Pennsylvania may seem like a great idea for real estate investors, but it involves a lot of steps.

Foreclosed houses for sale in PA are usually lower in price compared to non-foreclosed properties. So investors do not have to spend a lot of money at the start. This strategy might even help them turn a bigger profit. But if this is your first time buying a foreclosed property, there are things you need to consider before taking action.

First, there is a great deal of risk involved in buying foreclosures. Bank-owned homes are usually sold “as is” without the necessary disclosures that the state requires.

Then, you also have to know about the state laws surrounding the sale of this type of property. This includes looking out for public auction announcements and attending them. Do not forget to have an earnest money deposit on hand when you go.

In this article, you will find what you need to know about buying foreclosed homes in Pennsylvania, such as:

- The definition of foreclosed properties

- Pros and cons of buying a foreclosure

- How foreclosure works

- Steps on how to buy a foreclosed home

Related: Should I Buy a Foreclosed Home and Rent It Out?

Defining Foreclosed Properties

A foreclosed property is one that the homeowner has turned over back to the lender–usually a bank–after they default on the mortgage.

How Does Foreclosure Work in PA?

When a homeowner takes out a home loan in Pennsylvania, they usually sign two documents:

- A promissory note, which states their promise to repay the loan following the agreed-upon terms; and,

- A mortgage document, which gives the lender a security interest in the property. It also gives them the right to sell it in case the original homeowner fails to pay off the loan.

If the homeowner misses a payment, the lender usually charges a late payment fee after the set grace period expires. If they have not paid in 36 days, the lender must call the homeowner to offer loss mitigation options, which are alternatives to foreclosure. After 45 days of missed payment, the lender must send a letter to the homeowner discussing the same options.

But if the homeowner has not made a payment in 120 days, then the lender can start the Pennsylvania foreclosure process. Before that, though, they have to send the homeowner a notice of intent to foreclose at least 30 days before foreclosing. This gives the borrower a final chance to catch up on payments.

If they failed, then the lender must file a lawsuit against the delinquent homeowner. They must also send the homeowner a summons or complaint to serve as notice that they have filed a foreclosure against the property. If the homeowner fails to respond to the court action, then the court will give the lender a default judgment and allow them to hold a foreclosure sale.

Selling foreclosed homes in Pennsylvania is a way for the lender to recover the remaining loan balance. This is why they usually sell these properties at a lower price.

Pros and Cons of Buying Foreclosed Homes in Pennsylvania

The main reason why investors want to buy foreclosed homes in Pennsylvania is the lower cost compared to non-foreclosed homes. However, their lower prices can come with higher risks.

Pro #1: Lower Asking Price

Bank owned homes in PA tend to have lower prices compared to properties that are not foreclosures. This is because the lender aims to recuperate the remaining loan balance that the previous homeowner failed to pay.

Pro #2: Less Competition From Traditional Buyers

When you go to the auction to buy a foreclosed home, the other buyers who will most likely be there with you are investors and house-flippers. A majority of home buyers would want to get a turnkey home. It is unlikely for them to consider foreclosures as they do not want to deal with the possible repairs.

Pro #3: Big Upgrade Potential

Foreclosed homes are popular among house flippers because of their big potential in improving their value. If you are willing to rehab the foreclosure before you sell it or rent it out, you can get even bigger returns from it.

Con #1: “As is” Condition

Banks selling foreclosed properties do not necessarily have disclosure documents that are usually required for non-foreclosed homes. They also would not put in the time doing repairs or touch-ups to increase their value. So if you plan to purchase a foreclosed home, it would be safe to assume that the property you end up buying will require repairs.

Con #2: Less Desirable Neighborhoods

Many foreclosed homes may not be in desirable neighborhoods. And if they were, other interested buyers may have already acquired them sooner and at a higher price. Though they may also come with higher property taxes. So make sure to do further research on the neighborhood before purchasing.

Con #3: Unpaid Property Taxes

Before purchasing a foreclosed home, check for any unpaid property taxes that might come with it. As for liens, you will not have to worry about that. Pennsylvania law requires the lender to make sure that the property is free of any obstruction before they file the foreclosure suit.

Steps on How to Buy a Foreclosure in PA

Purchasing a foreclosure has its pros and cons. If you still want to go through with it, here are the steps on how to find and buy a foreclosed home in Pennsylvania.

Step 1: Search for Properties

There are two ways to look for foreclosed homes in Pennsylvania. The first method is to look for public auction announcements. State law requires that the selling of all foreclosed properties should go through a public auction. The date, time, and place of the auction are usually posted on government websites and your local newspaper.

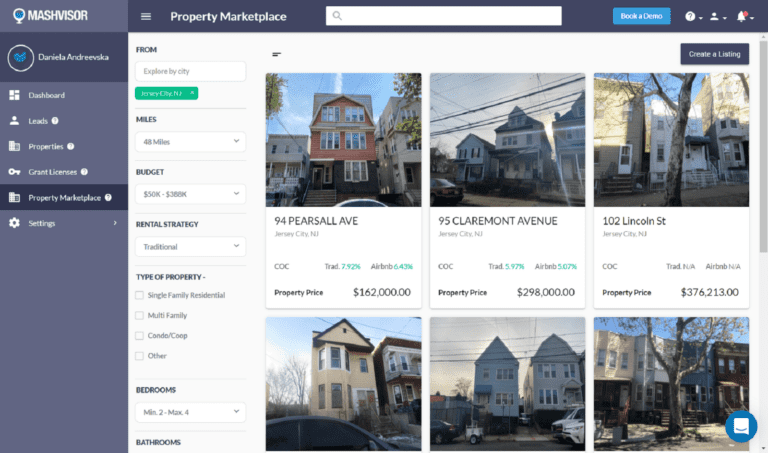

The second method is to search online using a real estate search platform like Mashvisor’s Property Marketplace. This website contains a vast supply of house listings including foreclosures. You can also use this to do your comparative market analysis while you search for a foreclosed property. Simply type in the city or neighborhood where you want to purchase a home, then filter your search to only display foreclosures.

The results will show you a list of foreclosed properties for sale along with their listing price, cash on cash return, cap rate, and more. Mashvisor will also show you its analysis of the neighborhood, so you can determine if it has potential for Airbnb or traditional rental opportunities.

When you find a home that you like, find out the requirements to secure it at auction. You can do this by contacting the lender’s representative, the trustee, or the sheriff. Most of the time, they only ask for an earnest money deposit in the form of a cashier’s check or money order. You can also try to schedule a site visit, but this is not always allowed especially if the home is still occupied by the previous owner.

Related: Mashvisor Property Marketplace: Investors’ Guide

Step 2: Finance Your Purchase

Unless you can buy foreclosed homes in Pennsylvania with cash, you need to find a lender who will finance your purchase. The best way to do this is by getting pre-approved for a mortgage.

Lenders are more sensitive when dealing with foreclosures, so make sure that you have good credit standing when applying for a loan or putting in an offer for a foreclosed home. Also, feel free to shop around for a lender that can give you the lowest possible interest rate and loan fees.

In the pre-approval process, the lender will check your credit to determine the amount they can lend to you. Once they clear your pre-approval, you will get a letter from the lender that states how much you can spend on a home. Use this document to set you apart from other buyers.

If a bank owns the foreclosed home you are buying, they might ask for you to get pre-approval through them to verify your eligibility. You do not have to take out a loan with them, so just to do as they asked but keep the pre-approval letter of the lender you actually want to work with.

The bank or government agency selling foreclosed homes prefer dealing with buyers whom they know can afford to purchase their property. They will not need to wait for you to get a loan after they accept your offer. Instead, they can close the sale quickly thanks to your pre-approved status.

Step 3: Make an Offer

When buying a foreclosure in PA, you will have to go to an auction that takes place in a courthouse, the county clerk’s office, or online. If you found the property you like on a real estate website, check the description to find details about the house and where they will auction it. Read it carefully, and if you have any questions, you can contact the seller’s attorney or whoever is running the auction.

On auction day, whether it is on-site or online, it is best to be early and prepared. On-site auctions run a traditional bidding situation where the representative accepts bids that are then raised in increments. When no one else increases their bids, the seller will then award the property to the highest bidder.

Meanwhile, online auctions have different processes depending on the website that is holding the auction. But the most common process is live online bidding. It is similar to on-site auctions where you will bid at or above the increments stated on the page of the property you wanted to buy. But unlike on-site auctions, there is a set time limit for interested buyers to place their bids. You can also place a new bid as many times as you want.

Related: The Real Estate Investor’s Guide to Buying a House at Auction

Step 4: Do a Home Inspection and Close the Deal

The last step in how to buy foreclosed homes in PA is closing the sale. Once you have successfully bid on the property you wanted, consider doing a home inspection to check for any serious issues. Pennsylvania law requires the National Home Inspection Association to do all home inspections.

Because they sell foreclosed homes as-is, you will have to cover the inspection costs and pay for any repairs needed. Unfortunately, you cannot walk away from a foreclosed home that you won at an auction just because it had too many issues. That is the number one risk when purchasing this type of property.

When you get the results of the home inspection, you can then start the closing process with the home’s realtor and the title company who will transfer the title to your name. At this point, you should not have to worry about having someone else lay claim to the foreclosed property. The seller should have run a title search on the house and made sure that it is free of any liens or other encumbrances before they started the foreclosure process.

Buying Foreclosures Is a High-Risk, High-Reward Investment

Overall, buying foreclosed homes in Pennsylvania is similar to purchasing a regular home except it entails more risks. You are unlikely to be able to inspect the property, so you might end up buying one that has serious issues.

However, the reward potential is big: because they sell foreclosures below market value, you do not need to take out a large amount of money to secure the property. And if you put in the work in rehabbing the home, you can enjoy high returns when you resell it or rent it out.

When you are ready, search for foreclosed properties using online platforms such as Mashvisor. Then make sure you have the funds available, whether it be your own cash or a pre-approved loan. Come auction day, prepare for a lot of hand-raising or clicking the bid button until you successfully get the home you want.

You should then have a home inspection to find out what parts you need to repair before you finally close the deal with the seller. Once the title is in your name, you can start renovating the home so you can make money out of it.