You browsed the real estate market for quite a while now—and finally, you’ve picked out the perfect property for you. It has everything you need, and you want to set foot in as soon as possible.

But then reality hits: You still have an entire financing and mortgage process to go through—and it’s anything but simple to navigate.

One of the things you have to get done is underwriting, which can be automatic or manual.

In this article, we’ll focus on the manual and see how it works in practice.

What Is Mortgage Underwriting?

Before we discuss the details of manual vs. automated underwriting, we should look at the bigger picture first – and try to explain what mortgage underwriting is.

In simple terms, mortgage underwriting is defined as the process where the lender evaluates the risks and determines if you qualify for the loan – and how likely you are to pay off the mortgage.

You’re required to submit documentation to your underwriter, who then reviews it in detail and determines whether your current financial situation – among other factors – can handle the mortgage in question.

As a potential borrower, you are met with automated and manual processes.

As the name implies, automated underwriting is handled by a computerized system. It needs much less input information to compile your financial report and determine if you do meet the lender’s standards or not.

The lender can then check the results and give you the final decision – but the system does most of the heavy-lifting, making the process faster and more efficient.

This type of algorithm-based underwriting isn’t limited to mortgages only; it can be used for other kinds of loans, as well.

Okay, this was just a brief intro to help you understand what we’ll be discussing today – and what your options are.

The main focus, however, is on the manual version of the process.

What Is Manual Underwriting?

Unlike automated underwriting, where the algorithm handles the entire process and makes a decision, manual underwriting is done by hand. This means your application is viewed by an actual person, not computer software.

There are circumstances where the lender might opt to underwrite your loan manually—the two most common ones being:

- The application got a “refer” recommendation from the automated process and has to be reviewed outside of the Automated Underwriting System (AUS)

- The borrower has unique financial circumstances but is otherwise in a good position to qualify for a mortgage

Here’s one plausible and realistic situation.

For example, suppose the borrower has had financial problems and even accumulated debt. In that case, working with an underwriter is arguably the best way to deal with their situation—and help the borrower obtain the mortgage.

On a similar note, if you fear that the algorithm will misinterpret your current financial situation—that can happen—you can rely on the manual approach.

What Does The Underwriter Do?

As we mentioned previously, an underwriter is a qualified individual who manually reviews the borrower’s application, assesses the risk, and evaluates whether the borrower is eligible for a loan.

An underwriter works for a financial organization—such as a loan, mortgage, insurance, or investment company—and evaluates assets and financial status.

In this particular case, based on their findings during the risk assessment, you can either be approved or denied a mortgage loan.

An underwriter’s job carries a lot of responsibility. Because they determine the borrower’s credibility and help them qualify for a mortgage, they can be held responsible if the contract turns out to be risky.

What Is Evaluated During the Underwriting Process?

Everything the underwriter reviews and evaluates can be categorized into three distinct groups, known as the 3 Cs of underwriting: credit, capacity, and collateral.

Credit History & Payment Records

Your credit reputation is arguably the most critical factor in determining whether you qualify for a loan.

Your credit report and how you handled repaying debts in the past are considered and examined thoroughly.

They’ll look for foreclosures, liens, bankruptcies, and mortgage and credit delinquencies. A history of consistent, on-time payments is always a good indicator of a responsible borrower.

Even more so, a good credit score is generally the most significant factor in getting better mortgage terms.

If you don’t have anything on your credit report, proof of other on-time payments—rent, utility, and insurance payments, for example—can all be reviewed.

Capacity (Your Income & Assets)

The second crucial factor the underwriter will check when evaluating your financial situation and ability to repay the mortgage is your payback capability. In short, they’ll check your income and assets (bank statements, 401(k), and IRS accounts) to work out your debt-to-income ratio.

The goal is to ensure that you’re in a stable financial position, that is, that your income will be enough to cover your current obligations and mortgage payments—should you get approved, of course.

A higher DTI and recurring financial liabilities will imply that your budget is already stretched out each month.

In most cases, at least two years of stable income would be desirable before qualifying.

A stable source of income is crucial here—and in most cases, the underwriter might contact your employer. If you’re a self-employed business owner, you will probably need to attach supporting documentation to your application.

They’ll also check your liquid cash reserves to ensure that you can cover the closing costs and make a down payment.

Collateral

Finally, checking your “collateral” is another part of the underwriting process. It focuses on the actual value of the property you’re taking out a mortgage loan to purchase and your down payment.

The lender wants to ensure that they approve you for a loan amount that is less than—or equal to—the property’s value. At this stage, they will likely request an appraisal of your property to verify its condition and estimated value.

They will use this information to determine your loan-to-value ratio; anything above 80% is considered high-risk, and you might be required to purchase lenders’ mortgage insurance.

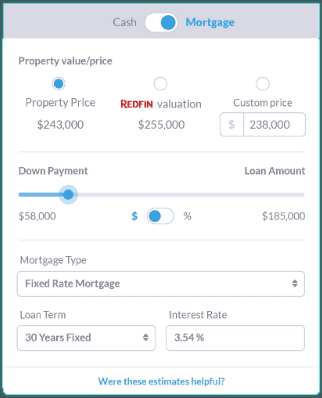

Consider using our Rental Property Calculator to handle all your ROI calculations regarding real estate financing.

Mashvisor’s mortgage calculator—Rental Property Calculator’s built-in feature—can provide the necessary insights to make more innovative financial investments based on the loan amount and preferred investment strategy.

The 5 Steps of the Underwriting Process

The point is to give you a realistic picture of what you can expect during the manual underwriting mortgage process. To do that, we also have to walk you through the five stages of the underwriting process, as outlined below.

-

The Preapproval

The preapproval phase is the first one, and it can imply different things. To determine whether you are “preapproved” or not, manual underwriting lenders have to review your financial records—specifically, the ones we’ve mentioned earlier.

You should know two terms within this first step: prequalification and preapproval.

Being pre-approved indicates that you’ll be approved for a certain amount of financing—not necessarily the total amount—as long as your conditions don’t change.

On the other hand, being “prequalified” is more of a general indication that you’ll probably be approved should you decide to apply formally.

-

Verification

This part should go without saying, but you must ensure that the documentation regarding your financial status, income, and other assets is accurate. At this stage, lenders will be verifying your financial records.

Some lenders will even require 12 months’ worth of bank statements and, more often than not, several years’ worth of tax records in addition to other documents.

Also, your retirement funds and the value of your insurance policy—if you have one—can be reviewed for this purpose.

The underwriter has the right to check this information and verify it on the following accounts:

- Sudden inflation in your income that does not correspond with the current job

- Any suspicion of fraud

However, some might still try to cheat when applying for manual underwriting home loans, thinking they could avoid verification. Some of the most common false information includes inflated salaries, inaccurate residency, or no reporting debt.

The consequences are severe. Those who try to mislead their lender could face charges and even jail time.

-

Appraisal

Okay, let’s imagine the best possible outcome. You found the property you wish to purchase, and you’ve been preapproved for the loan. Now what?

The next step would be appraising the property.

As we explained earlier, it’s not uncommon for manual underwriting mortgage companies to request an appraisal. Again, this has to do with your collateral and loan-to-value ratio. The lender must ensure you’re not borrowing more than the property is worth.

The goal is for the mortgage lender to be protected against lending more funds than it could recover in the worst-case scenario.

The appraisal report contains all information regarding the property, including square footage, sales data, current condition, and so on.

-

Title Search

To sum up, loans will not be approved if the property has legal claims on it. That’s why the lender must also perform a title search and ensure you can transfer the real estate property.

They’ll research the property’s history, claims, liens, pending legal actions, unpaid taxes, and the like. And yes, all of this can affect whether you are approved for a mortgage.

Following the title search, an insurance policy is issued to guarantee accuracy. That said, in some cases, two policies—one protecting the lender and the other covering the property owner —will be issued.

-

The Decision

After lengthy and comprehensive research, we’ve reached the final stage of the underwriting process—the decision-making part. Now, it’s time for the underwriters to finalize your loan application and decide whether you qualify for a mortgage.

There are three possible outcomes you can expect here:

- Denied

- Suspended

- Approved (with conditions)

Denied

The underwriter could deny your loan application for reasons such as too much debt, a poor credit score, or insufficient funds. But getting denied does not close the door for you.

You can take steps to improve your financial situation and apply again in a couple of months, preferably for a smaller loan.

Suspended

If your application has contingencies or the underwriter couldn’t verify specific points of your documentation—such as your income or employment—your application might be suspended.

If your application is suspended, the lender will let you know if you can proceed with it by providing additional documentation.

Approved (With Conditions)

Of course, the best-case scenario is where you’re approved for a mortgage. Here, the “conditions” part means that your underwriter will approve your mortgage if you meet their pending conditions.

Some common approval conditions include proof of mortgage insurance, additional income or bank statements, business licenses, and marriage certificates.

How Long Does The Process Last?

There is no fixed period here. The underwriter’s turn time depends on many different factors, like the complexity of your loan file and whether you need to provide additional information.

As we said, it’s not an automated process, so it might take longer than you expected.

Is Manual Underwriting Bad?

No, quite the contrary:

Working with an underwriter can be incredibly helpful because some circumstances and information can’t be accurately processed if you choose the automated method.

However, this is not the only advantage of the manual approach.

What Are Some Other Advantages?

Since this is a hands-on process, it gives the borrower more hope that their situation will be viewed from several angles. As such, it may be the preferred approach in cases where the borrower:

- Has a low credit score

- Has a minimal credit history or lives debt-free

- Is self-employed

- Has had financial problems in the past

If you belong to one of these borrower categories—and this is, by no means, an exhaustive list—know there’s a high chance that you’ll have to go through the manual process.

To Summarize

The mortgage underwriting process can be divided into automated and manual. The manual method involves an on-hand process handled by your underwriter.

Their job is to evaluate your financial information, including your credit card score, assets, bank statements, and credibility, and determine whether you qualify for the mortgage.

The process consists of five stages—from pre-approval to property appraisal. However, the main point is that you remain truthful about your finances and provide the underwriter with all the necessary documentation.

You can be denied, suspended, or approved with conditions. Whatever happens, don’t get discouraged; you can almost always try again.