When it comes to the short-term rental market, New York City has a wealth of opportunities. It happens to be one of the country’s biggest markets and has a top ten place in the list of most important markets for Airbnb.

However, if you’re looking for an Airbnb investment property and New York City is on your list of locations, you need to understand the NYC Airbnb rules. While there is no New York Airbnb ban, the city does make it exceedingly difficult. NYC Airbnb rules are pretty rigid on short-term rentals and other comparable properties.

If you want to invest in an Airbnb investment property in New York City, you need to know the answer to one especially important question, “Is Airbnb legal in NYC?” In this post, we’ll look at the different NYC Airbnb rules as well as some other helpful information, so you can better understand Airbnb laws.

NYC Airbnb Rules: Short-term Rental Regulations in NYC and the Multiple Dwelling Law

When it comes to understanding the NYC Airbnb rules, an excellent place to start is with the New York State Multiple Dwelling Law, or MDL for short. According to MDL, Article 1, Sections 4-7, 4-8a, a building that contains three or more dwelling units is classified as a Class A multiple dwelling.

According to the law, Class A multiple dwellings must be occupied for at least thirty or more consecutive days by the same individual or group of people independently.

The lease is illegal if a multiple dwelling is occupied for less than thirty days. However, there is an exception to this rule. It doesn’t apply if a “permanent resident” of the dwelling is present during the entire rental period (not including corporate hosts).

The MDL also prohibits any form of advertising for short-term rentals, including Airbnb listings or other online short-term rental platforms. The fines for breaking the rules are pretty steep, ranging from $1,000 to $5,000 to $7,500 for first, second, and third infringements. In addition, both individual hosts and the rental platform can be fined, which is serious.

Also included in the MLD are Class B multiple dwellings. These are multiple dwellings that are occupied transiently. The class consists of lodging houses, hotels, lodgings, rooming/boarding houses, and clubhouses. It also includes private homes occupied by one or two families with five or more transient boarders in one household. These properties are not generally subject to MDL regulations.

Other NYC Airbnb Rules to be Aware Of

If you’re wondering, “Can you Airbnb in NYC?” there are other NYC Airbnb rules you need to be aware of.

Certificate of Occupancy or CO

All residential buildings in NYC must have a certificate of occupancy. If there is already a CO for a building you’re interested in investing in, you can check its validity at the New York City Department of Buildings website.

If there isn’t a certificate of occupancy, you’ll need to get one before you start using the building as a short-term rental.

Business Licensing

A business license may be another requirement. You can find out whether this is necessary by visiting the New York City business portal or the New York City business regulation finder.

Rent Control Laws

Whether the property is rent-stabilized or rent-controlled is something else you’ll need to determine. You can find out whether it’s possible to rent this type of property short-term by checking out The New York Administrative Code rules. Rent stabilized properties are under Section 26-501-26-520, while rent-controlled properties come under Section 26-401-26-415. Alternatively, you can contact your local rent board for further guidance.

If you live in a rent-stabilized unit, such as a co-op, there may be restrictions on how much you can charge for an Airbnb rental. In general, those living in rent-stabilized buildings are discouraged from becoming Airbnb hosts. In addition, even in situations where laws are followed, many landlords frown on having their buildings used for Airbnb rental purposes.

Even if your co-op doesn’t have specific rules against short-term leases and using your unit for Airbnb hosting, you might still ruffle your landlord’s feathers or those of other tenants who grow tired of seeing non-residents coming in and out of the building.

Taxes

Properties meant for transient occupancy, or tourist use may be subject to multiple taxes that are imposed by New York City and New York State. You’ll find the information you need on the New York State Department of Taxation’s website.

Zoning Laws

For more information about areas where transient rental buildings are permitted, you should consult the New York City Zoning Code.

Lease Restrictions

If you’re already living in a property that has a residential lease and you’re considering starting a short-term rental there, you’ll need to get your landlord’s permission. This is for rental arbitrage purposes.

It’s advisable to ask the landlord to put their permission in writing. Having permission written in a legal document will avoid problems in the future. For example, if you violate your lease by engaging in unauthorized rentals, you could face eviction.

Condominiums and Single-Family Homes

State laws take precedent if you’re thinking about renting out your condominium as an Airbnb. If your condominium is located inside a Class A dwelling, you’ll still be unable to conduct any unhosted rentals for less than 30 days.

Your condominiums HOA may also have specific bylaws in place that make it difficult to become an Airbnb host. For example, some have minimum/maximum lease terms or expressly prohibit the use of units for vacation rentals.

Things are a little simpler for anyone with a single-family home in New York City. For example, the state’s Multiple Dwelling Laws won’t affect you. However, zoning restrictions may complicate your plans. For example, specific building codes may need to meet the legal requirements of a “rooming house.” Your Certificate of Occupancy will stipulate what type of zoning restrictions are in place for your property.

Airbnb and New York City Have Some History

Airbnb and New York City have a bit of a turbulent history. Things started getting sticky in August 2018 when New York Mayor Bill de Blasio signed the Homesharing Surveillance Ordinance.

The Ordinance required that rental advertising sites, including Airbnb, provide information to the Mayor’s Office of Special Enforcement relating to hosts and their listings. One of the roles of this office is checking for illegal short-term rentals.

Understandably, Airbnb was not happy about this and sued the New York City Council in court. Airbnb claimed that the law violated the free speech guarantee of the First Amendment and Fourth Amendments to the US Constitution and the Federal Stored Communications Act.

Airbnb decided to dismiss its federal lawsuit in 2020 because the law was amended. The law now states the following:

- Reporting of the required data is now quarterly rather than monthly.

- Listings that must be included in the data are those that offer short-term rental of an entire dwelling unit or short-term rental for three or more individuals at the same time.

- Listings that rent a dwelling unit or housing accommodation for four days or less don’t have to be reported.

NYC Airbnb Rules Include the Sharing of the Following Data

Airbnb will always ask for your consent before they share your data with the City. if you agree to them sharing your information, the following will be provided to the city:

Host and Co-Host Information

- Name

- Physical address

- Phone number

- Profile ID number

- Profile URL

- The total amount the platform transmitted to the host

- The account name and identifier for the account used to receive payments

Listing Information

- Physical address

- Listing’s name

- Listing ID number

- URL of listing

- Type

- Total number of nights booked per listing

Hopefully, you’ve not found these NYC Airbnb rules too off-putting. If you’re still set on becoming an Airbnb host in New York City, let’s share some more valuable tips.

Potential Fines and Penalties for Violating NYC Airbnb Rules

Specific fines and penalties for illegally renting out a dwelling in New York City vary considerably. For example, an MDL violation could easily result in a fine of up to $2,500 per day. As of October 2016, it’s also against the law to even advertise illegal rentals. If you get caught, you can expect to face fines of between $1,000 and $7,500, depending on the number of violations you’ve already had. Airbnb can also be charged these fines for allowing you to advertise on their platform.

The Benefits of Becoming an Airbnb Host

- Additional Income: Rent out extra space in your home, and you can earn extra money that may help offset your mortgage costs or monthly rental.

- Versatility and flexibility: You can choose to rent your place out during peak times of the year or offer rentals year-round. It’s down to you to decide what suits you best.

- Meet new people: You’ll have the chance to host new guests in your home on a regular basis. You’ll also be able to act as a “tour guide” by making recommendations around the city.

Possible Drawbacks of Becoming an Airbnb Host

- Unpredictable income: Demand for rentals can fluctuate tremendously, and so can your income from hosting an Airbnb.

- It’s demanding work: Communicating with renters and finding potential renters can take up a lot of your time. You’ll also need to be in frequent contact with them, and when they come to stay, they may need to get ahold of you with questions and requests.

- You’re opening your home to strangers: This can be a bit of a risk, even when they’re paying for their stay. Not all guests are as clean and courteous as you’d like. You may also have some cleaning to do when they leave.

- Some cities have strict regulations: New York City is a prime example, as you’ve just discovered.

Making the Most of Your Airbnb Rental in New York City

If you’ve decided to become an Airbnb host in New York City, you might be wondering where to start when it comes to finding the best Airbnb investment property.

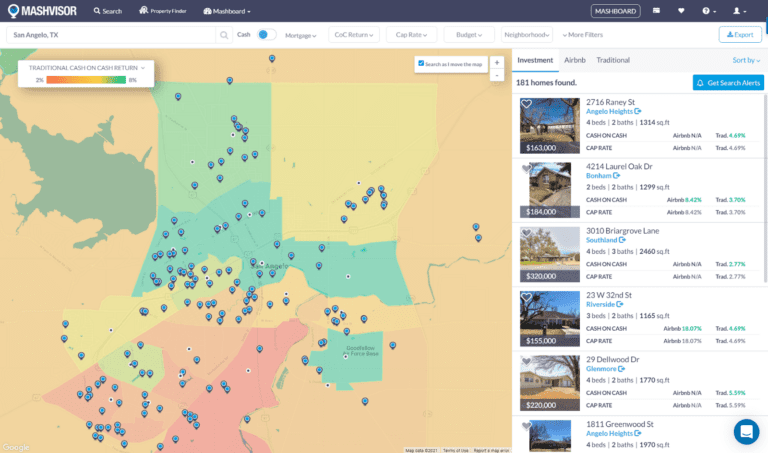

Mashvisor’s Real Estate Heatmap is a tool you can use to conduct neighborhood Airbnb market analysis and zero-in on profitable markets to invest in. It will give you data on Airbnb demand, identify areas with the most affordable listing prices, ideal cap rates, and the highest rental income. In addition, Airbnb market data such as cash on cash return and Airbnb occupancy rates will also be included.

Stay on Top of Changing Laws

It’s crucial that you stay updated on new laws and changes to existing laws. You don’t want to commit any violations as an Airbnb host.

Have a Plan for Maintenance Issues

It’s wise to have an experienced contractor or handyman on-call so you can address any maintenance issues quickly during your guest’s stay. For example, if a pipe springs a leak, you’ll want to be able to take care of it promptly and efficiently.

Know How Much to Charge

Airbnb allows you to charge as little or as much as you want for your rental, but there are some factors worth considering when it comes to pricing your property. An excellent place to start would be to look up current prices for similar rentals in your area. Then you can use the Mashvisor Investment Property Calculator to stay on top of your finances, fine-tune your costs and view readily calculated returns.

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here.

Make Sure Your House Rules are Clear

You can avoid issues with your guests by writing out a specific set of house rules. For example, include policies on things like pets, children, noise/quiet hours, and similar things.

NYC Airbnb Rules: Final Thoughts

Becoming an Airbnb host in New York City requires some specific knowledge of state, city, and NYC Airbnb rules. However, as long as you understand and abide by these NYC Airbnb rules, as well as those set by your HOA or landlord, you should be set to enjoy all the benefits of being an Airbnb host in the Big Apple.