Short term rental investment is a competitive industry, so you need to act smart to maximize your profits. Here are 10 tips to achieve that.

A short-term rental is when you rent out a residential property for 28 days or less. Homeowners usually rent out a part of their primary residence (either a room or an additional dwelling unit) to earn extra income. But as Airbnb became popular, short term rental properties are now part of a $63-billion industry.

Are short term rentals a good investment? Yes, they are. In fact, they can be three times more profitable than a traditional lease. They also provide a lot of advantages, such as not having to deal with long-term tenants. The one caveat is that you have to put in a lot of effort and proper management, especially in the beginning.

Before you commit to this type of investment, you must first determine whether your property will be profitable. To do this, you have to look into the location, applicable local laws and regulations, marketing strategy, and more.

In this blog post, we count 10 valuable tips to help you maximize profits for your short term rental investment. Keep reading if you are:

- Looking for valuable information before buying your first property; or,

- Finding more ways to improve your property’s performance.

Mashvisor’s 10 Tips to Have a Profitable Short Term Rental Investment

#1: Accept That a Short Term Rental Investment Is Not Exactly Passive Income

Investing in short term rentals is not as passive as many would believe. When you are starting out, you need to put in a lot of work, at least in the first year or so. Your efforts should not end after buying the property, remodeling it, and listing it online. You must also market it to get bookings.

This may involve:

- Setting your daily rate a bit lower than your more established competitors

- Responding to prospective guests’ inquiries within 15 minutes

- Encouraging your recent guests to leave a positive review on your page

Once you have five-star reviews and are booking nine out of 10 days in a month even after raising your rate, you may choose to allot your time elsewhere.

You may also decide to hire a property manager to handle your hosting duties on your behalf. Doing this will cut your profits. But it would free up enough time for you to explore other investment opportunities that would increase your income even more.

#2: Invest in the Right Location and Short Term Rental Investment Property

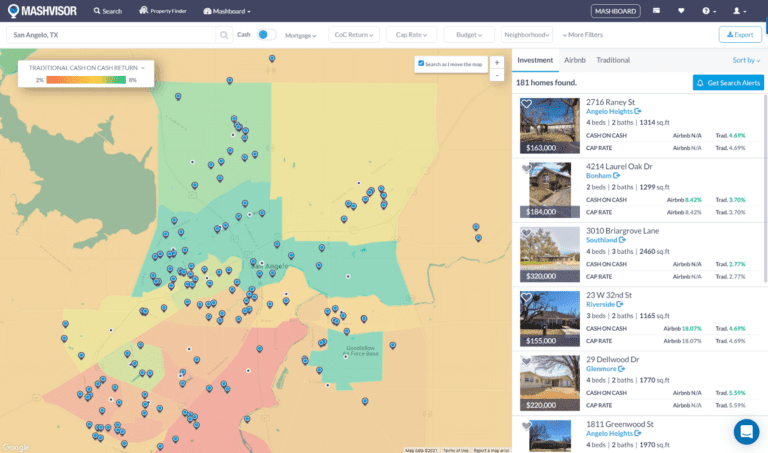

Not every location is lucrative for short term rental investment. If you use Mashvisor’s Property Search and activate the heatmap, you will find that some neighborhoods are better compared to others. This is why it is important to do your due diligence and use tools that help you find the most lucrative place to buy short term rental property.

When thinking of the right location, the first thing on your mind may be vacation destinations like New York or San Francisco. Tourists going to these places may favor short-term rentals for their competitive rates. But these areas tend to be so saturated with vacation homes that you are likely to get lower profit margins than you would expect.

You should also look up the local laws and regulations surrounding Airbnb investment property. Some cities and towns have outright banned these or restricted them to owner-occupied residences only. The cities of New York and San Francisco are prime examples of heavily regulated areas. And even if the city you chose allows it, the HOA of the community where you wish to buy may have rules against short-term rentals as well.

#3: Stay Organized

You will be running this short term rental investment yourself in the beginning. So you will have to deal with screening your guests, maintaining the property, and more. While this may look manageable at first, you may get overwhelmed by your daily tasks once you are welcoming new guests several times a week.

Before you get to this point in your operations, make it a habit to keep your records straight. Track your property taxes, bills, permits, and other concerns related to your Airbnb income property.

Once you can afford to hire someone to help you, be it an assistant or a property manager, you can then turn over these tasks to them. And because you know what they are doing, you will feel confident about how things are going and can catch anything that they overlooked.

You could also find a mentor who could guide you along the way. This is especially helpful to beginner investors who know someone who can teach them how to manage a short-term rental.

#4: Optimize Your Daily Rate As Often as Necessary

With traditional rentals, you have to stick to a fixed monthly rate for the duration of your lease agreement with the tenant. But when you have a short term rental investment, you can change your rate as often as every day. This is called “dynamic pricing strategy”. Here, you adjust your rate based on account timing, local supply, Airbnb demand, and other factors.

Before dynamic pricing became a thing, owners used to set their rates in advance. But doing this causes you to lose out on the opportunity to book more guests or maximize your profits. By analyzing real-time market data, you can adjust your price in response to supply and demand. You can use Airbnb’s built-in tool to adjust your rates based on these factors. But there are also third-party tools that provide a more customized and data-based approach.

When you are starting out, it makes sense to set your rates lower than your competitors’. But once you are getting a 90% occupancy rate, you can start increasing your price until your returns have stabilized.

#5: Look Into Your Guests Before Confirming Their Reservation

It is important to screen your potential guests before accepting their booking. This is to make sure that both of your experiences will be pleasant during their stay. On Airbnb, you can check their profiles to get to know them more. Their profile pages also contain reviews from previous hosts that they have stayed with. These will tell you what they are like as guests and whether they can follow your house rules.

You may also want to avoid people booking your short term rental investment as a party venue. To do this, you might have to take more extreme measures than communicating your house rules.

One of these steps is to set a higher starting age limit–about 28 to 30 years old–so you can only accept more mature guests. Implementing at least a three-night stay would work as well. And make sure to charge fees for cleaning and any extra guests. If you can, install a camera on the outside of your Airbnb income property to watch how many people are coming and going.

While these measures may lower your occupancy rate, you would at least be sure that you are only hosting high-quality guests. Otherwise, you are putting yourself at risk of property damage or even issues with your neighbors, the HOA, or your municipality.

#6: Market Your Short Term Rental Investment, Especially in the Offseason

It is easy to make money when your short term rental investment is getting booked every day, but what about during the off-season? If you want to keep getting bookings during low periods, then you need to be more creative with your marketing efforts.

One way to do this is by figuring out what kind of guests would book your property during the low season and market to them. For example, you could reach out to creative types who are looking for a quiet area where they can finish their project.

Another method is to try offering something that your competitors do not. This could be a lower price or more unique amenities. You could also highlight the location of your property if it is better than the other available listings.

It is also a good idea to pay attention to local events, no matter how small they are. Make sure to mention these events in your listing description, include them in your photos, or even add a word or two in your headline. And try reaching out to the event organizers to recommend your space. You could also offer to advertise on their marketing collaterals and websites.

#7: Provide Exceptional Customer Service

Good customer service is the key to success in the short-term rental industry, as guests now expect the same experience they would get in a high-end hotel but at a lower cost. No matter how many bookings you are getting in a week, you have to make sure that you meet your guests’ needs so they would have a great experience and leave a positive review.

If you happen to invest in a tourist hotspot with a lot of competitors, then you have to go above and beyond to please your guests. A great way to do this is to give them a welcome letter that contains extra information about the area. You must also make sure to always respond quickly and in a friendly manner.

Because of how critical this is, you may want to get help for this specific task especially if you have more than one rental home. Be sure to hire someone who is a people person and can deal with difficult guests.

#8: Reach Out to Your Previous Guests

Having returning guests is a great way to keep your occupancy rate up. If there is a major event coming up, reach out to your previous guests and give them “priority access” to be the first to book your property.

During the low season, you could give them a discount or deal that is exclusive to returning guests only. You could also do a referral campaign by giving them discount codes that they could hand out to friends and colleagues, and then reward them for every successful booking they refer. If the guests you reached out to had a good experience at your place, they would be willing to return or recommend your property to their network.

If your rental home attracts business travelers, build and maintain a good rapport with them as they are likely to return to the area and would need a place to stay. And if they do book your property a second or third time, give them a token or offer an amenity that they have not had in their previous stay. This could be a personalized message, a flower arrangement, or a supply of premium snacks and beverages.

#9: Create a Maintenance Schedule

Unlike traditional tenants who would be responsible for cleaning the rental property, guests of short term rentals expect the place to be clean and well-maintained. Keeping your rental home spotless will get you great reviews, which would then lead to more bookings.

The best way to stay on top of your property’s upkeep is to create a maintenance schedule instead of only doing it once problems start to occur. This is especially helpful when you have to outsource these to professionals as you likely have to book their services in advance. If you do not practice scheduled maintenance, you might have to temporarily suspend your operations and not accept bookings so you can deal with the needed repairs.

The first step to doing preventive maintenance is to inspect your short term rental property on a regular basis. If you live close to your investment, do this once a week or every other week, especially if it has been booked for all seven days. But if your property is out of state, a monthly inspection would do. You could also hire a property manager to do the inspections on your behalf so you do not have to include your travel in your business expense.

#10: Take Advantage of Tax Deductions

One way to increase your profits is to reduce your overhead costs, which includes taking advantage of any tax deductions and credits that you may be eligible for. For example, you may be able to deduct all of your expenses related to your property, which can help lower your tax liability. These expenses may include the new custom towels you bought for your guests, any remodeling projects, and the bottle of wine you leave as a welcome gift.

You can also deduct from your tax liability the service fee that Airbnb and other rental platforms charge. It is a business expense, after all.

And even if you find that you do not qualify for any tax benefits, you would still want to keep flawless records of your rentals. This way, you will have a much easier time dealing with tax issues related to your investment. You should also provide the short-term rental platforms your W-9 form or they will withhold a full 28% of your rental income. Lastly, be sure to talk to your accountant about this; they usually know how to legally reduce your taxes.

Conclusion

Short term rental investment can be more lucrative than a long-term rental, but you have to learn how to manage it properly. To recap, here are 10 tips to make your property profitable:

- Accept that it is not exactly passive income.

- Invest in the right location and property.

- Stay organized.

- Optimize your daily rate as often as necessary.

- Look into your guests before confirming their reservations.

- Market your rental well, especially in the off-season.

- Provide exceptional customer service.

- Reach out to your previous guests to encourage repeat business or referrals.

- Create a maintenance schedule.

- Take advantage of any tax deductions you are eligible for.

If you need help finding the right property, we recommend using a real estate investment tool like Mashvisor’s Property Finder. With this tool, you can find the best-performing rental homes in up to five markets of your choice all at once. There will be no need to open multiple tabs on your browser. The resulting properties will then be sorted and displayed starting with the highest cash on cash returns.

This is how savvy real estate investors using our platform manage to find their next investment property in 15 minutes without leaving their desks. You can try it for yourself by clicking here to sign up for a 7-day free trial of Mashvisor today, followed by 15% off for life.