Pro forma real estate is a way to analyze a potential investment property to make sure that it will generate high returns.

There is a lot more than just buying rental property when it comes to real estate investing. While many may think of it as a pretty straightforward investment, there are many proforma real estate calculations a property investor needs to go through before even buying the property to ensure its profitability.

From the property price and mortgage to rental income and cash on cash return, they are just a few of the necessary considerations that need to be taken when investing in real estate. Without a proper real estate property analysis or investment analysis, there is no real way to say that a single property will offer you a decent return on investment. In other words, real estate investors need to do a pro forma real estate analysis.

What Does Pro Forma Mean in Real Estate?

Before committing your purchase of an investment property, it is important to perform a pro forma real estate analysis to determine if the unit is worth investing in.

In business, pro forma documents refer to the estimated predictions of your future expenses and income. While the term is not as popular in the business of selling and renting properties, its definition in real estate is quite similar. Pro forma meaning in real estate, in the simplest terms, is a document that analyzes the profitability of a potential investment by comparing the known constant expenses of buying and maintaining the property against its potential income generation.

Using historical data on the property and area, pro forma real estate documents will compare projections and assess the possible framework regarding your property’s future financial state. While many expenses come with buying and owning an investment property, proforma real estate calculations usually include major and recurring expenses.

Think along the lines of how much repairs will cost and how often you’ll need to get them done. While pro forma real estate calculations are vital in evaluating profitability and costs, they will often leave out one-time or uncommon expenses that are not likely to occur.

A proforma real estate investment property analysis will focus more on your net operating income (NOI), consistent cash flow, and recurring expenses when conducting real estate math. By taking into account the most likely costs and income based on past data and trends, pro forma real estate calculations will be able to show you a closely accurate depiction of your property’s performance in the market.

A proforma real estate analysis will also take note of potential changes in computations, such as increases in rent, vacancy and occupancy rates, repairs, and possible management fees, depending on how you manage your property.

Why Is Pro Forma Important In Real Estate?

Investing in real estate is a very lucrative business. However, whether it be buying your first or your fifth property, the initial cost can take quite a toll on your finances. While you may be purchasing a $1,000,000 property hoping for a 2% return on investment, even a 1% decrease in profit margins can bring down your expected income by $10,000.

It is why an accurate real estate pro forma is very important. You are taking the risk of investing a substantial amount of money, so you should at the very least get some idea of how much you will get in return.

A proforma real estate calculation based on accurate data and information will help investors determine a property’s potential to generate income and decide if it’s worth the investment. A property with an estimated rental income of $2,000 on a $300,000 investment with virtually no repairs may be worth the investment risk to you. But a $2,500 rental income on a $500,000 with a recurring need for repairs may not be.

While the success of your investments depends on your strategy, seeing the estimates and projections will help you make a better decision to achieve your investment goals. Obtaining a pro forma real estate estimate based on market research and historical financial statistics is vital in any investment. It helps investors with projects and see the most accurate picture of the possible risks and returns a property can offer.

If you make an error in your pro forma or choose to forgo it altogether, you run the risk of overpaying for an underperforming piece of property. It will eventually harm your return on investment and even potentially cause financial issues to your bottom line.

How to Calculate Pro Forma Real Estate?

When it comes to real estate math, pro forma calculations include several important variables that may seem complicated for new and seasoned investors. While it is admittedly not the simplest of computations, you need not worry as we’ve provided you with a real estate pro forma template that includes all the variables you will need to make an accurate analysis.

1. Gross Rental Income

In simple terms, gross rental income is the amount your tenant pays you in rent for occupying your property. Gross rental income refers to the amount of income your property generates before any deductibles and expenses are accounted for. It’s purely how much money you make without any other costs.

For example, if you are renting out a two-bedroom apartment in LA with one room costing $1,500 in rent and the other costing $2,000 in rent, your total monthly gross income would be $3,500.

If you’re unable to access historical data with the previous rental price, you can forecast the properties’ gross rental income by taking a rough estimate of the annual gross rental income and multiplying the result by 0.75.

Additionally, if you can find the gross rent multiplier in the properties’ location, you can use the following formula to estimate the gross rental income:

Gross Rental Income = Property Price / Gross Rent Multiplier

Related: The Best Vacation Rental Income Calculator

2. Vacancy Rate

Vacancy rate refers to the amount of time your property will probably be on the market and unoccupied. As you will only generate an income when it is occupied, the vacancy rate also plays a key role in the property’s potential cash flow and NOI.

Depending on the type of investment properties you are looking at, your calculations for its vacancy rate may differ slightly. If you intend to buy a single-family home, you will need to calculate for a single family real estate pro forma. On the other hand, if you are looking into a multi-unit property, you will need to calculate the vacancy rate for a multi family real estate pro forma.

Single family properties are easier to calculate as there is only one unit to inhabit. However, when it comes to multi family units, you will need to account for the possibility of one unit being occupied while the other is vacant.

The vacancy rate is generally calculated by taking the number of unoccupied units and multiplying the figure by 100 and then dividing it by the number of total units. For example, you own a multi-family property with 10 units with three units currently unoccupied. To get the vacancy rate, you will multiple the three units occupied by 100 and divide it by 10, leaving you with a 30% vacancy rate.

Vacancy Rate = Number of Vacant Units x 100 / Total Number Of Units

Related: What Is Vacancy Rate and How to Keep It Low

3. Upkeep and Repair Expenses

Upkeep and repair expenses refer to the estimated amount of money needed to cover your property’s possible damages and repairs each year. While it is quite challenging to estimate how much damage and repairs will be needed each year, you can set aside a certain amount of money from your gross income to cover such contingency.

Real estate investors generally follow the 1% rule for repair expenses. The 1% rule indicates that whatever the value of your home for a particular year, you should set aside 1% of its total value for repairs. It means that if your property is valued at $500,000, you should set aside $5,000 for repairs or roughly $417 per month.

Related: 11 Costs First Time Real Estate Investors Should Consider

4. Management Fees

If you are a new real estate investor with only one property, chances are you will be the main manager of the property. However, as you grow your real estate portfolio, you will most likely hire a property manager to help you stay on top of your different investments.

At this point, you will need to consider their fees and costs each time you acquire new property in your pro-forma calculations. Additionally, regardless of whether it’s your first property or tenth property, depending on the property, you may need to pay a building super fee which will fall under management fee calculations.

5. Mortgage Payments and Loan Fees

Mortgage payments are pretty straightforward. If you took out a loan to buy the property, chances are you have a monthly mortgage to pay. As the mortgage is a fixed monthly expense, you will need to take it into account when calculating your pro forma, as it will affect your return on investment.

More often than not, mortgage payments will also play a significant factor in the rental income as most investors will include mortgage payments in their listing price for possible tenants. It means that if you pay a mortgage of $1,200 monthly, your rental rate should be any number above that.

If your mortgage is more than the average rental rate of the area, you may want to look for other investment properties for sale that offer a more lucrative deal.

6. Other Real Estate Expenses

While often overlooked by many, taxes, HOA dues, insurance, and other legal fees are also needed in a pro forma document. While some of them may not be monthly expenses, they do take a significant amount of money from your bottom line. Having such expenses accounted for will help you get a better picture of how much income your potential property can generate.

Now that you have all the necessary estimated factors and variables of your potential real estate investment property, you can calculate your pro forma accurately. To calculate your pro forma, here is the general formula that real estate investors use:

Pro Forma NOI = GRI – Vacancy Expenses (Vacancy Rate x GRI) – All Other Expenses

Real Estate Investment Tools

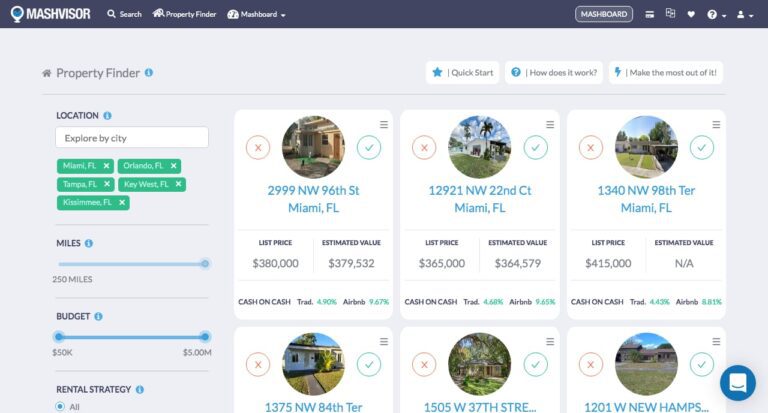

Mashvisor’s real estate investment tools like the Property Finder can help you find an investment property and perform a pro forma real estate analysis in minutes.

You may think that calculating your pro forma for each investment property is a daunting task, and we don’t blame you. The need to research and access large amounts of information to get one part of the formula is a time-consuming and tiring task for anyone, not to mention is very susceptible to human error.

It is why many seasoned real estate investors are turning to technology and real estate investment tools like Mashvisor to help them in their pro forma and comprehensive real estate investment analysis.

How Mashvisor Can Help You

Mashvisor offers many real estate tools to help you in your real estate investment journey. From its Property Finder to investment real estate analysis tools, you can easily find a property that meets your budget while also getting an estimate of its potential rental income, cash on cash returns, occupancy rates, and many more based on historical and current data of neighboring properties in the area.

Without the hassle of manually calculating each factor on your pro forma, Mashvisor can help you easily obtain all the necessary computation needed to plug into the real estate pro forma template. With this, you can rest assured that you are making data-based decisions with accurate computations with every real estate investment you make from here on out.

The Bottom Line

Real estate math, specifically pro forma real estate analysis, is essential to any property investment. With potential income and projected expenses all accounted for, you are sure to never overspend for an underperforming property in the area. To guarantee accuracy and ease of use, Mashvisor’s investment tools gather and find all the data you need for an accurate pro forma.

From the projected rental income to your cash on cash return, there is no need for you to shift through a pile of data just to see the full potential of one property.

Sign up for a 7-day free trial of Mashvisor and gain access to all our real estate data and investment tools today.