Investing in Maui Airbnb may be a risky move to stateside investors, but it doesn’t mean investing across the Pacific isn’t worth it.

Table of Contents

- Investing in Maui Airbnb: What Investors Should Know

- 9 Maui Cities Ranked for Airbnb Investing

- The Verdict: Is It Worth Investing in Airbnb in Maui?

People who are considering investing in out-of-state real estate properties might find Maui investment properties a worthwhile business venture.

Read on to know the best locations for investing in an Airbnb rental in Maui.

Investing in Maui Airbnb: What Investors Should Know

Hawaii may be literally an ocean away, but it remains one of the hottest real estate markets in the US despite its distance from the mainland. Affluent real estate investors who are serious about taking their game a notch higher and expanding their real estate investment portfolios are not hesitant to look into the Hawaii real estate market. They know Hawaii’s potential to generate a very attractive return on investment and are quick to take advantage of it.

And while not all investors may be able to access available funding sources to buy Hawaii investment properties, the serious ones should take the time to still find out all they can about the market. If the investors find themselves in a situation where they can already afford it, they already got a pretty good idea of what to expect from the market.

One of the most profitable markets in the Hawaiian Islands is Maui.

Aloha, Maui: The Maui Real Estate Market in a Nutshell

Maui is one of the islands that make up the Hawaiian archipelago in the Central Pacific. Also known as The Valley Isle, Maui is Hawaii’s second-largest island next to Hawai’i Island.

With a total land area of 727.20 square miles, the Valley Isle is one of the most populated islands in the Aloha State, with 168,307 residents. The residents are treated daily to some of the most amazing climates all year long and are able to access some of the most breathtaking natural sights in the world. Countless tourists from all over the world include Maui in their top places to visit and are willing to pay exorbitant airfares for a once-in-a-lifetime experience.

Because of the high influx of visitors, Maui enjoys a thriving tourism industry, which helps drive its economy forward. Before the pandemic, Maui used to welcome more than three million visitors annually. And while COVID temporarily slowed down Maui tourism, it is showing impressive growth following the recent economic reopening and easing of travel restrictions. As a result, a lot of real estate investors are now considering taking part in the Maui Airbnb action.

Why Is Hawaii an Attractive Location for Real Estate Investors?

Hawaii is not just attractive to tourists but also to mainland real estate investors. Such investors are looking for viable properties that will provide them with good returns on their investment.

Some are considering getting into Maui Airbnb; others want to buy commercial properties in Kauai. Whatever their goals are and whichever part of the Hawaiian archipelago they prefer, one thing is for sure; the investors understand that the Hawaii real estate market offers a lot in terms of investment properties.

1. Real Estate Appreciation Is Substantial

If there’s one thing that’s constant with real estate investing, it is that properties will inevitably increase in value. The only difference between markets is how fast property appreciation takes place. Hawaii is one of those markets that sees a steady appreciation rate, which lures in lots of potential investors to the state.

Whether they’re considering buying a vacation home for personal use or purchasing a rental property to use as a Maui Airbnb rental, investors know that when they invest in Hawaiian real estate, it’s only a matter of time before they reap the rewards.

2. Tourism Supports the Local Economy

Tourism is considered one of the backbones of Hawaii’s strong economy. In 2019, the number of tourists that visited Hawaii was a little over three million people. The pandemic disrupted the industry, but 2021 saw it make a remarkable recovery, ending the year with nearly 2.3 million visitors. In December 2021 alone, there were 235,433 visitors to Maui, which was a far cry from the 91,171 visitors to the island in the previous year.

With a hyperactive tourism industry, local businesses continue to thrive, affecting the local housing industry. The better the economy, the more visitors and in-migrants. The more people, the greater the housing demand. The higher the demand, the more people are willing to pay high prices for real estate properties. It not only goes for traditional rentals but also Maui Airbnb properties, too.

3. Limited Supply in a High-Demand Market

The law of supply and demand is very real in the Hawaii housing market. Because of its unique topography, Hawaii does not enjoy the same flexibility as mainland states where expansion and growth are concerned.

Because of the limited horizontal space, the number of housing developments that the islands can sustain is also quite limited. Such a limitation drives property prices up as investors and homebuyers who are intent on owning a piece of paradise are willing to pay exorbitant prices just to beat the competition.

4. Deferring Capital Gains Tax

Despite its distance from the US mainland, Hawaii enjoys the same real estate investing advantages as all the other states, including tax benefits. If you acquire a property in Hawaii and start your own Maui Airbnb business, you can deduct property taxes, maintenance costs, mortgage interest, depreciation, and insurance.

On the other hand, if you don’t want to convert it into a rental and decide to just sell it after some time, the property’s appreciation will be taxed as capital gains tax, which is a lot better than the typical tax rates.

5. Airbnb Is Legal

Investors who are keen on tapping into the Maui Airbnb market will be pleased to know that Airbnb is legal on the island. However, it doesn’t mean that you can just start a vacation rental business anywhere on the island. You need to comply with zoning restrictions to keep your short-term rental business on the legal side and avoid getting fined. Just keep the following three things in mind:

- Short-term rentals are legal for durations of 180 nights or less;

- County regulations require owners to a tax map key and a license number for transient accommodations; and

- Vacation rentals can only be operated in zones approved by the county for short-term rental properties.

9 Maui Cities Ranked for Airbnb Investing

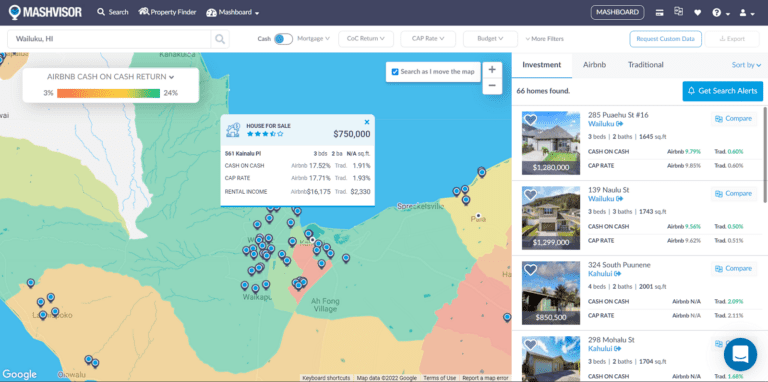

If you’re still not convinced that the Valley Isle is a great place to invest in vacation rental properties, let’s take a look at Mashvisor’s city-level data.

The following list for ideal Maui Airbnb locations is based on the average cash on cash return rate of properties found in the said locations. While cap rate is a metric a lot of real estate investors use to determine a property’s profitability, cash on cash return works better for most individuals as it considers the financing method used to buy the investment property.

Since a lot of real estate investors cannot afford to make all-cash payments, they are forced to look for financing options to help them achieve their investment goals. To put it simply, the cash on cash return formula simply takes the property’s potential net operating income (NOI) and divides it by the total cash spent to finance the purchase.

To start searching for and analyzing the best investment properties in your city and neighborhood of choice, click here.

Use Mashvisor to search for and analyze the best investment properties in your preferred city and neighborhood.

For this reason, we ranked each location on this list based on the Airbnb cash on cash return to help you, readers, as you work on your research. That said, here are nine of the top Airbnb Maui locations:

1. Wailuku

- Median Property Price: $1,364,935

- Average Price per Square Foot: $1,032

- Days on Market: 57

- Number of Airbnb Listings: 153

- Monthly Airbnb Rental Income: $9,259

- Airbnb Cash on Cash Return: 5.97%

- Airbnb Cap Rate: 6.03%

- Airbnb Daily Rate: $273

- Airbnb Occupancy Rate: 74%

- Walk Score: 77

2. Kihei

- Median Property Price: $1,480,732

- Average Price per Square Foot: $1,194

- Days on Market: 155

- Number of Airbnb Listings: 436

- Monthly Airbnb Rental Income: $8,821

- Airbnb Cash on Cash Return: 4.98%

- Airbnb Cap Rate: 5.02%

- Airbnb Daily Rate: $265

- Airbnb Occupancy Rate: 91%

- Walk Score: 5

3. Lahaina

- Median Property Price: $1,769,607

- Average Price per Square Foot: $1,382

- Days on Market: 89

- Number of Airbnb Listings: 635

- Monthly Airbnb Rental Income: $9,777

- Airbnb Cash on Cash Return: 4.73%

- Airbnb Cap Rate: 4.77%

- Airbnb Daily Rate: $354

- Airbnb Occupancy Rate: 84%

- Walk Score: 78

4. Hana

- Median Property Price: $2,349,857

- Average Price per Square Foot: $1,118

- Number of Airbnb Listings: 45

- Monthly Airbnb Rental Income: $11,130

- Airbnb Cash on Cash Return: 3.35%

- Airbnb Cap Rate: 3.37%

- Airbnb Daily Rate: $420

- Airbnb Occupancy Rate: 77%

- Days on Market: 137

- Walk Score: 38

5. Kula

- Median Property Price: $2,258,500

- Average Price per Square Foot: $1,394

- Days on Market: 58

- Number of Airbnb Listings: 13

- Monthly Airbnb Rental Income: $7,265

- Airbnb Cash on Cash Return: 3.28%

- Airbnb Cap Rate: 3.31%

- Airbnb Daily Rate: $282

- Airbnb Occupancy Rate: 87%

- Walk Score: 1

6. Maunaloa

- Median Property Price: $470,500

- Average Price per Square Foot: $380

- Days on Market: 58

- Number of Airbnb Listings: 58

- Monthly Airbnb Rental Income: $2,009

- Airbnb Cash on Cash Return: 3.17%

- Airbnb Cap Rate: 3.27%

- Airbnb Daily Rate: $119

- Airbnb Occupancy Rate: 53%

- Walk Score: 13

7. Makawao

- Median Property Price: $1,161,840

- Average Price per Square Foot: $821

- Days on Market: 63

- Number of Airbnb Listings: 18

- Monthly Airbnb Rental Income: $5,507

- Airbnb Cash on Cash Return: 3.10%

- Airbnb Cap Rate: 3.12%

- Airbnb Daily Rate: $330

- Airbnb Occupancy Rate: 72%

- Walk Score: 48

8. Haiku

- Median Property Price: $2,089,500

- Average Price per Square Foot: $1,359

- Days on Market: 134

- Number of Airbnb Listings: 41

- Monthly Airbnb Rental Income: $6,719

- Airbnb Cash on Cash Return: 2.09%

- Airbnb Cap Rate: 2.10%

- Airbnb Daily Rate: $271

- Airbnb Occupancy Rate: 77%

- Walk Score: 40

9. Kaunakakai

- Median Property Price: $656,100

- Average Price per Square Foot: $437

- Days on Market: 107

- Number of Airbnb Listings: 53

- Monthly Airbnb Rental Income: $1,352

- Airbnb Cash on Cash Return: 1.53%

- Airbnb Cap Rate: 1.61%

- Airbnb Daily Rate: $132

- Airbnb Occupancy Rate: 48%

- Walk Score: 29

Why Is Hawaii Real Estate So Expensive?

If you tried working on an Airbnb analysis as you went through the list, you would’ve probably noticed how expensive the properties are in Maui. While it is important to note that the prices listed above are median property prices (meaning half of the listings cost more while the other half is cheaper), Hawaii’s real estate scene is generally very expensive.

In the mid-20th century, home prices in Hawaii were always higher than in the 48 mainland states. One thing that contributed to the ridiculously high prices was the influx of people into the state, which led to a high demand for housing.

However, because Hawaii is made up of islands, it is not like most mainland states where expansion can easily take place from urban centers into suburbs. There’s simply not enough room to expand. Although there was a substantial increase in the number of single-family homes in the ’80s and ’90s, residents demanded and got more restrictions on development.

While housing development projects do get approved, it usually takes years to get through all the red tape. Meanwhile, more and more people start to come in and make the Aloha State a second home, putting more strain on the state’s housing market. It brings us back to the Aloha State being made up of smaller islands. How much expansion and development can the islands sustain today?

In the end, residents and investors get caught up in a continuing pattern. People come in, a great housing demand comes up, but supply is low and development is slow. Due to the scarcity of properties, investors and buyers compete over the relatively small amount of real estate properties available, which drives prices up.

The Verdict: Is It Worth Investing in Airbnb in Maui?

If you can set aside the fact that Hawaii real estate is pricey, investing in Maui Airbnb might not seem like such a bad idea after all. Most of the cities in Maui offer good cash on cash return rates at high occupancy rates. Investing in Hawaii—Maui in particular—offers excellent personal and financial rewards.

If you’re serious about investing in Hawaii real estate, you need to use the right real estate investment tools to get the right information and accurate Airbnb data.

To get access to our real estate investment tools, click here to sign up for Mashvisor today.