For real estate investors to excel in their strategies and maximize their earnings, they must be 100% familiar with the rental market data.

Table of Contents:

- Why Is Real Estate Investing Considered Aspirational in 2022?

- What Are the Top 10 Rental Market Data You Should Understand?

- Access Accurate Rental Market Data With the Help of Mashvisor

Being successful in real estate investing consists of three main steps:

Learning the theoretical part, performing a thorough research of the real estate market, and finally, using relevant information in practice to maximize your returns on investment.

The relevant information we’re referring to here is rental market data.

To perform a thorough analysis and, ultimately, find the best place for your future real estate investment, you need to be familiar with all the essential parameters in real estate—and their importance.

Today, we’ll pay special attention to the top 10 real estate market data that every real estate investor should abide by upon developing a strong investment strategy.

Scroll down for crucial information on the matter.

Why Is Real Estate Investing Considered Aspirational in 2022?

The fact that the US house market has experienced a significant boost in the previous years is unbelievable. However, what real estate investors are interested in here is if this favorable market climate will continue in 2022.

The short answer is: yes.

The real estate industry—as we know it—has improved over the years, and today, real estate investors are presented with numerous modern strategies that help them to calculate and maximize their returns on investment accurately.

As for the business of investing, there’s no need to doubt whether this will be a prospective venture in 2022.

Here’s why we think you should definitely include this in your plans:

People Will Always Need Housing

The first reason why the real estate business will not cease to exist in the foreseeable future, and will only continue to evolve further, is the simple fact that people will always be in need of housing.

We are talking about future students moving to college towns, newly established families searching for single-family homes, retirees buying vacation rentals to earn extra income, and more.

Also, the most popular part of real estate investing—profits from vacation rentals during the summer and winter holidays—should not be left out.

With the proper usage of rental market data, a real estate investor can attract and generate a steady passive income.

Here’s a brief side-note:

When deciding where to purchase a rental property, bear in mind that the sunny side has taken the lead in 2022. According to statistics, 56% of homes sold in December of 2021 were located in the South—and only 3% in the Northeast.

You don’t have to be a well-versed mathematician to see the obvious here.

For an even more accurate picture of the most prospective locations, we have a solution:

Mashvisor’s Property Finder is a tool designed to help real estate investors research and pin down the most profitable locations for investing across the entire US.

Home Appreciation Will Stabilize in 2022

Home appreciation refers to a jump in the value of your investment property over a period of time. Namely, this jump in value leads to investors generating more profit.

That can be realized by increasing the monthly rent—or selling the property for more money. Of course, when determining these prices, they should vary depending on the current market situation.

So far, the situation is looking good for investors.

In compliance with findings by the National Association of Realtors, the predictions for Home Appreciation in 2022 see a boost of 5.7%. One of the leading reasons for this steady climb in value is low mortgage rates that make it easier for borrowers to see a chance and invest.

The most favorable housing market prices and profit-making locations include:

It’s imperative for investors to research the type of rental real estate property that performs the best before making the official decision!

What Are the Top 10 Rental Market Data You Should Understand?

We’ve made our way to the key part of the article—which would be the essence of the top 10 rental market data that prove crucial to a successful investment strategy.

So, without further ado, let’s get right to explaining them in more detail and highlighting their importance for real estate investors.

1. Number of Rental Listings

The number of listings is possibly the first thing that you should take into consideration when looking at a particular real estate market. Knowing how many active rental homes there are in the area of your interest will help you in your comps analysis.

Why is this vital for the real estate investor?

It enables the investor to assess the market demand they are exploring. For instance, if the market that the investor is exploring happens to be over-saturated, then the chances are the competition will lower the prices.

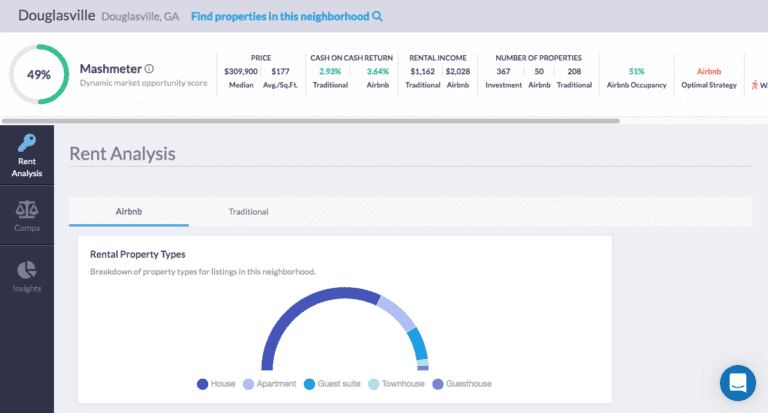

Mashvisor’s neighborhood analytics displays the number of Airbnb and traditional rental listings in each area.

2. Monthly Rental Income

Monthly rental income represents the amount of money that landlords receive from tenants living on their property each month. This rental market data is calculated by taking the rental rate, multiplying it by the number of tenants, and subtracting expenses and vacancy rates.

Cleaning of communal areas, heating, hot water, and repairs to the property are all included in renting charges.

Why is this vital for the real estate investor?

Calculating the monthly rental income can help the investor assess the overall profitability of the investment property and see if they will be able to generate a passive income from it.

However, determining an attractive yet affordable rental price might be difficult if you don’t have the right tools. It could easily happen that you overcharge for your property, or even worse—undervalue it and lose money.

To get accurate information, you can rely on our Rental Property Calculator.

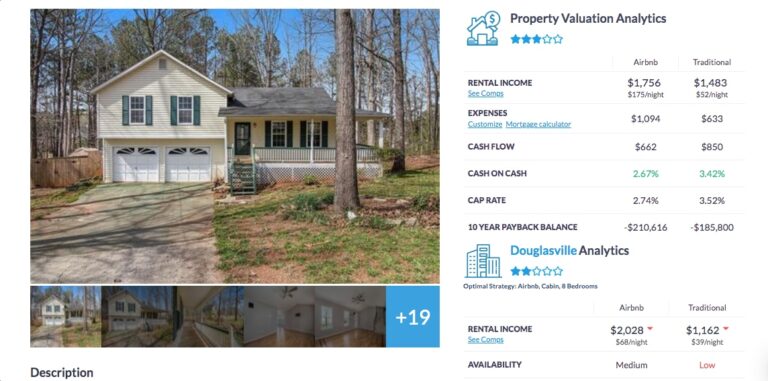

Each listing published on Mashvisor includes the estimated monthly rental income the property could earn, depending on the rental strategy.

3. Cash on Cash Return

Cash on cash return (CoC) is a widely used metric in calculating traditional and vacation rental market data. In essence, it presents the investors with an estimated profit that they can earn based on the money they initially invested in a property.

The formula for calculating cash on cash returns goes as follows:

Cash on Cash Return = (Annual Cash Flow / Initial Cash Invested) x 100%

Why is this vital for the real estate investor?

The cash on cash return formula is a beneficial one because it helps the investor see the bigger picture, meaning that they can determine how the investment will play out and see if the cash invested will pay off.

Also, many investors use this formula to compare the CoC return of multiple properties and find the most optimal investment.

4. Cap Rate

The capitalization rate—more commonly referred to as “cap rate”—is another crucial metric when looking at rental market data. It is a metric used to accurately estimate the return on investment that is expected to result from investing in real estate property.

Real estate investors can calculate the cap rate by following this formula:

Cap Rate = NOI / Property Value

Why is this vital for the real estate investor?

The importance of calculating the cap rate is realized in the evaluation of several investment opportunities. It presents the investors with a possible return on investment and a chance to see whether they should proceed with the strategy or alter it.

Check out this Airbnb Cap Rate By City 2022: What Real Estate Investors Should Expect guide to learn more.

5. Price to Rent Ratio

The price to rent ratio is used in real estate to show the connection between home prices and annualized rents in a given location. It is a primary indicator used for determining fair market value.

In economic terms, the price to rent ratio compares buying vs. renting.

Why is this vital for the real estate investor?

It’s essential for real estate investors since it helps them determine the market value more accurately and estimate the potential demand of a real estate property they’re interested in purchasing.

For example, if the calculation shows a price to rent ratio of less than 15, then it means that buying a property is not as expensive as paying rent. In this case, people who’d want to live in an area with a low price to rent ratio would rather buy their own home than rent.

6. Cash Flow

Cash flow is a simple yet extremely important metric in viewing short term rental market data. This metric indicates how well your rental business is doing.

There are two possible outcomes for this: positive and negative cash flow.

Cash flow from investing activities (or CFI for short) is a clear indicator of how much your investment has generated over a period of time and if it promises a positive outcome—or you might need to put this investment strategy on hold.

Why is this vital for the real estate investor?

Although fairly simple, cash flow is essential for real estate investors because, if it proves to be negative, it warns the investor that they will not be able to meet their obligations and pay the bills.

That could be due to your inadequate spending money on the property or a tenant who’s late on their rent. Either way, you’ll be able to oversee the performance of your rental business by incorporating this formula.

If you’re a beginner, scroll through our guide on the cash flow formula to get the full picture.

7. Net Operating Income

The Net Operating Income (NOI) is crucial when evaluating rental market data.

It’s an income statement that tells the investor how much money they make from a potential investment opportunity.

It includes expenses such as the rental income, parking fees, laundry machines, and other services—basically all charges that are associated with operating the property.

NOI is calculated as follows:

NOI = Real Estate Revenue / Operating Expenses

Why is this vital for the real estate investor?

The result from the Net Operating Income is a direct indicator of whether your investment property will be able to generate profit. Even more so, it allows the real estate investor to evaluate a property without looking at financial terms separately.

It’s also used to calculate the cap rate.

So, you could say that these two metrics are intertwined when it comes to exploring the housing market.

8. The 1% Rule

The 1% Rule is significant for real estate investors looking at properties because it helps measure the price of an investment property against the expected income it will generate.

So, in order for the investment property to pass the 1% rule, its monthly rental income must be equal to—or no less than—1% of the purchase price.

Calculating it is simple, as well. All you should do is take the purchase price of the property and multiply it by 1%. Remember that if there are any needed repairs, you’ll want to include them as well—so as to get the precise number.

Why is this vital for the real estate investor?

The value behind the 1% rule is that it allows the real estate investor to find the right property for achieving their investment goals.

9. 1013 Exchange

If you’re a real estate investor who already owns a real estate property and is thinking of selling it—or even buying another one—you should definitely inquire about 1013 Exchange.

Under the 1013 Section of the US Internal Revenue Code, there are rules that govern capital gains taxes at the actual time of the sale.

According to the law, the investor is allowed to pay income taxes at a later date rather than immediately after closing the deal, as expected.

Why is this vital for the real estate investor?

The importance of relying on 1013 Exchange is incorporated in the definition itself. Basically, it allows the real estate investor to defer payments, for example, if the property sells for more money than stated in the depreciation value.

It gives the investor financial flexibility when buying and selling real estate property.

10. HOA Fees

The last term that real estate investors should bear in mind while exploring the market value is HOA—or Homeowners’ Association—fees. When purchasing the property, the real estate investor should inquire whether it falls under the HOA.

In simple terms, this is an organization that sets forward the rules that govern activities that are related to property composition. Buying a property in a neighborhood with an HOA automatically makes you a member, thus requiring you to pay the HOA fees.

Why is this vital for the real estate investor?

The real estate investor needs to know whether and how much money they will have to set aside for HOA fees because these expenses are likely to change the course of your rental rates.

To read more about whether you can refuse to join the HOA, click here.

Access Accurate Rental Market Data With the Help of Mashvisor

We’ve successfully covered the most prominent rental market data every real estate investor should know and understand.

It’s crucial to emphasize that the real estate investing business has witnessed a boost in the previous years. There are a number of positive forecasts circling the US housing market, claiming that home appreciation will stabilize in 2022.

Truth be told, people will always be in need of housing—no matter the market situation or the housing prices. So, it’s imperative for real estate investors to familiarize themselves with rental market data such as the cap rate, cash flow, price-to-rent ratio, and many more.

For additional assistance, you can choose to work with Mashvisor and rely on accurate and up-to-date information regarding anything and everything related to real estate.

Start your free trial today.