Have you been thinking of investing in short term rentals for sale Orlando? Read on to find out how you can make a profit from your investment.

Table of Contents

- Can You Do Short Term Rentals in Orlando?

- 3 Steps to Finding Profitable Short Term Rentals for Sale in Orlando

- Top 5 Neighborhoods in Orlando for Short Term Rentals

Investing in short term rentals isn’t as complicated as some real estate investors think. If done right, it can even be more profitable than the traditional rental strategy.

Besides the profit potential, investors also love short term rentals due to the flexibility they offer. You can adjust the nightly rates according to the prevailing market conditions and also set aside a few days to use the property yourself.

As an investor considering investing in short term rentals for sale in Orlando, you probably got a lot of questions. Are short term rental properties in Orlando profitable? Are they legal? Which are some of the best neighborhoods in Orlando for investing in short term rentals?

Well, you’ve come to the right place. In today’s blog post, we’ll seek to answer the questions above. We’ll also introduce you to Mashvisor, which offers the best real estate tools to walk you through your investment journey in Orlando.

Can You Do Short Term Rentals in Orlando?

Yes, you can invest in short term rentals for sale Orlando. There are a few reasons for doing so:

Benefits of Short Term Rentals in the Orlando Housing Market

There are a couple of reasons why the Orlando housing market stands out as a conducive location for short term rentals. They include:

Occupancy Rate

It’s almost impossible to achieve a 100% occupancy rate with short term rental properties. However, according to Mashvisor, Airbnb rentals in the Orlando housing market show an average occupancy rate of 51%. It is a good occupancy rate, which means your short term rentals in Orlando will be occupied for more than half of the year.

A high occupancy rate is an important part of a property’s profitability. It makes sense to make $150 a night when only $1,500 goes to monthly mortgage payments. If your property is only occupied for less than half of the month, you might struggle to break even after settling all property expenses and fees.

Growing Demand

Orlando is a destination location. Destination locations in the US are set to increase in demand as people seek to travel more after the pandemic. As of January 2022, Orlando was ranked as the most booked destination for spring travels. Due to such a trend, booking rates will continue growing at a higher rate than in previous years.

High Revenue

If you’re wondering whether Orlando is a lucrative market for short term rentals, the answer is yes. Airbnbs in Orlando offer an average monthly rental income of $2,763 and an average daily rate of $120.

You can obtain the figures through the return on investment metrics, namely cash on cash return and cap rate. In Orlando, the Airbnb cash on cash return is 2.12%, while the cap rate is 2.16%.

Florida Is Popular Among Remote Workers

The pandemic brought many changes in the way people live and work. One such change was the growing popularity of the remote workplace.

Many people who don’t need to work in a fixed physical location consider living in a location with all-year-round weather, such as Florida, even if it’s just for a month. The trend’s seen a rise in Florida’s population, growing at a rate almost twice that of the US.

It is a good trend for investors in short term rentals to take advantage of. If you don’t want to shoulder the hassle of property management and high turnovers, you can consider setting up monthly stays on your short term rentals. Monthly stays allow you to see a more consistent income.

Orlando Short Term Rentals Ordinances

In July 2018, Orlando started allowing its residents to offer their properties for rent as short term rentals. The short term rental ordinance in Orlando enables residents to rent their bedrooms, garage spaces, and properties to guests.

Here is a complete breakdown of the Orlando short term rental laws and regulations so that you can understand how you can be a law-abiding host on Airbnb, Vrbo, and other short term listing sites.

Short Term Rentals Registration

According to the City of Orlando, a short term rental is a rental property that’s rented for fewer than 30 days. Short term rental hosts can apply for Home Sharing Registration online. The home-sharing program includes the following provisions:

- The host must be present during the guests’ stay – A short term rental host doesn’t need to be the rental owner. However, they must provide proof that the property is their primary residence. If you’re not the property owner, you must get approval from the landlord.

- Hosts can only accept a single booking at a time – The Orlando short term rental ordinance restricts hosts to just a single booking at a particular time. Further, only a maximum of two guests is allowed per room and a maximum of four non-family members on the property.

- Hosts can only rent a section of their property – Operators of short term rentals in Orlando can’t rent the entire property out. However, they can rent up to half the property’s number of bedrooms. If you invest in a duplex, you can rent out the other unit, provided it’s of equal or smaller size. It must also be located on the same development site.

- You must get Home Owners Association approval – If there’s an HOA in your neighborhood, you must get its approval. In this case, your registration request must be accompanied by a letter of approval.

- The short term rental host must link their proof of registration when advertising online – You must ensure that you include your proof of registration in any online advertising. In addition, the online advertisement must reflect the regulation’s criteria, i.e., it must state that “one bedroom available for sharing in a two-bedroom property.”

Annual Fees

Short term rental property hosts must pay annual fees to register their home-sharing properties. The fee for the first year is $275. Afterward, the owner must pay $100 for every year they live on the property and $125 if the owner doesn’t occupy the property.

Short Term Rentals Taxes

Orlando short term rental hosts must collect lodging taxes from the guests. The state levies a 6% Transient Tax and a 0.5% County Discretionary Sales Surtax. Orange County also collects a 6% Tourist Development Tax.

Airbnb hosts in Orlando don’t need to worry about lodging taxes since the platform automatically collects them. Other platforms, such as Vrbo, require you to collect and submit the taxes yourself.

3 Steps to Finding Profitable Short Term Rentals for Sale in Orlando

Now that you’ve made up your mind to invest in short term rentals in the Orlando housing market, how do you actually find profitable investment properties?

Here is the step-by-step process to find lucrative short term rentals for sale Orlando:

1. Carry Out Neighborhood Analysis

Location is one of the critical factors that determine whether your short-term rental will be profitable. Location determines how much rental rates you can set and how much property expenses and taxes you’ll need to pay.

How can you tell that a certain neighborhood is more profitable than others?

While it can be challenging to predict the future, especially in real estate, where market fluctuations occur often, there are a few indicators to guide you. The indicators include:

- Property taxes – You must pay property taxes when you own a property. Property tax rates differ from location to location. Always visit your local authority’s office for more tax information. Friendly tax rates leave you with enough cash flow and eventual return on investment since you incur lower expenses.

- Amenities – The neighborhood you invest in should be as close as possible to public transportation, parks, shopping malls, restaurants, and other amenities that make a neighborhood conducive to living. The closer you are to amenities, the higher you can charge and the more short term rental guests you attract.

- Short term rental ordinances – Due to the rising popularity of short term rentals, most authorities created laws to regulate the sector. Others banned Airbnbs outright within their jurisdiction. It’s important for you to consider the local laws to avoid running into legal trouble in the future.

Other Considerations

In addition to the different factors mentioned above, you also need to take the following into consideration:

- Tourist attractions – The best neighborhoods for short term rental property investments are located in tourism hotspots. The best thing about Orlando is that it is home to many tourist attractions, which bring in enough tourists for you to host.

- Areas prone to natural disasters – When investing in short term rentals, you must stay away from areas prone to floods, forest fires, hurricanes, and other natural disasters. Such areas will compel you to get special insurance coverage, which can significantly affect your profits. Also, no guest wants to lease a short rental only to wake up to floods.

Mashvisor Heatmap

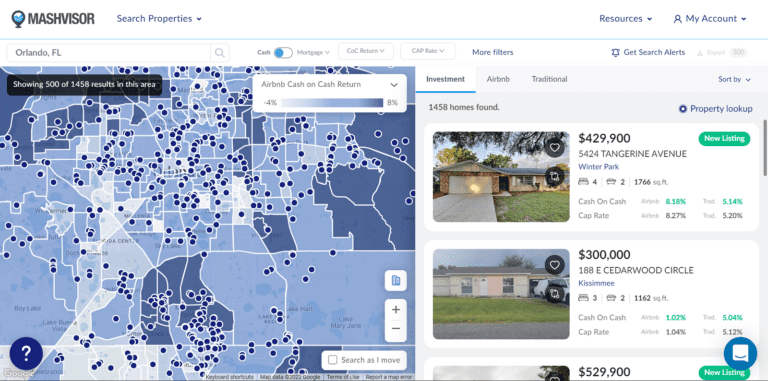

As you can see, you need to consider several factors when carrying out neighborhood analysis. However, you don’t need to do the analysis manually. Mashvisor’s heatmap feature is the best tool for conducting a comprehensive neighborhood analysis.

The heatmap is a color-coded real estate tool that helps real estate investors identify the top-performing neighborhoods within a city based on their search criteria. You can set your search criteria using metrics such as Airbnb rental income, occupancy rate, and cash on cash return.

The tool uses real estate comps, current market trends, historical data, and predictive analytics to show you the most profitable places for you to invest.

Mashvisor’s heatmap helps real estate investors identify the top-performing neighborhoods within a city based on their search criteria, such as rental income, occupancy rate, cash flow, cash on cash return, and cap rate.

2. Spot Lucrative Short Term Rental Investment Properties

You can use several strategies to find short term rental investment properties. You can decide to drive around looking for for-sale signs, check newspaper ads, attend open houses, or hire a real estate agent. However, the problem with the said strategies is that you can’t analyze a property’s profit potential.

It is why you need to use Mashvisor’s Property Finder. As the name suggests, investors use the tool to find profitable real estate investment properties in various locations across the US housing market.

Using the Property Finder is pretty straightforward. To find profitable Airbnb rentals, simply set the Rental Strategy filter to Airbnb. You can also use the following filters to specify your search criteria:

- Location

- Distance (Miles)

- Listing price

- Property type

- Number of bedrooms

- Number of bathrooms

The Property Finder will then show you a list of properties that meet your criteria using predictive analytics and machine learning algorithms. The listings are listed based on their performance. The properties with the highest return potential are ranked at the top.

The tool turns the long and tiresome property search process into a 15-minute activity.

3. Carry Out Investment Property Analysis

Once you’ve spotted potential investment properties, you need to carry out further investment property analysis to evaluate their profit potential. The process involves calculating the costs associated with buying and maintaining the short term rental property. Afterward, you need to calculate the rate of return on investment you can expect from your property.

The best tool for this process is Mashvisor’s investment property calculator. Also known as the rental property calculator, the tool helps you run accurate and reliable estimations to evaluate whether an investment property makes financial sense or not.

Additionally, it saves you weeks and possibly months you’d otherwise use to collect data, enter them on a spreadsheet, and manually compute the numbers.

The investment property calculator helps you carry out a comprehensive property analysis for any listing in any location in the US real estate market. With the tool, you don’t need to worry about reliability and accuracy since we pull our data from the Airbnb platform itself. The numbers reflect the performance of real estate comps within the past 12 months.

Our investment property calculator provides you with the following important numbers:

- Estimated rental income

- Monthly property expenses

- Cash flow

- Cap rate

- Cash on cash return

- Airbnb occupancy rate

The best thing about the tool is that it provides estimates for both Airbnb and traditional rental strategies. It helps you see which rental strategy would better match your investment and financial goals.

Top 5 Neighborhoods in Orlando for Short Term Rentals

It’s now time to look at some of the top neighborhoods to invest in short term rentals for sale Orlando. The following list is compiled from Mashvisor’s latest location data as of September 2022. We looked at locations with at least 100 short term rental listings, short term rental income of over $2,000, the highest short term rental cash on cash return and cap rate, and short term rental occupancy rate of at least 50%.

1. Colonialtown North

- Median Property Price: $600,854

- Average Price per Square Foot: $334

- Days on Market: 72

- Number of Short Term Rental Listings: 271

- Monthly Short Term Rental Income: $4,859

- Short Term Rental Cash on Cash Return: 4.73%

- Short Term Rental Cap Rate: 4.80%

- Short Term Rental Daily Rate: $139

- Short Term Rental Occupancy Rate: 52%

- Walk Score: 71

2. Lake Weldona

- Median Property Price: $389,900

- Average Price per Square Foot: $232

- Days on Market: 128

- Number of Short Term Rental Listings: 286

- Monthly Short Term Rental Income: $2,493

- Short Term Rental Cash on Cash Return: 3.64%

- Short Term Rental Cap Rate: 3.71%

- Short Term Rental Daily Rate: $138

- Short Term Rental Occupancy Rate: 50%

- Walk Score: 31

3. Bel Air

- Median Property Price: $500,750

- Average Price per Square Foot: $293

- Days on Market: 54

- Number of Short Term Rental Listings: 284

- Monthly Short Term Rental Income: $2,914

- Short Term Rental Cash on Cash Return: 3.49%

- Short Term Rental Cap Rate: 3.58%

- Short Term Rental Daily Rate: $138

- Short Term Rental Occupancy Rate: 51%

- Walk Score: 45

4. Colonialtown South

- Median Property Price: $482,055

- Average Price per Square Foot: $376

- Days on Market: 45

- Number of Short Term Rental Listings: 285

- Monthly Short Term Rental Income: $2,943

- Short Term Rental Cash on Cash Return: 3.13%

- Short Term Rental Cap Rate: 3.18%

- Short Term Rental Daily Rate: $137

- Short Term Rental Occupancy Rate: 52%

- Walk Score: 84

5. Lawsona-Fern Creek

- Median Property Price: $660,989

- Average Price per Square Foot: $348

- Days on Market: 124

- Number of Short Term Rental Listings: 287

- Monthly Short Term Rental Income: $3,943

- Short Term Rental Cash on Cash Return: 2.72%

- Short Term Rental Cap Rate: 2.76%

- Short Term Rental Daily Rate: $138

- Short Term Rental Occupancy Rate: 51%

- Walk Score: 52

You’re now set to start searching for lucrative short term rentals for sale in Orlando on the Mashvisor platform.

Final Thoughts

Orlando is a perfect housing market for investing in short term rentals. With our list of top five neighborhoods to invest in short term rentals for sale Orlando, you’re set to start a successful investment journey. Remember that to make smart investment decisions, you need to carry out comprehensive market and investment property analyses.

Mashvisor provides the best tools to help you invest in profitable real estate properties. Besides providing you with vital tools, we also offer important resources to assist you in developing an effective short term rental investment plan.

Sign up today and begin your 7-day free trial of Mashvisor.