As 2022 comes to an end, real estate investors are faced with yet another challenge as house flipping profits go down in the third quarter.

A lot of real estate investors have already been greatly impacted by the present high-interest rates and a cooling US housing market. 2023 will prove to be a challenging year for investors, especially those who are into the fix-and-flip business.

Diana OIick reports on CNBC that the Q3 gross profit on house flipping went down to an average of only $62,000 per transaction. The gross profit is the difference between the median property purchase price and the median resale price on the market.

This decrease registered an 18.4% drop from the previous quarter and an 11.4% year-over-year decline. These numbers were taken from real estate data provider ATTOM. These numbers represent the smallest house flipping profit since 2019 and the fastest drop in a quarter since 2009.

According to ATTOM, the return on investment on house flipping went down from 30% in the previous quarter to 25%. While it did go down a bit, it’s still not as good as investors were hoping for. ATTOM said that it’s not about the amount of money but rather the speed at which profits are going down.

Flips made up roughly about 7.5% (or 92,422 single-family homes and condos) of Q3 2022 overall home sales. That’s roughly 1 in 13 transactions. And while the market, indeed, is cooling down, property prices are still high on investment properties.

Related: Will There Be a Real Estate Housing Market Correction in 2023?

3 Challenges House Flipping Investors Are Facing

Investing in the real estate housing market is a great way of building wealth and equity, but it is not without its challenges. These challenges may be common in all markets and unique in some, but their effects depend largely on the type of investment strategy you get yourself into.

Going into 2023, given the current housing market conditions, house flippers are faced with certain challenges that impact their line of business in a unique way. House flipping profits are affected by the following:

Shifting Market Conditions

The US real estate market has always been a constantly changing market but has remained a much more reliable investment vehicle compared to other types of assets.

ATTOM’s executive vice president of market intelligence, Rick Sharga, expressed that even house flippers aren’t invulnerable to the market’s changes and shifting behavior.

He goes on to say, “With demand from buyers weakening, prices trending down over the past few months, and financing rates significantly higher than they were at the beginning of the year, flippers face a much more difficult environment today and probably will in 2023, as well.”

High Property Prices and Mortgage Rates

The changes in market conditions are affected by several factors, which include inflation, the law of supply and demand, and buyer behavior. But two other notable factors impact the changes in every housing market: property prices and mortgage rates.

Let’s talk about mortgage rates first.

As the Federal Reserve does its best to battle inflation, the ones taking the brunt of all this are consumers and borrowers. And we all know how expensive it is to purchase an investment property. Not everyone who goes into real estate investing has enough money for an all-cash transaction. This is why a huge chunk of investors turn to financial institutions and lenders.

We took a look at Bankrate to see what the existing mortgage rates are at the time of writing this. The rate for a 30-year fixed-rate loan is 6.47%, while a 30-year refinance rate is 6.54%. Although they have gone down a bit from the previous week, they’re still hovering near the 6.50%-mark.

Unless you’re using the BRRRR strategy, taking out a mortgage on a potential fix-and-flip investment property won’t do you any good. This is why most house flippers make all-cash purchases. Which leads us to property prices.

While the housing market has shown signs of slowing down, this doesn’t necessarily mean that property prices have gone down, too. This just means that the rate of appreciation is going at a much slower rate compared to the previous month’s.

House flipping investors are still faced with high property prices, especially in areas that have a higher housing demand.

Related: How to Get the Best Mortgage Rate for Investment Property in 2023

Costs of House Flipping

An investor’s financial obligations on a fix-and-flip property don’t end with its purchase. Going into house flipping will cost you a pretty penny, especially if you want to make some good profit from it.

Aside from the property purchase cost, the closing costs, inspection fees, and other expenses associated with buying a property, you will also need to take care of several other costs that go with rehabilitating and reselling a home. These are just some of the things you will need to set aside some money for:

- Renovation costs (materials and labor)

- Insurance

- HVAC repairs or replacement

- Appliance replacement

- Selling costs

- Permits

Related: The Real Estate Investor’s Guide to Micro Flipping

A More Profitable Alternative Strategy to House Flipping in 2023

While things may seem a bit bleak for the house flipping industry, the good thing is that real estate investing is chock full of opportunities for those who are serious about it. There are several ways that you can still get into real estate investing and make some serious profit aside from the seemingly attractive house flipping profits flippers typically enjoy.

Perhaps one of the best ways to get into real estate investing is by starting a rental property business. Getting into the rental property business opens doors for you in two different worlds—the world of long term rentals and the world of vacation rentals. As an investor, you can choose which strategy suits you best.

Investing in long term rentals gives you the following advantages:

- Stable source of monthly income

- Fewer tenant turnovers

- Savings on utility payments

On the other hand, if you decide to invest in vacation homes for sale, you enjoy the following benefits:

- Potentially bigger rental income compared to long term rentals

- Tax benefits

- Dual usage as a rental property and a personal vacation home

A rental property strategy also allows you to enjoy real estate appreciation, unlike fix-and-flip property owners. This allows you to build even more wealth and equity as an investor.

Related: Real Estate Investing for Beginners with Money—Is This Possible?

Investing With the Help of Technology

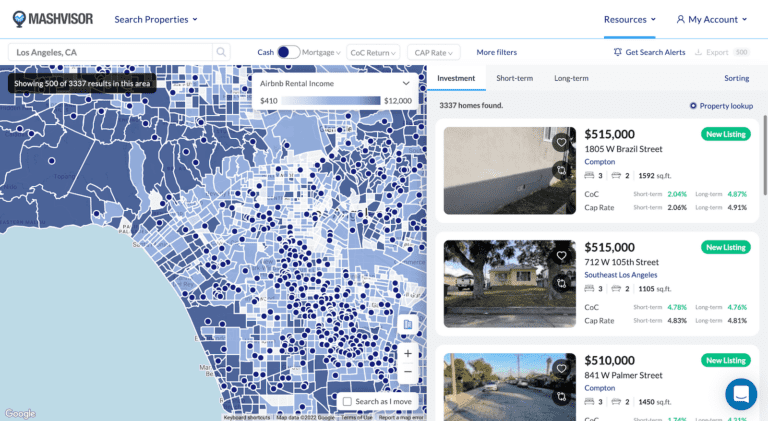

Finding the best rental properties is also a lot easier today, thanks to technological advances that weren’t available decades ago. Mashvisor is one of the most reliable technological tools when it comes to rental property investing.

As a website, Mashvisor has already helped countless investors find the right rental properties in the most profitable rental markets in the country. It gives users access to a massive database filled with the most relevant data and up-to-date information on nearly every market in the US.

On top of that, it also gives users access to valuable real estate investing tools that can help them make more accurate and realistic ROI and profit projections. Investment property analysis has never been easier and quicker.

Learn more about how Mashvisor can help you find the best deals in the most profitable markets by scheduling a demo now.

Mashvisor’s real estate heatmap gives you an overview of which parts of a city is optimal for your chosen rental strategy.

Wrapping It Up

House flipping profits may be down, but that doesn’t mean you can’t get into real estate investing in 2023. There are other better ways of investing in real estate, specifically getting into rental properties.

Let Mashvisor help you find short term rentals for sale to get you a step closer to building your rental property business.

Get started on your 7-day free trial with Mashvisor today, followed by a lifetime 15% discount.