Do you wish to invest in a rental property for sale in 2023? Here’s a forecast and prediction for the year, what to expect, and how to invest.

At the start of every year, many real estate investors take a step back to take stock of the previous year and what they’ve learned. Many also go ahead and analyze trends they believe will affect investments in the coming year.

Table of Contents

Real estate investors favor rental properties in most cases. The idea of earning consistent monthly income and building your investment portfolio is convincing enough. Also, if you obtain financing to purchase the property, you can get your tenants to repay the mortgage for you.

Fairly low risk, rental income, and handsome returns. They sound like a no-brainer, right?

Even then, rental properties may or may no longer be what they’ve always been. 2023 will be an interesting year, especially with the current state of the economy, inflation, and mortgage rates.

Should you take a risk and dive headfirst into the murky waters of rental property investment in 2023? Or should you watch everything unravel from the sidelines?

In today’s blog post, we seek to answer the above questions and help you choose the best course of action when it comes to rental property for sale near me in 2023. We’ll also cover how Mashvisor can help you manage the risks of real estate investing in 2023, so stick around for that as well.

Is Buying a Rental Property Worth It in 2023?

Rental market predictions are quite tough to make right now. It is mainly due to the fact that the Federal Reserve might be compelled to raise interest rates anew to keep inflation in check. However, there are a few trends on that you can base the market forecast.

Here’s what you need to know about investing in a rental property for sale in 2023. We divided the reasons into two major sections:

Why You Should Invest in a Rental Property in 2023

Investing in a rental property for sale will be a good investment in 2023 for several reasons. Here is a breakdown of a few reasons:

Balanced Housing Markets

The 2020 pandemic brought about a rise in interest in small, rural markets. As many companies switched to remote work, many people moved from primary markets to tertiary markets. It was mainly because people were looking for affordable housing with larger spaces.

While remote work is set to continue, companies are also going back to full operation. As such, people are moving back to the cities. Primary markets are set to go back to pre-pandemic levels.

Also, many markets, such as Florida, were described as sellers’ markets in the past two years. The conditions favored sellers, as property prices hit all-time highs and priced out many potential buyers. But, you can expect to see a change in 2023.

Hot markets are expected to cool down. Many real estate markets will also experience different demands. Many markets will neither be sellers’ nor buyers’ markets. It should encourage you to invest in a rental property for sale since such properties will be more affordable, and market conditions will be more favorable.

Related: Buyers Market vs Sellers Market in Real Estate: Everything That You Need to Know

Recovery in the Short Term Rental Industry

The past two years had a devastating effect on the short term rental industry. The inflation and poor economic conditions have led to many people cutting down their spending to stay afloat. One of the areas affected was the vacation and travel sectors.

In 2023, we can expect the short term rental sector to go back to pre-pandemic levels. And there are statistics to support this forecast.

According to US Travel, the monthly travel expenditure in April 2022 in the US surpassed the spending in April 2019 for the first time by 3%.

Travel is one of the core pillars of the Airbnb rental industry. Travelers and vacationers tend to book short term rentals when they travel. More expenditure in the travel industry means more revenue for the vacation rental industry.

It is a sign for you to be creative and invest in short term rentals in a top-performing short term rental market, such as Florida.

Growing Demand for Rentals

Property prices and mortgage rates are expected to stay high in 2023. The said factors will discourage many people from investing in a rental property for sale. It’s a positive sign for real estate investors since it means that you’ll face less competition.

The demand for rental properties will remain high. With Gen Z coming of age, you can expect to see more people looking for properties to rent. Millennials make up the majority of renters in the US. Baby boomers and Gen X, on the other hand, seem tired of all the trouble involved in keeping a house; they’re now going back to renting.

As a rental property owner, it is a sign that you will enjoy a good occupancy rate and low tenant turnover.

Why You Should Not Invest in a Rental Property in 2023

After looking at some factors that may influence you to invest in a rental property for sale, what other things should you keep in mind?

Inflation

Let’s face it; the cost of everything is going through the roof. Families all over the world are doing everything to afford the cost of living, including rent. It is putting a strain on living situations.

To counter such issues, many people are choosing to move in together with other family members or roommates to share the cost of monthly rent. While it may be a downside for a few, real estate investors can view it as an opportunity.

The trend is leading to an increase in demand for larger rental properties. Besides living with family members and roommates, people also prefer larger units. They want something that can support their remote working lifestyles.

As a real estate investor, it is an opportunity for you to invest in a larger residential property for sale. You could choose to invest in a multifamily property with several units or buy a single family property with several bedrooms.

High Property Prices and Mortgage Rates

The main downsides of investing in rental properties in 2023 are the high property prices and mortgage rates.

In November 2022, the median property price in the US rose 11% compared to the same period in the previous year. Though the increase was 16% slower than the annual growth rate seen in June and July, the prices would not be coming down any time soon.

Also, the current high demand for properties but a low supply of housing might push the prices even higher.

As for mortgage rates, the average interest rate for a 15-year fixed-rate mortgage went up from 2.8% in January 2022 to 6.36% in October of the same year. It was the highest recorded rate within the past 15 years.

With the current inflation, you can expect the rates to remain high. The high property prices and interest rates are going to price out many real estate investors. Specifically, those who can’t afford to place a 20% down payment or secure an affordable mortgage will be out of luck.

A Few Tips on Investing in the Current Market

However, you can still invest in the current conditions. Simply follow the following tips:

- Save for the down payment: A down payment is usually at least 20% of the property’s selling price. Raise the amount in cash before getting a mortgage. While you can still get financing with less than a 20% down, you’ll be required to pay for private mortgage insurance (PMI). It will increase costs and your monthly mortgage payments. Save the said amount, then obtain a mortgage.

- Get a good mortgage: It’s clear that there are many exploitative mortgage providers with exorbitant costs. Our recommendation is to always get a 15-year conventional mortgage with a fixed interest rate. There are 30-year mortgage options, but they tend to come with

- higher interest rates. With a 15-year fixed-rate mortgage, you’ll finish repaying the loan sooner and at a favorable interest rate. You’ll save more money in the long run.

- Remember the 25% rule: The 25% rule generally states that your monthly home payments should be no more than 25% of your total monthly income. The monthly home payments consist of the principal, interest, property taxes, insurance, and HOA fees.

Related: Adjustable-Rate Mortgage vs Fixed-Rate: Which Is Better for a Real Estate Investor?

The Best Website to Find a Profitable Rental Property

We’ve looked at a number of reasons why you should invest in a rental property for sale in 2023. We’ve also seen some reasons why some investors may choose to sit on the sidelines.

While the positives are enough to convince you to invest your money, it’s not guaranteed that you’ll make substantial returns. Your success is tied down to your ability to find properties with a high yield.

There are thousands of homes for sale in most housing markets at any particular time. The process of analyzing different homes to filter in the most lucrative ones can be challenging, especially for beginners.

Also, there are multiple property listing sites on the internet today. So, which is the best website for smart real estate investors?

As an investor, you want a website that will allow you to find profitable rental properties in any city in the US real estate market. You also want one that’s easy to use, with updated listings, and provides available tools for you to carry out in-depth analysis.

Look no further than Mashvisor.

What Is Mashvisor?

Mashvisor is an online real estate platform that employs cutting-edge algorithms and AI technology to help you find lucrative real estate properties in any market in the US. It’s the best platform for investors looking for properties that match their investment and financial goals.

Mashvisor ticks all the right boxes. It doesn’t just allow you to search for properties across all markets. It also helps you analyze neighborhoods and properties using different crucial metrics, such as occupancy rate, cap rate, and cash on cash return.

In short, it’s a one-stop shop for real estate investors.

Let’s break down some of Mashvisor’s important tools.

Rental Property Finder

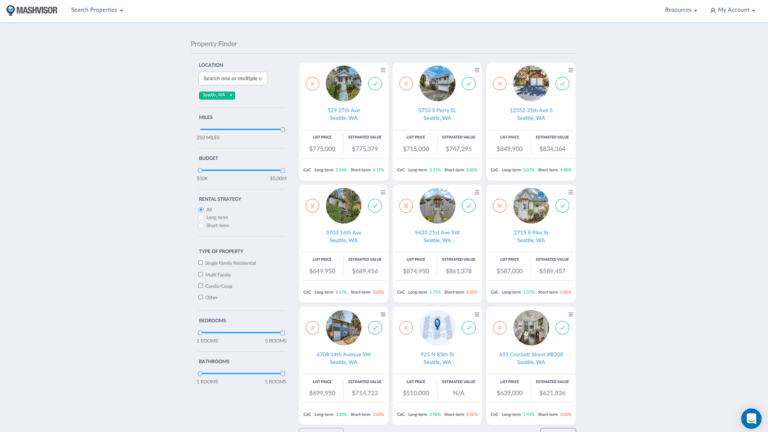

You need a good investment property search tool to help you find a lucrative rental property for sale. Mashvisor’s Property Finder is the best tool for the job.

When doing their property search, most investors have an idea of what they want in mind. The Property Finder tool helps you filter out any properties that don’t fit your search criteria and end up with properties that do.

As such, the tool comes with a set of filters that you can use to set up your search criteria. After you’ve set the filters, it then uses machine learning and AI to generate a list of top-performing listings based on your requirements.

The listings are ranked in order based on performance. The properties with the highest profit potential are ranked first.

This tool is the fastest and most efficient way to find profitable rental properties for sale. You don’t need to type “rental properties for sale near me” on Google Search and then go through thousands of listings.

Here are the filters you’ll find on the Property Finder tool:

- Location: You can add up to 10 cities to your search

- Budget: You can set a budget between $50,000 to $5 million

- Miles: Helps you set the preferred distance between the city and the property

- Rental Strategy: Do you plan to use the rental property as a short term rental or a long term rental? You can also select both.

- Property Type: Allows you to choose your preferred property type. Property types include single family homes, multifamily properties, condos, townhouses, and many others.

- Number of bedrooms and bathrooms: You can select between one and five.

Related: How to Invest in Real Estate for Beginners in 2023

You can use Mashvisor’s Property Finder tool to find a lucrative rental property for sale.

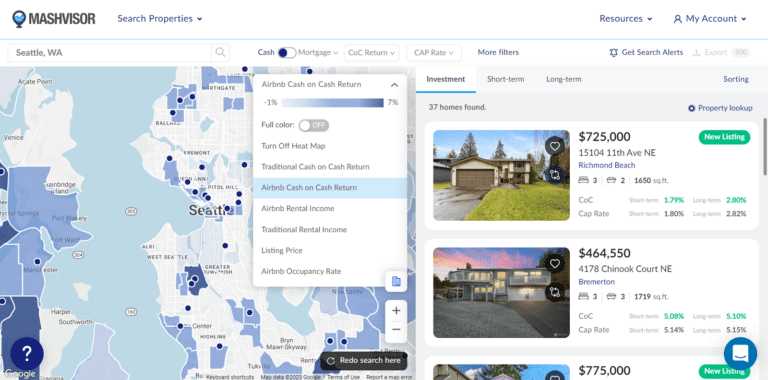

Real Estate Heatmap

Let’s assume that you now have a list of cities you’d like to invest in. While it is a good first step, it can be a little confusing. It is because different neighborhoods in the same city offer different returns on investment.

It’s always best to narrow down your search for a rental property for sale to specific neighborhoods in a city. Location is important in real estate investing. Narrow down your focus to specific neighborhoods.

Using the Heatmap Tool

Mashvisor will help you carry out in-depth neighborhood analysis. Our heatmap tool gives you relevant visual cues and important analytics. You can use the heatmap to analyze different neighborhoods in a city based on the following criteria:

- Listing price: This filter on the heatmap tool will help you view neighborhoods that sell properties within your budget. You can easily view properties listed in a particular neighborhood based on the listing price.

- Cash on cash return: It’s important to determine a property’s cash on cash return before buying it. This filter will allow you to set your search criteria based on the metric for both short term and long term rental strategies. You can then easily see the neighborhoods that generate good cash on cash returns for each rental strategy.

- Rental income: You can use this filter to set the amount of monthly income you expect to receive from the property for both short term and long term rental strategies. The heatmap tool will show you which neighborhoods match your rental income expectations.

- Occupancy rate: One of the most important metrics for investors who wish to invest in short term rentals is occupancy rate. Occupancy rate is simply a metric that shows you the demand for short term rentals in a neighborhood. Use this metric to see neighborhoods that offer a good Airbnb occupancy rate.

You can use Mashvisor’s real estate heatmap tool to analyze different neighborhoods in a city based on several metrics, such as listing price, cash on cash return, rental income, and occupancy rate.

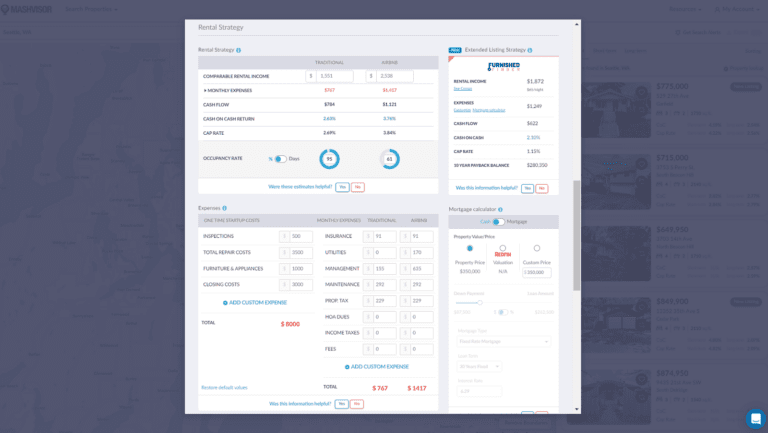

Investment Property Calculator

After viewing a few potential properties in your desired neighborhood, you’re not done yet. You must carry out an in-depth rental property analysis since you want to invest in a potentially profitable property.

To do it, you need to perform several calculations to compute various returns on investment metrics. Doing so manually would be tedious and would expose your calculations to errors.

But with Mashvisor’s investment property calculator, you can access all the metrics and analytics with just the click of a button. The tool provides you with an in-depth analysis of all property listings on the platform.

Accessing Property Data and Analytics

You can access the following data and analytics using the investment property calculator:

- Startup costs: These are the one-time costs that you’re expected to sort at the beginning of your investment. They include a number of expenses, such as inspection, closing costs, repairs, and other initial fees.

- Recurring expenses: These are the monthly fees associated with owning and operating the rental property. They include property taxes, insurance, utilities, HOA fees, and maintenance fees.

- Rental income: The calculator will provide you with rental income estimates for both short term and long term rental strategies.

- Cash flow: This is the amount of money you have left once you take away your expenses from your income. Always aim to invest in positive cash flow properties that leave you with a reasonable profit.

- Return on investment: Many real estate investors are mainly concerned with a property’s return on investment. The two vital ROI metrics are cash on cash return and cap rate. Our calculator provides you with both metrics so you can estimate a property’s ROI.

The best thing is that Mashvisor offers a 7-day free trial for investors looking for a rental property for sale. Try it now.

You can use Mashvisor’s investment property calculator to conduct an in-depth analysis of all property listings on the platform.

Invest in a Rental Property for Sale in 2023

Rental properties have always been the best option for real estate investors who wish to receive a steady income and build their wealth. The 2023 market, in particular, is quite promising for investors looking for rental property for sale.

Real estate markets, like Florida, are expected to cool down and become more balanced. While property prices may not come down, they’ll stop going up at crazy rates. We’re also going to see an increased demand for short term and long term rentals.

However, you need to prepare yourself to invest amidst inflation, high property prices, and increased mortgage rates. You can do it by saving at least 20% to use as the down payment, securing a 15-year fixed-rate conventional mortgage, and following the 25% rule.

Importantly, you need to use the Mashvisor platform to find lucrative rental properties and carry out comprehensive neighborhood and property analyses.

Schedule your demo now and see how Mashvisor can hold your hand in your investment journey.