Starting a real estate investment business is surely a profitable thing to do if you know how to do it. Many beginner real estate investors fail because they often jump into actions before learning the basics of real estate investing. This blog post is a step by step guide dedicated to showing inexperienced real estate investors the basics of starting a real estate investment business.

A real estate investing business can take several forms. Do you wish to invest in income generating properties or do you want to fix and flip distressed real estate properties? In this blog, we focus on investing in a rental property business. If you want to know more about flipping real estate, read this blog post here.

Related: How to Start a Rental Property Business – 5 Simple Steps

Step #1: Do your research

The first step for starting a real estate investment business is to research every aspect of the industry. Doing this step at an early stage can save you the trouble later on. But when it comes to real estate education, the process never stops. You always have to stay up to date with the latest tools and market trends if you plan on making money in real estate.

A good starting point would be researching the types of real estate properties and what the current market trends say about each. Is there more demand in your area for single family homes or condominiums?

Additionally, the list of concepts you need to research before starting a real estate investment business includes:

- Rental strategies: short-term rental properties vs long-term rentals

- Local rental laws and regulations

Mashvisor’s blog section has thousands of articles that cover every aspect of real estate education. Sign Up to follow our blogs for the latest.

Step #2: Choose a real estate investing strategy

After researching the basics of real estate investing, the next step would be choosing a real estate investment strategy. When starting a real estate investment business, these are the most common rental strategies:

1- Long-term or traditional buy and hold. This strategy, as the name implies, involves buying an investment property with the aim of renting it out for a long period until it is sold again. Profits are made after subtracting costs from monthly collected rent.

2- Short-term or Airbnb rentals. Unlike the first strategy, a short-term rental is rented out for short periods, a maximum of 6 months. Tenants of short-term rentals pay per night of stay.

Location is the most important word in real estate. The location of the investment property decides whether you should opt for a long-term or a short-term rental strategy.

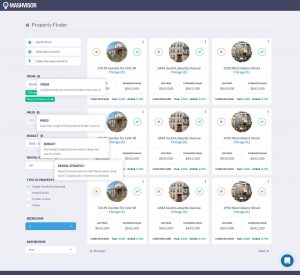

Step #3: Search for properties

Starting a real estate investment business means that you first have to locate an investment property that suits your preferences. Mashvisor’s property finder tool is designed to drastically cut down the time you need to find an investment property and filter options to match your investment needs. It will show you the properties with the highest cash on cash return in your desired location.

Moreover, Mashvisor provides another useful tool for finding the best investment properties using heat map analysis. All you have to do is choose a city and set the investment criteria such as cash on cash return. Neighborhoods will be colored to show you which ones have the best properties for that particular metric.

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here.

Step #4: Conduct a real estate market analysis

After you find an investment property, the next step is to conduct a real estate market analysis or CMA – comparative market analysis. The purpose of a CMA is to find the market value of the property you have chosen by comparing it to market comparables, or real estate comps. This gives you an idea of whether you are paying too much or too little for the subject income property. To qualify as comparables, properties need to be in the same area, have the same size, be of the same type of real estate, etc…

Related: How to Perform a Real Estate Market Analysis

Step #5: Conduct an investment property analysis

An important step before starting a real estate investment business is to evaluate the performance of the property itself should it be rented out using any of the discussed rental strategies. The easiest way to perform an investment property analysis is using an investment property calculator also known as a rental property calculator.

Mashvisor’s own rental property calculator is a tool every real estate investor should use if they want to make money fast in real estate. All you have to do is enter in how much down payment you are going to pay and the financing method. Thanks to thousands of inputs, data analytics provides you with important real estate metrics such as the expected rental income, cap rate, and cash on cash return. Furthermore, the calculator will advise you as to which rental strategy is more favored for the investment property.

To start your 14-day free trial with Mashvisor and subscribe to our services with a 20% discount after, click here.

Step #6: Look for financing options

Starting a real estate investment business means that you have to look for financing methods to purchase your investment property. The first decision you have to make is choosing between cash or mortgage to finance a property. Both methods have their pros and cons, but many argue that financing a real estate investment with debt is less risky. For more about cash vs mortgage financing, read Financing Investment Properties: Buying a House in Cash vs Mortgage.

Starting a real estate investment business means that you have to look for financing methods to purchase your investment property. The first decision you have to make is choosing between cash or mortgage to finance a property. Both methods have their pros and cons, but many argue that financing a real estate investment with debt is less risky. For more about cash vs mortgage financing, read Financing Investment Properties: Buying a House in Cash vs Mortgage.

Real estate investing can be done with little or no money at all. Don’t let financing get between you and your dream of owning a rental property.

Find out how to make money in real estate with little capital here.

Starting a real estate investment business is not rocket science. Follow the steps above next time you wonder how to start investing in real estate.