Real estate investors use a wide range of metrics to analyze the performance of different income-generating properties and thus decide whether to buy or not. Some of the most popular metrics include the capitalization rate (cap rate), internal rate of return (IRR), gross operating income (GOI), net operating income (NOI), loan-to-value ratio (LTV), debt coverage ratio (DCR) and gross rent multiplier (GRM).

Related: Real Estate Return on Investment Analysis: Which Metrics to Use?

Return on investment (ROI) is another metric that can be used to judge investment properties. All it takes is calculating the profit made from a sale and dividing it with the total amount invested. For instance, if a property seller (principal) makes a profit of $12,000 on a property that cost them $100,000, the ROI is 12%. However, when it comes to rental property investments, a different formula is needed to calculate returns since the property is not being sold immediately.

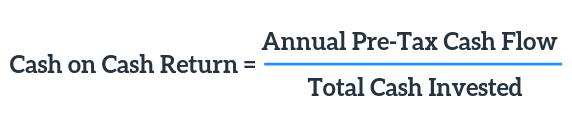

Rental property owners can calculate the return on their investment using cash on cash return (CoC), a very popular and crucial metric used in real estate. Also referred to as the equity dividend rate or cash yield, CoC is a ratio of the net annual rental income collected from a real estate investment and the total cash invested in the same property. Every rental property owner needs to know how to calculate cash on cash return.

Calculating cash on cash return is simple. The cash on cash return formula is:

The cash on cash return on a rental property will vary depending on whether the real estate investor took out a loan or not.

Example 1: Investment in Rental Property Without a Loan

A real estate investor buys a condo for a cash investment of $1,000,000 and receives a monthly rental income of $4,000. The rental property expenses amount to $1,000.

Therefore, the monthly income is $4,000 – $1,000 = $3,000. Annual income on the investment property is 12 x $3,000 = $36,000.

The cash on cash return calculation is $36,000/$1,000,000 = 3.6%

Example 2: Investment in Rental Property with a Loan

A real estate investor purchases a condo for $1,000,000 and makes a down payment for investment property (principal) of $200,000. He receives a monthly rental income of $4,000 and pays debt service of $1,500 (depending on the investment property mortgage rates). There is also an operating cost of $1,500 every month.

So, the monthly earning after expenses is $4,000 – $2,000 = $2,000. Annual income is 12 x $2,000 = $24,000. Therefore, the cash on cash return calculation is $24,000/$200,000 = 12%

As can be seen from these examples, taking a loan resulted in a higher ratio. At the same time, however, the leverage or loans make the real estate investment riskier. This is because, while paying the loan, the property investor will also have to take responsibility for any loss of capital, extra costs, impairment losses, and damage.

Operating Expenses: What to Include

Operating expenses in the cash on cash return calculation are basically costs that landlords incur in the day-to-day running of their rental properties. This includes costs such as marketing and advertising, property insurance, property taxes, trash collection, utilities, maintenance and repairs, property management, pest control, and accounting and legal.

Real estate investors must ensure that every operating expense listed is related to their rental properties. For example, a printer can only be listed as an expense if it is being used to print posters and flyers for real estate purposes. Illegal kickbacks or bribes, charitable donations, landlord’s personal labor, penalties, and fines for violation of the law, political contributions and lobbying expenses are not acceptable as deductible expenses in the cash on cash return calculation.

Related: Investment Property Costs to Consider This 2018

The good news is that real estate investors don’t have to do the cash on cash return calculation manually. They can use Mashvisor’s cash on cash return calculator to figure out the cash on cash return on investment properties such as single family homes, multi-family homes, and condos.

Related: Rental Property Calculator: Just for Beginners or a Tool for All Real Estate Investors?

Benefits and Drawbacks of the Cash on Cash Return Metric

Here are some of the benefits of using the cash on cash return calculation to compute return on investment:

- Simplicity – Compared to metrics such as the internal rate of return (IRR), the cash on cash return calculation is relatively simple, which is a benefit thanks to the next point.

- Quick Comparison –CoC makes it easy for real estate investors to compare different investments and find out which ones have the highest return potential.

- Leverage Assessment – For instance, if someone paid cash for a specific investment property, they might get a CoC return of 7%. However, if they choose to take out a mortgage and put down 25%, it might give them a better return. Therefore, the cash on cash return calculation helps real estate investors compare different scenarios and determine what amount of leverage would work.

However, cash on cash return also comes with its challenges:

- Since different costs arise at different times, the cash on cash return calculation can be very tricky. For instance, a real estate investor could pay the closing costs and down payment at closing but wait for a few more weeks or months until repairs are done to pay the contractor. It is therefore hard to determine when cash on cash calculations should begin.

- Cash on cash does not consider unseen returns such as tax benefits, equity pay down, or appreciation.

- CoC returns do not consider the time value of money. Therefore, the calculation might only be accurate in the first year of investment.

- The ratio does not take into account compound interest. A property with a compound interest of as little as 3% could be a much better investment than another with high cash on cash return.

So, What Would Be Considered a Good CoC Return?

There is no fixed number for good cash on cash return. While some industry gurus consider 8% as a good return, others say it should be between 8-12%. On the other hand, some real estate investors are not satisfied if the cash on cash return is not at least 15%.

In Conclusion

There is a whole world of difference between investing for cash flow versus investing for purely speculative reasons. Positive cash flow allows rental property owners to continue thriving even during periods of economic crisis. On the other hand, developers, speculators, and fix-and-flip investors find themselves in a tough situation when there is a downturn.

Cash on cash return calculation allows real estate investors to figure out if the investment properties they are considering will yield a positive cash flow. In addition, this ratio protects investors from over-leveraging and putting themselves in a financial crisis.

In addition to doing the cash on cash return calculation for the property, investors should analyze factors such as the location of the rental property, the aesthetic feel of the property and future prospects of the neighborhood. In addition, other metrics such as ROI and cap rate should be used when comparing and analyzing properties.

Do you have questions about Mashvisor? Read our FAQs and learn about our tools.