Are you unsure of where to invest in real estate? One of the most popular metrics investors consider when analyzing a specific location is the price to rent ratio. This is simply the average ratio of the median property price divided by the annual rent price in the area. It’s only a simple metric, but it can tell you a lot. Homeowners and renters use it to decide which option makes more financial sense – to buy a home or to keep renting. Real estate investors, on the other hand, use this ratio to help them find the best places to buy rental property as well as to analyze investment opportunities. If you’re planning to analyze locations using this real estate metric, then you must be wondering how to calculate price to rent ratio. If so, keep on reading!

How to Calculate Price to Rent Ratio

Calculating price to rent ratio is very simple. All you have to do is take the median property price of your area and divide it by the average annual rent price. Hence the price to rent ratio formula:

Price to Rent Ratio = Average Property Price/Average Annual Rent

As a rough example, say that the average price of property for sale in your housing market is $300,000 and properties rent for $2,000 a month. In this case, the price to rent ratio is $300,000/$24,000 (2,000 x 12) = 12.5. But what does this number mean exactly? Well, the price to rent ratio is generally classified into three ranges:

- Low (15 and below): suggests that it’s better to buy a house than to rent one

- Moderate (16-20): suggests that it’s usually better to rent than to buy a house

- High (21 and above): suggests that it’s definitely better to rent a house than to buy one

Why Should You Calculate Price to Rent Ratio?

As mentioned, the average person would consider this number when choosing whether they should buy a house or keep renting. As a real estate investor, however, knowing how to calculate price to rent ratio is important because it gives you some insight into the viability of residential real estate investment for a given location.

For starters, when you know that the real estate market has a low price to rent ratio, this tells you that the average property price here is affordable for the average person, which is why it makes more financial sense for people to buy a house. In turn, this housing market is not a good place for a real estate investor to buy rental properties. Why? Simply because you need to be able to find renters if you want to make positive cash flow from rental income. If the ratio is telling everyone that this market is great for buying, there will likely be fewer tenants looking to rent. Meaning, the demand will be lower and so will your rental income.

Of course, that’s not to say cities with the highest price to rent ratio are necessarily better locations than cities with lowest ratios. It mainly depends on your real estate investment strategy. For example, if you’re implementing a fix and flip strategy or buying an investment property at below market value to sell soon after, then you’ll actually want to invest in real estate markets where the ratio is low. As mentioned, a lower ratio means it’s more affordable to buy, so you can find cheap investment property for sale and a large pool of potential buyers when it’s time to sell. And if you’re planning on buying a vacation home to rent out on Airbnb, then this ratio wouldn’t matter much to you.

Furthermore, while understanding the ratios of particular cities is important, drilling down into small geographies of an area is even more useful for real estate investors. This helps in identifying the best neighborhoods and zip-codes where buying a second home to rent out has a high probability of being a profitable investment. This is another reason why you should learn how to calculate price to rent ratio. Knowing the ratios of different neighborhoods within the same city or real estate market is a great strategy to narrow down your search for a good location to invest in real estate even further.

Related: The Best Real Estate Markets to Invest in the US for Price to Rent Ratio

How to Find Data for Price to Rent Ratio Calculation

Now that’s its clear why calculating price to rent ratio before choosing an investment location is a smart move for real estate investors, it’s time that you go ahead and start running the numbers. But first, you need to gather data on the median property prices and average rents in your housing market of choice. As with any calculation, everything comes down to the data you input. So, now the question is where can you find reliable data for the price to rent ratio formula?

While you can do your own research manually, smart investors use real estate investment software and tools that’ll allow them to make their calculations and the right decisions quickly, with more confidence. And one of the best real estate investor websites is Mashvisor. Our software comes with multiple tools that were designed to meet the needs of real estate investors in the US housing market. Using our property search tools, you can search any city of your choice, pick a neighborhood, and you’ll see a summary bar that includes all the key calculations you need including the average property price and the average traditional rental income. Having this data readily available will make calculating price to rent ratio really easy!

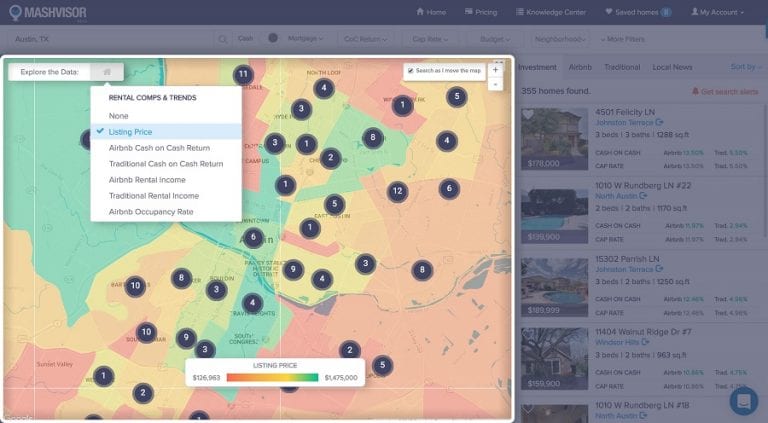

While on the neighborhood page, you’ll also get a complete rent analysis of historical rental income in that neighborhood, a list of comparable property sales, and even more insights such as the optimal property type, optimal number of bedrooms, and optimal rental strategy. And that’s not all Mashvisor has to offer! You can use our real estate heat map to do a neighborhood analysis based on the criteria that matter most to you. You can analyze neighborhoods based on listing price, cash on cash return, or cap rate.

To learn more about how we will help you make faster and smarter real estate investment decisions, click here!

Keep in Mind…

Although knowing how to calculate price to rent ratio is good for comparing one area to another, investors must remember that it’s not the ultimate real estate metric. It’s only an indicator of what the demand for a rental property in a market will be like. Meaning, it doesn’t account for everything that investors look for in a location. For example, while it compares buying to renting a house, it doesn’t reflect the overall housing affordability of a real estate market compared to other markets.

Furthermore, the price to rent ratio also doesn’t tell you anything about the investment property itself. For example, it doesn’t separate out properties in lower-income areas of a certain zip code. Furthermore, it doesn’t take into account the condition of properties, property taxes, insurance, repairs, tenant turnover, and it doesn’t distinguish between investment properties of different sizes or number of bedrooms. It simply doesn’t look at a lot of things which is why you should do a complete real estate market analysis and look at properties with specifics – not averages – or you might miss out on a great location simply because of bad data.

In the end, calculating the rate of return on rental properties should be your main focus. You can easily do that with Mashvisor’s Investment Property Calculator. So if you’re searching for the best locations to buy a rental property, sign up today for a 7-day free trial to start your search and calculations without the hassle of gathering data yourself!