Buying vacation homes for sale is exciting. You’ve reached a point where you can afford your personal getaway (or at least the down payment).

But you didn’t come this far without being money-savvy. So you know it’s smart to view your second home as a vacation rental property—a place that allows you to save money on holidays, but that also makes you money for the rest of the year.

Table of Contents

- 4 Fail-Proof Steps for Finding Vacation Homes for Sale

- Key Considerations Before Buying a Vacation Home

- 10 Best Places for Buying a Vacation Rental Property

- Get Started

It means that your search for vacation homes for sale cannot start with the question, “Where do I want to go on vacation?” Instead, you need to know how to find vacation homes for sale to rent out and make a good return on investment (ROI). Follow along as I show you exactly how you can achieve this in a few simple steps.

4 Fail-Proof Steps for Finding Vacation Homes for Sale

There may be a few different ways to find vacation homes for sale:

- Ask around in your personal network to see if anyone is selling a property. Consider asking your family, friends, and colleagues if they know anyone who’s selling a property.

- Find a real estate agent to help you out. A reputable real estate agent will be able to give you proper guidance on what to look for in a property and where you can start your search.

- Start your search online by Googling “vacation rental properties for sale.” Here, Google is your friend.

- Directly visit a few different real estate websites. Comb through hundreds (if not thousands) of listings. Weigh the pros and cons of the different listings and see if you can find the ideal vacation home for you.

But it’s safe to say that most of those ways for finding a second home to rent out are time-consuming and may either lead nowhere or, worse, lead you to a lemon investment property.

So rather than risk leading you down the wrong path in your search for a profitable rental property, I’ve put together four fail-proof steps to finding your dream vacation home for sale that will give you that high ROI.

Each step has one thing in common: the use of vacation rental data. Otherwise known as Airbnb data, this is what you should rely on when buying a vacation home to rent out. As we move through the following steps, it will become crystal clear why this is the case.

Step #1: Choose a City to Start Your Investment Property Search

As mentioned, simply buying a vacation rental property in a city you imagine yourself relaxing and recharging in isn’t the best real estate investment strategy. Instead, you need to check out the vacation rental data on different cities to see which ones are the most profitable. You need to conduct a vacation rental market analysis.

In addition to that, you also need to make sure renting out a vacation home that you don’t live in (a non-owner-occupied rental property) is legal in the location of your choice. With the emergence of the Airbnb investment strategy, more and more cities are outlawing this practice, limiting the choices for real estate investors.

So, where should you start your search for vacation homes for sale? Below, we put together a list of the top 10 best places for buying vacation rentals based on Mashvisor’s latest Airbnb analytics. In all of these cities, renting out a second home is legal.

Step #2: Find a Profitable Neighborhood for Renting Out a Vacation Home

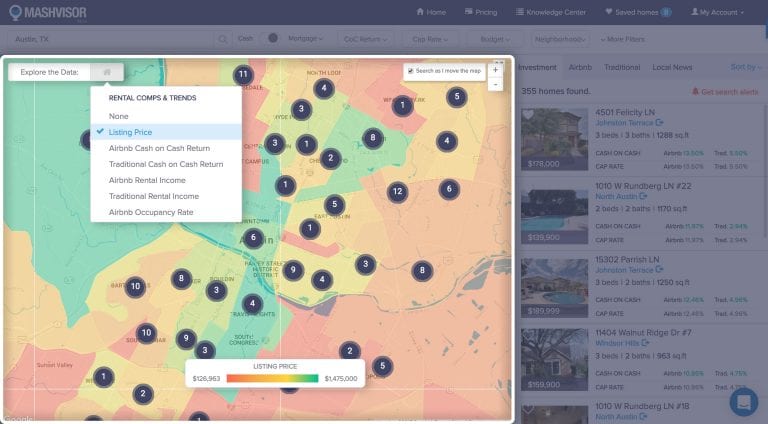

Now that you have a city in mind, it’s time to find a good Airbnb neighborhood. Again, you need data on vacation rentals, and the best way to get that is with Mashvisor’s Real Estate Heatmap.

All you have to do is type in the city where you want to search for vacation homes for sale. From there, you can set the following filters, one by one:

- Listing Price

- Airbnb Rental Income

- Airbnb Cash on Cash Return

- Airbnb Occupancy Rate

If you’re looking for cheap vacation homes for sale, then select the Listing Price filter and shoot for neighborhoods that are in red (meaning the prices in these areas are relatively lower). And then narrow down that list of neighborhoods further by selecting any of the other filters that suit your strategy and look into the areas highlighted in green. These will be neighborhoods with a high average Airbnb rental income, Airbnb cash on cash return, or Airbnb occupancy rate, depending on the filter you selected.

Within minutes, you’ll have completed a neighborhood analysis, and you’ll know where to buy a vacation home rental investment.

Step #3: Zero-In on a High Return on Investment Property

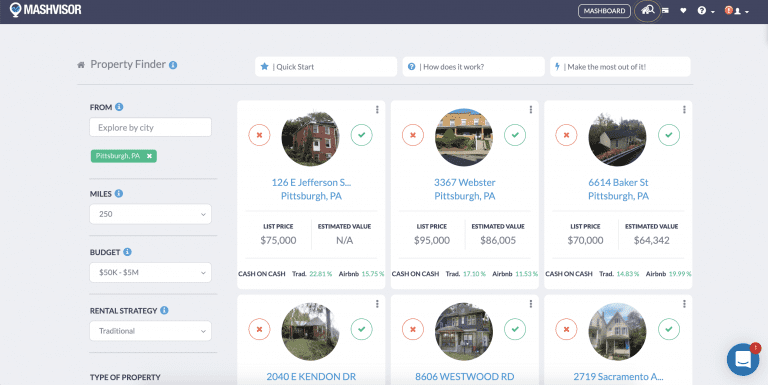

At this point, you may be staring at a dozen vacation rentals for sale (or more!). You need to find the one that promises a high return on investment (upon initial inspection of the vacation rental data). For this, you should use Mashvisor’s Rental Property Finder.

Again, you’ll get to play around with a few different vacation investment property search filters, including:

- Location (you can choose up to 10 cities at once if you’re still undecided)

- Distance from the City

- Budget

- Rental Strategy (select the Airbnb rental strategy)

- Type of Vacation Rental Real Estate (single-family home, multi-family home, condo, etc.)

- Number of Bedrooms/Bathrooms

From there, the AI will return a list of the high-cap rate properties for sale for you to choose from. Select a few that are located in the neighborhood you found as the best place for investing in vacation homes for sale because now it’s time to perform a vacation rental property investment analysis on each one.

Step #4: Perform a Vacation Home Investment Analysis

If you’re a beginner investor or even an experienced one, the word “vacation home investment analysis” may draw up the images of endless spreadsheets filled with formulas and addresses. But because I told you I was laying out four easy steps for finding the best vacation homes for sale, we will not be using spreadsheets here.

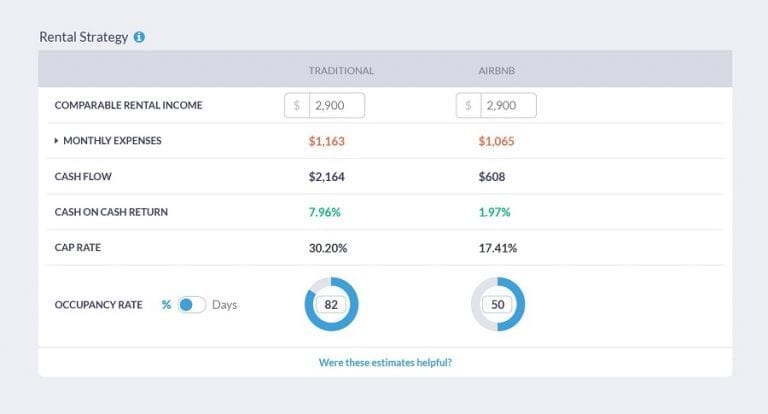

Rather, you should take advantage of Mashvisor’s Vacation Income Property Calculator. The real estate investment tool is the best way to find vacation rental properties for sale.

Continuing from the Rental Property Finder, a real estate investor can simply click on any of the vacation rental investment property cards. From there, you’ll get to view the Property Analysis Page, where the calculator displays all the vacation rental data you need, like this:

As you can see, the Airbnb data includes:

- Comparable Airbnb Rental Income

- Monthly Expense Estimates

- Cash Flow

- Cash on Cash Return

- Cap Rate

- Occupancy Rate

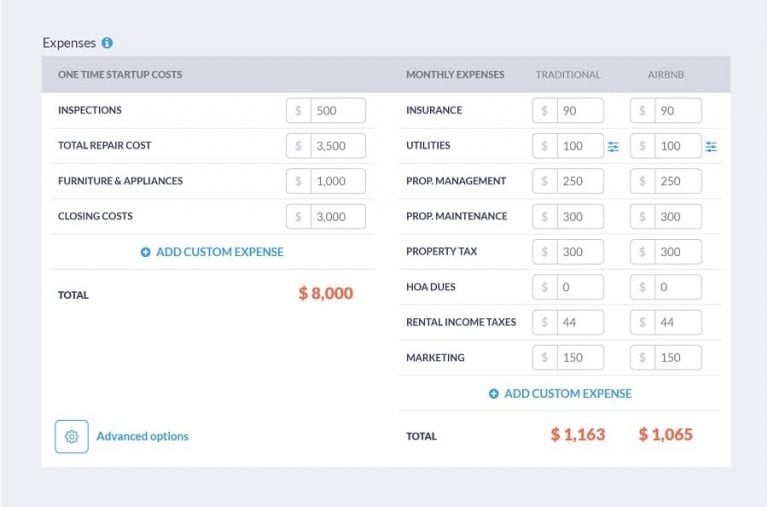

With this, you’ll be able to see the potential income and return on investment from vacation rentals with the different investment properties for sale. Be sure to add your mortgage information, such as the vacation home down payment, loan type, interest rate, loan term, and loan amount. In such a way, you can see how your chosen method of financing a vacation home affects your cash on cash return.

You will also be able to adjust your expenses from vacation rentals or add any additional ones based on your own Airbnb market research.

Comparative Market Analysis

Finally, a vacation rental investment analysis wouldn’t be complete without a comparative market analysis (CMA). With CMA, you’ll be able to determine the value of the vacation rental property for sale to ensure you’re not overpaying. Alternatively, you can snatch up a great real estate deal! Mashvisor’s vacation income property calculator provides a list of real estate comps for this purpose.

If you’re ready to start making money from Airbnb rentals, learn how to become an Airbnb host now.

Key Considerations Before Buying a Vacation Home

Before anything else, here are a few more things to keep in mind before purchasing vacation rentals:

1. Identify Your Goals

As with any other endeavor, it pays to know what your goals are and keep your eyes on them. The real estate industry is always evolving, with numerous aspects to look into to make sure that you’re getting the most out of your investment in vacation rentals.

2. Location, Location, Location

If there is only one thing to think about when looking for a vacation home for sale to rent out, it’s the location. Your preferred location does not necessarily need to be a large city or a major tourist destination.

It depends on your target market. Many prefer cities for business and leisure trips, while others look for vacation rentals that are close to the city for a bit of peace and quiet.

3. Buy Suitable Insurance

Insurance is one of the few things that you’d rather “have and don’t need it than need it but not have it.” Adequate insurance coverage is necessary primarily to keep you protected in case something unexpected occurs.

Another benefit of getting suitable insurance is that your future tenants will have peace of mind, knowing that the property has the right coverage no matter what happens. If your existing home is covered, make sure to review the policy and check if it can be extended to your vacation home for renting out.

4. Check Different Financing Options

Do you have the cash to buy a vacation home to rent out? Great! Otherwise, consider other ways to buy vacation rentals.

One such way is the conventional loans or mortgage loans that are offered through banks and credit unions. Another option is tapping into your existing home’s equity, provided, of course, that you already own a property.

5. Don’t Forget the Taxes

Getting a vacation home to rent out means you need to consider federal and state income taxes. Aside from the rental rates, your guests will pay sales tax that needs to be collected and handed over to the government.

6. Promote Your Vacation Home

There is no point in buying the best vacation home for rent if people are not aware of it. That is why it is important to think about your marketing strategy—getting the word out about your property and what it can offer.

Are you going to use a website on vacation rentals? How about social media platforms? Are you going to hire a property manager?

7. Make a Plan on How to Manage Your Real Estate Property

Getting into vacation home rental investing entails a lot of effort and dedication. Before buying a property, think about your level of involvement when it comes to property management.

Create a list of tasks that you need to do and see if you can accomplish them by yourself. Determine also what you need to delegate to another individual or a separate property management company.

8. Try Renting It Before Buying

What better way to get a better feel of the real estate property than by renting it first? Consider staying at the vacation rentals you’re planning to purchase for a couple of weeks.

See if you’ll be comfortable and satisfied with the overall experience. You will be able to experience firsthand the different amenities and make the necessary upgrades.

10 Best Places for Buying a Vacation Rental Property

To help you save time, we’ve prepared a list of the top cities to purchase your next rental property. The location data are from Mashvisor and are arranged from the highest to the lowest cash on cash returns:

1. Linton, IN

- Median Property Price: $232,500

- Average Price per Square Foot: $113

- Days on Market: 17

- Monthly Airbnb Rental Income: $2,515

- Airbnb Cash on Cash Return: 9.99%

- Airbnb Cap Rate: 10.46%

- Airbnb Daily Rate: $146

- Airbnb Occupancy Rate: 53%

- Walk Score: 69

2. Coventry, CT

- Median Property Price: $419,519

- Average Price per Square Foot: $190

- Days on Market: 58

- Monthly Airbnb Rental Income: $3,914

- Airbnb Cash on Cash Return: 9.95%

- Airbnb Cap Rate: 10.27%

- Airbnb Daily Rate: $185

- Airbnb Occupancy Rate: 64%

- Walk Score: 17

3. Hampden, ME

- Median Property Price: $399,770

- Average Price per Square Foot: $136

- Days on Market: 34

- Monthly Airbnb Rental Income: $2,268

- Airbnb Cash on Cash Return: 9.92%

- Airbnb Cap Rate: 10.49%

- Airbnb Daily Rate: $115

- Airbnb Occupancy Rate: 69%

- Walk Score: 35

4. Pottstown, PA

- Median Property Price: $313,982

- Average Price per Square Foot: $163

- Days on Market: 46

- Monthly Airbnb Rental Income: $3,470

- Airbnb Cash on Cash Return: 9.91%

- Airbnb Cap Rate: 10.34%

- Airbnb Daily Rate: $133

- Airbnb Occupancy Rate: 66%

- Walk Score: 55

5. Eureka, IL

- Median Property Price: $202,240

- Average Price per Square Foot: $103

- Days on Market: 14

- Monthly Airbnb Rental Income: $2,287

- Airbnb Cash on Cash Return: 9.89%

- Airbnb Cap Rate: 10.51%

- Airbnb Daily Rate: $117

- Airbnb Occupancy Rate: 70%

- Walk Score: 57

6. New Scotland, NY

- Median Property Price: $403,450

- Average Price per Square Foot: $183

- Days on Market: 203

- Monthly Airbnb Rental Income: $2,286

- Airbnb Cash on Cash Return: 9.85%

- Airbnb Cap Rate: 10.42%

- Airbnb Daily Rate: $172

- Airbnb Occupancy Rate: 60%

- Walk Score: 14

7. Durham, CT

- Median Property Price: $659,080

- Average Price per Square Foot: $202

- Days on Market: 181

- Monthly Airbnb Rental Income: $6,063

- Airbnb Cash on Cash Return: 9.73%

- Airbnb Cap Rate: 9.92%

- Airbnb Daily Rate: $252

- Airbnb Occupancy Rate: 62%

- Walk Score: 38

8. Dixon, IL

- Median Property Price: $204,827

- Average Price per Square Foot: $109

- Days on Market: 43

- Monthly Airbnb Rental Income: $3,293

- Airbnb Cash on Cash Return: 9.70%

- Airbnb Cap Rate: 10.08%

- Airbnb Daily Rate: $225

- Airbnb Occupancy Rate: 62%

- Walk Score: 73

9. Colchester, CT

- Median Property Price: $399,787

- Average Price per Square Foot: $189

- Days on Market: 44

- Monthly Airbnb Rental Income: $3,468

- Airbnb Cash on Cash Return: 9.68%

- Airbnb Cap Rate: 10.09%

- Airbnb Daily Rate: $195

- Airbnb Occupancy Rate: 66%

- Walk Score: 54

10. Scranton, PA

- Median Property Price: $192,619

- Average Price per Square Foot: $102

- Days on Market: 80

- Monthly Airbnb Rental Income: $2,522

- Airbnb Cash on Cash Return: 9.67%

- Airbnb Cap Rate: 10.31%

- Airbnb Daily Rate: $113

- Airbnb Occupancy Rate: 76%

- Walk Score: 24

None of the locations above might have come to mind when you initially thought of buying a vacation home. However, these housing markets offer a high return on vacation rental investment and lenient Airbnb laws and regulations.

Take, for example, Orlando, Florida. You might have thought of starting to search for Orlando vacation homes for sale. And why not? It’s a popular tourist destination with many attractions like Universal Orlando and the Walt Disney World Resort.

However, not only is Orlando’s average return on investment lower than the ones listed above but for out-of-state Airbnb real estate investors, renting out a non-owner-occupied Airbnb in the city is illegal.

It is why it’s best to follow the vacation rental data and Airbnb regulations so that you land on the best place to buy a second home. You can use Mashvisor’s Rental Property Finder to start searching for your ideal investment property in any of the 10 cities listed above.

Get Started

Follow the four easy steps above on how to find vacation homes for sale and you’ll find yourself making money with vacation rental property in no time.

Get started in vacation rental investing today. Sign up for a 7-day free trial to get access to all of Mashvisor’s investment property search tools.