Coronavirus fears and plunging stocks are starting to hit the Big Apple. Here’s what investors need to know about how COVID-19 is affecting the New York City real estate market as well as Airbnb NYC.

As of this writing, the novel coronavirus has rapidly spread across the US, with the largest number of confirmed cases (at least 950) in New York State, including 463 cases testing positive for COVID-19 within New York City.

Due to this pandemic, New York State (along with New Jersey and Connecticut) has banned all gatherings of more than 50 people to contain the spread of COVID-19. And with more people choosing to self-quarantine, top NYC officials started calling for a shutdown in the city.

As anyone can imagine, this will definitely have an effect on all sorts of businesses in the city as well as the New York City housing market. Due to the coronavirus global impact, it’s safe to say that now, the real estate business in NYC isn’t business as usual.

One of the biggest impacts of COVID-19 on the real estate industry can be seen in the Airbnb market. Vacationers and travelers are canceling their Airbnb bookings either due to the numerous travel bans or simply because they’re afraid to move.

Of course, the Big Apple is one of the biggest tourist magnets in the world, making the Airbnb New York City market one of the biggest Airbnb markets. Unfortunately, this also means that many Airbnb NYC hosts are hit the hardest with the impacts of the novel coronavirus.

If you own an Airbnb rental property in NYC, keep reading to understand how COVID-19 is affecting the New York City real estate market in general and specifically the NYC short-term rental market based on Airbnb data and analytics provided by Mashvisor.

The Coronavirus Impact on New York City Real Estate

The New York City housing market has proven to be difficult to predict even without a global pandemic. But as COVID-19 continues to spread, buyers and sellers in NYC are trying to work out the wisest move to make. When it comes to sellers, many of them are hesitant to list their homes, fearing falling prices and the risks of having strangers touring their homes as the coronavirus spreads.

While early spring is typically a prime time for sellers in the New York City real estate market, listings this year have barely increased (up 2% according to CNBC). Last year, there was a 9% growth in listing during the same time period. This tells us that sellers are holding back on listing their homes for sale at the moment. This is true for sellers not just in NYC, but across the country as well.

As for property buyers, it appears that they are separating into two camps. First, those who are backing out of the housing market and postponing big decisions fearing contagion at viewings and/or stock market uncertainty. Many would-be buyers have canceled their appointments to look at properties and CNBC has reported that the average attendance at open houses in New York fell 27% because of the coronavirus.

The next camp of buyers is those who are seizing the opportunity to buy property while mortgage rates drop. They feel it’s a good time to be in the market as mortgage rates are at the lowest they have been in almost eight years. This is good news if you’re looking to finance an investment property in NYC as it gives you more purchasing power.

COVID-19 and the Short-Term Rental Industry

As mentioned earlier, Airbnb NYC hosts are feeling the pain of the coronavirus global impact. According to AirDNA, cancellations of Airbnb bookings are at an all-time high in many major cities in the US including New York, Seattle, and Austin.

Based on Mashvisor’s Airbnb analytics (which are obtained from Airbnb and reflect the performance of actual Airbnb listings over the past 12 months), we can see how this is affecting those investing in the short-term rental market.

Our data shows that Airbnb investment property owners in the US are starting to see drops in the Airbnb occupancy rate as well as Airbnb income. The national average Airbnb occupancy rate has dropped from 54.2% in September – November 2019 to 48.9% in December 2019 – February 2020. Consequently, the national average monthly Airbnb income has also fallen from $2,614 to $2,571 in the above-mentioned time period.

Amid the global coronavirus outbreak that has severely reduced travel demand, Airbnb has decided to adjust its refund policy in an attempt to balance the needs of Airbnb hosts and guests. Last week, the company established the More Flexible Reservations program which helps with the process of refunds for cancellations.

Airbnb’s new policy is that all reservations can be canceled within 48 hours of booking for a full refund. However, not all Airbnb NYC hosts are happy about Airbnb’s decision.

Michael Skiles, the cofounder and the CEO of HostGPO, an international group purchasing organization for short-term rental hosts, believes that Airbnb’s decision is a disaster for the hosting community.

Skiles told Mashvisor: “Spring is when many hosts count on earning enough to support themselves through slower months, but now we have hosts who are reporting huge losses of over 80% of their monthly revenue and who are struggling to keep their homes.”

The Coronavirus Impact on Airbnb NYC Hosts

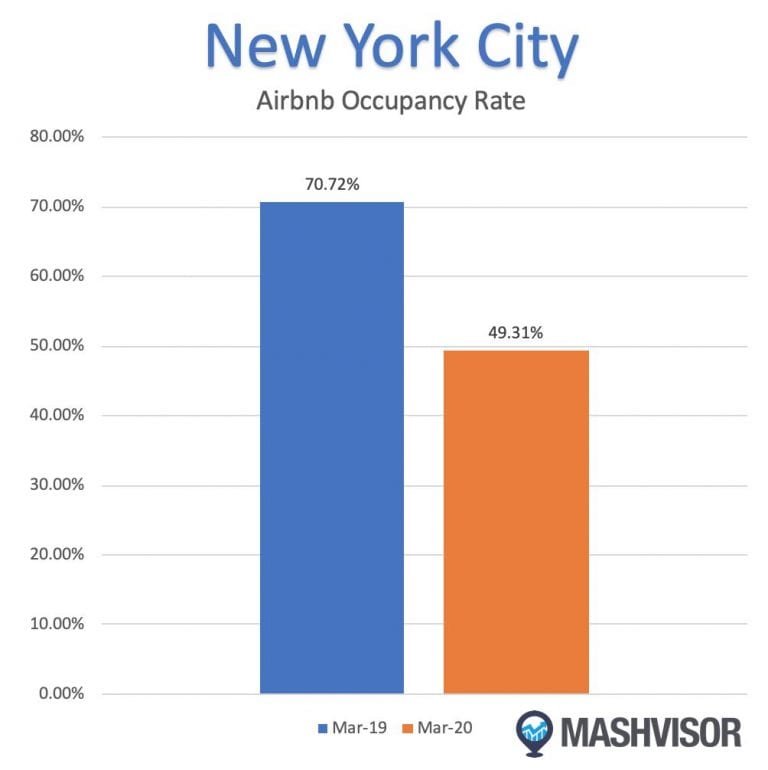

To better understand the effects of coronavirus on Airbnb in New York City, we at Mashvisor have pulled our data on the performance of Airbnb NYC today versus this time last year:

March 2019

- Airbnb Occupancy Rate: 70.72%

- Airbnb Daily Rate: $150

- Airbnb Rental Income: $3,256

March 2020

- Airbnb Occupancy Rate: 49.31%

- Airbnb Daily Rate: $151

- Airbnb Rental Income: $2,352

Our NYC Airbnb investment property analysis shows clearly how hard the COVID-19 pandemic has hit the Airbnb market in the Big Apple. The Airbnb occupancy rate has had a major drop, from a whopping 70.72% in 2019 to just 49.31%. This marks a year-over-year decrease of 21%.

As for the average daily rate, it remains relatively the same, though an argument could be made that Airbnb hosts could have been able to charge more had the coronavirus global impact never occurred. And in terms of monthly Airbnb income, our data shows that it also had a drop between March 2019 and March 2020 for short-term rental properties in NYC. So what’s the next move for Airbnb NYC hosts?

What Should Airbnb NYC Hosts Do?

Many real estate experts recommend those investing in Airbnb in NYC to convert their short-term rentals into traditional rentals for now. After the spread of the coronavirus in the city, many people are looking to move out and rent in places like the Hamptons to escape the coronavirus in New York City.

So if you own an Airbnb investment property there or in a nearby area, consider renting it out on a long-term basis. This way, you can enjoy some of the benefits of owning a traditional rental such as stable cash flow and passive rental income.

Real estate investors should remember that the relationship between the coronavirus and the short-term rental industry is dynamic and there are new developments every day. At Mashvisor, we’ll continue to watch how Airbnb NYC (and Airbnb markets across the country in general) are performing and keep you updated on our real estate investment blog.

To get all the latest news and trends in the US housing market, sign up now to Mashvisor.