To say that the Coronavirus pandemic has had an immense impact on the US spring housing market 2020 is an understatement. Buying and selling real estate activities have been affected in major ways in face of the lockdowns, the shelter in place and stay at home policies, and people’s fear for their safety in general as well as future financial well-being in specific. Nevertheless, this doesn’t mean that beginner real estate investors have to put their intention to start a rental business to a complete stop. There are many things which investors can do on Mashvisor’s real estate investment software platform during the COVID-19 pandemic to be ready for buying rental properties as soon as the situation begins to settle and things start going back to normal.

Here is how you can use our real estate investment app to make the most out of the extra free time which you might have on your hands at the moment:

1. Stay Informed About Coronavirus Real Estate Trends

In the 21st century information is power, and this statement becomes particularly true at times of uncertainty and a potential recession as the one that experts are expecting as a result of the outbreak of COVID-19.

Where can you find all the information that you need about everything related to the Coronavirus pandemic and the US real estate market?

On Mashvisor’s real estate investment software blog. We have devoted a special section of our blog on the Coronavirus real estate trends to provide you with all the real estate market analysis and data that you need to stay informed.

Now is the time to keep a close eye on the impact of the pandemic on different real estate markets across the US, especially in terms of home prices, Airbnb daily rates, and traditional rental rates. Some locations such as the NYC housing market, the Seattle real estate market, and the Bay Area housing market felt the effect immediately. Residential real estate property values are forecast to decline in these areas and many others, which means that in a couple of months they might become affordable and profitable markets for buying an investment property.

While a US housing market crash is not expected in 2020, home prices are known to take a downward plunge at times of housing market crisis like the one in 2008. As soon as this happens, time will be ripe for those with sufficient savings for a down payment to jump on the opportunity and invest in rental properties for sale. It will be important to act fast before other more experienced investors sweep all good real estate deals. Thus, using our real estate investment software platform’s blog will help you get prepared for the good time to invest in real estate after the COVID-19 crisis starts resolving.

2. Learn the Basics of Real Estate Investing

Many beginner real estate investors were caught by surprise by the Coronavirus pandemic right when they were planning to buy their first rental property. As misfortunate as this might be for them, now is the best time to learn everything one needs to know about buying positive cash flow properties with a good cash on cash return and a good cap rate.

Related: Cap Rate vs. Cash on Cash Return: How to Calculate Rate of Return in Real Estate Investing

And the best place to obtain the real estate investing knowledge that you need is once again the blog page of Mashvisor’s real estate investment software app. The Beginner Investors, Buying Investment Property, Mashvisor Tools, and Real Estate Analysis categories are specifically written with first-time real estate investors in mind. The blog posts available in these sections use straightforward, non-technical language to teach newcomers all they need to know about how to conduct real estate market analysis, how to go about property search, and how to perform investment property analysis.

The smart real estate investing move right now is to use the time that you have at home under the shelter in place policy to get the education you need to start buying rental properties in a few months when things begin to settle.

3. Analyze the Investment Potential of US Real Estate Markets

Location is the most important factor for the success of a real estate investment business. While this is always the case, the housing market where one decides to buy an investment property becomes particularly important at times of crisis such as the current COVID-19 pandemic.

While the impact of the Coronavirus on the US population has been devastating, it is definitely not evenly distributed. Some locations have been disproportionately affected, while others have been relatively spared, at least for the time being.

This is especially true when it comes to the Airbnb rental business. As demonstrated by the Airbnb data available on our real estate investment software platform, the Airbnb occupancy rate has plummeted in some of the hottest tourist destinations and business hubs such as Airbnb Seattle and Airbnb NYC. Meanwhile, Airbnb hosts in more isolated and quieter locations such as Airbnb Joshua Tree are reporting even increased short term rental activities as the elderly, remote workers, and families with small children look for secluded safe places to spend the next few months.

Related: Airbnb Data Reveals the Impact of Coronavirus

Thus, doing detailed real estate market analysis is a must for making profitable real estate investing decisions and buying rental properties with a high return on investment. Mashvisor’s real estate investment app allows investors to conduct neighborhood analysis in any US housing market quickly and efficiently.

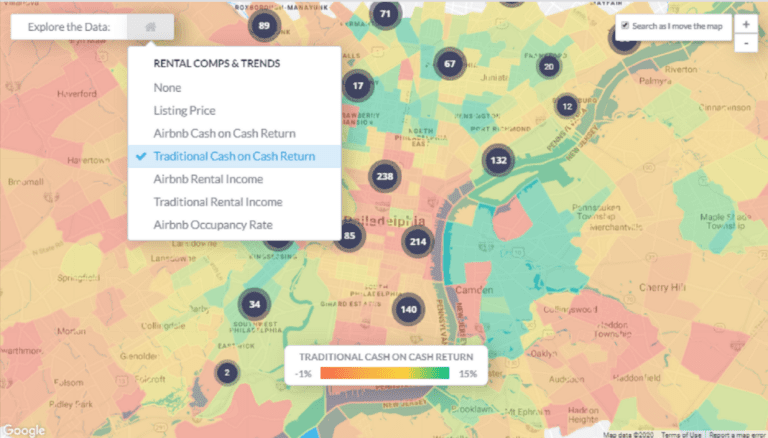

First of all, as soon as new real estate investors notice a drop in home prices in any city based on the articles in the Coronavirus real estate trends section of our blog, they can use our heatmap tool to start analyzing this particular market. Mashvisor’s heatmap provides a color-coded view of any US real estate market to highlight areas with:

- Low and high property prices

- Low and high traditional and Airbnb rental income

- Low and high traditional and Airbnb cash on cash return

- Low and high Airbnb occupancy rate

Related: Real Estate Heat Map: A Revolutionary Tool for Neighborhood Analysis

In terms of home values, investors should focus on areas marked in red (low), while for the other metrics they need to concentrate on areas market in green (high). That’s the optimal way to find positive cash flow income properties.

Mashvisor’s Heatmap: Neighborhood Analysis of the Philadelphia Real Estate Market

The next step of the rental market analysis is checking out the readily available neighborhood analysis of a few locations within a city which match the above-mentioned criteria. For each neighborhood in any US real estate market, our investment property calculator gives investors access to the following data:

- Mashmeter: a score of how good an area is for investing in rental properties developed by our real estate investment software

- Median property price

- Average price per square foot

- Average traditional and Airbnb rental income

- Average traditional and Airbnb cash on cash return

- Average Airbnb occupancy rate

- Number of investment properties for sale

- Number of traditional and Airbnb rental listings

- Optimal rental strategy: traditional vs. Airbnb

Moreover, as part of the neighborhood analysis, investors get access to data on recently sold properties in the area, i.e., real estate comps, as well as a list of actual traditional rentals and Airbnb rentals in the neighborhood including their monthly income. Last but not least, you can see the optimal property type and the best number of bedrooms for investing in rental properties in this area.

Consequently, you can conduct thorough real estate market analysis from the comfort and safety of your home during the Coronavirus pandemic. All the data and analytics that you need are available on Mashvisor’s real estate investment software platform.

4. Conduct Property Search

The next thing which you can do with our real estate investment app at the time of COVID-19 is to search for investment properties for sale. You don’t need to leave your home in order to find lucrative opportunities in the US real estate market in 2020. Furthermore, you can invest in real estate equally successfully and confidently both close to home and out of state with the help of the best real estate investment tools.

On our platform, you can set all the criteria necessary for buying an investment property with a high rate of return within your budget. There are numerous factors that our property search will take into consideration including:

- Your budget

- Financing method: cash vs. mortgage

- Expected return on investment in terms of cash on cash return and cap rate

- Preferred neighborhood

- Expected traditional and/or Airbnb income

- Property type: single family home, townhouse, condo, multi family home, or other

- Number of bedrooms and bathrooms

Another tool particularly good for searching for investment properties for sale in one or more US real estate markets is the Property Finder. Based on your budget, preferred rental strategy, and selected property type, it will show you all properties that match your search criteria in a decreasing order of cash on cash return.

Driving for dollars is simply not a safe option at the moment, amid the Coronavirus pandemic. Additionally, it is becoming more and more obsolete with the recent disruption of the real estate industry and the introduction of high-tech to the rental property business.

With Mashvisor’s real estate investment software, you can do rental property search safely from your laptop or smartphone.

5. Conduct Investment Property Analysis

Choosing the right location is required for making a profitable real estate investing decision. However, it is not sufficient. The next step in the real estate analysis needed for investing in positive cash flow properties with a high return is analyzing in detail a few investment properties for sale which have caught your eye.

Rental property analysis is a process dreaded by many experienced investors. It requires looking for comparable rental properties – rental comps – and figuring out how much rental income they generate. This activity becomes very time-consuming if you consider a few different property types in various markets.

However, investment property analysis is one more thing that you can easily do from home with Mashvisor’s real estate investment software. We’ve gathered all the data and information needed to forecast exactly how much rental income any property in the US housing market will produce, for either rental strategy.

Importantly, in addition to analyzing the properties available on our platform, you can also find out the investment potential of any off market property as soon as you enter the address.

Related: How to Analyze Off Market Properties

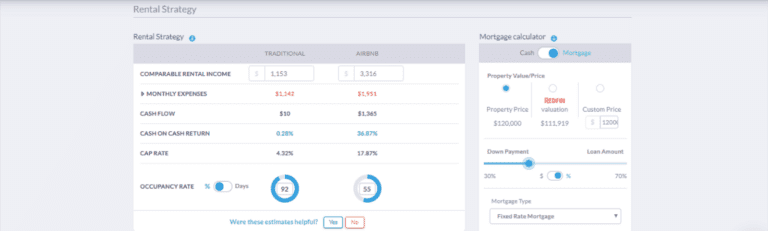

Moreover, it is not only the traditional and Airbnb income estimate that you get access to. For each income property, our rental property calculator computes:

- Property price

- One-time startup costs including:

- Home inspection

- Closing costs such as real estate appraisal

- Repairs

- Furniture and appliances, especially if you invest in a vacation home rental

- Traditional and Airbnb rental income

- Traditional and Airbnb occupancy rate

- Recurring monthly expenses including:

- Mortgage payment

- Property tax

- Rental income tax

- Home insurance

- Property management

- Property maintenance

- HOA fees if investing in a condo

- Cleaning fees if buying an Airbnb property

- Utilities if renting out on Airbnb

- Cash flow

- Traditional and Airbnb cash on cash return

- Traditional and Airbnb cap rate

Mashvisor’s Rental Property Calculator: Analyzing a Philadelphia Investment Property

The entire investment property analysis is based on real estate data obtained from the MLS, Zillow, and Airbnb and on the performance of actual rental comps. In this way, our real estate investment software allows new and experienced investors to analyze properties for sale as well as off market properties even amid the COVID-19 pandemic.

6. Contact Property Owners

With the quick spread of the Coronavirus, the last thing which a real estate investor should do is to meet in person with the owners of a property he/she wants to buy. Mashvisor’s real estate investment app provides a solution to this dilemma as well.

With professional and expert subscription, real estate investors get access to homeowners data. Once they’ve liked a few properties for sale within their budget, they can use the Mashboard to obtain the contact information of the owner. This includes both the phone number and the email address. In addition, investor’s personalized Mashboard acts like a CRM platform through which they can contact homeowners and keep log of all activities.

Related: How to Find Out Who Owns a House

After you connect with the property seller, you can ask for additional information about the investment property and even request a virtual tool. While our real estate investment software platform has photos of each listing, virtual tours are becoming the new reality of the real estate industry. After all, they give a much better perspective on the home you are about to purchase and the best alternative to actual viewings amid the current Coronavirus pandemic.

7. Get in Touch with the Listing Agent

Last but not least, at the time of the Coronavirus, it is crucially important to avoid unnecessary contacts with all parties involved in a real estate transaction. This includes the buyer’s agent, the seller’s agent, the property seller, financiers, home inspectors, real estate appraisers, attorneys, and others.

The best way to do that when buying an investment property amid the pandemic is to work with a real estate agent. He/she will be able to handle all aspects of the process professionally, with the least amount of contacts possible. In the vast majority of the US real estate market, even where real estate has been deemed an essential business, agents and brokers have received specific instructions how to conduct real estate deals safely and securely.

For each listing available on Mashvisor’s real estate investment software platform, investors have access to the name and the contact information of the seller’s agent. For off market properties, investors can visit the real estate agent profiles available on our website to find the top-performing agents in any US housing market.

Mashvisor’s real estate investment software allows investors to polish their knowledge of the rental property business, conduct professional-level real estate analysis, and even buy an investment property amid the Coronavirus pandemic. All this without endangering their own safety or the safety of others in the real estate industry.

To start analyzing rental properties for sale across the US housing market, sign up for Mashvisor now with a 15% discount with promo code BLOG15.