Are you thinking of buying an income property? Buying residential income properties can be a lucrative way to generate income and create substantial wealth over time. As a matter of fact, real estate has made a majority of the world’s millionaires. Therefore, getting started in real estate investing can be a smart move. Nevertheless, with the risks that come with real estate investing, it’s important that you learn how to buy income property in a manner that maximizes your returns and minimizes risk before you take the plunge. Savvy real estate investors know that acquiring profitable investment properties takes a lot of preparation and research.

If you want to learn how to buy income property that will help you achieve your financial goals, this blog is for you. Here, we cover the main steps you need to take to buy a profitable income property.

5 Steps for How to Buy Income Properties

1. Hire a Real Estate Agent

Buying your first income property can be daunting because of your limited knowledge and little experience in real estate. However, this is no excuse not to go after your investment goals. You can use the knowledge and experience of real estate professionals to make smarter investment decisions.

A realtor can make up for your lack of experience and guide you on how to buy income property. This includes helping you out with negotiations and paperwork. This way, you will be able to avoid common mistakes made by first-time real estate investors. With their real estate networks and knowledge of the local housing market, they can also help you in finding off-market deals and connect you to other real estate contractors.

However, make sure you choose your real estate agent wisely. You want them to be licensed, experienced, and someone you can trust. With a good real estate agent, you can save a lot of your time, effort, and money.

Related: 10 Questions to Ask a Realtor Before Hiring One to Buy Investment Property

2. Assess Your Financing Options

Real estate is a highly capital-intensive business. Therefore, not many people will be able to buy an investment property with cash. If you are buying your first income property, it’s likely that you will need some form of financing. Therefore, getting your finances in order early enough is an important step when you are thinking of how to buy income property. Financing an income property shouldn’t intimidate you. There are many options to choose from depending on your situation. You just have to find an investment property financing method that is right for you.

Most investors will take out a mortgage loan. For most investment property loans, you will need a down payment of at least 20%. Therefore, if you are buying property for rental income with a mortgage, you should have a substantial amount of money saved up, depending on your budget. Remember, you need to also take into account other expenses such as closing costs and a reserve for emergencies. Moreover, you need to review your credit history and, if necessary, work to improve your creditworthiness.

Be sure to shop around for the best mortgage deal in terms of interest rates, monthly payments, fees, and loan terms. Also, getting pre-approved will not only give you a competitive edge but also ensure that you shop within your budget.

But what if you can’t raise the money for a down payment? Well, there are several options for how to buy an income property with no money down. You can use investment property financing methods like FHA loans for house hacking, partnerships, home equity loans, and seller financing.

Be sure to do your due diligence to find the most appropriate financing option for your situation and investment goals. If unsure, be sure to seek guidance from professionals.

Related: How to Get Your Finances in Order Before Buying an Investment Property

3. Find a High Return Real Estate Market

With your finances in order, the next step in our guide on how to buy income property is to find a profitable market for real estate investing. This is your first step in finding income properties for sale. Where your income property investment is located has a great impact on your return on investment. Therefore, it only makes sense to take your time to find a good rental market.

To find the best market for rental investment, you need to consider all parts of the country and not just your local market. This means that you need to conduct a thorough real estate market analysis. You should research the housing market at both city and neighborhood levels. You need to focus on markets with features like low property taxes, a growing job market, high population growth, low crime rates, plenty of amenities, etc.

However, the easiest way to find hot cities in the US housing market is to check out market data on Mashvisor’s blog. Moreover, Mashvisor’s real estate heatmap enables you to identify the best-performing neighborhoods in your city of choice based on key metrics like average listing price, cash flow, cash on cash return, and Airbnb occupancy rate. Try it out now.

Related: How to Spot a High Return Real Estate Market

4. Search for Income Properties for Sale

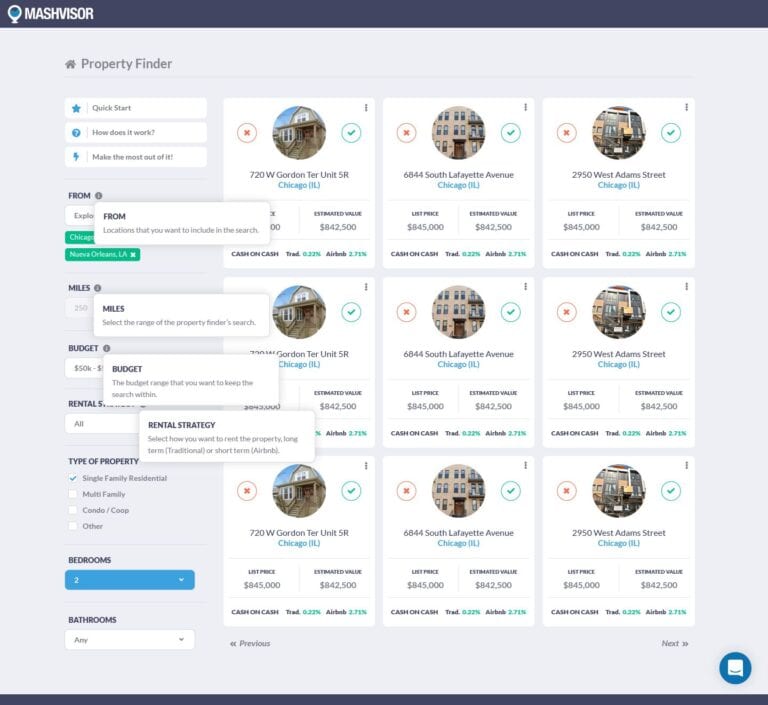

With a target market in mind, the next step of how to buy income property is to begin searching for investment properties for sale. While there are many ways to find income properties for sale, many of them are not very efficient. With Mashvisor’s Property Finder, however, you can easily find profitable income properties for sale that match your criteria. This tool allows you to search for high return income properties in the US housing market and customize your search using filters like budget, property type, rental strategy, and the number of bedroom/bathrooms.

5. Conduct a Thorough Income Property Analysis

The final and most important step in our guide on how to buy income property is to run the numbers. The main reason for investing in real estate is to make money. Therefore, you want to invest in positive cash flow income properties with a good return on investment. To find them, you need to conduct in-depth income property analysis. This is a process that involves collecting a variety of property data and doing calculations.

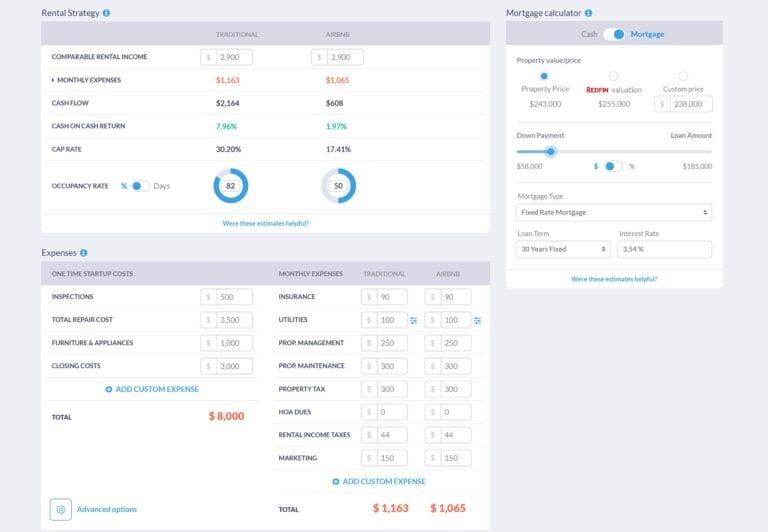

Analyzing income properties manually can be time-consuming and tiresome. However, there’s an easier and better way to do it – using Mashvisor’s income property calculator! Using our calculator is the quickest and most accurate way to conduct your income property analysis. You can analyze investment properties for sale in just a matter of minutes. Using predictive analytics, the tool allows you to calculate key metrics such as rental income, cash flow, cap rate, cash on cash return, and Airbnb occupancy rate. Collectively, these numbers will help you identify the best income property for sale to buy.

Additionally, our income property calculator gives you access to real estate comps for properties on the platform and off-market. With these comps, you can run a comparative market analysis to determine the fair market value of income property for sale. This way, you can avoid overpaying for an income property you are interested in.

The Bottom Line

If you are hoping to become financially independent, investing in income properties can be a good way to improve your finances. However, success in real estate boils down to understanding how to buy income property. By following this step-by-step guide, you will be able to able to eliminate your fears and make smart property investment decisions. If you are looking to buy an income property soon, be sure to use Mashvisor’s tools to find and analyze income property.

To start your 7-day free trial with Mashvisor and subscribe to our services with a 20% discount after, click here.