We all know that investing in real estate is one of the best ways to make money. After all, 90% of millionaires have amassed their wealth through real estate investing. Still, getting started in real estate investing is easier said than done. There are many facets of the business, especially if you’re looking to get started with rental property investments. You’ll have to go about researching investment properties for sale and financing options. Once you make it through the purchase process, it’s on to renting out and managing income properties. Without proper guidance, it will be difficult to find positive cash flow properties and manage them effectively to keep the cash flowing. But there’s no reason to worry. In today’s blog, we’ll provide you with the best real estate tips for getting started in real estate investing.

4 Tips for Getting Started in Real Estate Investing

1. Explore ways to invest with no money down

Financing can be a major barrier for many investors who are just getting started in real estate investing. There are many components to proper financing that investors need to be aware of. Having a good credit score and a low debt-to-income ratio, for instance, are essentials. Both these requirements take time to form. As a result, before you plan on getting started in real estate, work on maintaining good credit (620 or more) and low DTI (36% or less).

Besides those requirements, how much money do you need to get started in real estate? (For a complete breakdown, read this.) When it comes to saving up money to invest in real estate, you will likely need to have a down payment (20%) ready to go if you plan on approaching a traditional bank. Therein comes our first tip: Explore the many options available to invest in real estate with no money down. Rather than letting the lack of a down payment keep you out of the real estate game, educate yourself about all of your options for investment loans.

Here are a few ways for getting started in real estate investing with no money down:

- Federal loan programs, such as those from the FHA and the USDA, provide the means to invest with little-to-no money.

- Negotiating private money and hard money loans can also lead to little-to-no down payment, but at the expense of high interest rates.

- You can also work with other investors through real estate partnerships and agree on no down payment.

- If you are currently renting, see if your landlord is interested in selling the property. If that turns out to be the case, you can agree on a lease with the option to buy, which can also result in no down payment.

All of these methods come with their own benefits and possible disadvantages. At the end of the day, you need to find the no-down-payment option that works best for you.

Related: Buying Rental Property With No Money Down: 10 Ways It’s Possible

2. Go for residential real estate rather than commercial real estate

Another key part of getting started in real estate investing is picking a type of rental property. You have two options: commercial vs residential real estate investing. While both are profitable, residential rental properties are the better option for beginner real estate investors. There are many reasons why:

- Commercial real estate investing is more expensive than residential real estate investing. While it is true that residential properties require considerable sums of money, such as a down payment, they are still more affordable. Residential properties require a lower initial capital, in terms of purchase prices, down payments, closing costs, and more.

- Residential properties are safer investments compared to commercial properties. Commercial real estate can easily become a money pit during economic hardships. (This is the case now, during the coronavirus.) Residential properties, on the other hand, are always in demand, as people will always need places to live.

- It also helps that buying and selling residential properties is much simpler than commercial properties.

- Self-management is much more doable for residential rental properties than commercial ones. This is a key aspect for anyone getting started in real estate investing.

With residential real estate, there are two main rental real estate investment strategies. The first is the long-term, traditional rental strategy. This strategy is what comes to most people’s minds when they think about investing in real estate. Through this strategy, investors rent out to tenants for long periods of time. The second strategy is the short-term rental strategy, which involves renting out to tenants on a nightly or weekly basis through Airbnb vacation homes and the like. Ultimately, you can’t go wrong with traditional vs Airbnb real estate investing as a beginner. We here at Mashvisor can tell you which strategy is best for your rental property. To find out how Mashvisor’s tools do this using predictive analytics, CLICK HERE!

Related: A Guide to Choosing the Best Rental Property Strategy: Airbnb vs. Traditional

3. Try house hacking your first investment property

House hacking is arguably the best method of getting started in real estate investing. Through this method, you purchase a multi-family home (such as duplexes or triplexes). Then, you reside in one unit as your primary residence and rent out the remaining units. This way, you’ll essentially be making a profit in real estate while living for free! What also makes house hacking excellent for beginners is the fact that this real estate investment strategy allows you to qualify for FHA loans. With little-to-no down payments through FHA loans, house hacking a multi-family property is a great way to invest in real estate for the first time.

4. Use tools to conduct a real estate market and investment property analysis

In order to succeed when getting started in real estate investing, you will need real estate investment tools. More specifically, you will need tools to conduct a real estate market analysis and an investment property analysis. Luckily, you don’t have to look far to find these tools! Mashvisor’s real estate software has the ultimate assortment of real estate investment tools for all investors.

Related: What’s the Best Real Estate App of 2020?

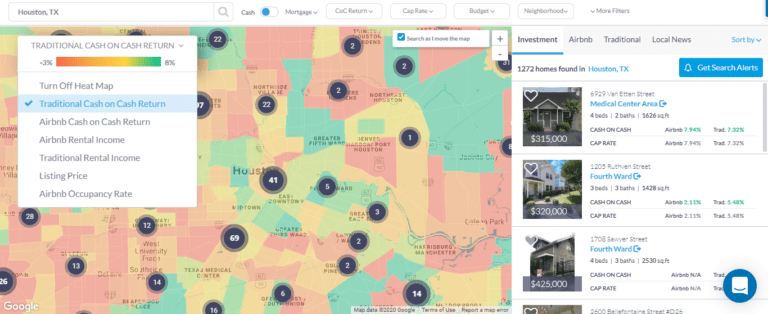

Let’s start with Mashvisor’s heatmap analysis tool. The heatmap analysis tool is an online tool that will help you search for an investment location. In other words, it helps you conduct a neighborhood analysis. The heatmap presents neighborhood data in a color-coded, easy-to-understand form. Mashvisor’s heatmap is also interactive, allowing users to find locations based on their preferred filters, such as budget, return on investment, and more.

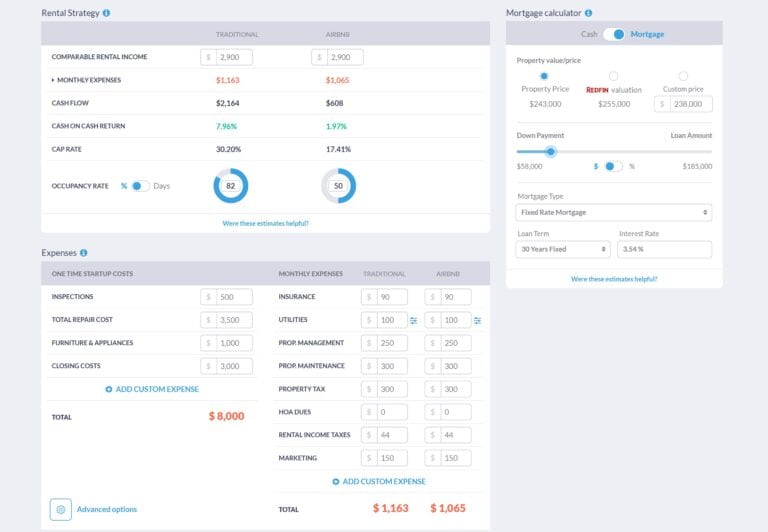

To conduct an investment property analysis, you can use Mashvisor’s investment property calculator. Mashvisor’s investment property calculator uses the most up-to-date data to generate results. The results project how profitable a rental property will be, whether it’s rented out traditionally or as an Airbnb. Here are some of the key results from Mashvisor’s investment property calculator:

- Traditional and Airbnb rental income

- Rental property expenses

- Traditional and Airbnb cash flow

- Traditional and Airbnb rate of return on a rental property (cap rate and cash on cash return)

- Traditional and Airbnb occupancy rate

- Rental comps

These are just 4 tips for getting started in real estate investing. But they are 4 great ones! Ready to get started? Start your search for investment property now.