Since the founding of Airbnb.com in 2008, Atlanta has been one of the leading US cities in the short term rentals industry. Will this trend continue? Should you invest in Airbnb Atlanta in the coming year? If so, when? Keep reading to find out the answers to these questions and many more if you are aspiring to become a successful real estate investor and Airbnb host.

Airbnb Atlanta, GA: Projected Investment Property Performance

People invest in real estate in general and in rental properties in specific in order to make money, and the way to do that is through high return on investment. To evaluate whether the Atlanta real estate market is a good choice for buying a vacation home, we need to take a look at the forecast for the performance of short term rentals there.

We’ve used Mashvisor’s rental property calculator – which relies on big data for the US housing market and predictive analytics AI algorithms – to estimate all key figures for Airbnb Atlanta properties.

Atlanta Vacation Rentals Performance Forecast

- Median Property Price: $426,700

- Price per Square Foot: $231

- Listings for Sale: 6,175

- Average Days on Market: 73

- Monthly Airbnb Rental Income: $2,200

- Average Airbnb Cash on Cash Return: 2.3%

- Average Airbnb Occupancy Rate: 48.4%

Looking at the above Airbnb data, experienced real estate investors might feel skeptical about the profitability potential of short term rentals in Atlanta. A cash on cash return of 2.3% does not sound encouraging when the traditionally recommended good cash on cash return is above 8%.

However, beginner real estate investors with limited expertise on the US rental market should consider two things. First of all, this is only a city-average Airbnb cash on cash return, while the best neighborhoods in Atlanta for vacation home rentals generate double-digit rate of return on rental properties.

Second, according to Mashvisor’s data and overall US real estate market analysis, the Atlanta Airbnb return on investment exceeds the rates which the majority of other best places to invest in real estate will offer.

So, as long as you have the best real estate investment tools to analyze markets and specific rental properties for sale, you can proceed with investing in an Airbnb Atlanta property with confidence.

Atlanta Airbnb Laws and Regulations

As you’re thinking about buying an Airbnb investment property, you must have been doing some research on the current state of the market. You’ve probably noticed that a lot of the top locations for investing in vacation rentals in the US housing market have introduced highly restrictive and even prohibitive legislation in an attempt to control or altogether prevent the development of the short term rental industry. So, how about Atlanta?

Is Atlanta Airbnb legal?

Yes, it is. That’s one more reason to say that Atlanta is one of the best cities to buy a vacation rental in the coming year. Currently there are absolutely no laws which prohibit or limit Atlanta Airbnb rentals.

However, there are a few rules and regulations which potential Airbnb hosts should take into consideration:

- Real estate investors in Airbnb properties need to obtain a hotel license and a business license in order to operate an Atlanta short term rental legally.

- Airbnb hosts need to pay an 8% hotel/motel tax to the City of Atlanta as well as a $5/night hotel/motel fee to the State of Georgia.

These requirements are quite reasonable and nothing unexpected. So, if you’re seriously contemplating the idea of investing in Airbnb Atlanta, there is nothing to worry about in the legal and regulatory framework.

Real Estate Trends in the Atlanta Housing Market

Before you are fully ready to move forward with investing in short term houses for rent in Atlanta, let’s have a look at the most important factors and trends which are driving the Atlanta real estate market and its position as one of the top places for Airbnb investments:

Tourism Is Attracting Airbnb Guests

First and foremost, how popular of a tourist destination a certain location is determines how much rental demand vacation homes there will face. Atlanta attracts over 53 million visitors per year, which makes it one of the most visited US cities. These visitors include both tourists and business travelers who come to see one of Atlanta’s many attractions or to do business in the city.

The fact that Atlanta is one of the most popular tourist locations nationwide results in a high Airbnb occupancy rate of over 48%. As real estate investors know, the occupancy rate is one of the most significant factors determining the overall return on investment including both cap rate and cash on cash return.

Real Estate Prices Are Appreciating Reasonably

Atlanta investment properties not only have the potential to bring high return in the short term but also to allow you to make money in the long term through appreciation. Appreciation in the Atlanta real estate market in recent years has exceeded the rate in the overall Georgia real estate market and reached about the US average level.

The values of homes for sale in Atlanta are expected to continue growing at a moderate pace, which means that investors will still benefit from natural appreciation. At the same time though, prices of listings will remain reasonable and affordable, both for local investors and out of state ones.

Overall, the Atlanta housing market is predicted to shift towards a buyer’s market, which is a positive trend not only for Atlanta Airbnb hosts but for all property investors.

Major Events Are Bringing Even More Visitors

Any Airbnb real estate investor knows that Airbnb occupancy rate and Airbnb rental income are not the same throughout the year. Seasonality is an important factor in the return on investment on short term rentals.

If you plan to buy an investment property to rent out on Airbnb Atlanta, you should be aware of the following popular events there which bring people from near and far and adjust your Airbnb pricing strategy accordingly:

- Atlanta Dogwood Festival: April

- Virginia Highland Summerfest: June

- Peachtree Road Race: 4th of July

- Music Midtown: September

Speaking of major events, here’s something which you should hear if you are still having doubts where investing in Airbnb Atlanta is worth your money. During the Super Bowl weekend at the beginning of 2019, an average Atlanta Airbnb host made $690 in rental income.

According to most estimates, the short term rentals industry in Atlanta made a total of $1.35 million in revenue over a few short days, while other estimates place this number at as high as $3.3 million. This shows the potential for making money with this real estate investing strategy.

Best Atlanta Neighborhoods for Airbnb Investments

Knowing that Atlanta is one of the best cities for investing in Airbnb is not enough to make a profitable investment. After all, that’s such a vast market with over 6,000 homes for sale in Atlanta. Thus, real estate investors need to conduct neighborhood analysis to find the top neighborhoods in Atlanta for this rental strategy.

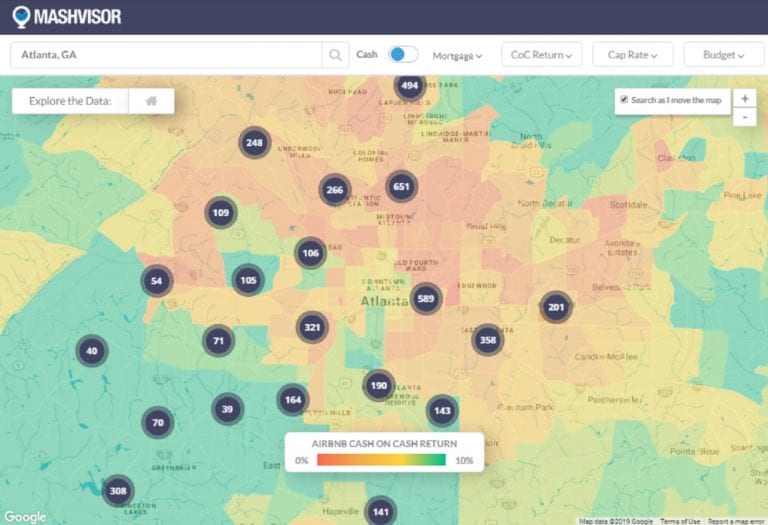

The most straightforward and efficient way to do that – without wasting weeks on gathering data and looking for rental comps – is with Mashvisor’s heatmap analysis tool. The heatmap allows investors to quickly find the areas with the highest Airbnb occupancy rate, Airbnb rental income, and Airbnb cash on cash return. You can have a look below:

Mashvisor’s Heatmap Analysis: Atlanta Neighborhoods by Airbnb Cash on Cash Return

We’ve further used Mashvisor’s investment property calculator to provide you with detailed data on the most profitable neighborhoods for Airbnb Atlanta rental properties. Here they are:

1. Mt. Gilead Woods

- Median Property Price: $168,800

- Price per Square Foot: $74

- Listings for Sale: 6

- Average Days on Market: 59

- Monthly Airbnb Rental Income: $3,800

- Average Airbnb Cash on Cash Return: 14.9%

- Average Airbnb Occupancy Rate: 48.2%

2. Swallow Circle – Baywood

- Median Property Price: $156,300

- Price per Square Foot: $117

- Listings for Sale: 6

- Average Days on Market: 98

- Monthly Airbnb Rental Income: $3,370

- Average Airbnb Cash on Cash Return: 14.9%

- Average Airbnb Occupancy Rate: 66.1%

3. South Atlanta

- Median Property Price: $190,100

- Price per Square Foot: $159

- Listings for Sale: 7

- Average Days on Market: 47

- Monthly Airbnb Rental Income: $2,390

- Average Airbnb Cash on Cash Return: 13.5%

- Average Airbnb Occupancy Rate: 54.6%

4. Southwest

- Median Property Price: $174,100

- Price per Square Foot: $118

- Listings for Sale: 21

- Average Days on Market: 43

- Monthly Airbnb Rental Income: $3,130

- Average Airbnb Cash on Cash Return: 10.9%

- Average Airbnb Occupancy Rate: 51.6%

5. Lakewood Heights

- Median Property Price: $224,500

- Price per Square Foot: $148

- Listings for Sale: 23

- Average Days on Market: 121

- Monthly Airbnb Rental Income: $2,570

- Average Airbnb Cash on Cash Return: 10.6%

- Average Airbnb Occupancy Rate: 62.5%

6. Princeton Lakes

- Median Property Price: $161,800

- Price per Square Foot: $90

- Listings for Sale: 173

- Average Days on Market: 69

- Monthly Airbnb Rental Income: $2,730

- Average Airbnb Cash on Cash Return: 10.3%

- Average Airbnb Occupancy Rate: 53.2%

7. Cascade Avenue-Road

- Median Property Price: $192,700

- Price per Square Foot: $109

- Listings for Sale: 20

- Average Days on Market: 57

- Monthly Airbnb Rental Income: $3,210

- Average Airbnb Cash on Cash Return: 10.2%

- Average Airbnb Occupancy Rate: 53.5%

8. Laurens Valley

- Median Property Price: $181,800

- Price per Square Foot: $231

- Listings for Sale: 6

- Average Days on Market: 91

- Monthly Airbnb Rental Income: $3,120

- Average Airbnb Cash on Cash Return: 10.1%

- Average Airbnb Occupancy Rate: 50.7%

Finding the Best Airbnb Atlanta Investment Properties for Sale

We believe that by now you’ve realized the money-making potential of the Atlanta Airbnb rental business. But how do you search for the top-performing income properties for this rental strategy? You can use two of the best real estate investment tools: Mashvisor’s Property Finder and Airbnb profitability calculator.

The Property Finder will allow you to filter the rental properties for sale in Atlanta which match all your criteria such as property price and number of bedrooms and bathrooms. Once you’ve narrowed down your search to a few properties, you can analyze each one of them with Mashvisor’s rental property calculator to figure out what costs, rental income, occupancy rate, cash flow, cash on cash return, and cap rate to expect.

Do you want to start using these tools right away to get ready to buy a top-performing Airbnb Atlanta investment property? Sign up for Mashvisor today.